PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690926

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690926

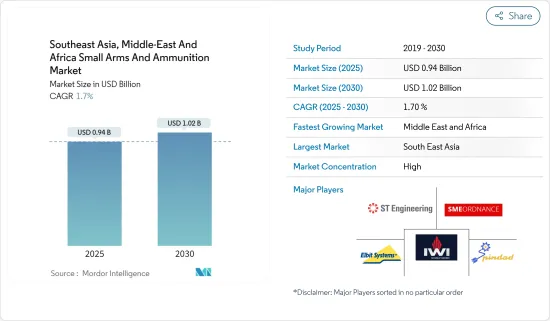

Southeast Asia, Middle-East And Africa Small Arms And Ammunition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Southeast Asia, Middle-East And Africa Small Arms And Ammunition Market size is estimated at USD 0.94 billion in 2025, and is expected to reach USD 1.02 billion by 2030, at a CAGR of 1.7% during the forecast period (2025-2030).

Amid escalating tensions with neighboring nations, several countries in Southeast Asia and the Middle East are ramping up their acquisitions of small arms and ammunition. While military and law enforcement personnel training remains a consistent driver of demand, factors like border disputes, militant threats, and civil unrest amplify the need for these armaments.

Over recent years, bolstered by government backing, local arms and ammunition manufacturers in the UAE, Saudi Arabia, and select Southeast Asian nations have steadily expanded their market presence. The burgeoning defense sectors in Turkey, the UAE, and Saudi Arabia are poised to pose fresh challenges for both incumbent and new market entrants.

With a clear push toward bolstering domestic ammunition production, these nations are becoming attractive destinations for foreign companies eyeing cost-effective labor. However, while this trend may pose challenges for local defense firms, it also opens the door for new players to introduce advanced weaponry. Yet, it's worth noting that technological constraints could temper the demand outlook in the coming years.

Southeast Asia, Middle-East And Africa Small Arms And Ammunition Market Trends

The Military Segment is Expected to Dominate the Market During the Forecast Period

The military segment currently holds a dominant position in the market and is poised to maintain this lead through the forecast period. As global military engagements rise, armed forces are increasingly turning to more potent small arms to meet combat demands. With advancements in military armor, there is a heightened emphasis on firearms that deliver cyclical impacts, inflicting greater damage on adversaries. Many nations are actively procuring and advancing their arsenals with the latest small arms. For example, at the April 2022 Indian Defense Expo, the Indonesian Police secured Turkish Semi-automatic KMR762 pistols from Kale Kalip (Turkey). Concurrently, the Indonesian Army placed orders for KNG-C5 rifles. Additionally, in March 2022, Indonesia added a semi-automatic sniper KMR 762 rifle to its arsenal. In September 2023, the Bangladeshi Police bolstered its inventory with a significant procurement, including 35 lakh shotgun bullets, 6 lakh blank cartridges, 3.22 lakh tear gas shells, 30 sniper rifles, and other essential riot control items.

The arms and ammunition manufacturing sector in the Middle East and Southeast Asia witnessed a surge in localization efforts. Governments in these regions are increasingly mandating local production and re-investment offsets in their military procurement strategies. In November 2022, Malaysia's Maruss Sdn Bhd and Indonesia's PT Pindad inked a pivotal memorandum of understanding (MoU) for arms manufacturing. This collaboration aims to delve into contract manufacturing for small arms and their components alongside ammunition supplies of varying calibers. Such initiatives are set to propel the growth of the military segment.

Saudi Arabia is Anticipated to Witness Significant Growth During the Forecast Period

During the forecast period, Saudi Arabia is poised for significant market growth, driven by the government's substantial investments in bolstering its defense capabilities and advancing to the next generation of weaponry. In 2023, the nation ranked as the world's fifth-largest defense spender, allocating a budget of USD 75.5 billion, marking a notable increase.

Given the current geopolitical landscape, Saudi Arabia's neighboring nations-such as Iraq to the north, Iran across the Persian Gulf, and Yemen to the south-present considerable threats, underscoring the nation's need to prioritize ammunition purchases. With a military force exceeding half a million, including paramilitary units, Saudi personnel predominantly rely on firearms like the FN F2000 (5.56x45 mm), Bushmaster M4-Type (5.56x45 mm), FN Five-seven (5.7x28 mm), and ORSIS T-5000 (7.62x51 mm NATO).

Despite its significant military spending, only 2% currently supports local defense firms, making Saudi Arabia the world's leading arms and ammunition importer. To reduce this reliance, as part of Vision 2030, the government aims to elevate local military equipment spending to 50% by 2030. A key initiative under Vision 2030 is the establishment of Saudi Arabian Military Industries (SAMI), a state-owned entity producing a range of ammunition not just for Saudi forces but also for other nations in the Middle East and North Africa.

Southeast Asia, Middle-East And Africa Small Arms And Ammunition Industry Overview

Key players dominate the small arms and ammunition market in Southeast Asia and the Middle East and Africa. These include Israel Weapon Industries (IWI) Ltd, Elbit Systems Ltd, PT Pindad, SME Ordnance Sdn Bhd Company (SMEO), and Singapore Technologies Engineering Ltd.

In recent years, bolstered by government backing, domestic arms and ammunition manufacturers in the UAE, Saudi Arabia, and select nations in Southeast Asia and Africa have steadily expanded their market presence. The rising defense sectors in Turkey, the UAE, and Saudi Arabia are set to challenge both established and emerging market entrants. Notably, these regional players not only offer cutting-edge technology but also match the caliber of equipment used by NATO forces. As they vie with international OEMs, these firms are gaining traction for their advanced offerings and attracting a growing number of investors and orders.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness-Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Arms

- 5.1.1.1 Handguns

- 5.1.1.2 Rifles

- 5.1.1.3 Machine Guns

- 5.1.1.4 Shotguns

- 5.1.2 Ammunition

- 5.1.2.1 Lethal

- 5.1.2.2 Non-lethal

- 5.1.1 Arms

- 5.2 End User

- 5.2.1 Civil

- 5.2.2 Law Enforcement

- 5.2.3 Military

- 5.3 Geography

- 5.3.1 Southeast Asia

- 5.3.1.1 Singapore

- 5.3.1.2 Malaysia

- 5.3.1.3 Indonesia

- 5.3.1.4 Rest of Southeast Asia

- 5.3.2 Middle East and Africa

- 5.3.2.1 Saudi Arabia

- 5.3.2.2 United Arab Emirates

- 5.3.2.3 Turkey

- 5.3.2.4 Israel

- 5.3.2.5 Bahrain

- 5.3.2.6 Kuwait

- 5.3.2.7 Qatar

- 5.3.2.8 Oman

- 5.3.2.9 Rest of Middle East and Africa

- 5.3.1 Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Singapore Technologies Engineering Ltd

- 6.2.2 PT Pindad

- 6.2.3 ME Ordnance Sdn Bhd Company (smeo)

- 6.2.4 Elbit Systems Ltd

- 6.2.5 Saudi Arabian Military Industries (SAMI)

- 6.2.6 Oman Munition Production Company (OMPC)

- 6.2.7 Jorammo

- 6.2.8 Kenya Ordnance Factories Corporation

- 6.2.9 Defence Industries Corporation of Nigeria

- 6.2.10 Israel Weapon Industries (IWI) Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS