PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406894

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406894

South Africa Beverages - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

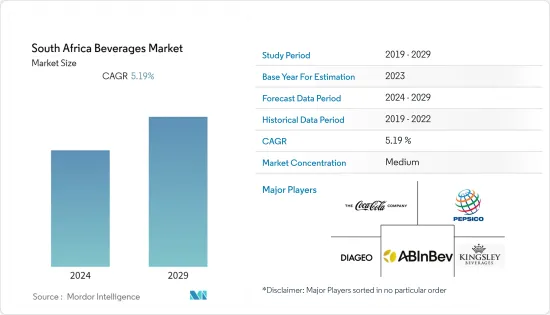

The South African beverages market size is expected to grow from USD 20 billion in 2024 to USD 25.74 billion by 2029, at a CAGR of 5.19% during the forecast period (2024-2029).

Key Highlights

- The South African beverage market has experienced significant growth in recent years due to various factors, including changing dietary patterns and preferences of consumers. Due to busy schedules, consumers opt for quick and on-the-go beverage options that offer immediate benefits such as energy, hydration, or nutrition. This, in turn, has increased the demand for bottled water, energy drinks, sports drinks, and ready-to-drink tea and coffee, among other products.

- Moreover, organic, plant-based, and functional beverages are gaining immense traction with consumers' increasing preference for healthier and more natural beverage options. Furthermore, the demand for premium alcoholic drinks in South Africa has been growing and is projected to continue during the forecast period. Local players have been introducing fruit hops in preparing craft beer, which has become popular among consumers. This strategy allows the companies to position their products as premium, bolstering market growth.

- Besides this, with a rise in social drinking trends due to cocktail culture and the growing urban population, the demand for alcoholic beverages, including beer, has increased. On the other hand, alcohol-free and low-alcohol beer has also gained popularity, especially among young consumers trying to make positive lifestyle choices and manage their alcohol intake.

- Additionally, the rising influence of social media, increasing Internet penetration, and growth of the e-commerce sector have enabled manufacturers to create improved retailing channels and market presence.

South African Beverage Market Trends

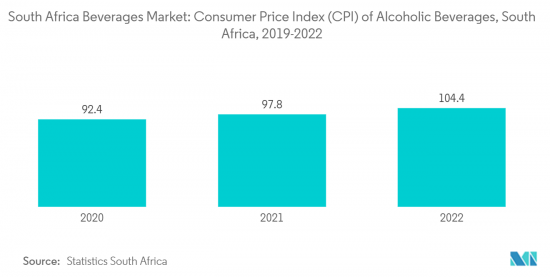

Increased Consumption of Alcoholic Beverages

- The alcoholic beverages segment in South Africa is anticipated to grow with an increased number of social drinkers. Changing consumer preferences toward low-alcohol and craft beers and the rising premiumization trend associated with low alcohol content encourage manufacturers to produce high-quality products.

- For instance, in March 2021, South African Breweries (SAB), a subsidiary of AB InBev, launched low-alcohol Flying Fish Seltzer beer in the country. The company claims that Flying Fish Seltzer beer is formulated with 5.5% ALC/VOL and contains 35 calories per 100 ml. It comes in a premium 300 ml slim can with two flavors: lemon and raspberry.

- Furthermore, the market has witnessed an increased proliferation of smaller and independent breweries selling locally and directly to consumers. This trend is not unique to South Africa and reflects a global shift towards more niche and artisanal products as consumers increasingly seek unique and personalized experiences.

Functional Beverages in Trend

- Functional beverages are becoming increasingly popular among consumers, especially millennials, due to increased advertising, promotional spending, and health consciousness among the wider population. Additionally, ads for energy drinks portray them as beverages that energize the intellect, revive the body, and improve performance and stamina.

- Moreover, functional beverages in South Africa are witnessing a growth phase with new flavor formulations, reduced sugar and calories, and ingredient innovations such as botanicals and herbs. For instance, Coca-Cola, South Africa, offers an energy drink called Coca-Cola Energy. The drink, available in a 300-ml can, contains caffeine, guarana extracts, B vitamins, and no taurine.

- Key players in the market are offering new products fortified with additional nutrition to enhance their market position in the country. For instance, Red Bull South Africa offers Red Bull Green energy drinks fortified with B vitamins, amino acids, and natural sugar (beet sugar) to cater to consumer demand for low-sugar functional beverages, per the company's claims.

South African Beverage Industry Overview

The South African beverages market is competitive due to several regional and international players holding a significant market share. Anheuser-Busch InBev NV, PepsiCo Inc., Kingsley Beverages, Diageo PLC and Coca-Cola Company have a prominent share in the beverage segment of the country. In contrast, the Coca-Cola Company is central in the South African non-alcoholic beverages market segment. Players are increasing their investments in R&D and marketing and expanding their distribution channels to maintain their roles in the market. They also focus on providing consumers with innovative offerings while including functional benefits in each product. Furthermore, the players in the region are reducing the sugar content in their products to mitigate sugar content-related taxes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing demand for flavored beverages in food and beverage industries

- 4.2 Market Restraints

- 4.2.1 Increasing concerns regarding obesity and health awareness

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Alcoholic Beverages

- 5.1.1.1 Beer

- 5.1.1.2 Wine

- 5.1.1.3 Spirits

- 5.1.2 Non-Alcoholic Beverages

- 5.1.2.1 Energy & Sport Drinks

- 5.1.2.2 Carbonated Soft Drinks

- 5.1.2.3 Tea & Coffee

- 5.1.2.4 Other Non-alcoholic Beverages

- 5.1.1 Alcoholic Beverages

- 5.2 Distribution Channel

- 5.2.1 On-Trade

- 5.2.2 Off-Trade

- 5.2.2.1 Supermarkets/Hypermarkets

- 5.2.2.2 Convenience Stores

- 5.2.2.3 Online Retail Stores

- 5.2.2.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 PepsiCo Inc.

- 6.3.2 Coco-Cola Company

- 6.3.3 Red Bull GmbH

- 6.3.4 Diageo PLC

- 6.3.5 Anheuser-Busch InBev NV

- 6.3.6 Ekhamanzi Springs (Pty) Ltd

- 6.3.7 Kingsley Beverages

- 6.3.8 Carlsberg Group

- 6.3.9 The Beverage Company

- 6.3.10 Vital Pharmaceuticals (Bang Energy)

- 6.3.11 Twizza Soft Drinks (Pty) Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS