PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406206

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406206

Anti-Submarine Warfare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

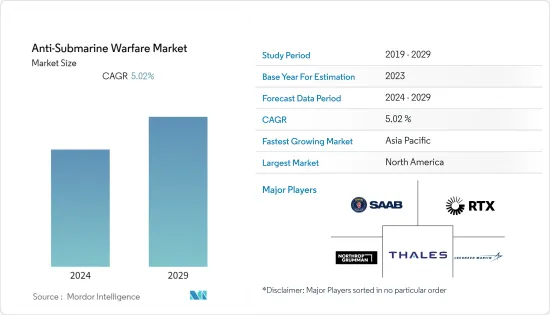

The anti-submarine warfare market was valued at USD 17.98 billion in 2024 and is projected to grow to USD 22.98 billion by 2029, registering a CAGR of 5.02% during the forecast period.

Anti-submarine warfare is critical for protecting the strategic speed and operational agility of naval forces around the world, as the proliferation of new technologies is dramatically affecting the operational planning and execution of missions of both friendly and hostile forces. With counter- and anti-denial strategies evolving as a crucial part of implemented maritime strategies of key naval forces, anti-submarine warfare has become vital in protecting maritime assets against a swift, stealthy attack from hostile forces operating below the surface of the water. The ongoing R&D toward the development of advanced maritime technologies, such as stealth submarines and unmanned marine systems, is envisioned to inspire potential investments in developing countermeasures, such as enhanced range-sonar systems, that can detect stealth submarines and other immersed hostile craft. However, operational complexities and high costs involved in the development of anti-submarine warfare systems may pose a challenge to market growth.

Anti-Submarine Warfare Market Trends

Submarines to WItness Highest Growth During the Forecast Period

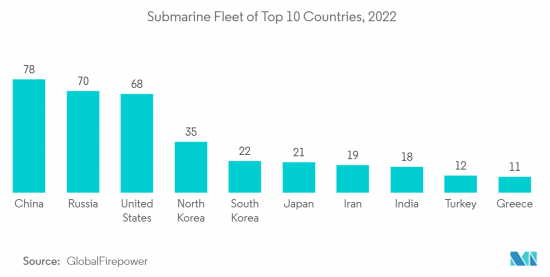

The submarines segment is expected to grow at a high CAGR owing to their ability to change depth and their quietness, which aids detection. Military powerhouses, such as the United States, the United Kingdom, China, and India, are focused on augmenting their naval firepower, and several fleet modernization and procurement contracts are underway to address the evolving threats to their national security. For instance, in December 2022, the US Navy awarded a USD 5.1 billion contract to General Dynamics to conduct advanced construction of critical components for the US Navy's future Columbia-class submarines. The US Navy has been actively implementing force structure expansion plans, aiming to reach its 355-ship goal by FY 2034 through a mix of service life extensions and new construction. In this regard, in 2021, the US Navy received a Los Angeles-class attack submarine. Recently, in March 2023, Australia announced its plan to build a nuclear-powered submarine with the help of the US and UK and signed an agreement called the Aukus. The entire program is projected to cost between USD 268-368 billion. Similar induction programs are envisioned to drive the submarine segment during the forecast period.

Asia-Pacific to Witness Highest Growth During the Forecast Period

The strengthening of the strategic military alliances between the United States and several Asia-Pacific sovereign nations and subsequent reinforcement of military deployment and intervention has resulted in a complex scenario, urging rapid modernization of defense capabilities of regional countries, such as China, to safeguard their vested interests. China has invested its vast technological prowess toward the indigenous development of several weapon systems to foster its military prowess over all three platforms- land, air, and water. China is also developing large, smart, and relatively low-cost crewless submarines with long endurance capacity to perform a wide range of missions, from reconnaissance to mine placement to even suicide attacks against enemy vessels. In August 2023, China conducted anti-submarine exercises in the South China Sea as part of efforts to hone its capabilities amid rising maritime tensions with its neighbors and their allies.

On the contrary, the increasing interest of the Chinese People's Liberation Army Navy in the Indian Ocean region has led the Indian Navy to rapidly invest in anti-submarine ships, such as the Kamorta-class corvette, long-range maritime reconnaissance aircraft such as Boeing P-8 Poseidon and ships such as the Saryu-class patrol vessel, among others. Australia also envisions boosting its submarine fleet with the induction of six Barracuda class submarines based on the Scorpene-class. Several other programs are underway in the region, bolstering the growth prospects of the market in focus during the forecast period.

Anti-Submarine Warfare Industry Overview

The anti-submarine warfare market is fragmented, with many global players present in the market. Some of the prominent players in the market are Lockheed Martin Corporation, RTX Corporation, Northrop Grumman Corporation, Saab AB, and THALES. In order to gain long-term contracts and expand their global presence, players are investing significantly in the procurement of new naval assets. Furthermore, continuous R&D, partnerships, and expansions are fostering the advancements in accuracy and efficiency of integrated weapon technologies and associated products and solutions of naval combat systems with anti-submarine warfare capabilities. For instance, in April 2021, THALES signed a contract with Lockheed Martin as a tier-one supplier for the delivery of up to 55 airborne anti-submarine warfare sonars. Likewise, in April 2022, Saab announced a new 10,000 sq. ft. Anti-Submarine Warfare (ASW) production facility in Rhode Island, the US. The facility will also house the Autonomous and Undersea Systems Division of Saab AB.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 System

- 5.1.1 Sensors

- 5.1.2 Electronic Support Measures

- 5.1.3 Armament

- 5.2 Platform

- 5.2.1 Submarines

- 5.2.2 Surface Ships

- 5.2.3 Helicopters

- 5.2.4 Maritime Patrol Aircraft

- 5.2.5 Unmanned Systems

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BAE Systems plc

- 6.2.2 Lockheed Martin Corporation

- 6.2.3 RTX Corporation

- 6.2.4 THALES

- 6.2.5 General Dynamics Corporation

- 6.2.6 Saab AB

- 6.2.7 L3Harris Technologies Inc.

- 6.2.8 Northrop Grumman

- 6.2.9 Safran

- 6.2.10 Elbit Systems Ltd.

- 6.2.11 Kongsberg Defense & Aerospace (Kongsberg Gruppen ASA)

- 6.2.12 TERMA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS