PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406197

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406197

United Arab Emirates Fuel Station - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

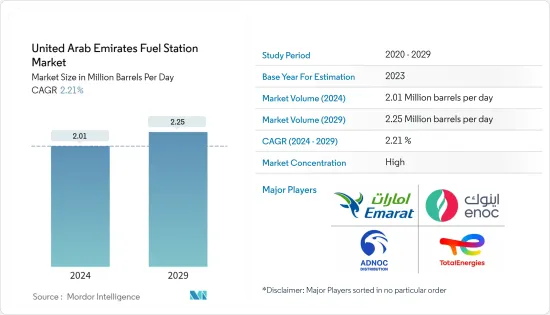

The United Arab Emirates Fuel Station Market size is estimated at 2.01 Million barrels per day in 2024, and is expected to reach 2.25 Million barrels per day by 2029, growing at a CAGR of 2.21% during the forecast period (2024-2029).

The United Arab Emirates fuel station market is estimated to be at 1.97 million barrels per day by the end of this year and is projected to reach 2.20 million barrels per day in the next five years, registering a CAGR of over 2.21% during the forecast period.

Key Highlights

- Over the medium term, the growing demand for fuel stations, increasing adoption of the compact fuel station concept, and expansion of existing fuel station infrastructure are expected to drive the market during the forecast period.

- On the other hand, increasing demand for electric vehicles in the country, fluctuating fuel prices, and stringent regulations implemented by fuel station industries are expected to restrain the UAE fuel station market.

- Nevertheless, upcoming investments in the downstream oil and gas market by domestic and foreign players may create several opportunities for the market in the coming years.

UAE Fuel Station Market Trends

Increasing Number of Vehicles to Drive the Demand

- The country's automotive fleet has increased significantly over the decade, which is expected to create greater demand for fuel stations in the coming years.

- The compact stations aim to serve consumers living in remote residential areas. These fuelling stations can be placed in the parking areas of urban locations with an anticipated capacity of 30,000 L. The compact fuel station has a fuel tank above the ground, facilitating reassembling and moving to a new location.

- There has been significant demand for petroleum products from vehicle fleets in the country, which is expected to create opportunities for operators to provide mobile fuel stations at the convenience of the customers.

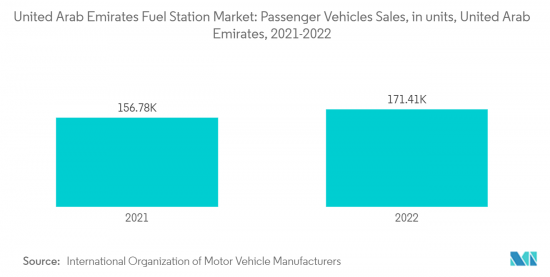

- The increasing number of vehicles on-road in the country will likely increase the demand for compact fuel stations during the forecast period. According to the International Organization of Motor Vehicle Manufacturers (OICA), the total sales of passenger cars volume of vehicles in the country reached 171,414.000 units in 2022, witnessing a rise from 156,780.000 units in 2021.

- ENOC Group piloted its first compact fuel station concept in Dubai in 2018. The pilot station is designed to cater to residents living in residential communities and is equipped with one above-tank fuel dispenser and a vending machine. The fuelling unit is distinguished for its mobility as it can be dismantled, relocated, and re-installed at locations without easy access to fuel in just 30 days.

- In June 2023, ENOC Group announced the opening a new service station on Sharjah-Kalba Road in the Al Bataeh suburb. With this station, the company's total number of service stations in Sharjah.

- Thus, technological advancements are expected to drive the fuel station market in the United Arab Emirates during the forecast period.

Increasing Adoption of Electric Vehicles to Restraint the Market's Growth

- With a desire for higher decarbonization of transport in the United Arab Emirates, the government is expected to encourage further technological and economic improvements in electric vehicle technologies at each vehicle hybridization and electrification level.

- In the current market scenario, supportive policies are the major factor driving electric vehicle adoption. The policies enable market growth by creating consumer awareness, reducing risks for investors, and encouraging manufacturers to develop electric vehicles on a large scale. In 2022, nearly 4383 units of electric vehicles were sold in the country, increasing from 3194.0 units.

- For instance, the United Arab Emirates government plans to launch a free charging station for electric vehicles in Sharjah. The Sharjah City Municipality (SCM) and the Sharjah Electricity and Water Authority (Sewa) partnered for this project. ION, a UAE-based company, will supply, install, and operate EV charging stations in the Emirate.

- In August 2021, the Abu Dhabi Department of Energy (DoE) announced a new governance framework for charging electric vehicles (EVs) in the Emirate. It aimed to enhance vehicle-grid integration and encourage the private sector and consumer participation to scale up EV use in Abu Dhabi.

- Thus, the increasing adoption of electric vehicles is expected to hinder the growth of the UAE fuel station market.

UAE Fuel Station Industry Overview

The United Arab Emirates fuel station market is consolidated. Some of the major players in the market (in no particular order) include Abu Dhabi National Oil Company, Emirates National Oil Company (ENOC), Emirates General Petroleum Corporation, and TotalEnergies SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Gasoline Production and Consumption Forecast, till 2028

- 4.3 Fuel Price Analysis

- 4.4 Number of Fuel Station Analysis

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Increasing Number of Vehicles

- 4.7.1.2 Increasing Adoption of Compact Fuel Station Concept

- 4.7.2 Restraints

- 4.7.2.1 Increasing Demand for Electric Vehicles in the Country

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 PESTLE Analysis

5 COMPETITIVE LANDSCAPE

- 5.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 5.2 Strategies Adopted by Leading Players

- 5.3 Company Profiles

- 5.3.1 Abu Dhabi National Oil Company (ADNOC) Distribution PJSC

- 5.3.2 Emirates National Oil Company (ENOC)

- 5.3.3 Emirates General Petroleum Corporation

- 5.3.4 TotalEnergies SE

6 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 6.1 Upcoming Investments in the Downstream Oil and Gas Market by Domestic and Foreign Players