PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689905

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689905

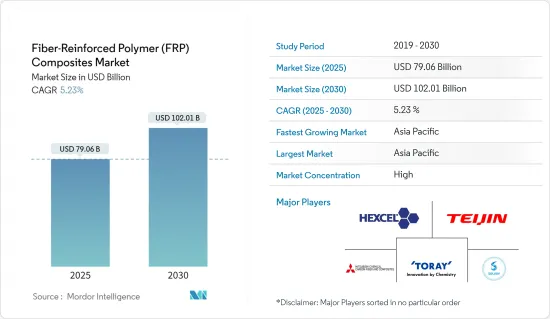

Fiber-Reinforced Polymer (FRP) Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Fiber-Reinforced Polymer Composites Market size is estimated at USD 79.06 billion in 2025, and is expected to reach USD 102.01 billion by 2030, at a CAGR of 5.23% during the forecast period (2025-2030).

COVID-19 negatively impacted the market from 2020 to mid-2021. Due to the pandemic, construction and manufacturing activities were temporarily stopped, which hampered the market for materials, including fiber reinforced polymer composites to be used in these industries. However, post-pandemic, the industries recovered, and the market is expected to retain its growth trajectory in the coming years.

Key Highlights

- Over the short term, the increasing demand from the construction sector and the growing demand for energy efficiency in the aerospace and automotive industries are expected to drive the market's growth.

- On the flip side, the availability of substitutes is expected to hinder the market's growth.

- Nevertheless, the development of new advanced forms of FRP materials and the development of composite materials to be used in the transportation industry are likely to act as opportunities for the market over the forecast period.

- The Asia-Pacific is expected to represent the largest market over the forecast period, owing to the increasing consumption from countries such as China, India, and Japan.

Fiber Reinforced Polymer (FRP) Composites Market Trends

Transportation Industry to Dominate the Market

- Fiber-reinforced polymer composites are widely accepted materials in the automotive and transportation industry as these materials are used as alternatives for lightweight of automobiles.

- These materials offer enhanced properties, such as easy moldability, improved aesthetics, reduced weight, and impact strength, as compared to other conventional automotive components.

- The main advantage of fiber-reinforced polymer composites is their ability to exhibit maximum mass reduction of automobile and carbon emission reduction potential by reducing the overall weight of the vehicle.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, around 85.01 million vehicles were produced across the globe, witnessing a growth rate of 5.99% compared to 80.20 million vehicles in 2021, thereby indicating an increased demand for fiber reinforced polymer composites from the automotive and transportation industry.

- The growth in the industry can also be seen due to the rising demand for electric vehicles. As per the World Economic Forum (WEF), nearly 4.3 million new battery-powered EVs (BEVs) and plug-in hybrid electric vehicles (PHEVs) were sold globally in the first half of 2022. Therefore, enhancing the demand for materials such as fiber reinforced polymer composites, and others.

- According to the European Automobile Manufacturers Association, the car production rate in the North America region rose by 10.3% in 2022 to 10.4 million units, primarily driven by strong demand in the United States. In 2022, global new car registrations reached 66.2 million units.

- Germany is among the key manufacturer of vehicles. The automobile manufacturing industry in Germany is a prominent shareholder of the overall automotive production in the European region. The country hosts major car-making brands, including Volkswagen, Mercedes-Benz, Audi, BMW, Porsche, among others.

- All these factors are expected to impact the demand for the fiber reinforced polymer composites from the transportation industry, during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the fiber-reinforced polymer (FRP) composites market during the forecast period. Due to the high demand for applications from countries like China, India, and Japan, the demand for FRP composites is increasing in the region.

- The construction sector in the Asia-Pacific region is the largest in the world. It is increasing at a healthy rate, owing to the rising population, increase in middle-class income, and urbanization. The highest growth for housing is expected to be registered in the Asia-Pacific region, owing to the expanding housing construction markets in China and India.

- The rising household income levels, combined with the population migrating from rural to urban areas, are expected to continue to drive the demand for the residential construction sector in China.

- In addition, the country has the largest construction market in the world, encompassing 20% of all construction investments globally. China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive market outlook for the fiber-reinforced polymer composites market.

- Furthermore, the construction sector is an important pillar for the growth of the Indian economy. The Indian government has been actively boosting housing construction, aiming to provide houses to about 1.3 billion people.

- Many Automakers are investing heavily in various segments of the industry; for instance, in November 2022, Maruti Suzuki India announced an investment of USD 865.12 million on various projects, including new facilities set-up and introduction of new models.

- In January 2022, Honda's Chinese joint venture with Dongfeng Motor Corporation Ltd. announced the development of an electric vehicle manufacturing factory in Wuhan. The new Dongfeng-Honda Automobile facility will be opened in 2024 with a production capacity of 120,000 units per year.

- According to the Association of Southeast Asian Nations Automotive Federation, Asia Pacific produced 4,383,744 units of motor vehicles and 3,636,453 units of motorcycles and scooters in 2022. It sold over 3,424,935 and 4,049,598 units of motor vehicles and two-wheelers, respectively, in the same year.

- The demand for electronics products in the Asia-Pacific region majorly comes from China, India, and Japan. China is a strong, favorable market for electronics producers, owing to the country's low labor cost and flexible policies.

- China's market is the largest in the world, even larger than the combined markets of all industrialized countries. In the year 2022, the Chinese electronic industry expanded by 14% and is expected to grow by 8% in 2023.

- In India, the electronics sector is seeing rapid growth owing to government schemes such as Make in India, National Policy of Electronics, Net Zero Imports in Electronics, and Zero Defect Zero Effect, which offer a commitment to growth in domestic manufacturing, lowering import dependence, energizing exports, and manufacturing.

- Thus, all such factors are likely to drive the growth of the fiber-reinforced polymer composites market during the forecast period.

Fiber Reinforced Polymer (FRP) Composites Industry Overview

The global fiber-reinforced polymer (FRP) composites market is partially consolidated in nature, with the top five players accounting for a major share of the market studied. Some of the key players include (not in any particular order) Hexcel Corporation, Teijin Limited, Toray Industries Inc., Solvay, and Mitsubishi Chemical Carbon Fiber and Composites Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Construction Sector

- 4.1.2 Growing Demand for Energy Efficiency in the Aerospace and Automotive Industries

- 4.2 Restraints

- 4.2.1 Fiber-reinforced Polymer (FRP) Material Shortcomings

- 4.2.2 Availability of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Fiber Type

- 5.1.1 Glass Fiber-reinforced Polymer

- 5.1.2 Carbon Fiber-reinforced Polymer

- 5.1.3 Aramid Fiber-reinforced Polymer

- 5.1.4 Basalt Fiber-reinforced Polymer

- 5.1.5 Other Fiber Types

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Transportation

- 5.2.3 Electrical and Electronics

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aegion Corporation

- 6.4.2 AGC Chemicals Americas

- 6.4.3 Gurit

- 6.4.4 GSC

- 6.4.5 Hexcel Corporation

- 6.4.6 Kordsa Teknik Tekstil A.S.

- 6.4.7 Mitsubishi Chemical Carbon Fiber and Composites Inc.

- 6.4.8 Nippon Electric Glass Co. Ltd.

- 6.4.9 Owens Corning

- 6.4.10 Park Aerospace Corp.

- 6.4.11 SGL carbon

- 6.4.12 Solvay

- 6.4.13 TEIJIN LIMITED

- 6.4.14 TORAY INDUSTRIES INC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of New Advanced Forms of FRP Materials

- 7.2 Developments and Partnerships In the Field of Composite Material From the Transportation Industry