PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406047

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406047

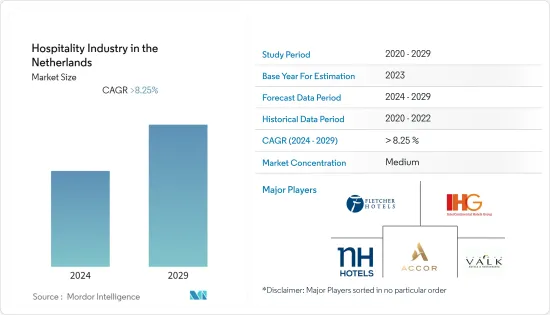

Hospitality Industry in the Netherlands - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

The Hospitality Industry in the Netherlands Market is expected to register a CAGR of greater than 8.25% during the forecast period(2024-2029).

The hospitality industry in the Netherlands has generated revenue of USD 5.30 billion in the current year and is poised to register a CAGR of more than 8.25% during the forecast period.

Though the entry for new hotels in Amsterdam is going to get limited in the coming years owing to the fact that with more municipalities implementing a restrictive hotel policy, which means there are fewer opportunities for new hotel developments as the city already bulges, it still retained the top spot as the most attractive European city for hotel investments in 2022 with respect to the high demand that the city holds for new hotels.

The city has been stretching its borders for visitors and for hotels to room them. Along with Amsterdam, both supply and demand for new developments grew throughout the Netherlands in 2022. The number of hotel rooms is growing at a rapid pace in the major Dutch cities. Among the top 5 cities with high RevPAR, Rotterdam registered high growth when compared to Amsterdam, Maastricht, Utrecht, and The Hague. The increasing RevPAR that many tier-II cities have been recording is attracting investors. The increase in the percentage of RevPAR in Rotterdam was almost 10% in 2022 when compared to that in 2021. Also, Rotterdam stood next to Amsterdam in the number of hotel projects that are in the construction pipeline, with around 2,000 rooms, while Amsterdam has more than 8,100 rooms. The shifting preference for local and authentic experiences is notably driving the hospitality market growth in the Netherlands. However, factors such as difficulties in implementing tourism policies may impede the market growth.

Netherlands Hospitality Market Trends

Tier-II Cities Are Going to Attract More Investors Thus Driving The Industry

Amsterdam achieved the highest average room rate in 2021 at EUR 162 (USD 171), which is an increase of 5.2% compared to 2022. The Amsterdam market also showed growth in the average occupancy rate of 2%. Utrecht has been recording high demand numbers, whereas supply is less, thus making it a great opportunity for investors. And with the restrictive hotel policy in Amsterdam is also making investors focus on other regions of the country. With the recent developments from the past three years, Amsterdam recorded a high number of hotels opening for the same period. With this trend, more focus is going to be given to tier-II cities in the forecast period.

Crowded Amsterdam is Opening Up Opportunities for Other Cities for Development

The growing employment opportunities and population are leading to urbanization, thus making them a good market for hotels. Cities like Amstelveen and Haarlem are registering almost an equal growth rate in population as Amsterdam. They are forecasted to attract more investors as these cities are recording growing percentage growth of job opportunities, which correlates with the increase in population and GDP. The natural attractions in those cities are attracting more visitors.

Netherlands Hospitality Industry Overview

The Netherlands hospitality industry is the consolidated market. Like most of the European Union countries, the hospitality industry in the Netherlands is largely covered by most of the European-born companies, yet the number of international players and their brands also penetrates well in the region. Most of the hotels are strategically located in places that tourists highly prefer. The region holds good demand for hotels as the supply is a little less than the demand. With the co-operating government policies, the region is an attractive one for investors. The major players in the Netherlands are Van der Valk, Accor SA, NH Hotels, InterContinental Hotels Group Plc, and Fletcher Hotel.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Contribution to the Economy to Generate Income for the Nation

- 4.2.2 Market Restraints

- 4.2.2.1 Long Hours of Working Pattern

- 4.2.3 Market Opportunities

- 4.2.3.1 Technological Advancements in Netherlands Hospitality Industry

- 4.2.1 Market Drivers

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on Hospitality Industry

- 4.5 Technological Innovations in the Hospitality Industry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Chain Hotels

- 5.1.2 Independent Hotels

- 5.2 By Segment

- 5.2.1 Service Apartments

- 5.2.2 Budget and Economy Hotels

- 5.2.3 Mid and Upper mid scale Hotels

- 5.2.4 Luxury Hotels

6 COMPETITVE INTELLIGENCE

- 6.1 Market Concentration

- 6.2 Company profiles

- 6.2.1 Van der Valk

- 6.2.2 AccorHotels

- 6.2.3 NH Hotels

- 6.2.4 Fletcher Hotel

- 6.2.5 InterContinental Hotel Group

- 6.2.6 Louvre Hotels Group

- 6.2.7 Bastion Hotel Group

- 6.2.8 Marriott International

- 6.2.9 Hilton Hotels &Resorts

- 6.2.10 Radisson Hotel Group*

- 6.3 Loyalty programs offered by Major Hotel Brands

7 MARKET FUTURE TRENDS

8 DISCLAIMER