PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851184

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851184

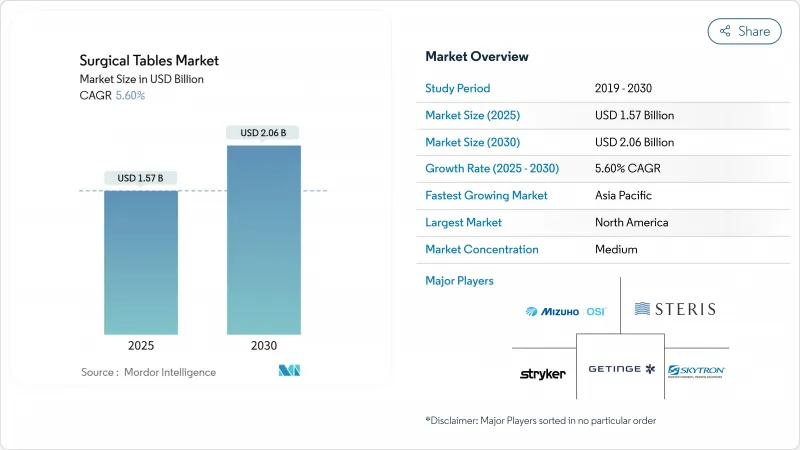

Surgical Tables - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The surgical tables market stood at USD 1.57 billion in 2025 and is on track to reach USD 2.06 billion by 2030, growing at a 5.6% CAGR.

Demographic aging is lifting orthopedic and cardiovascular caseloads, outpatient care is shifting more procedures into ambulatory surgical centers (ASCs), and robotics-ready operating rooms (ORs) are raising the technical bar for patient-positioning platforms. Hospitals are upgrading to carbon-fiber radiolucent tops to support real-time imaging, while sustainability mandates in Europe and North America reward energy-efficient modular designs. Competitive strategies increasingly revolve around bundled OR ecosystems that tie surgical tables to imaging, lighting, and robotic offerings, helping providers simplify procurement and integration. Premium-segment manufacturers are also launching service and financing programs that mitigate capital-budget constraints for mid-tier hospitals.

Global Surgical Tables Market Trends and Insights

Rising surgical procedure volumes & ASC expansion

Outpatient sites perform the bulk of U.S. procedures and continue to attract complex orthopedic and gastroenterology cases because they operate at 45-60% lower costs than hospital outpatient departments and cut average wait times by 20% . ASC growth is encouraging vendors to deliver compact, multi-specialty tables that fit smaller footprints and rotate quickly between cases. To keep capital outlays down, manufacturers now market modular bases that accept specialty tops, letting centers defer upgrades until volumes justify them. Group-purchasing contracts and equipment-as-a-service financing further lower barriers to adoption.

Aging population driving higher orthopedic & cardiac caseload

Population aging elevates demand for joint reconstruction, fracture repair, and interventional cardiology procedures that require precise positioning and bariatric weight limits. U.S. orthopedic volumes are projected to reach 6.6 million procedures annually, reinforcing the need for heavy-load lifts and pressure-injury mitigation sensors. Bariatric-capable tables with integrated pressure mapping, such as XSENSOR's ForeSite OR, reduce hospital-acquired pressure injuries that affect up to 45% of surgical patients.

Premium pricing & capex freezes in mid-tier hospitals

Rising operating costs and inflation have caused smaller hospitals to delay capital purchases, selectively opting for refurbished equipment or multi-year leasing. Medicare reimbursement has slipped for total joint arthroplasty even as volumes climb, compressing margins and making high-end imaging-compatible tables harder to justify . Vendors are countering with staged upgrade paths that let facilities install a base and add connectivity kits later, plus service contracts that bundle maintenance, remanufacturing compliance, and software updates.

Other drivers and restraints analyzed in the detailed report include:

- Integrated-OR & robot-ready table upgrades

- Carbon-fiber radiolucent tops enabling intra-op imaging

- Surge in minimally invasive & robotic surgeries requiring advanced patient-positioning functionality

- Hospital sustainability mandates favoring energy-efficient, modular table platforms

- Shortage of skilled OR technologists for advanced tables

- Carbon-fiber supply chain volatility

- Stricter reprocessing and regulatory compliance raising lifetime ownership costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

General surgery held 35.78% of the surgical tables market share in 2024. Hospitals favor versatile, quick-switch platforms that serve appendectomies in the morning and bariatric cases in the afternoon. The segment's broad procedural mix supports economies of scale for replacement purchases, and its workflows align with standardized accessories such as removable armboards and lithotomy leg supports. Meanwhile, robotic cholecystectomy adoption is nudging many providers to replace manual hydraulic bases with motorized column systems featuring footswitch memory profiles for speed and consistency.

Orthopedic & trauma procedures are set to log a 6.78% CAGR to 2030, the fastest in the market. Knee and hip robotics like Zimmer Biomet's TMINI Miniature Robotic System depend on rigid, low-vibration surfaces that maintain sub-millimeter accuracy during milling. Table manufacturers respond with longitudinal slide and tilt ranges that expose distal femurs without repositioning, shortening anesthesia times and radiographic exposure. Neurosurgery and cardiovascular specialties occupy smaller shares but command premium pricing because they demand carbon tops, 360° C-arm clearance, and head fixation interfaces that integrate with navigation systems. As hospitals pursue cross-disciplinary hybrid rooms, demand is shifting toward universal platforms that support spinal, vascular, and cranial workflows on the same chassis, reducing inventory and service overhead.

The Surgical Tables Market Report is Segmented by Type of Surgery (General and Specialty), Material (Metal and Composite), End User (Hospitals, Ambulatory Surgical Centers, and Clinics), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Report Offers the Value (USD) for the Above Segments.

Geography Analysis

North America captured 38.75% of 2024 revenue, supported by high procedure volumes and early uptake of advanced robotics. The U.S. ASC market alone could reach nearly USD 59 billion in revenue by 2028, spurring orders for cost-optimized, quick-turnover tables. Medicare's push for site-neutral reimbursement further accelerates equipment migration from hospitals to ASCs, while regional service networks from Getinge and STERIS reduce downtime and reinforce brand stickiness.

Europe forms a mature, replacement-driven market where sustainability and regulatory rigor shape purchasing. ASHRAE 189.3 guidelines influence tender scores, nudging buyers toward energy-efficient motor drives and recyclable packaging. Getinge's Surgical Workflows segment posted 15.6% revenue growth in Q4 2023, helped by hospitals refreshing legacy fleets with integrated OR suites. Capital grants tied to green public-procurement criteria are likely to sustain steady demand despite flat procedural growth.

Asia-Pacific is the fastest-growing region, projected at a 6.84% CAGR. Healthcare infrastructure investment and widening medical-tourism flows drive adoption of hybrid rooms in China, India, and ASEAN states. Medtronic's Robotics Experience Studio in Singapore illustrates how training hubs accelerate diffusion of advanced OR technologies throughout the region. Venture funding dipped 22% over the past two years, yet domestic manufacturing initiatives in Vietnam and Korea help offset import tariffs and supply bottlenecks, supporting localized table production.

- Getinge

- Stryker

- Steris plc

- Trumpf Medical (Baxter/Hill-Rom)

- Mizuho

- Skytron

- Schaerer Medical AG

- Merivaara

- Alvo Medical

- LINET Group

- Mindray Medical Intl.

- Opt SurgiSystems Srl

- Eschmann Holdings

- Allengers Medical Systems

- Nuvo Inc.

- AGA Sanitatsartikel GmbH

- Meditek Canada

- Staan Bio-Med Engg. Pvt Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising surgical procedure volumes & ASC expansion

- 4.2.2 Aging population driving higher orthopedic & cardiac caseload

- 4.2.3 Integrated-OR & robot-ready table upgrades

- 4.2.4 Carbon-fiber radiolucent tops enabling intra-op imaging

- 4.2.5 Surge in minimally invasive & robotic surgeries requiring advanced patient-positioning functionality

- 4.2.6 Hospital sustainability mandates favoring energy-efficient, modular table platforms

- 4.3 Market Restraints

- 4.3.1 Premium pricing & capex freezes in mid-tier hospitals

- 4.3.2 Shortage of skilled OR technologists for advanced tables

- 4.3.3 Carbon-fiber supply chain volatility

- 4.3.4 Stricter reprocessing and regulatory compliance raising lifetime ownership costs for providers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Type of Surgery

- 5.1.1 General Surgery

- 5.1.2 Orthopedic & Trauma

- 5.1.3 Cardiovascular

- 5.1.4 Neurosurgery

- 5.1.5 Others

- 5.2 By Material

- 5.2.1 Metal

- 5.2.2 Carbon-fiber Composite

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialty Clinics

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Getinge AB

- 6.3.2 Stryker Corporation

- 6.3.3 Steris plc

- 6.3.4 Trumpf Medical (Baxter/Hill-Rom)

- 6.3.5 Mizuho OSI

- 6.3.6 Skytron LLC

- 6.3.7 Schaerer Medical AG

- 6.3.8 Merivaara Corp.

- 6.3.9 Alvo Medical

- 6.3.10 LINET Group SE

- 6.3.11 Mindray Medical Intl.

- 6.3.12 Opt SurgiSystems Srl

- 6.3.13 Eschmann Holdings Ltd

- 6.3.14 Allengers Medical Systems

- 6.3.15 Nuvo Inc.

- 6.3.16 AGA Sanitatsartikel GmbH

- 6.3.17 Meditek Canada

- 6.3.18 Staan Bio-Med Engg. Pvt Ltd

7 Market Opportunities & Future Outlook