PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1404522

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1404522

UAE Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

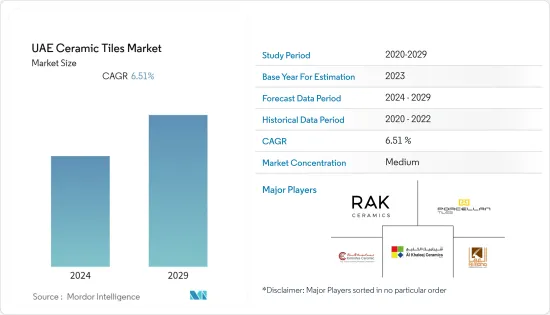

The UAE Ceramic Tiles Market reached USD 9.4 billion in the current year, and it is expected to witness a CAGR of 6.51% during the forecast period.

The UAE ceramic tiles market is projected to witness substantial growth over the forecast period, owing to significant growth in the medical and housing and construction industries. A significant increase in construction activities in the country is providing an impetus to the ceramic tiles market. The ceramics tile manufacturers in the United Arab Emirates use advanced technology and original designs. Thus, the tiles produced by these manufacturers are not only of high quality but also have artistic value. Large companies from around the world are willing to set up companies in the United Arab Emirates because of the demand for ceramic tiles in the country. RAK Ceramics is one of the leading companies in the United Arab Emirates, which specializes in ceramic tiles. In June 2019, the company launched Maximus porcelain mega slabs. Industrial development fuelled by huge investments made by the government plays a crucial role in the growth of the industry, as all industrial facilities need fit-for-purpose flooring.

UAE Ceramic Tiles Market Trends

Imports and Export of Ceramic Tiles to the Country

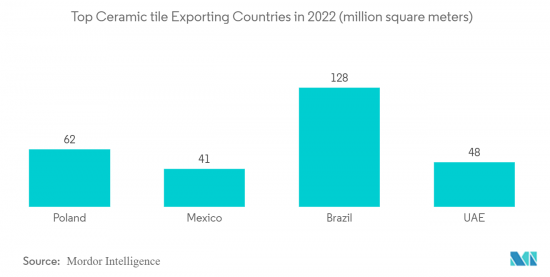

The demand for ceramic tiles in the United Arab Emirates and across the world is increasing year-on-year, with the consumption of millions of square meters per annum in the country, as new projects are announced every month. This tremendous growth of ceramic tiles is also attributed to the excellent advanced technological developments that have taken place in the flooring section and tile manufacturing process. The country is one of the major importers and exporters of ceramic tiles.

The Commercial Application is Driving the Market

The development in the real estate and infrastructure sectors has helped the country become a global tourist destination in recent years. The real estate sector has a positive impact on development, investments, and tourism, as estate projects were launched to meet the market's needs. The commercial segment is dominating the market in the country.

UAE Ceramic Tiles Industry Overview

The report covers major international players operating in the UAE ceramic tiles market. In terms of the market share, the players are moderately fragmented. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets. Some of the major players in the market are Al Khaleej Ceramics, RAK Ceramics, Al Maha Ceramics, Emirates Ceramic, and Porcellan Co. LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Construction and Renovation Activities

- 4.2.2 Growing Urbanization is Driving the Market

- 4.3 Market Restraints

- 4.3.1 High Competitiveness in Players Resilient Flooring Market

- 4.3.2 Substitution by Other Products

- 4.4 Market Opportunities

- 4.4.1 Rapidly Evolving Design Trends can be seen as Opportunity in the Market

- 4.4.2 Increase in Online Distribution

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porters' Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Technology Innovation in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Glazed

- 5.1.2 Porcelain

- 5.1.3 Scratch-free

- 5.1.4 Other Products

- 5.2 By Application

- 5.2.1 Floor Tiles

- 5.2.2 Wall Tiles

- 5.2.3 Other Applications

- 5.3 By Construction Type

- 5.3.1 New Construction

- 5.3.2 Replacement and Renovation

- 5.4 By End User

- 5.4.1 Residential

- 5.4.2 Commercial

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Emirates Ceramics

- 6.2.2 Al Khaleej Ceramics

- 6.2.3 RAK Ceramics

- 6.2.4 Al Anwar Ceramic

- 6.2.5 Al Maha Ceramics

- 6.2.6 Saudi Ceramics

- 6.2.7 Al Moheb Group

- 6.2.8 Porcellan Co. LLC

- 6.2.9 Meraki Ceramics

- 6.2.10 Emirates Ceramics*

7 FUTURE OF THE MARKET

8 DISCLAIMER AND ABOUT US