Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687387

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687387

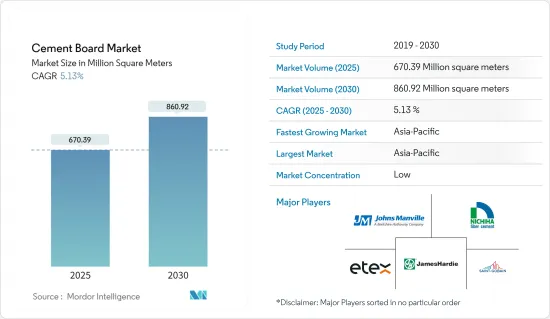

Cement Board - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Cement Board Market size is estimated at 670.39 million square meters in 2025, and is expected to reach 860.92 million square meters by 2030, at a CAGR of 5.13% during the forecast period (2025-2030).

Key Highlights

- The increasing adoption in residential and commercial construction and desirable properties of impact resistance and durability are expected to drive the cement board market during the forecast period.

- However, the high initial cost compared to its traditional counterparts is expected to hinder market growth.

- Nevertheless, the rising trends for aesthetic improvement are expected to create new opportunities for the market.

- Asia-Pacific is expected to dominate the market, with the majority of demand coming from China and India.

Cement Board Market Trends

Increasing Adoption in Residential and Commercial Construction

- Cement boards offer a unique combination of durability, fire resistance, moisture resistance, and cost-effectiveness, making them a popular choice for residential construction.

- The commercial segment stands out as a pivotal player in the cement board market, with the office sector leading the way. As global commercial activities surge, so does the demand for cement boards in this segment.

- Asia-Pacific, a burgeoning hub for office spaces, ranks among the top markets in commercial construction. Countries like India and China have seen a consistent uptick in demand for office spaces, driven by sectors such as technology, e-commerce, and banking, leading to a flurry of new office constructions.

- India's burgeoning startup ecosystem highlights an increasing appetite for office spaces. Bolstered by government initiatives, the Department for Promotion of Industry and Internal Trade (DPIIT) recognized a remarkable 1,17,254 startups by December 2023.

- The United States is also a huge market for the building and construction industry. As per the data from the US Census Bureau, in 2023, the United States spent over USD 706.1 billion on new private non-residential buildings, a significant increase from USD 596.5 billion in 2022. Moreover, the residential construction in 2023 was only USD 864.9 billion.

- In 2023, an estimated 1,469,800 housing units were authorized by building permits, 11.7% below the 2022 figure of 1,665,100. Moreover, an estimated 1,413,100 housing units were started in 2023, 9% (+-2.5%) below the 2022 figure of 1,552,600.

- In July 2024, the seasonally adjusted annual rate for privately-owned housing units authorized by building permits stood at 1,396,000. This figure represents a 4% decline from the revised June rate of 1,454,000 and a 7% drop compared to the July 2023 rate of 1,501,000.

- Germany's robust economy is fueling a demand for commercial spaces, especially high-quality, ESG-compliant office buildings, which is evident from rising prime rents. In Q3 2023, 246,000 square meters of office space were completed, with projections reaching 1.8 million sq. m by 2024. Retail space development, particularly in shopping centers, also saw consistent growth in 2023.

- Brazil's residential sector is drawing substantial private investments fueled by swift urbanization. In response to this burgeoning demand, the government reintroduced the "Minha Casa, Minha Vida" (My Home, My Life) program in February 2023, setting an ambitious goal of 2 million new projects by 2026.

- Saudi Arabia is witnessing a construction boom, highlighted by the Jeddah Central megaproject. Spearheaded by the Jeddah Central Development Company (JCDC), a subsidiary of the Public Investment Fund (PIF), this ambitious USD 20 billion project includes landmarks like a museum, opera house, and sports stadium, alongside 17,000 residential units and over 3,000 hotels. The first phase is set for completion in 2027, with further developments extending to 2030 and beyond.

- These dynamics underscore a robust demand for cement boards in both residential and commercial construction globally, with promising growth during the forecast period.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific holds a dominant position in the global cement board market, led by China. Cement boards find extensive applications in China's diverse construction activities, spanning both residential and commercial sectors.

- China is actively pursuing urbanization, aiming for a 70% urban rate by 2030. This urbanization drives a demand for more living spaces and reflects the middle class's aspirations for better living conditions. Such dynamics are set to boost the housing market and residential construction, positively influencing the cement board market.

- In Hong Kong, China, housing authorities have initiated multiple measures to kickstart the construction of affordable housing. Officials have set a target to deliver 301,000 public housing units by 2030.

- With plans to relocate 250 million rural residents to new megacities by 2025, the Chinese government's ambitious construction initiatives are set to boost the cement board market.

- In response to a struggling economy, Chinese governors are ramping up budgets for major building projects by nearly 20%. Over two-thirds of China's regions have committed to significant projects, including transportation infrastructure and industrial zones, with a combined budget exceeding CNY 12.2 trillion (USD 1.8 trillion) for 2024.

- Rising disposable incomes in China are fueling the demand for upscale commercial spaces, including malls and hotels. China stands at the forefront of shopping center development, boasting nearly 4,000 existing centers and an estimated 7,000 more by 2025. Projects like the Wuhan Fosun Bund Center T1, with construction starting in Q3 2021 and completion slated for Q4 2025, further bolster the market.

- India is set to witness a 70% surge in the availability of affordable housing. According to Invest India, the construction sector is projected to attain a valuation of USD 1.4 trillion by 2025. With forecasts suggesting that over 30% of the population will be urban dwellers by 2030, there is a pressing need for 25 million more mid-end and affordable housing units. Recent reforms, such as the Real Estate Act, GST (goods and services tax), and REITs (real estate investment trusts), aim to expedite approvals and strengthen the construction industry, driving market growth.

- South Korea is undertaking significant industrial construction ventures. A notable example is S-Oil Corp.'s ambitious Shaheen refinery-integrated petrochemical plant in Ulsan, set to finish by 2026. This facility will house the world's largest naphtha-fed steam cracker, capable of producing 1.8 million mt/year of ethylene, underscoring the project's potential to elevate industrial demand and support market growth.

- Given these dynamics, the demand for cement boards in Asia-Pacific is poised for significant growth during the forecast period.

Cement Board Industry Segmentation

The cement board market is partially fragmented in nature. The major players (not in any particular order) include James Hardie Industries PLC, Etex Group, Saint-Gobain, Johns Manville, and NICHIHA Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 62218

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Adoption in Residential and Commercial Construction

- 4.1.2 Desirable Properties of Impact Resistance and Durability

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 High Initial Cost in Comparison to Traditional Counterparts

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Product Type

- 5.1.1 Fiber Cement Board (FCB)

- 5.1.2 Wood Wool Cement Board (WWCB)

- 5.1.3 Wood Strand Cement Board (WSCB)

- 5.1.4 Cement Bonded Particle Board (CBPB)

- 5.2 By Application

- 5.2.1 Flooring

- 5.2.2 Exterior and Partition Walls

- 5.2.3 Roofing

- 5.2.4 Columns and Beams

- 5.2.5 Facades, Weatherboard, and Cladding

- 5.2.6 Acoustic and Thermal Insulation

- 5.2.7 Other Applications (Prefabricated Houses, Permanent Shuttering, Fire-resistant Construction, etc.)

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial and Institutional

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Etex Group

- 6.4.2 Elementia Materials

- 6.4.3 Everest Industries Limited

- 6.4.4 James Hardie Industries PLC

- 6.4.5 Johns Manville

- 6.4.6 Knauf Gips KG

- 6.4.7 Saint-Gobain

- 6.4.8 BetonWood SRL

- 6.4.9 Cembrit Holding A/S

- 6.4.10 HIL Limited

- 6.4.11 GAF

- 6.4.12 NICHIHA Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Trends for Aesthetic Improvement

- 7.2 Other Opportunities

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.