PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852047

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852047

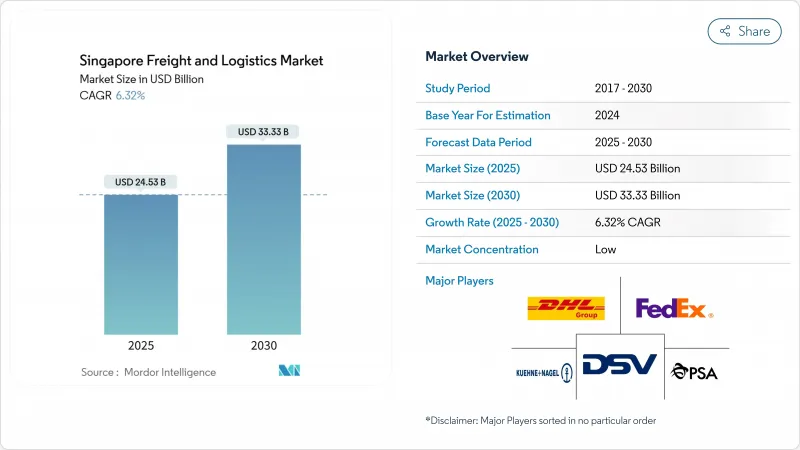

Singapore Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Singapore freight and logistics market size is valued at USD 24.53 billion in 2025 and is forecast to reach USD 33.33 billion by 2030, reflecting a 6.32% CAGR through the period.

Robust throughput at PSA's terminals, a 50% uplift in Changi's planned cargo capacity, and steady policy support for digital adoption anchor this momentum. Cold-chain projects, 5G-enabled port operations, and direct long-haul freighter lanes are steering the Singapore freight and logistics market toward higher-value, time-critical flows. Manufacturers relocating some production from China to ASEAN now route an increasing share of high-tech and pharmaceutical cargo through the city-state, drawn by fully automated yard equipment and near-instant customs clearance. Competition from Malaysian ports is heightening, yet Singapore offsets cost disadvantages with superior reliability, visibility, and multimodal speed.

Singapore Freight And Logistics Market Trends and Insights

Tuas Mega-Port Capacity Expansion Transforms Regional Container Flows

Phase 1 went live in 2022 and pushed aggregate throughput past 40 million TEUs in 2024, while automated cranes and autonomous vehicles cut berth times by 25%. The SGD 20 billion (USD 15.15 billion) build-out ultimately elevates capacity to 65 million TEUs, ensuring the Singapore freight and logistics market stays ahead of lower-cost Malaysian alternatives.

Digital Plan 2.0 Accelerates Cold-Chain and Automation Investments

Government co-funding drives IoT sensors, blockchain tracing, and robotic picking. DHL's EUR 500 million (USD 551.82 million) pharma hub integrates real-time temperature control across 8,200 m2, illustrating how digitization captures premium life-science flows.

Industrial Land Cost Inflation Pressures Operator Profitability

Average JTC rentals reached SGD 16-45 (USD 12.12- 34.08) per m2 per month in 2024, squeezing smaller forwarders. Many relocate overflow storage to Johor while retaining Singapore for high-velocity cargo. Larger operators leverage automation to lift space productivity and offset rent hikes, sustaining presence in the Singapore freight and logistics market.

Other drivers and restraints analyzed in the detailed report include:

- Pharmaceutical and Aerospace MRO Output Drives Specialized Logistics Demand

- Customs Efficiency Enhancement Strengthens Transshipment Competitiveness

- Foreign Worker Policy Tightening Constrains Capacity Expansion

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wholesale and retail trade represented 30.82% of 2024 turnover, a testament to Singapore's heritage as a distribution entrepot. Manufacturing, led by pharmaceuticals and aerospace, will outpace all other segments at 6.83% CAGR between 2025-2030, shifting focus toward validated cold-chain, time-critical services and boosting the Singapore freight and logistics market.

Construction logistics stays buoyant on ASEAN infrastructure builds, while agriculture, fishing, and forestry flows rely on Singapore's stringent food-safety regime. Oil and gas volumes are steady, benefiting from the city-state's role as a bunkering hub.

Freight transport generated 61.33% of 2024 revenue, cementing its place at the core of the Singapore freight and logistics market. Sea and inland waterways lifted significant segment revenue, while air freight booked a 7.13% CAGR between 2025-2030, thanks to semiconductor and vaccine movements. Road freight handled 130.27 million tons in 2024 but remains constrained by land scarcity. Pipelines moved 97.36 million tons of petrochemicals, a steady yet mature niche.

Courier, Express, and Parcel (CEP) is gathering speed, advancing 7.27% CAGR (2025-2030) as cross-border e-commerce demands next-day transit across ASEAN. Warehousing revenues stay resilient, but temperature-controlled space is growing twice as fast as ambient sheds. Freight forwarding thrives on customs speed; air forwarding in particular, benefits from direct Singapore-US freighter links that cut lead times by one full day. Together, these shifts illustrate how the Singapore freight and logistics market is evolving from pure transshipment to an integrated digital supply-chain platform.

The Singapore Freight and Logistics Market Report is Segmented by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Wholesale and Retail Trade, Oil and Gas, Mining and Quarrying, and Others), and by Logistics Function (Courier, Express, and Parcel (CEP), Freight Forwarding, Freight Transport, Warehousing and Storage, and Other Services). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- A.P. Moller - Maersk

- CJ Logistics Corporation

- CMA CGM Group (Including CEVA Logistics)

- CWT Pte, Ltd.

- DHL Group

- DSV A/S (Including DB Schenker)

- FedEx

- GEODIS (Including Keppel Logistics Pte Ltd.)

- Kuehne+Nagel

- Nippon Express Holdings, Inc.

- Pacific International Lines Pte, Ltd.

- Poh Tiong Choon Logistics, Ltd

- PSA International

- SATS, Ltd.

- SF Express (KEX-SF)

- Singapore Post, Ltd.

- ST Logistics Pte, Ltd.

- United Parcel Service of America, Inc. (UPS)

- Vibrant Group, Ltd.

- Yamato Holdings Co., Ltd.

- YCH Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Modal Share

- 4.13 Freight Pricing Trends

- 4.14 Freight Tonnage Trends

- 4.15 Infrastructure

- 4.16 Regulatory Framework (Road and Rail)

- 4.17 Regulatory Framework (Sea and Air)

- 4.18 Value Chain and Distribution Channel Analysis

- 4.19 Market Drivers

- 4.19.1 Tuas Mega-Port Capacity Expansion Fueling Overall Sea-Freight Volumes in Singapore

- 4.19.2 Logistics Industry Digital Plan 2.0 Incentivizing Automation and Cold-Chain Investments

- 4.19.3 Pharma and Aerospace MRO Output Surges, Driving Demand for Time-Critical, Temperature-Controlled Services

- 4.19.4 Supply Chain Diversification from China-Centric Models Boosting Singapore as Alternative Hub

- 4.19.5 99% of Customs Permits Cleared Within 10 Minutes Enhancing Trans-Shipment Attractiveness

- 4.19.6 Changi East (T5) Expansion Lifting Air-Cargo Capacity to 4.5 Million Tons in the Airport

- 4.20 Market Restraints

- 4.20.1 Escalating Industrial Land and Warehouse Rents Compressing Operator Margins

- 4.20.2 Manpower Crunch from Tighter Foreign-Labor Quotas and Aging Workforce Curtailing Growth

- 4.20.3 Despite a Significant Land Coverage, the Country Faces Limited Domestic Road-Freight Capacity

- 4.20.4 Rising Competition Witnessed from Port Klang and Tanjung Pelepas for Trans-Shipment Flows

- 4.21 Technology Innovations in the Market

- 4.22 Porter's Five Forces Analysis

- 4.22.1 Threat of New Entrants

- 4.22.2 Bargaining Power of Suppliers

- 4.22.3 Bargaining Power of Buyers

- 4.22.4 Threat of Substitutes

- 4.22.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Road

- 5.2.3.1.4 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 Competitive Landscape

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.3.1 A.P. Moller - Maersk

- 6.3.2 CJ Logistics Corporation

- 6.3.3 CMA CGM Group (Including CEVA Logistics)

- 6.3.4 CWT Pte, Ltd.

- 6.3.5 DHL Group

- 6.3.6 DSV A/S (Including DB Schenker)

- 6.3.7 FedEx

- 6.3.8 GEODIS (Including Keppel Logistics Pte Ltd.)

- 6.3.9 Kuehne+Nagel

- 6.3.10 Nippon Express Holdings, Inc.

- 6.3.11 Pacific International Lines Pte, Ltd.

- 6.3.12 Poh Tiong Choon Logistics, Ltd

- 6.3.13 PSA International

- 6.3.14 SATS, Ltd.

- 6.3.15 SF Express (KEX-SF)

- 6.3.16 Singapore Post, Ltd.

- 6.3.17 ST Logistics Pte, Ltd.

- 6.3.18 United Parcel Service of America, Inc. (UPS)

- 6.3.19 Vibrant Group, Ltd.

- 6.3.20 Yamato Holdings Co., Ltd.

- 6.3.21 YCH Group

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment