PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907313

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907313

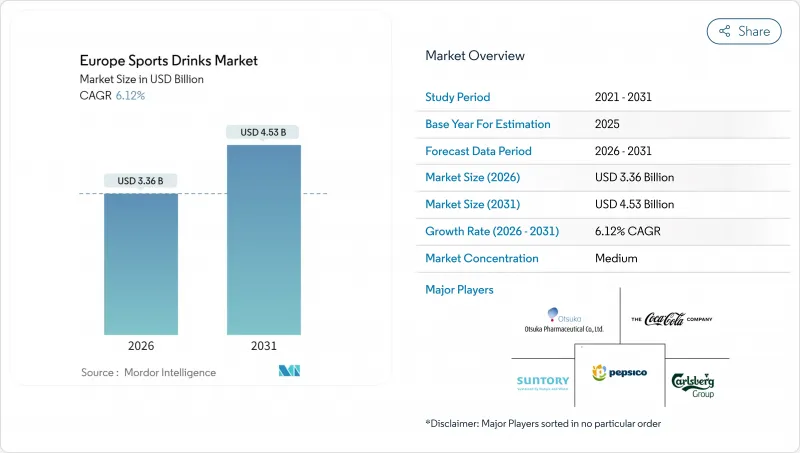

Europe Sports Drinks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe sports drinks market size in 2026 is estimated at USD 3.36 billion, growing from 2025 value of USD 3.17 billion with 2031 projections showing USD 4.53 billion, growing at 6.12% CAGR over 2026-2031.

Rising fitness club memberships, the spread of sugar-free formulations that meet European Union calorie-reduction goals, and regulatory incentives favoring recycled-content packaging are reinforcing demand. Multinational leaders still command shelf visibility and advertising scale, yet premium challengers that spotlight plant-based electrolytes and AI-enabled personalization are winning high-margin share. Deposit-return schemes, fluctuations in ingredient costs for potassium salts and natural sweeteners, and the phase-out of PFAS coatings remain the primary cost headwinds for all participants. Overall, the Europe sports drinks market continues to evolve toward cleaner labels, aluminum packaging, and digital engagement features that turn one-off purchases into ongoing hydration programs.

Europe Sports Drinks Market Trends and Insights

Rising participation in sports and physical activities

Rising participation in sports and physical activities across Europe is driving growth in the sports drinks market, as a growing number of consumers seek functional hydration solutions to support exercise, recovery, and overall well-being. Public health authorities and governments are promoting active lifestyles to address lifestyle-related health concerns, broadening the market from professional athletes to include recreational and casual exercisers. This trend is integrating sports drinks into everyday fitness routines, moving beyond their traditional role as niche performance-focused products. The demand driven by increased participation is further supported by grassroots initiatives and policy measures. According to Sport England, approximately 213,400 people participated in track and field athletics in England between November 2023 and November 2024, highlighting sustained engagement in organized physical activities that require effective hydration . Additionally, the World Health Organization's 2024 physical activity guidelines, which recommend 150 minutes of moderate-intensity exercise per week, are being incorporated into national health policies in countries such as Germany, the Netherlands, and Sweden . These policies, along with employer wellness programs and public health campaigns, are indirectly boosting sports drink consumption. Brands focusing on preventive health and everyday hydration, rather than solely on performance enhancement, are increasingly appealing to casual exercisers who previously relied on tap water, thereby capturing additional market share.

Growing demand for hydration and electrolyte replenishment

Electrolyte science is aligning with increasing consumer demands for transparency, as peer-reviewed research published in 2024 demonstrates that hypotonic formulations (osmolality below 270 mOsm/kg) enhance gastric emptying and fluid absorption rates by up to 30% compared to plain water, particularly during prolonged exercise in ambient temperatures exceeding 25°C . This physiological benefit is being emphasized in marketing strategies, with brands prominently showcasing sodium, potassium, and magnesium content on front-of-pack labels to distinguish themselves from functional waters with minimal electrolyte content. Southern European markets, including Spain, Italy, and southern France, show higher per-capita consumption due to extended summer training seasons and elevated sweat-loss rates, providing a buffer against economic downturns that may reduce discretionary spending in cooler regions. The European Food Safety Authority's 2024 guidance on electrolyte health claims allows manufacturers to state that sodium supports normal muscle function, provided formulations meet specified thresholds. This regulatory framework reinforces the positioning of sports drinks as functional foods rather than indulgent beverages. Additionally, coconut-water-based products are gaining traction as plant-derived alternatives to synthetic electrolyte blends.

Competition from functional waters and water enhancers

Enhanced water products, fortified with vitamins, minerals, or botanicals but without the carbohydrate content of traditional sports drinks, are impacting isotonic drink volumes in the casual-exercise segment. In this segment, consumers prioritize hydration over glycogen replenishment. These products are priced 20-30% lower than branded sports drinks while offering similar electrolyte content, presenting a strong value proposition for price-sensitive consumers in discount retail channels such as Aldi and Lidl. The European Union's tap-water quality standards, which ensure potable water across all member states, diminish the perceived necessity for bottled hydration solutions. This trend is particularly evident among environmentally conscious consumers who view single-use packaging as wasteful. Competitive intensity is notably high in Germany, the United Kingdom, and the Netherlands, where private-label penetration in the broader beverage category exceeds 40%. This indicates low brand loyalty in markets where functional differentiation is minimal.

Other drivers and restraints analyzed in the detailed report include:

- Growing trend of active lifestyles and fitness club memberships

- Development of sugar-free and low-calorie variants

- Consumer concerns over artificial colors, flavors, and additives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, isotonic drinks accounted for 55.62% of revenue, driven by their balanced osmolality, which matches blood plasma for efficient absorption. This makes them a preferred choice for moderate-intensity activities such as gym workouts, recreational cycling, and team sports. Hypotonic drinks, with carbohydrate concentrations below 4%, are tailored for rapid fluid absorption and cater to niche segments like youth sports and training in hot climates, where sweat loss surpasses energy expenditure. Hypertonic drinks are projected to grow at a CAGR of 6.78% through 2031, exceeding the market average growth rate of 6.12%. These formulations are increasingly adopted by endurance athletes and CrossFit enthusiasts for carbohydrate-dense recovery strategies that emphasize glycogen replenishment over immediate hydration.

With carbohydrate concentrations of 8-10% (compared to 6-8% in isotonic drinks), hypertonic drinks have an osmolality above 300 mOsm/kg, which slows gastric emptying but provides sustained energy release during ultra-marathons, triathlons, and extended training sessions. Electrolyte-enhanced water, a zero-calorie subcategory, is gaining market share in casual-exercise segments as consumers seek hydration without the 80-120 calories typically found in a 500 ml bottle of traditional isotonic drinks. The "Others" category includes emerging products such as protein-electrolyte blends and adaptogen-infused recovery drinks. While these formats remain small-scale, they are attracting venture capital investments and gaining shelf space in specialty retail outlets.

The Europe Sports Drinks Market Report is Segmented by Sports Drinks Type (Isotonic, Hypertonic, Hypotonic, and More), Packaging Type (PET Bottles, Metal Can, Aseptic Packages, and Tetra-Pak Pouches), by Distribution Channel (Supermarkets/Hypermarkets, Online Retail, Specialty Stores, and More), and by Geography (Germany, Italy, Netherlands, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Suntory Holdings Limited

- PepsiCo Inc.

- The Coca-Cola Company

- Red Bull GmbH

- Carlsberg A/S

- Otsuka Holdings Co. Ltd.

- Congo Brands (Prime Hydration)

- Abbott Laboratories (Pedialyte Sport)

- Monster Beverage Corp.

- United Soft Drinks B.V. (AA Drink)

- Adelholzener Alpenquellen GmbH

- Olvi Plc

- Primo Water Corporation (Energise)

- Rauch Fruchtsafte GmbH (Isostar)

- Tiger Brands Ltd.

- Carabao Group PCL

- iPro Sport Holdings Ltd.

- Vitamin Well AB

- Glanbia PLC (HydroTech)

- Nestle S.A. (Isostar - Nutrition et Sante)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising participation in sports and physical activities

- 4.2.2 Growing demand for hydration and electrolyte replenishment

- 4.2.3 Growing trend of active lifestyles and fitness club memberships

- 4.2.4 Development of sugar-free and low-calorie variants

- 4.2.5 Shift to plant-based electrolytes and coconut-water formulations

- 4.2.6 Product innovation and functional enhancements

- 4.3 Market Restraints

- 4.3.1 Competition from functional waters and water enhancers

- 4.3.2 Consumer concerns over artificial colors, flavors, and additives

- 4.3.3 Environmental concerns related to packaging and waste

- 4.3.4 Input-supply volatility for potassium salts and natural sweeteners

- 4.4 Supply Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECATS (VALUE)

- 5.1 By Sports Drinks Type

- 5.1.1 Isotonic

- 5.1.2 Hypotonic

- 5.1.3 Hypertonic

- 5.1.4 Electrolyte-Enhanced Water

- 5.1.5 Others

- 5.2 By Packaging Type

- 5.2.1 PET Bottles

- 5.2.2 Metal Can

- 5.2.3 Aseptic packages

- 5.2.4 Tetra-Pak Pouches

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Convenience Stores

- 5.3.3 Specialty Stores

- 5.3.4 Online Retail

- 5.3.5 Others

- 5.4 By Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 Italy

- 5.4.4 Spain

- 5.4.5 France

- 5.4.6 Netherlands

- 5.4.7 Poland

- 5.4.8 Belgium

- 5.4.9 Sweden

- 5.4.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Suntory Holdings Limited

- 6.4.2 PepsiCo Inc.

- 6.4.3 The Coca-Cola Company

- 6.4.4 Red Bull GmbH

- 6.4.5 Carlsberg A/S

- 6.4.6 Otsuka Holdings Co. Ltd.

- 6.4.7 Congo Brands (Prime Hydration)

- 6.4.8 Abbott Laboratories (Pedialyte Sport)

- 6.4.9 Monster Beverage Corp.

- 6.4.10 United Soft Drinks B.V. (AA Drink)

- 6.4.11 Adelholzener Alpenquellen GmbH

- 6.4.12 Olvi Plc

- 6.4.13 Primo Water Corporation (Energise)

- 6.4.14 Rauch Fruchtsafte GmbH (Isostar)

- 6.4.15 Tiger Brands Ltd.

- 6.4.16 Carabao Group PCL

- 6.4.17 iPro Sport Holdings Ltd.

- 6.4.18 Vitamin Well AB

- 6.4.19 Glanbia PLC (HydroTech)

- 6.4.20 Nestle S.A. (Isostar - Nutrition et Sante)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK