PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850107

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850107

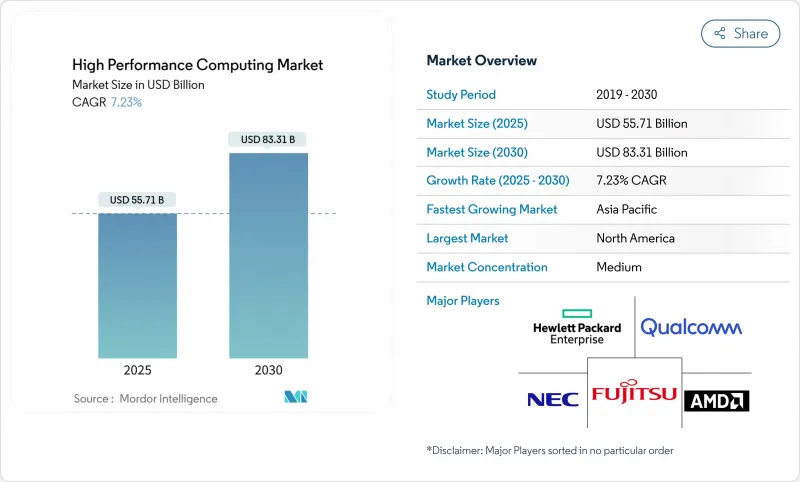

High Performance Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The high-performance computing market size is valued at USD 55.7 billion in 2025 and is forecast to reach USD 83.3 billion by 2030, advancing at a 7.23% CAGR.

Momentum is shifting from pure scientific simulation toward AI-centric workloads, so demand is moving to GPU-rich clusters that can train foundation models while still running physics-based codes. Sovereign AI programs are pulling government buyers into direct competition with hyperscalers for the same accelerated systems, tightening supply and reinforcing the appeal of liquid-cooled architectures that tame dense power envelopes. Hardware still anchors procurement budgets, yet managed services and HPC-as-a-Service are rising quickly as organizations prefer pay-per-use models that match unpredictable AI demand curves. Parallel market drivers include broader adoption of hybrid deployments, accelerated life-sciences pipelines, and mounting sustainability mandates that force datacenter redesigns.

Global High Performance Computing Market Trends and Insights

The Explosion of AI/ML Training Workloads in U.S. Federal Labs & Tier-1 Cloud Providers

Federal laboratories now design procurements around mixed AI and simulation capacity, effectively doubling addressable peak-performance demand in the high-performance computing market. The Department of Health and Human Services framed AI-ready compute as core to its 2025 research strategy, spurring labs to buy GPU-dense nodes that pivot between exascale simulations and 1-trillion-parameter model training. The Department of Energy secured USD 1.152 billion for AI-HPC convergence in FY 2025. Tier-1 clouds responded with sovereign AI zones that blend FIPS-validated security and advanced accelerators, and industry trackers estimate 70% of first-half 2024 AI-infrastructure spend went to GPU-centric designs. The high-performance computing market consequently enjoys a structural lift in top-end system value, but component shortages heighten pricing volatility. Vendors now bundle liquid cooling, optical interconnects, and zero-trust firmware to win federal awards, reshaping the channel.

Surging Demand for GPU-Accelerated Molecular Dynamics in Asian Pharma Outsourcing Hubs

Contract research organizations in India, China, and Japan are scaling DGX-class clusters to shorten lead molecules' path to the clinic. Tokyo-1, announced by Mitsui & Co. and NVIDIA in 2024, offers Japanese drug makers dedicated H100 instances tailored for biomolecular workloads. India's CRO sector, projected to reach USD 2.5 billion by 2030 at a 10.75% CAGR, layers AI-driven target identification atop classical dynamics, reinforcing demand for cloud-delivered supercomputing. Researchers now push GENESIS software to simulate 1.6 billion atoms, opening exploration for large-protein interactions. That capability anchors regional leadership in outsourced discovery and amplifies Asia-Pacific's pull on global accelerator supply lines. For the high-performance computing market, pharma workloads act as a counter-cyclical hedge against cyclic manufacturing demand.

Escalating Datacenter Water-Usage Restrictions in Drought-Prone U.S. States

Legislation in Virginia and Maryland forces disclosure of water draw, while Phoenix pilots Microsoft's zero-water cooling that saves 125 million liters per site each year. Utilities now limit new megawatt hookups unless operators commit to liquid or rear-door heat exchange. Capital outlays can climb 15-20%, squeezing return thresholds in the high-performance computing market and prompting a shift toward immersion or cooperative-air systems. Suppliers of cold-plate manifolds and dielectric fluids therefore gain leverage. Operators diversify sites into cooler climates, but latency and data-sovereignty policies constrain relocation options, so design innovation rather than relocation must resolve the cooling-water tension.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory Automotive ADAS Simulation Compliance in EU EURO-NCAP 2030 Roadmap

- National Exascale Initiatives Driving Indigenous Processor Adoption in China & India

- Global Shortage of HBM3e Memory Constraining GPU Server Shipments 2024-26

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware accounted for 55.3% of the high-performance computing market size in 2024, reflecting continued spend on servers, interconnects, and parallel storage. Managed offerings, however, posted a 14.7% CAGR and reshaped procurement logic as CFOs favor OPEX over depreciating assets. System OEMs embed metering hooks so clusters can be billed by node-hour, mirroring hyperscale cloud economics. The acceleration of AI inference pipelines adds unpredictable burst demand, pushing enterprises toward consumption models that avoid stranded capacity. Lenovo's TruScale, Dell's Apex, and HPE's GreenLake now bundle supercomputing nodes, scheduler software, and service-level agreements under one invoice. Vendors differentiate through turnkey liquid cooling and optics that cut deployment cycles from months to weeks.

Services' momentum signals that future value will center on orchestration, optimization, and security wrappers rather than on commodity motherboard counts. Enterprises migrating finite-element analysis or omics workloads appreciate transparent per-job costing that aligns compute use with grant funding or manufacturing milestones. Compliance teams also prefer managed offerings that keep data on-premise yet allow peaks to spill into provider-operated annex space. The high-performance computing market thus moves toward a spectrum where bare-metal purchase and full public-cloud rental are endpoints, and pay-as-you-go on customer premises sits in the middle.

On-premise infrastructures held 67.8% of the high-performance computing market share in 2024 because mission-critical codes require deterministic latency and tight data governance. Yet cloud-resident clusters grow at 11.2% CAGR through 2030 as accelerated instances become easier to rent by the minute. Shared sovereignty frameworks let agencies keep sensitive datasets on local disks while bursting anonymized workloads to commercial clouds. CoreWeave secured a five-year USD 11.9 billion agreement with OpenAI, signalling how specialized AI clouds attract both public and private customers. System architects now design software-defined fabrics that re-stage containers seamlessly between sites.

Hybrid adoption will likely dominate going forward, blending edge cache nodes, local liquid-cooled racks, and leased GPU pods. Interconnect abstractions such as Omnipath or Quantum-2 InfiniBand allow the scheduler to ignore physical location, treating every accelerator as a pool. That capability makes workload placement a policy decision driven by cost, security, and sustainability rather than topology. As a result, the high-performance computing market evolves into a network of federated resources where procurement strategy centers on bandwidth economics and data-egress fees rather than capex.

The High Performance Computing Market is Segmented by Component (Hardware, Software and Services), Deployment Mode (On-Premise, Cloud, Hybrid), Industrial Application (Government and Defense, Academic and Research Institutions, BFSI, Manufacturing and Automotive Engineering, and More), Chip Type (CPU, GPU, FPGA, ASIC / AI Accelerators) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 40.5% of the high-performance computing market in 2024 as federal agencies injected USD 7 million into the HPC4EI program aimed at energy-efficient manufacturing. The CHIPS Act ignited over USD 450 billion of private fab commitments, setting the stage for 28% of global semi capex through 2032. Datacenter power draw may climb to 490 TWh by 2030; drought-prone states therefore legislate water-neutral cooling, tilting new capacity toward immersion and rear-door liquid loops. Hyperscalers accelerate self-designed GPU projects, reinforcing regional dominance but tightening local supply of HBM modules.

Asia-Pacific posts the strongest 9.3% CAGR, driven by sovereign compute agendas and pharma outsourcing clusters. China's carriers intend to buy 17,000 AI servers, mostly from Inspur and Huawei, adding USD 4.1 billion in domestic orders. India's nine PARAM Rudra installations and upcoming Krutrim AI chip build a vertically integrated ecosystem. Japan leverages Tokyo-1 to fast-track clinical candidate screening for large domestic drug makers. These investments enlarge the high-performance computing market size by pairing capital incentives with local talent and regulatory mandates.

Europe sustains momentum through EuroHPC, operating LUMI (386 petaflops), Leonardo (249 petaflops), and MareNostrum 5 (215 petaflops), with JUPITER poised as the region's first exascale machine. Horizon Europe channels EUR 7 billion (USD 7.6 billion) into HPC and AI R&D. Luxembourg's joint funding promotes industry-academia co-design for digital sovereignty. Regional power-price volatility accelerates adoption of direct liquid cooling and renewable matching to control operating costs. South America, the Middle East, and Africa are nascent but invest in seismic modeling, climate forecasting, and genomics, creating greenfield opportunities for modular containerized clusters.

- Advanced Micro Devices, Inc.

- NEC Corporation

- Fujitsu Limited

- Qualcomm Incorporated

- Hewlett Packard Enterprise

- Dell Technologies

- Lenovo Group

- IBM Corporation

- Atos SE / Eviden

- Cisco Systems

- NVIDIA Corporation

- Intel Corporation

- Penguin Computing (SMART Global)

- Inspur Group

- Huawei Technologies

- Amazon Web Services

- Microsoft Azure

- Google Cloud Platform

- Oracle Cloud Infrastructure

- Alibaba Cloud

- Dassault Systemes

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 The Explosion of AI/ML Training Workloads in U.S. Federal Labs and Tier-1 Cloud Providers

- 4.2.2 Surging Demand for GPU-Accelerated Molecular Dynamics in Asian Pharma Outsourcing Hubs

- 4.2.3 Mandatory Automotive ADAS Simulation Compliance in EU EURO-NCAP 2030 Roadmap

- 4.2.4 National Exascale Initiatives Driving Indigenous Processor Adoption in China and India

- 4.3 Market Restraints

- 4.3.1 Escalating Datacenter Water-Usage Restrictions in Drought-Prone U.S. States

- 4.3.2 Ultra-Low-Latency Edge Requirements Undermining Centralized Cloud Economics

- 4.3.3 Global Shortage of HBM3e Memory Constraining GPU Server Shipments 2024-26

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook (Chiplets, Optical Interconnects)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Servers

- 5.1.1.1.1 General-Purpose CPU Servers

- 5.1.1.1.2 GPU-Accelerated Servers

- 5.1.1.1.3 ARM-Based Servers

- 5.1.1.2 Storage Systems

- 5.1.1.2.1 HDD Arrays

- 5.1.1.2.2 Flash-Based Arrays

- 5.1.1.2.3 Object Storage

- 5.1.1.3 Interconnect and Networking

- 5.1.1.3.1 InfiniBand

- 5.1.1.3.2 Ethernet (25/40/100/400 GbE)

- 5.1.1.3.3 Custom/Optical Interconnects

- 5.1.2 Software

- 5.1.2.1 System Software (OS, Cluster Mgmt)

- 5.1.2.2 Middleware and RAS Tools

- 5.1.2.3 Parallel File Systems

- 5.1.3 Services

- 5.1.3.1 Professional Services

- 5.1.3.2 Managed and HPC-as-a-Service (HPCaaS)

- 5.1.1 Hardware

- 5.2 By Deployment Mode

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.2.3 Hybrid

- 5.3 By Chip Type (Cross-Cut with Component)

- 5.3.1 CPU

- 5.3.2 GPU

- 5.3.3 FPGA

- 5.3.4 ASIC / AI Accelerators

- 5.4 By Industrial Application

- 5.4.1 Government and Defense

- 5.4.2 Academic and Research Institutions

- 5.4.3 BFSI

- 5.4.4 Manufacturing and Automotive Engineering

- 5.4.5 Life Sciences and Healthcare

- 5.4.6 Energy, Oil and Gas

- 5.4.7 Other Industry Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Nordics (Sweden, Norway, Finland)

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Singapore

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Israel

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Saudi Arabia

- 5.5.5.4 Turkey

- 5.5.5.5 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA, JVs, IPOs)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Advanced Micro Devices, Inc.

- 6.4.2 NEC Corporation

- 6.4.3 Fujitsu Limited

- 6.4.4 Qualcomm Incorporated

- 6.4.5 Hewlett Packard Enterprise

- 6.4.6 Dell Technologies

- 6.4.7 Lenovo Group

- 6.4.8 IBM Corporation

- 6.4.9 Atos SE / Eviden

- 6.4.10 Cisco Systems

- 6.4.11 NVIDIA Corporation

- 6.4.12 Intel Corporation

- 6.4.13 Penguin Computing (SMART Global)

- 6.4.14 Inspur Group

- 6.4.15 Huawei Technologies

- 6.4.16 Amazon Web Services

- 6.4.17 Microsoft Azure

- 6.4.18 Google Cloud Platform

- 6.4.19 Oracle Cloud Infrastructure

- 6.4.20 Alibaba Cloud

- 6.4.21 Dassault Systemes

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment