PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686643

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686643

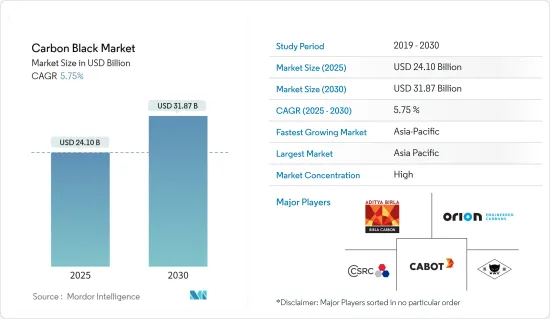

Carbon Black - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Carbon Black Market size is estimated at USD 24.10 billion in 2025, and is expected to reach USD 31.87 billion by 2030, at a CAGR of 5.75% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19 in 2020. Due to the COVID-19 outbreak in the first half of 2020, the tire and rubber industry was significantly affected. This, in turn, had an unfavorable impact on the consumption of carbon black. The market was projected to grow steadily as automotive production recovered from the impact of the pandemic in 2021. The market witnessed a significant growth in 2022.

Key Highlights

- In the short term, the major factors driving the market are the increasing market penetration of specialty black and growing applications in the batteries segment.

- On the flip side, the increasing investments in recovered carbon black and volatility in the prices of raw materials are hindering the growth of the market studied.

- The growth in the adoption of electric cars is expectde to act as an opportunity in the future.

- Asia-Pacific dominated the market worldwide, with the largest consumption from China and India.

Carbon Black Market Trends

Increasing Application of Tires and Industrial Rubber Products

- Carbon black is one of the reinforcements that is frequently used in the tire industry, owing to its effect on the mechanical and dynamic properties of tires. It is used in various formulations with different rubber types to customize the performance properties of tires.

- Carbon black is mainly required in the inner liners, sidewalls, and carcasses. It has heat-dissipation capabilities when added to rubber compounds. It also improves handling, tread wear, and fuel mileage. It also provides abrasion resistance.

- Carbon black is used in vehicle tires and other rubber products as a filler, strengthening, and reinforcing agent. Owing to its vital applications in tires and rubber products, the trends in these industries are expected to favor the growth of the market studied.

- According to the WBCSD, the tire industry consumes approximately 70% of the world's natural rubber, and the demand for natural rubber is increasing, diversifying the social, economic, and environmental opportunities associated with the production of this important raw material.

- The demand for tires in the newly produced segments of passenger cars and light trucks has been witnessing stable growth worldwide. This is depicted through the monthly statistics provided by the Michelin Group, which state that the worldwide original equipment tire market has seen a 10% growth in the first five months of 2023 when compared with 2022.

- According to the Modern Tire Dealer, in 2022, overall shipments of tires in the United States amounted to around 335 million units. The majority of tire units shipped in 2022 were replacement passenger tires, with some 222 million units.

- The growth in the automotive industry, including both conventional and electric vehicles, is a significant factor driving the growth of tire and tire component manufacturing.

- According to the OICA, the global sales and registration of automobiles in 2022 observed a decline of around 0.8% as compared to 2021. It stood at 68,995,575 over 69,560,173 in 2021.

- According to the International Rubber Study Group, global rubber production saw a minimal increase in the production in 2022, when compared with the prior year. This was majorly due to the increased production in the second half of the year. The global production of rubber reached 29.6 million metric tons in 2022 as compared to 29.4 million metric tons in 2021. The synthetic rubber produced during 2022 amounted to approximately 14.9 million metric tons, just 0.3 million metric tons higher than the natural rubber produced during the year.

- Hence, all the above factors are expected to increase the demand for carbon black in the tires and industrial rubber products.

China to Dominate the Market in the Asia-Pacific Region

- China accounts for a higher share of the world's carbon black capacity in terms of both production and consumption. Any demand-supply imbalance in China can affect the market share and performance of domestic players.

- Owing to the application of carbon black in tires and other rubber-based products and the positive development of China's rubber and automobile industries in recent years, the carbon black industry's rapid development has taken the country's limelight, and the overall industry production is on the rise.

- As per the data released by the National Bureau of Statistics, the Chinese tire industry is experiencing substantial growth, reflecting the increasing demand for tires in the domestic and international markets.

- In March 2023, China's output of tires increased by 11.3% to 90.87 million compared to the same period last year, indicating a trend in the growing demand in the domestic market. China produced 219.98 million rubber tires from January to March 2023, a Y-o-Y increase of 6.4%.

- The growing rubber tire production can be validated by the fact that the country has been the most significant vehicle producer in the world for the past many years. According to the China Association of Automobile Manufacturers, China has already manufactured more than 13.25 million vehicles in the first half of 2023, witnessing a significant 9.3% growth Y-o-Y.

- Along with applications in tires and rubber products, the application of carbon black as a pigment in paints and coatings and as a toner in the textile industry also accounts to significant demand in the country. Hence growth trends in paints and coatings and textile industries in the country is further expected to drive the market demand.

- China is known for its industrialization and its manufacturing sector, where paints and coatings are widely required. China accounts for more than one-fourth of the global coatings market. According to the China National Coatings Industry Association, the industry has been registering a growth of 7% in recent years.

- According to the World Paint & Coatings Industry Association, China presently dominates the region market, which is growing at a CAGR of 5.8%. The Chinese paints and coatings market was expected to increase by 5.7 % in 2022. China's total paints and coatings sales exceeded USD 45 billion in 2022, thereby depicting the country's dominance in having the largest market share (78%) in East Asia.

- In 2022, China experienced a 2.53% increase in its exports of textiles and apparel, reaching a total value of USD 323 billion. Over the year, China's exports in textiles, apparel, and clothing accessories amounted to USD 323.344 billion, showing a modest growth of 2.53% when compared to the previous year.

- It is projected by the China National Textile and Apparel Council (CNTAC), the regulatory authority overseeing China's textile and apparel sector, that, by 2025, the annual retail sales of clothing in China could surpass USD 415 billion.

- Thus, all the abovementioned factors are expected to provide a huge impetus for the growth of the carbon black market over the forecast period.

Carbon Black Industry Overview

The global carbon black market is a consolidated market, where the top ten players contribute to a significant share of the overall market. Some of the major players in the market include Cabot Corporation, Birla Carbon (Aditya Birla Group), Orion Engineered Carbons SA, Jiangxi HEIMAO Carbon black Co. Ltd, and International CSRC Investment Holdings Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Market Penetration of Specialty Black

- 4.1.2 Growing Applications in the Batteries Segment

- 4.2 Restraints

- 4.2.1 Increasing Investments for Recovered Carbon Black

- 4.2.2 Volatility in Prices of Raw Materials

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Trade Analysis

- 4.6 Technology Landscape - Quick Snapshot

- 4.7 Production Analysis

- 4.8 Price Trend Analysis

5 MARKET SEGMENTATION (Market Size in Volume and Value)

- 5.1 Process Type

- 5.1.1 Furnace Black

- 5.1.2 Gas Black

- 5.1.3 Lamp Black

- 5.1.4 Thermal Black

- 5.2 Application

- 5.2.1 Tires and Industrial Rubber Products

- 5.2.2 Plastic

- 5.2.3 Toners and Printing Inks

- 5.2.4 Coatings

- 5.2.5 Textile Fiber

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ADNOC Group

- 6.4.2 Asahi Carbon Co. Ltd

- 6.4.3 Birla Carbon (Aditya Birla Group)

- 6.4.4 BKT Carbon

- 6.4.5 Cabot Corporation

- 6.4.6 Epsilon Carbon Private Limited

- 6.4.7 Himadri Speciality Chemical Ltd

- 6.4.8 Imerys SA

- 6.4.9 International CSRC Investment Holdings Co. Ltd

- 6.4.10 Jiangxi Heimao Carbon Black Co. Ltd

- 6.4.11 Longxing Chemical Stock Co. Ltd

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 NNPC Limited

- 6.4.14 OCI Company Ltd

- 6.4.15 Omsk Carbon Group

- 6.4.16 Orion Engineered Carbons SA

- 6.4.17 PCBL Limited

- 6.4.18 Tokai Carbon Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in the Adoption of Electric Cars