Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640476

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640476

FPSO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

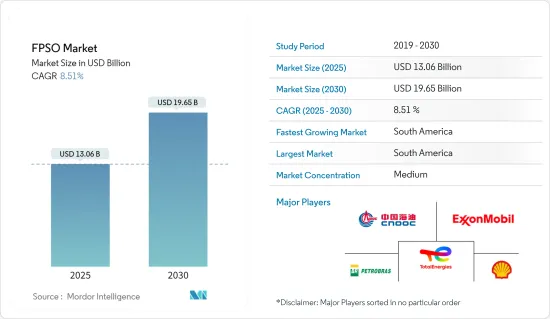

The FPSO Market size is estimated at USD 13.06 billion in 2025, and is expected to reach USD 19.65 billion by 2030, at a CAGR of 8.51% during the forecast period (2025-2030).

Key Highlights

- In the medium term, the increasing exploration and production activities in deep and ultradeep water depths are expected to drive the FPSO market during the forecast period.

- On the other hand, the high upfront cost is expected to hinder the market's growth during the forecast period.

- Nevertheless, the technological advancements and innovation in FPSO systems are expected to create huge opportunities for the FPSO market.

- South America is expected to be a dominant region for the FPSO market due to increasing offshore activities in the region.

FPSO Market Trends

The Contractor-owned Segment is Expected to Dominate the Market

- There are three primary methods for procuring FPSOs: new build, conversion of an existing vessel, and redeployment of an existing unit. Among these options, redeployment poses several challenges due to the highly customized nature of the FPSO for a specific field. As a result, operators have predominantly favored the new build and conversion approaches, often relying on third-party contractors with specialized expertise for these services over the past two decades.

- Contractor-owned FPSOs offer cost advantages over operator-owned FPSOs or fixed platforms. Contractors specializing in designing, constructing, and operating FPSOs can achieve economies of scale and optimize their fleet utilization, reducing operator costs. This makes contractor-owned FPSOs an attractive option for operators seeking cost-effective solutions.

- Contractor-owned FPSOs are typically available for lease, providing operators greater flexibility in field development. Leasing allows operators to access and deploy FPSOs with minimal upfront capital investments, benefiting smaller operators or projects with uncertain production profiles.

- With increasing offshore activities, the cost of exploration and production activities is increasing, and FPSO-related activities are being outsourced to contractors. This allows operators to allocate their resources and attention to areas where they can create the most value, leaving the FPSO operations to specialized contractors.

- For instance, according to Baker Hughes Rig Count, at the end of 2023, there were around 246 offshore rigs, which witnessed about 6.4% compared to the previous year, signifying an increase in offshore exploration and production activities, consequently driving the demand for FPSOs.

- In May 2023, MODEC, a Japanese FPSO supplier, secured a contract from Equinor to supply an FPSO vessel for the BM-C-33 block in the Campos Basin offshore Brazil. In addition to delivering the FPSO, which is expected to be completed by 2027, MODEC will provide Equinor with operations and maintenance services for the first year of the FPSO's oil production. Subsequently, Equinor plans to take over the operational responsibilities of the FPSO.

- There are several untapped offshore reserves globally that have not been discovered yet or are in the process of exploration. As oil and gas companies are focusing on discovering these untapped oil and gas reserves in the future, the demand for FPSO is expected to increase.

- With increasing demand for FPSO and its advantages over other types of FPSO, the Contractor-owned FPSO is expected to dominate the market during the forecast period.

South America is Expected to Dominate the Market

- South America is anticipated to exert the highest influence on the global FPSO market. Particularly, Brazil and Guyana have emerged as key players in this market, experiencing a significant surge in demand for FPSOs in recent years.

- South America has significant offshore oil and gas reserves, particularly in Brazil and Guyana. These reserves are located in deepwater and ultra-deepwater areas, requiring FPSOs for efficient production, storage, and offloading. The potential for large-scale discoveries and production in these regions drives the demand for FPSOs.

- For instance, in January 2024, Offshore Frontier Solution Pte Ltd awarded a contract for an electrical system and associated digital solutions on an ExxonMobil floating production storage and offloading (FPSO) vessel for the South American Uaru oil field. The unit will perform operations approximately 200 kilometers off the coast of Guyana.

- Moreover, South America has extensive pre-salt reserves, especially in Brazil's Santos and Campos Basins. These reserves are located beneath thick layers of salt, presenting technical challenges for exploration and production. FPSOs are well-suited for these challenging environments, as they can safely operate in deepwater and handle the complex processing requirements of pre-salt fields. Thus, in the future, with the upcoming deep and ultra-deep oil and gas projects' exploration and production in the region, demand for the FPSO is expected to grow.

- Therefore, as per the above points, South America is expected to dominate the FPSO market during the forecast period.

FPSO Industry Overview

The FPSO market is moderately consolidated. Some of the major players in the market are Petroleo Brasileiro SA (Petrobras), CNOOC Ltd, TotalEnergies SE, Exxon Mobil Corp., and Shell PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 53453

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 FPSOs in Operation, by Region and Operator, 2023

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Offshore Oil and Gas Exploration and Production Activities

- 4.6.1.2 Increasing Demand for Energy

- 4.6.2 Restraints

- 4.6.2.1 High Upfront Costs

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Ownership

- 5.1.1 Operator-owned

- 5.1.2 Contractor-owned

- 5.2 Water Depth

- 5.2.1 Shallow Water

- 5.2.2 Deep Water

- 5.2.3 Ultra-deep Water

- 5.3 Geography Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Norway

- 5.3.2.2 United Kingdom

- 5.3.2.3 Russia

- 5.3.2.4 Netherland

- 5.3.2.5 France

- 5.3.2.6 Italy

- 5.3.2.7 NORDIC

- 5.3.2.8 Germany

- 5.3.2.9 Spain

- 5.3.2.10 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Indonesia

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Japan

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Venezuela

- 5.3.4.4 Colombia

- 5.3.4.5 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Nigeria

- 5.3.5.4 Algeria

- 5.3.5.5 Qatar

- 5.3.5.6 South Africa

- 5.3.5.7 Egypt

- 5.3.5.8 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 FPSO Contractors

- 6.3.1.1 Modec Inc.

- 6.3.1.2 SBM Offshore NV

- 6.3.1.3 BW Offshore Limited

- 6.3.1.4 Teekay Offshore Partners LP

- 6.3.1.5 Bluewater Holding BV

- 6.3.1.6 Saipem SpA

- 6.3.1.7 Petrofac Limited

- 6.3.2 FPSO Operators

- 6.3.2.1 Petroleo Brasileiro SA (Petrobras)

- 6.3.2.2 CNOOC Ltd

- 6.3.2.3 TotalEnergies SE

- 6.3.2.4 ExxonMobil Corp.

- 6.3.2.5 Chevron Corporation

- 6.3.2.6 Shell PLC

- 6.3.2.7 BP PLC

- 6.3.3 Market Ranking/Share (%) Analysis

- 6.3.1 FPSO Contractors

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements and Innovations

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.