PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851994

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851994

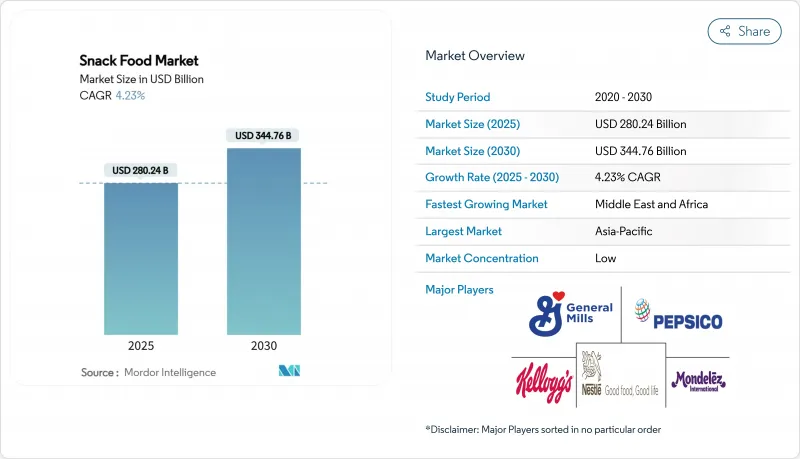

Snack Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The snack foods market size stood at USD 280.24 billion in 2025 and is projected to reach USD 344.76 billion by 2030, reflecting a 4.23% CAGR over the forecast period.

Convenience continues to be a significant driver of demand, with 92% of adults reporting at least one snacking occasion within a 24-hour period. This underscores the increasing consumer preference for accessible and ready-to-eat options that fit into their busy lifestyles. Digital commerce, combined with quick-commerce fulfillment models, is transforming route-to-market strategies by enabling faster delivery, expanding brand visibility, and leveraging data-driven personalization to meet diverse consumer needs effectively. At the same time, regulatory and sustainability agendas are gaining momentum. Key initiatives, such as HFSS advertising restrictions aimed at curbing the promotion of high-fat, salt, and sugar products, and extended-producer-responsibility mandates focusing on sustainable waste management, are driving investments toward the development of healthier product formulations and innovative, low-impact packaging solutions. These shifts reflect the growing alignment of industry practices with consumer expectations and regulatory requirements.

Global Snack Food Market Trends and Insights

Rising demand for convenient foods

Urban lifestyles are shrinking meal times, driving up demand for portable, individually portioned packs. Brands are increasingly adopting resealable pouches and oxygen-barrier films, which not only extend shelf life but also cater to the needs of on-the-go consumers. These packaging innovations ensure convenience while maintaining product freshness, making them highly appealing to busy urban populations. This trend leans heavily towards protein-rich offerings, particularly in meat and plant-protein categories, as they provide meal-replacement satisfaction and meet the growing consumer preference for high-protein diets. The rise of quick-commerce further amplifies this trend, favoring companies that can efficiently deliver high-demand SKUs within a 15-minute window, a critical factor in maintaining competitiveness in this fast-paced market. Meanwhile, manufacturers face the challenge of adhering to stringent labeling standards, which require them to ensure that their formulations, packaging designs, and claims comply with FDA nutritional disclosure mandates, adding another layer of complexity to product development and marketing strategies.

Growing demand for fortified and functional snacks

Consumers are increasingly shifting from empty-calorie snacks to those rich in protein, fiber, probiotics, and essential micronutrients, driven by a growing awareness of health and wellness. Advanced processes, such as high-moisture extrusion, allow formulators to seamlessly incorporate these functional actives into products without compromising texture or sensory appeal. The rising demand for clean-label products further accelerates this trend, as shoppers actively avoid artificial colors, preservatives, and other synthetic additives. Additionally, the FDA's updated criteria for the "healthy" claim, set to take effect in February 2028, will enforce stricter nutritional standards, creating opportunities for companies that proactively reformulate their offerings to meet these guidelines. Companies that source bioactive ingredients directly from growers not only enhance their credibility among health-conscious consumers but also mitigate supply chain risks, particularly in this premium-priced and highly competitive segment.

Fragmented unorganized retail and distribution gaps

In many emerging markets, informal mom-and-pop outlets hold sway, curbing the reach of chilled chains and dampening the potential for premiumization. These outlets dominate due to their accessibility, affordability, and deep-rooted presence in local communities, making it challenging for organized retail formats to penetrate. Additionally, deficits in rural roads and cold storage infrastructure further hinder the distribution and availability of higher-value perishable snacks, limiting their market growth and reducing opportunities for category expansion. While digital B2B ordering apps are making strides in Indonesia, India, and the Philippines, bridging small stores with organized distributors and mitigating stock-out risks, adoption rates vary significantly. Factors such as digital literacy, internet connectivity, trust in technology, and the willingness of small retailers to shift from traditional procurement methods to digital platforms contribute to the uneven adoption of these solutions.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of snackification as meal replacements

- Growing penetration of e-commerce and quick-commerce

- Volatility in agricultural commodity prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, savory snacks continued to dominate the global snack foods market, commanding a 32.87% share. This stronghold underscores the persistent consumer affinity for salty, crispy treats like potato chips, corn snacks, and pretzels. While competition from healthier snack alternatives is on the rise, savory snacks remain a cherished indulgence across various age groups and regions. Innovations, such as extruded vegetable crisps and pulse-based puffs, are infusing plant-based nutrition into the savory realm. Yet, mainstream consumers still gravitate towards authentic flavors, enticing seasoning blends, and that coveted crunch. Even with the ascent of healthier options, the segment's wide sensory allure cements savory snacks as a go-to for both spontaneous and planned grocery buys.

Meat snacks are carving out a niche as the snack foods market's fastest-growing segment, with projections indicating a robust CAGR of 6.26%. Items like meat sticks and jerky are particularly favored by active, health-conscious consumers, thanks to their portability and high protein content, all without the need for refrigeration. In response to clean-label demands, brands are rolling out product extensions featuring grass-fed beef, turkey, and bison, emphasizing both taste and ethical sourcing. Such innovations resonate especially with premium snack buyers who value flavor and ingredient transparency. The segment is riding the wave of broader protein wellness trends and a pivot away from high-carb snacks. With its dynamic growth, diverse protein offerings, and alignment with modern lifestyles and clean eating, the meat snacks category is steadily increasing its footprint in the global snack foods arena.

In 2024, conventional snack food formulas dominated the market, accounting for 63.54% of total revenue. Their stronghold is largely due to cost competitiveness, appealing to mass-market consumers, and the widespread availability of core raw materials. This ensures predictable manufacturing and distribution for producers, leading to steady supply chains and consistent pricing. Additionally, conventional snacks enjoy consumer familiarity, established brand loyalty, and economies of scale that keep costs low. Despite facing stiff competition from health-focused alternatives, their accessibility in both developed and emerging markets solidifies their substantial market share. The segment's pervasive retail presence poses challenges for newer formats, even as niche categories gain traction.

Organic and clean-label snack formulas are on track to achieve a 5.35% CAGR over the forecast period, positioning them as the market's fastest-growing segment. This surge is driven by consumers' readiness to pay a premium for transparency in farming and for formulations that are additive-free and non-GMO. Yet, scaling this segment introduces complexities: processors need to secure certified organic acreage, verify ingredient origins, and uphold stringent traceability. While a projected dip in organic soybean and corn prices may alleviate some cost pressures, brands must navigate procurement judiciously to ensure a steady supply. Companies that spotlight collaborations with farmers and emphasize regenerative agriculture practices stand a better chance of winning over eco-conscious consumers. With shoppers increasingly prioritizing sustainability and health in their choices, organic and clean-label snacks are steadily expanding their footprint in the snack food market.

The Global Snack Food Market Report is Segmented by Product Type (Frozen Snacks, Savoury Snacks, and More), Ingredient Type (Conventional, Organic/Clean-Label), Packaging Type (Bags/Pouches, Cans, Others), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, and More), and Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, the Asia-Pacific region claimed the largest share of global revenue at 31.68%, driven by urbanization, rising middle-class incomes, and a deep-rooted cultural preference for savory and spicy flavors. China, with its retail snack sales surpassing 1 trillion yuan, owes much of its success to domestic champions adept at fusing traditional ingredients with contemporary processing methods. Meanwhile, regional research and development centers are swiftly introducing localized products, like seaweed-infused chips in Japan and chili-mango gummies in Thailand.

The Middle East and Africa is set to experience the fastest growth, projected at a 4.83% CAGR through 2030. This surge is fueled by youthful demographics, a rise in e-commerce, and a rebound in tourism. Both Saudi Arabia and the United Arab Emirates are channeling significant investments into food processing hubs and logistics networks, aiming to lessen import dependencies and harness re-export opportunities. Seasonal peaks in spending are driven by premium gifting assortments during Ramadan and Diwali, alongside a growing trend towards functional snacks, mirroring global wellness trends.

North America, Europe, and South America navigate a landscape of mature market penetration, each with its distinct regulatory and economic nuances. The U.S. market, while a stronghold for high-protein and artisanal products, grapples with commodity-price fluctuations that challenge price sensitivity. Europe takes the lead in stringent policies, especially concerning plastics and HFSS marketing, pushing brands towards constant reformulation and innovative packaging designs. In South America, Brazil and Mexico stand out as growth powerhouses, even as they contend with currency volatility and a fragmented retail landscape that complicates nationwide expansions. Across all continents, businesses are increasingly recognizing the necessity of integrated risk-management strategies, addressing sourcing challenges, climate resilience, and multi-modal freight solutions.

- PepsiCo Inc.

- The Kellogg Company

- Nestle S.A.

- General Mills Inc.

- Mondel?z International Inc.

- Conagra Brands Inc.

- Link Snacks Inc.

- Unilever plc

- Hunter Foods LLC

- Lundberg Family Farms

- Tyson Foods Inc.

- The Kraft Heinz Company

- Campbell Soup Company

- Intersnack Group GmbH & Co. KG

- Calbee Inc.

- Grupo Bimbo SAB de CV

- The Hershey Company

- Mars Inc.

- KIND LLC

- Blue Diamond Growers

- The Hain Celestial Group

- Utz Brands Inc.

- Amplify Snack Brands Inc.

- Meiji Holdings Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for convenient foods

- 4.2.2 Growing demand for fortified & functional snacks

- 4.2.3 Expansion of "snackification" as meal replacements

- 4.2.4 Growing penetration of e-commerce and quick-commerce

- 4.2.5 Upcycling food waste into value-added snacks

- 4.2.6 Flavor Forward: The Impact of Culinary Trends on the Market

- 4.3 Market Restraints

- 4.3.1 Fragmented unorganised sector and distribution gaps

- 4.3.2 Volatility in agricultural commodity prices

- 4.3.3 Rising scrutiny of HFSS* advertising to children

- 4.3.4 Tightening single-use-plastic & extended-producer-responsibility (EPR) rules

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Frozen Snacks

- 5.1.2 Savoury Snacks

- 5.1.3 Fruit Snacks

- 5.1.4 Confectionery Snacks

- 5.1.5 Bakery Snacks

- 5.1.6 Meat Snacks

- 5.1.7 Others

- 5.2 By Ingredient Type

- 5.2.1 Conventional

- 5.2.2 Organic/Clean-Label

- 5.3 By Packaging Type

- 5.3.1 Bags/Pouches

- 5.3.2 Cans

- 5.3.3 Others

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Netherlands

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Indonesia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PepsiCo Inc.

- 6.4.2 The Kellogg Company

- 6.4.3 Nestle S.A.

- 6.4.4 General Mills Inc.

- 6.4.5 Mondel?z International Inc.

- 6.4.6 Conagra Brands Inc.

- 6.4.7 Link Snacks Inc.

- 6.4.8 Unilever plc

- 6.4.9 Hunter Foods LLC

- 6.4.10 Lundberg Family Farms

- 6.4.11 Tyson Foods Inc.

- 6.4.12 The Kraft Heinz Company

- 6.4.13 Campbell Soup Company

- 6.4.14 Intersnack Group GmbH & Co. KG

- 6.4.15 Calbee Inc.

- 6.4.16 Grupo Bimbo SAB de CV

- 6.4.17 The Hershey Company

- 6.4.18 Mars Inc.

- 6.4.19 KIND LLC

- 6.4.20 Blue Diamond Growers

- 6.4.21 The Hain Celestial Group

- 6.4.22 Utz Brands Inc.

- 6.4.23 Amplify Snack Brands Inc.

- 6.4.24 Meiji Holdings Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK