PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850043

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850043

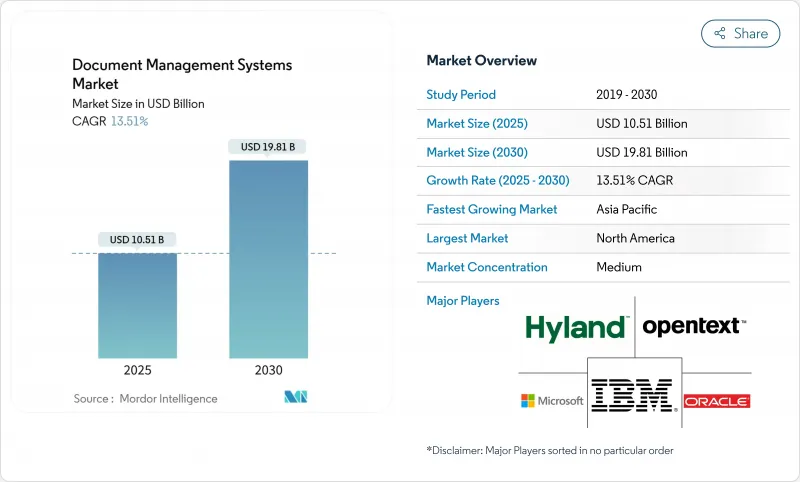

Document Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The document management systems market is valued at USD 10.51 billion in 2025 and is forecast to reach USD 19.81 billion by 2030, advancing at a 13.5% CAGR throughout the period.

Growth rests on the enterprise need to digitize document-centric workflows and replace paper archives with searchable digital repositories that satisfy expanding compliance mandates. Organizations are aggressively embedding AI to turn static repositories into knowledge engines that surface insights from unstructured files, driving measurable efficiency gains and improved governance. The document management systems market is also benefitting from cloud migration, modular platform designs that simplify integration with collaboration tools, and region-specific offerings that address emerging data-sovereignty rules. Competitive intensity is rising as vendors race to embed generative AI copilots able to summarize, draft, and route content inside everyday business applications.

Global Document Management Systems Market Trends and Insights

Rapid Shift Toward Paper-Free Processes Driving Enterprise Adoption

Organizations are discarding paper archives to reduce operating costs and meet ESG targets, and many are realigning policies around digital-first workflows. Implementations of document management systems market solutions are delivering operating-cost reductions up to 30% and processing-time improvements near 50%. Hospitals that introduce electronic document workflows report 40-50% faster record handling and tighter HIPAA compliance. Success stories are reinforcing an adoption flywheel: once early ROI appears, executives rapidly extend deployments across customer-service, HR, and supply-chain teams. This widening footprint underpins the sustained momentum of the document management systems market.

Cloud-Native DMS Platforms Redefining Integration Capabilities

The embedding of document functionality inside cloud collaboration suites is reshaping buyer expectations. Microsoft processed more than 100 trillion AI tokens in Q3 2025, and revenue from cloud services jumped 22% to USD 42.4 billion, underscoring demand for integrated platforms. Enterprises prefer familiar interfaces that blend content creation, storage, and governance under unified authentication, pressuring legacy vendors to deepen interoperability. The trend is especially powerful within remote and hybrid workplaces, where seamless cross-device access is non-negotiable. Consequently, the document management systems market is tilting toward vendors capable of drop-in integrations rather than standalone feature checklists.

Persistent User Resistance Hampering Implementation Success

Despite clear ROI, entrenched back-office teams often view new workflows as disruptive. Seventy percent of organizations cite user resistance as the key factor behind delayed deployments. Skepticism is especially acute in healthcare and finance where audit trails are mission critical. Training investments and change-management roadmaps frequently lag technical rollout, stretching payback periods and muting the full potential of the document management systems market. Enterprises with dedicated adoption programs, however, record 62% higher user satisfaction and 41% faster value realization, illustrating that cultural alignment is as important as functionality.

Other drivers and restraints analyzed in the detailed report include:

- AI-Enhanced Search Transforming Information Retrieval

- Data Sovereignty Regulations Reshaping Implementation Strategies

- Industry-Specific Templates Shorten Deployment Cycles

- Generative-AI Copilots Unlock "Content-in-Context" Workflows

- Vendor Lock-In Concerns Creating Implementation Hesitancy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Implementation complexity is tilting spending toward professional and managed services. Although software captured 76% of the document management systems market in 2024, services revenue is rising at an 18.9% CAGR from 2025-2030 as enterprises seek customized integrations with ERP, CRM, and industry-specific platforms. The document management systems market size for services is forecast to expand faster than any other component category, reflecting growing demand for continuous optimization contracts and compliance audits. Vendors report that advisory engagements tied to AI model tuning and metadata strategy are now the most profitable service lines.

The shift also underscores how success hinges on process re-engineering rather than licensing alone. Consulting teams orchestrate user-acceptance pilots, build templates, and craft retention policies that satisfy regulators. Demand for governance-centric consulting is climbing as privacy laws proliferate. Consequently, system integrators with vertical know-how are capturing a larger portion of overall project budgets within the document management systems market.

Document Management System Market Segmented by Component (Software and Services), Deployment (Cloud and ), End-User Industry (Banking and Financial Services, Manufacturing and Construction and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 35% of global revenue in 2024, anchored by early cloud migration and mature regulatory frameworks that mandate granular audit trails. Financial services and healthcare buyers dominate regional spending, integrating advanced AI modules to unlock unstructured insights. Leading vendors such as Microsoft, IBM, and Adobe leverage existing enterprise licenses to expand document management modules, reinforcing regional scale advantages. Government incentives that reward paper-free procurement further stimulate spending, ensuring the document management systems market remains a core pillar of broader digital-transformation roadmaps across the United States and Canada.

Asia-Pacific is the fastest growing geography with a 15.8% CAGR projected for 2025-2030. Policy-driven digitization programs in India, China, and South Korea are accelerating adoption across public and private sectors. India's DPDP Act is prompting banks and insurers to implement geo-fenced storage nodes, while Chinese firms often select domestic vendors to satisfy cybersecurity law requirements. Japan shows robust uptake among manufacturers embedding DMS in lean production systems. Hyperscale cloud providers are expanding regional data centers, addressing residency concerns that once slowed cross-border deployments and helping the document management systems market capture modernizing enterprises throughout APAC.

Europe's market is shaped by GDPR and country-specific privacy laws, making compliance functionality a critical purchase filter. The United Kingdom and Germany lead in volume, emphasizing controlled records-management and retention automation. Organizations favour platforms guaranteeing that content never leaves designated EU zones, boosting demand for European vendors with sovereignty credentials. Sustainability initiatives promote paper-reduction targets, further fuelling projects. Southern European adoption is rising, yet procurement cycles are lengthier due to multi-stakeholder approvals. Overall, data governance stringency positions Europe as a bellwether for privacy-first capabilities within the global document management systems market.

- Microsoft Corp.

- OpenText Corp.

- IBM Corp.

- Hyland Software Inc.

- Oracle Corp.

- Box Inc.

- Adobe Inc.

- Laserfiche

- M-Files Corp.

- Alfresco (-Hyland)

- Dropbox Business

- Zoho Corp.

- DocStar (Epicor)

- AODocs

- LogicalDOC Srl

- Agiloft Inc.

- Synergis Technologies

- Everteam

- FileHold Systems

- PaperSave

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid shift toward paper-free processes (enterprise cost and ESG mandates)

- 4.2.2 Cloud-native DMS platforms bundled inside collaboration suites

- 4.2.3 Surge in AI-enhanced search and auto-classification accuracy (>95 %)

- 4.2.4 Strict data-sovereignty rules (EU GDPR, India DPDP) triggering compliant DMS roll-outs

- 4.2.5 Rise of industry-specific templates (health, legal, AEC) shortening deployment cycles

- 4.2.6 Generative-AI copilots unlocking content-in-context workflows (under-reported)

- 4.3 Market Restraints

- 4.3.1 Persistent user-change resistance in regulated back-office functions

- 4.3.2 High e-discovery costs from poor metadata hygiene

- 4.3.3 Cyber-insurance premiums rising after DMS-centred ransomware events (under-reported)

- 4.3.4 Vendor lock-in concerns slowing migration from legacy ECMs (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Pricing Analysis

- 4.9 Industry Ecosystem Analysis

- 4.10 Macroeconomic Impact Assessment

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 Cloud

- 5.2.2 On-Premise

- 5.3 By End-User Industry

- 5.3.1 Banking and Financial Services

- 5.3.2 Manufacturing and Construction

- 5.3.3 Education

- 5.3.4 Healthcare

- 5.3.5 Retail

- 5.3.6 Legal

- 5.3.7 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Australia

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Israel

- 5.4.5.1.2 Saudi Arabia

- 5.4.5.1.3 United Arab Emirates

- 5.4.5.1.4 Turkey

- 5.4.5.1.5 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Microsoft Corp.

- 6.4.2 OpenText Corp.

- 6.4.3 IBM Corp.

- 6.4.4 Hyland Software Inc.

- 6.4.5 Oracle Corp.

- 6.4.6 Box Inc.

- 6.4.7 Adobe Inc.

- 6.4.8 Laserfiche

- 6.4.9 M-Files Corp.

- 6.4.10 Alfresco (-Hyland)

- 6.4.11 Dropbox Business

- 6.4.12 Zoho Corp.

- 6.4.13 DocStar (Epicor)

- 6.4.14 AODocs

- 6.4.15 LogicalDOC Srl

- 6.4.16 Agiloft Inc.

- 6.4.17 Synergis Technologies

- 6.4.18 Everteam

- 6.4.19 FileHold Systems

- 6.4.20 PaperSave

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment