PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906978

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906978

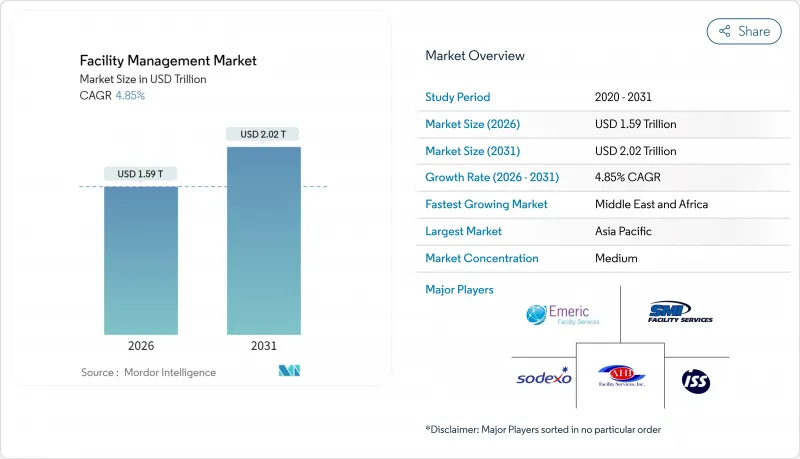

Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

facility management market size in 2026 is estimated at USD 1.59 trillion, growing from 2025 value of USD 1.517 trillion with 2031 projections showing USD 2.02 trillion, growing at 4.85% CAGR over 2026-2031.

Growth momentum reflects the repositioning of facility management from a support cost to a strategic lever for operational resilience, digital integration, and employee productivity. Heightened outsourcing appetite, rapid cloud migration despite cybersecurity incidents, and the steady pull of ESG mandates are collectively widening addressable demand. Rising infrastructure spending in emerging markets, particularly Asia-Pacific, is reinforcing a multi-regional expansion cycle for the facility management market. Providers that blend technology platforms with outcome-based models are capturing premium contracts as clients seek transparent cost control and measurable efficiency.

Global Facility Management Market Trends and Insights

Growing emphasis on outsourcing non-core operations

Corporations are channeling capital toward core innovation by transferring facilities responsibilities to specialist partners, with 35% of enterprises boosting FM budgets in 2024 to curb operational complexity. The facility management market is benefiting from scale effects that let providers absorb supply-chain shocks and provide diversified labor pools. Demand is pronounced in technology and healthcare, supporting CBRE's 16% net revenue rise from facilities contracts during Q1 2025. The practice also mitigates supplier-risk exposure-29% of firms flagged disruption fears-fueling preference for FM partners with fortified logistics. As outsourcing volume mounts, providers are reinvesting margin gains into automation, predictive analytics, and workforce upskilling, reinforcing a virtuous growth cycle across the facility management market.

Facility digitisation via IoT-enabled predictive maintenance

Predictive maintenance platforms worth USD 5.5 billion in 2025 and expanding 17% annually underpin a structural shift from reactive repairs to condition-based care. Healthcare adopters report 10-15% facility cost savings through automated work-order generation. The software layer-44% of spend-packages pre-trained algorithms that democratize access for midsize sites inside the facility management market. Early pilots in industrial plants reveal 25% faster waste-heat recovery, highlighting tangible ESG payoffs. As anomaly-detection models mature, data prerequisites shrink, enabling smaller assets to participate without dense historical logs, thereby broadening market penetration across geographies.

High wage inflation in custodial labour

Average hourly earnings in facilities support soared 4.1% in 2024, lifting median pay to USD 21.74 and compressing margins for labour-intensive contracts. Skilled-trade shortages, especially HVAC and electrical, intensify bidding wars, while events such as Cornell University's facilities-worker strike underscore rising union activism. Hidden contract fees and backend surcharges further strain budgets, pushing buyers to reconsider outsourcing economics. Providers respond by accelerating robotics and autonomous-cleaning pilots, but up-front capital and retraining requirements weigh on near-term adoption across the facility management market.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability and ESG-linked FM contracting

- Post-pandemic hybrid workplace re-design needs

- Fragmented vendor base in emerging markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hard Services generated 58.65% of the facility management market size in 2025, buoyed by mandatory mechanical, electrical, and plumbing (MEP) maintenance that safeguards asset integrity. Regulatory codes and rising asset complexity necessitate certified technicians, reinforcing demand stability. Over the forecast horizon, convergence with Soft Services will intensify as clients seek unified experience management, creating cross-selling avenues for integrated vendors.

Soft Services, though smaller, accelerate at a 6.05% CAGR, reflecting heightened focus on hygiene, security, and occupant well-being. Cleaning contracts embed anti-microbial protocols and robotic vacuums, while security shifts toward AI video analytics. As ESG scorecards widen to include indoor air and catering sustainability, Soft Services gain board-level visibility. Providers that fuse Hard and Soft data streams can proactively adjust preventive schedules, creating tangible operational gains and broadening wallet share within the facility management market.

In-house models held 53.20% of the facility management market share in 2025, underpinned by integrated FM (IFM) contracts that streamline accountability. Multisite firms appreciate single-invoice transparency, propelling uptake. Simultaneously, Outsourcing FM expands 5.71% CAGR as cyber-sensitive industries retain critical controls. Hybrid structures are proliferating: strategic planning stays internal, while field execution shifts to partners, balancing flexibility and risk.

As IFM scope widens, vendors embed analytics portals that surface cost-to-serve by location, enabling data-driven renewals. Single-service options erode as clients insist on total-value propositions, nudging smaller contractors toward mergers or specialisation niches. CBRE's USD 1.6 billion Industrious acquisition underscores strategic re-positioning toward experiential subscriptions that bundle facilities, hospitality, and space analytics, thereby redefining competitive contours of the facility management market.

The Facility Management Market Report is Segmented by Service Type (Hard Services, and Soft Services), Offering Type (In-House, and Outsourced), Deployment Model (On-Premise, and Cloud-Based), Organisation Size (Large Enterprises, and Small and Medium Enterprises), End-User Industry (Commercial, Hospitality, Institutional, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 41.10% of the facility management market in 2025 and is set to expand at a 6.05% CAGR, sustained by government stimulus and urban migration. China's USD 51.4 trillion fixed-asset push, including 5.9% growth in infrastructure placements, underpins long-run service pipelines. India's commercial real estate surge adds demand for remote monitoring, while ASEAN smart-city programs embed FM contracts into master planning stages. Providers scaling localized supply chains and multilingual platforms will gain early-mover advantage.

North America maintains a mature yet innovative landscape where cloud penetration and ESG compliance drive premium fees. The facility management market in the region contends with tight labor pools, spurring automation adoption. Energy-optimisation mandates and the Inflation Reduction Act's incentives incentivize retrofits managed by FM specialists. Europe exhibits similar digital sophistication but is distinguished by stringent carbon regulations such as EPBD, steering contracts toward performance-linked remuneration. Pan-European vendors leverage cross-border governance frameworks to standardise service quality.

The Middle East and Africa witness accelerating adoption through public-private partnerships in transport, healthcare, and education infrastructure. Gulf Cooperation Council megaprojects integrate FM provisions from the design stage, anchoring lifecycle value. South America experiences steady demand tied to logistics and manufacturing expansion, though currency volatility necessitates flexible pricing. Across all emerging regions, fragmented supplier landscapes encourage consolidation plays, broadening the facility management market for global majors adept at merger integration.

- CBRE Group Inc.

- Cushman and Wakefield plc

- JLL (Jones Lang LaSalle Inc.)

- ISS A/S

- Sodexo SA

- Compass Group plc

- Emeric Facility Services

- SMI Facility Services

- AHI Facility Services Inc.

- Aramark Corporation

- ABM Industries Inc.

- G4S Limited

- Atalian Global Services

- Vinci Facilities (VINCI SA)

- EMCOR Group Inc.

- Comfort Systems USA

- Balfour Beatty - Workplace

- Serco Group plc

- Reliance Facilities (India)

- Sinopec Engineering FM (China)

- Unispace Global

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing emphasis on outsourcing non-core operations

- 4.2.2 Facility digitisation via IoT-enabled predictive maintenance

- 4.2.3 Sustainability and ESG-linked FM contracting

- 4.2.4 Post-pandemic hybrid workplace re-design needs

- 4.2.5 Public-private infrastructure pipelines in EMs

- 4.2.6 AI-led energy optimisation mandates

- 4.3 Market Restraints

- 4.3.1 High wage inflation in custodial labour

- 4.3.2 Fragmented vendor base in emerging markets

- 4.3.3 Cyber-security risk in cloud-based FM platforms

- 4.3.4 Capital lock-in for IFM platforms among SMEs

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing Analysis

- 4.9 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Type

- 5.1.1 Hard Services

- 5.1.1.1 Asset Management

- 5.1.1.2 MEP and HVAC

- 5.1.1.3 Fire and Safety

- 5.1.1.4 Other Hard Services

- 5.1.2 Soft Services

- 5.1.2.1 Cleaning

- 5.1.2.2 Security and Office Support

- 5.1.2.3 Catering

- 5.1.2.4 Other Soft Services

- 5.1.1 Hard Services

- 5.2 By Offering Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.2.2.1 Single-service FM

- 5.2.2.2 Bundled FM

- 5.2.2.3 Integrated FM (IFM)

- 5.3 By Deployment Model

- 5.3.1 On-Premise

- 5.3.2 Cloud-Based

- 5.4 By Organisation Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By End-User Industry

- 5.5.1 Commercial (IT/Telecom, Retail, Warehouses)

- 5.5.2 Hospitality (Hotels, Restaurants)

- 5.5.3 Institutional and Public Infrastructure

- 5.5.4 Healthcare

- 5.5.5 Industrial and Process

- 5.5.6 Residential and Leisure

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Benelux (Belgium, Netherlands, Luxembourg)

- 5.6.2.7 Nordics (Sweden, Norway, Denmark, Finland)

- 5.6.2.8 Poland

- 5.6.2.9 Russia

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Chile

- 5.6.4.5 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 GCC (Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain)

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Kenya

- 5.6.5.2.5 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 CBRE Group Inc.

- 6.4.2 Cushman and Wakefield plc

- 6.4.3 JLL (Jones Lang LaSalle Inc.)

- 6.4.4 ISS A/S

- 6.4.5 Sodexo SA

- 6.4.6 Compass Group plc

- 6.4.7 Emeric Facility Services

- 6.4.8 SMI Facility Services

- 6.4.9 AHI Facility Services Inc.

- 6.4.10 Aramark Corporation

- 6.4.11 ABM Industries Inc.

- 6.4.12 G4S Limited

- 6.4.13 Atalian Global Services

- 6.4.14 Vinci Facilities (VINCI SA)

- 6.4.15 EMCOR Group Inc.

- 6.4.16 Comfort Systems USA

- 6.4.17 Balfour Beatty - Workplace

- 6.4.18 Serco Group plc

- 6.4.19 Reliance Facilities (India)

- 6.4.20 Sinopec Engineering FM (China)

- 6.4.21 Unispace Global

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment