PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1333719

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1333719

Bakery Enzymes Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028)

The Bakery Enzymes Market size is expected to grow from USD 581.66 million in 2023 to USD 781.70 million by 2028, at a CAGR of 6.09% during the forecast period (2023-2028).

Key Highlights

- The baking industry has used yeasts and enzymes for centuries to manufacture many high-quality products. Over recent years, the increased consumption of bakery products worldwide has propelled the growth of the global bakery enzymes market. Baking enzymes help keep baked goods fresher for longer, reducing food waste. They also help improve flour performance and dough stability throughout the process, making less product discarded. Moreover, consumers' preference for organic food ingredients over synthetic additives like emulsifiers has positively impacted the global bakery enzymes market.

- According to the study conducted by the Research Institute of Organic Agriculture (FiBL) in Luxembourg, it was found that the per capita spending on organic products increased from EUR 285 (USD 335) in 2020 to EUR 313 (USD 354) in 2021. The market is further propelled by the increased utilization of various bakery enzymes for manufacturing baked goods with desired sensory aspects and enhanced shelf life.

- Besides this, busy lifestyles and increased preference for RTE food surged the consumption of bakery products, especially the packaged variety, driving the overall market. Moreover, manufacturers are launching products that act as label-friendly alternatives to many commonly used baking ingredients to meet consumer demand for a simple and clean label while maintaining excellent product quality and ensuring a robust baking process. Therefore, the factors mentioned above are anticipated to create lucrative opportunities for key players to expand their market reach and urge global market growth.

Bakery Enzymes Market Trends

Demand for Convenient Bakery Goods Augments the Market

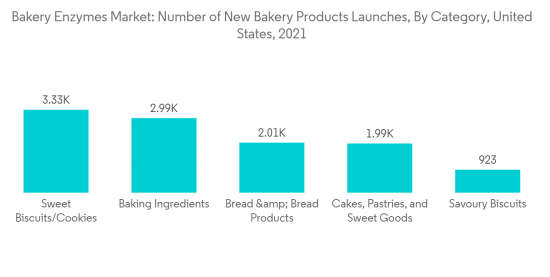

- Due to changing dietary patterns and busy lifestyles, there has been a considerable rise in the demand for convenient bakery goods like bread, which also holds the major market share in the bakery products industry. The main driver for the growth of enzymes is the demand for good quality bread with all the desired properties. Bakery products manufacturers are launching new and innovative products in the market to cater to consumer demand for bread and bakery products.

- Owing to this, their demand for baking enzymes like proteases and lipases is increasing. Bread is a staple food in many countries; therefore, its production and consumption are increasing. According to the data from Defra 2021, the weekly consumption of bread per person was 502 grams in 2021.

- In March 2021, International Flavors & Fragrances (IFF), a US-based company, launched EnoveraTM 3001, a dough strengthener, to target label-friendly baking demands in the North American market. The "enzyme-only" ingredient allows bakers to formulate without compromising dough strength, texture, or taste.

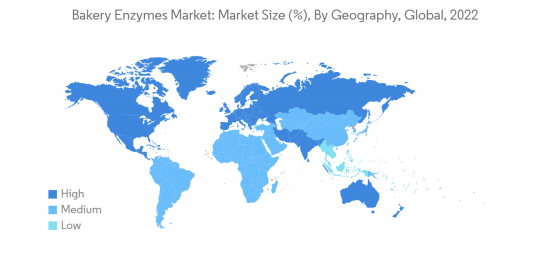

North America Holds the Largest Market Share

- North America is the largest market for bakery enzymes. The region's high consumption of baked goods is the primary factor responsible for the market growth.

- Enzymes help bakers unlock new differentiated products, innovate with new recipes for evolving consumer preferences, and develop more robust dough for improved shock tolerance to expand market reach. The number of bakers is increasing in the region owing to the increasing demand for bread and bakery products.

- According to Bureau of Labour Statistics (BLS) data from 2022, number of bakers in the United States was 205,300 in 2022. The rising consumer need for increased wellness, convenience, and sustainable and ethical baked products created new growth opportunities for market players, leading to the development of products with better value.

- Moreover, companies are creating label-friendly products to meet consumer needs by reducing added sugar, enhancing nutrition, or removing or substituting existing ingredients without impacting product quality, texture, or taste.

Bakery Enzymes Industry Overview

The bakery enzymes market is highly fragmented, with the significant presence of numerous players. Some of these players include Koninklijke DSM N.V., Novozymes, AB Enzymes, DuPont de Nemours, and Aum Enzymes, among others. These players' most preferred growth strategies are new product development, mergers, acquisitions, expansion, and partnerships to fuel market growth. They also offer product customization solutions to boost their brand presence and drive sales.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Clean Label Bakery Products

- 4.1.2 Increasing Popularity of Specialty Ingredients

- 4.2 Market Restraints

- 4.2.1 Risk of Allergies

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Carbohydrases

- 5.1.2 Proteases

- 5.1.3 Lipases

- 5.2 Application

- 5.2.1 Bread

- 5.2.2 Biscuits and Cookies

- 5.2.3 Cakes

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Spain

- 5.3.2.3 Italy

- 5.3.2.4 France

- 5.3.2.5 Russia

- 5.3.2.6 Germany

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab of Emirates

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Koninklijke DSM N.V.

- 6.3.2 Novozymes

- 6.3.3 AB Enzymes

- 6.3.4 Aum Enzymes

- 6.3.5 DuPont de Nemours, Inc

- 6.3.6 Amano Enzyme Inc

- 6.3.7 Maps Enzymes Ltd.

- 6.3.8 VEMO 99 Ltd.

- 6.3.9 SternEnzym GmbH & Co. KG

- 6.3.10 Mirpain

- 6.3.11 International Flavors and Fragrances Inc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS