PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637877

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637877

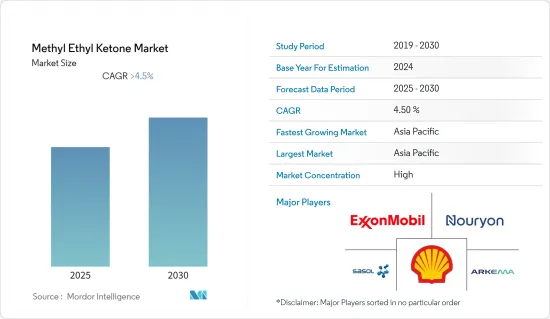

Methyl Ethyl Ketone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Methyl Ethyl Ketone Market is expected to register a CAGR of greater than 4.5% during the forecast period.

COVID-19 harmed the market in 2020. Given the pandemic scenario, automotive and manufacturing activities were temporarily halted during the lockdown, reducing the usage of methyl ethyl ketone as a component and thereby impacting the market. But with the easing of the restrictions, the market started to gather pace over time.

Key Highlights

- In the short term, rising demand for MEK in the construction industry for applications such as resins, paints, and coatings, as well as increased use of MEK as a solvent in the pharmaceutical industry, are likely to fuel market expansion.

- On the flip side, the increasing awareness regarding the toxic effects of MEK is likely to hamper the growth of the market studied.

- Increasing government investments in infrastructural developments are expected to offer various opportunities for market growth shortly.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Methyl Ethyl Ketone Market Trends

Paints and Coatings Segment to Dominate the Market Demand

- The paints and coatings segment stands to be the largest consumer of methyl ethyl ketone. MEK is an excellent solvent for use in the paints and coatings sector. The paints and coatings major consumption is in the construction industry.

- Asia-Pacific and North America regions have been witnessing strong growth in residential construction, which is further likely to increase the demand for MEK for residential applications during the forecast period.

- North America witnessed healthy growth in the construction sector due to significant investments in the United States and Canada. According to the US Census Bureau, in December 2022, construction spending in the country was estimated at a seasonally adjusted annual rate of USD 1,809.9 billion, 0.4% below the revised November estimate of USD 1,817.3 billion. However, the December 2022 figure is about 8% above the previous year's December estimate of USD 1,681.0 billion.

- Moreover, in 2022, construction spending amounted to a value of about USD 1,790 billion, around 10% above USD 1,600 billion in 2021, thereby increasing the consumption of paints and coatings in construction applications.

- The automotive industry is also a major end-use for paints and coatings. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), the global production of motor vehicles saw a 3% growth. The production in 2020, which was 77.71 million units, increased to 80.14 million units in 2021. Thus, the increasing demand for automobile units after the COVID era will likely increase the market of paints and coatings and, eventually, of MEK.

- Europe is home to many large paint industries, with the four largest mainland economies of Germany, France, Italy, and Spain. Germany is the largest market of paints and coatings and is home to approximately 300 coatings, paint, and printing ink-producing companies, and Germany is Europe's largest exporter of coatings.

- Therefore, the above factors are expected to significantly impact the market in the coming years.

Asia-Pacific Region to Dominate the Market

- With growing residential and commercial construction investments in countries such as India, China, the Philippines, Vietnam, and Indonesia, the methyl ethyl ketone (MEK) market is expected to increase in the coming years.

- Currently, China includes numerous airport construction projects in the development or planning stage. The Civil Aviation Administration of China (CAAC) aims to construct 216 new airports by 2035 to meet the growing demands for air travel, and this number is likely to hit 450 by 2035. Additionally, the government rolled out massive construction plans to move 250 million people to its new megacities over the next ten years.

- China is the largest producer and consumer of automotive vehicles. The China Association of Automobile Manufacturers reports that, compared to the prior year, China's automobile sales increased by about 2.1% in 2022. Compared to the 26.27 million automobiles sold in 2021, around 26.86 million were sold in 2022.

- Indian Real Estate sector is expected to reach a market size of USD 1 trillion by 2030, and its contribution to the country's GDP is expected to be approximately 13% by 2025.

- India is the fourth-largest consumer of rubber in the world as of 2022. Rubber usage per capita in India is currently 1.2 kg, compared to 3.2 kg globally. India's rubber industry generates approximately INR 12000 crores (USD 1,449 million). The tire sector consumes most of India's rubber production, accounting for over half of the country's total output.

- According to Japan's Ministry of Land, Infrastructure, Transport, and Tourism (MLIT), overall investment in the construction sector in 2022 is estimated to be around JPY 66,990 billion (USD 508.16 billion), a 0.6% increase over the previous year.

- The Philippine Statistics Authority also mentioned in its annual report for 2022 that motor vehicles and motorcycle maintenance played a significant part in the country's GDP growth of 7.6% over the previous year. The segment was the main contributor, accounting for around 8.7% of overall expansion.

- Because of the rising disposable income, greater living standards, and urbanization, major developed and developing countries such as China, India, and Japan are witnessing faster expansion in construction activities and automotive production, resulting in increased demand for the methyl ethyl ketone market.

Methyl Ethyl Ketone Industry Overview

The methyl ethyl ketone market is a consolidated market, where a few major players hold a significant share of the market demand. Some of the major players in the market include (not in a particular order) Shell Plc, Arkema, Exxon Mobil Corporation, Nouryon, and Sasol, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Paints and Coatings

- 4.1.2 Growing Demand for Resins as Solvent in the Pharmaceutical Industry

- 4.2 Restraints

- 4.2.1 Increasing Awareness About Toxic Effects of MEK

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

- 4.6 Trade Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Solvent

- 5.1.2 Resin

- 5.1.3 Printing Ink

- 5.1.4 Adhesive

- 5.1.5 Other Applications

- 5.2 End-user Industry

- 5.2.1 Paints and Coatings

- 5.2.2 Rubber

- 5.2.3 Construction

- 5.2.4 Packaging and Publishing

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Cetex Petrochemicals

- 6.4.3 China National Petroleum Corporation

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 Idemitsu Kosan Co., Ltd

- 6.4.6 INEOS

- 6.4.7 Maruzen Petrochemical

- 6.4.8 Nouryon

- 6.4.9 Shell Plc

- 6.4.10 Sasol

- 6.4.11 Tasco Chemicals

- 6.4.12 Zibo Qixiang chemical Co., Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Government Investments for Infrastructural Developments