Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644928

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644928

South America Screw Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

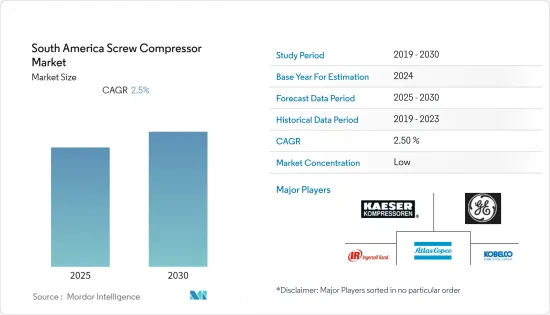

The South America Screw Compressor Market is expected to register a CAGR of 2.5% during the forecast period.

Key Highlights

- Over the short term, the South America screw compressor market is expected to have an augmented growth due to the growing natural gas demand in countries like Argentina and Brazil, which has led to the growth in natural gas production and the advantages associated with screw compressors like low maintenance costs, high compression ratio, etc.

- On the other hand, the aspects like oil contamination when screw compressors are applied in hot and sour applications are expected to impede the market in the near future.

- Nevertheless, the technological developments that cropped up in the screw compressor industry recently present a golden opportunity for the growth of the market. As an example, the modern screw compressors have a fully-enclosed design that makes them suitable for heat recovery. They can convert 100% of the drawn electrical energy into heat and up to 96% of this energy can be recovered.

- Brazil is expected to have a faster growth during the forecast period due to the growth in the oil and gas and manufacturing industries.

South America Screw Compressor Market Trends

Oil and Gas Industry Expected to Witness Significant Growth

- The screw compressors are used in the oil and gas industry for various applications like boosters for gas gathering platforms, gas transportation via pipelines, oil and gas refining processes, and the petrochemical industry. These types of compressors are preferred in the industry, mainly for applications where constant pressure is required for longer periods. The South American region has witnessed an acceleration in natural gas production, especially in countries like Argentina and Brazil which have ramped up the deployment of screw compressors.

- The natural gas production in Argentina was recorded as 38.6 billion cubic meters in the year 2021, a continuous uptrend in the last five years, except for the Covid effect. The screw compressor industry did not get the vibes from the production segment only but also from the gas transportation projects in the recent picture.

- As an example, Argentina planned a new gas pipeline project in the Vaca Muerta shale gas region in December 2021. The country's government has also financially aided the project by earmarking around USD1.6 billion for the project. The project will add around 24 million cubic meters of gas transportation capacity by 2023.

- Further, in July 2022, MAN Energy Solutions bagged a contract from Yinson to supply centrifugal and screw compressor trains for the FPSO-based gas production project at the Jubarte field, offshore Brazil. The agreement included the supply of five centrifugal compressor trains and two SKUEL321/CP200 screw compressor trains for the project. The gas production is expected to get started in 2024.

- Such kind of developments is likely to see the oil and gas industry spearheading the screw compressor market in the region.

Brazil Expected to Witness Significant Growth

- Brazil is likely to take over other countries in South America in the screw compressors market growth due to the developing oil and gas industry and manufacturing sector, particularly steelmaking and chemical manufacturing. The country has witnessed an upsurge in gas extraction projects, mainly in the offshore segment, which has resulted in the aggressive deployment of compression systems.

- According to BP Statistical Report 2022, the natural gas production in Brazil was around 24.3 billion cubic meters in 2021. The indigenous gas supply has largely increased in the last decade due to the fuelled natural gas demand. A number of oil and gas production projects are still on the way to be added to the national production data.

- For example, Brazil is anticipating the deployment of an FPSO, Anna Nery, very soon at the Marlim offshore oil and gas field in the Campos Basin. The FPSO is currently under-construction at the Cosco Changxing shipyard, China. The vessel will include double screw compressor trains aboard, which will be powered by electric motors and will be used for the vapor recovery process.

- The other lucrative market for the screw compressor industry is the steel manufacturing industry. The country has witnessed a growth in the domestic steel demand, leading to expansion projects at the manufacturing facilities. For instance, in February 2022, the global steel manufacturing corporation announced plans to pursue a manufacturing unit expansion project in Rio de Janeiro, Brazil, with an investment of BRL 1.3 billion.

- Such developments are expected to drive the screw compressor market in Brazil substantially.

South America Screw Compressor Industry Overview

The South America screw compressor market is fragmanted. Some of the major players (in no particular order) include Kobe Steel Ltd., Atlas Copco AB Class A, Ingersoll Rand Inc., General Electric Company, and Kaeser Compressor Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93188

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Oil-Injected

- 5.1.2 Oil-Free

- 5.2 Application

- 5.2.1 Natural Gas Applications

- 5.2.2 Process Gas Applications

- 5.2.3 Process Refrigeration

- 5.2.4 Fuel Gas Compression

- 5.2.5 Solution Gas Applications

- 5.2.6 Vapor Recovery Compression Systems

- 5.3 Stage

- 5.3.1 Single-Stage

- 5.3.2 Multi-Stage

- 5.4 End-User Industry

- 5.4.1 Manufacturing

- 5.4.1.1 Steel

- 5.4.1.2 Chemical

- 5.4.1.3 Others

- 5.4.2 Oil and Gas Industry

- 5.4.3 Mining

- 5.4.4 Construction

- 5.4.5 Others

- 5.4.1 Manufacturing

- 5.5 Geography

- 5.5.1 Brazil

- 5.5.2 Argentina

- 5.5.3 Chile

- 5.5.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Kobe Steel Ltd.

- 6.3.2 Atlas Copco AB Class A

- 6.3.3 Ingersoll Rand Inc.

- 6.3.4 General Electric Company

- 6.3.5 Kaeser Corporation Inc.

- 6.3.6 Man Energy Solutions

- 6.3.7 Burckhardt Compression AG

- 6.3.8 Zhejiang Kaishan Compressor Co.,Ltd.

- 6.3.9 Quincy Compressor LLC

- 6.3.10 Shandong Sollant Machinery Manufacturing Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.