PUBLISHER: Mellalta Meets LLP | PRODUCT CODE: 1307857

PUBLISHER: Mellalta Meets LLP | PRODUCT CODE: 1307857

Acute low back pain (ALBP)| Primary Research (KOL's Insight) | Market Intelligence | Epidemiology & Market Forecast-2033

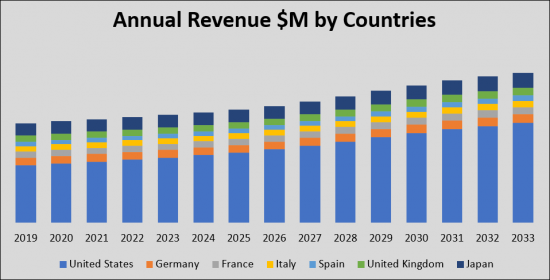

The acute low back pain market is undergoing substantial growth and transformation, driven by the increasing prevalence of LBP and the need for more effective and convenient treatment options. With the projected rise in incident cases and market size, as well as the introduction of innovative therapies, the acute LBP market presents lucrative opportunities for pharmaceutical companies and healthcare providers. In terms of geographical distribution, the G7 countries-United States, European five countries, and Japan-currently dominate the ALBP therapy market. By 2033, the market size in these countries is projected to reach a substantial amount, representing a significant increase from USD 5 billion in 2019, with a steady compound annual growth rate (CAGR). In 2019, the United States held the largest market share at USD 3.3 billion, followed by the European five countries at USD 1.7 billion and Japan at USD 0.7 billion. With the introduction of new therapies, the overall market is expected to expand significantly by 2033. By 2033, the United States is projected to achieve a market size of billions of dollars, while the European five countries and Japan are also expected to reach notable market sizes.

"Acute low back pain (ALBP) comes with significant socioeconomical burden as it is the condition that, worldwide, cause the most disability. Although, Pharmacological therapy may improve symptoms in acute LBP, but there is clear need to identify the most effective drug(s) with lesser side effects for the management of this condition."

Acute low back pain can be defined as six to 12 weeks of pain between the costal angles and gluteal folds that may radiate down one or both legs (sciatica). Acute low back pain is often nonspecific and therefore cannot be attributed to a definite cause. It is estimated that up to 84 percent of adults have low back pain at some time in their lives. The vast majority of patients seen in primary care (>85 percent) have nonspecific low back pain, meaning that the patient has back pain in the absence of a specific underlying condition that can be reliably identified. For most of these individuals, episodes of back pain are self-limited. Patients who continue to have back pain beyond the acute period (four weeks) have subacute back pain (lasting between 4 and 12 weeks), and some may go on to develop chronic back pain (lasting >12 weeks).

Treatment plans with the goals of pain relief, functional improvement, and minimization of time off work can be formulated with the patient. Nonsteroidal anti-inflammatory drugs (NSAIDs) are prescribed to 55% of the ALBP patients as part of their initial treatment regimen. Opioids and Muscle relaxants, are utilized in the management of Acute Low Back Pain (ALBP), however, their usage remains a topic of ongoing controversy. The current treatment landscape for ALBP presents significant challenges within the healthcare industry, with healthcare professionals contending with a limited array of analgesic options and non-pharmacologic therapies. While systemic agents such as acetaminophen, nonsteroidal anti-inflammatory drugs (NSAIDs), and opioids have demonstrated efficacy, their use is hindered by well-documented toxicities and adverse effects.

Acute low back pain (ALBP) Epidemiology

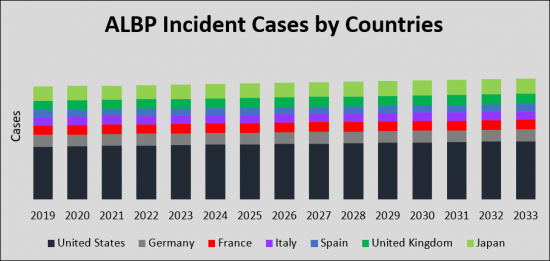

The total incident cases of Acute low back pain (ALBP) in the G7 countries are projected to increase from 23.55 million in 2019 to a projected number of cases by 2033, with a compound annual growth rate (CAGR) of 0.5% for the study period (2019-2033). According to estimates, the United States accounted for the highest incidence of Acute low back pain (ALBP) cases in 2019 which is projected to significantly increase for the study period. Among the EU5, Germany had the highest cases of Acute low back pain (ALBP), followed by the UK, France, Italy, and Spain. Japan is reported to have the highest number of cases after the United States.

In terms of diagnosis, the recommended approach for diagnosing Acute LBP involves a combination of physical examination, history taking, and various diagnostic tools. These tools can include X-ray, neuroimaging, such as MRI scans and CT myelography, as well as Electromyography (EMG). The prognosis for most patients with acute LBP is favorable, with approximately 5% experiencing persisting problems. In our forecast model, we assumed a 100% diagnosis rate for Acute LBP, as all patients with acute low back pain are expected to seek medical attention.

Acute low back pain (ALBP) Current Market Size & Forecast Trends

The G7 therapeutic market for acute low back pain (ALBP) is on a trajectory of significant growth from 2019 to 2033. Driven by the strategic adoption strategies implemented by key market players, this market is expected to expand from USD 5.7 billion in 2019 to a staggering value in the billions by 2033, reflecting a robust compound annual growth rate (CAGR). The remarkable growth of the LBP therapy market can be attributed to a combination of factors. Firstly, the market is bolstered by the wide utilization of existing treatments, including NSAIDs, analgesics, opioids, and muscle relaxants. These established therapies play a pivotal role in addressing acute low back pain, providing relief and improving patients' quality of life. Secondly, the introduction of innovative drugs such as Etoricoxib/Tramadol, Dexketoprofen, and SP-103 adds further momentum to the market expansion, ensuring a comprehensive range of treatment options for patients.

The current treatment approach for acute low back pain (ALBP) is primarily conservative and multidisciplinary, aiming to alleviate pain, improve function, and facilitate natural healing. The prescribing patterns of pain medications in ALBP indicate that 86% of the pain medications prescribed were NSAIDs, aligning with the current guidelines. The study also showed that diclofenac, ibuprofen, and paracetamol were the most commonly prescribed drugs for ALBP. Based on this information, it is estimated that 55% of ALBP patients will receive NSAIDs, 35% will receive co-medications (such as proton-pump inhibitors, muscle relaxants, and antidepressants), and 10% will be prescribed opioids. However, it is important to note that these estimates may vary based on individual patient characteristics and healthcare provider practices.

The Acute LBP market is further split by line of treatments, with the current prescribed therapies expected to reach a substantial market size and increase with a steady CAGR. New therapies are expected to be launched in the acute low back pain space and will compete with and replace existing treatments in the first-line treatment setting. SP-103 (Scilex/Sorrento) is projected to generate an increase in market sales, followed by Etoricoxib/Tramadol (Laboratorios Silanes S.A. de C.V.) and Dexketoprofen/Vitamin B (Laboratorios Silanes S.A. de C.V.), with significant projected market sizes by 2033.

Report Highlights:

- ALBP - Current Market Trends

- ALBP - Market Opportunities and Sales Potential for Agents

- ALBP - Patient-based Market Forecast to 2032

- ALBP - Untapped Business Opportunities

- ALBP - Product Positioning Vis-a-vis Competitors' Products

- ALBP - KOLs Insight

Table of Contents

Executive Summary

- Key Findings

Acute low back pain (ALBP) Disease Background

- Acute low back pain (ALBP) Overview

- Definition

- Causes

- Symptoms

- Pathogenesis

- Diagnosis

- AAAPT Diagnostic Criteria for Acute LBP with and Without Lower Extremity Pain

- Differential Diagnosis

- Diagnosis Flowchart

Epidemiology and Patient Populations

- Key Findings

- Methods and Data Sources

- Country Specific Incident Cases of Acute Low Back Pain (US, Germany, France, Italy, Spain, UK, and Japan)

- Country Specific Severity Specific Cases of Acute low back pain (ALBP)

Key Sources for Acute low back pain (ALBP) Epidemiology and Model Parameters

- United States

- United States incident cases of Acute low back pain (ALBP)

- United States severity specific cases of Acute low back pain (ALBP)

- Germany

- Germany incident cases of Acute low back pain (ALBP)

- Germany severity specific cases of Acute low back pain (ALBP)

- France

- France incident cases of Acute low back pain (ALBP)

- France severity specific cases of Acute low back pain (ALBP)

- Italy

- Italy incident cases of Acute low back pain (ALBP)

- Italy severity specific cases of Acute low back pain (ALBP)

- Spain

- Spain incident cases of Acute low back pain (ALBP)

- Spain severity specific cases of Acute low back pain (ALBP)

- United Kingdom

- United Kingdom incident cases of Acute low back pain (ALBP)

- United Kingdom severity specific cases of Acute low back pain (ALBP)

- Japan

- Japan incident cases of Acute low back pain (ALBP)

- Japan severity specific cases of Acute low back pain (ALBP)

Current Therapies and Medical Practice

- Acute low back pain (ALBP)-Non-invasive Treatments As Per American College of Physicians Guidelines

- Summary of the American College of Physicians Guideline on Noninvasive Treatments for Acute Low Back Pain

- Acute low back pain management pathway

- NICE Guidelines for Low back pain management

- Acute low back pain (ALBP): Management Algorithm

- Treatment Plan

- Prescription Patterns

Unmet Needs

Emerging Therapies

- Pipeline Overview

- Therapeutic Developments Pipeline for Acute low back pain (ALBP)

- Product Analysis

- Etoricoxib/Tramadol (Laboratorios Silanes S.A. de C.V.)

- Product Profile

- Clinical Development

- Sales & Market Opportunity by 2033

- Dexketoprofen/Vitamin B (Laboratorios Silanes S.A. de C.V.)

- Product Profile

- Clinical Development

- Sales & Market Opportunity by 2033

- SP-103 (Scilex Pharmaceuticals, Inc./Sorrento Therapeutics)

- Product Profile

- Clinical Development

- Sales & Market Opportunity by 2033

- Tolperisone (Sanochemia Pharmazeutika/ Neurana Pharmaceuticals, Inc.)

- Product Profile

- Clinical Development

- Etoricoxib/Tramadol (Laboratorios Silanes S.A. de C.V.)

- Product Analysis

- Late-Stage Therapies with no current intention for entry in G7 Markets

Future Treatment Paradigm

- Acute low back pain (ALBP) Competitor Landscape and Approvals Anticipated

- Future Treatment Algorithms and Competitor Positioning

- Key Data Summary for Emerging Treatment

Annual Cost of Current & Emerging Therapies

Market Outlook

- Key Findings

Country Specific Market Forecast to 2033

- Sales of Drugs to Treat Acute low back pain (ALBP) in the Major Pharmaceutical Markets, 2019-2033

- Patient Share of Acute low back pain (ALBP) Therapies 2019-2033 (USD Million)

Market Forecast by Country

- United States

- United States Market for Acute low back pain (ALBP) 2019-2033 (USD Million)

- United States Market for Acute low back pain (ALBP) by Therapies 2019-2033 (USD Million)

- Germany

- Germany Market for Acute low back pain (ALBP) 2019-2033 (USD Million)

- Germany Market for Acute low back pain (ALBP) by Therapies 2019-2033 (USD Million)

- France

- France Market for Acute low back pain (ALBP) 2019-2033 (USD Million)

- France Market for Acute low back pain (ALBP) by Therapies 2019-2033 (USD Million)

- Italy

- Italy Market for Acute low back pain (ALBP) 2019-2033 (USD Million)

- Italy Market for Acute low back pain (ALBP) by Therapies 2019-2033 (USD Million)

- Spain

- Spain Market for Acute low back pain (ALBP) 2019-2033 (USD Million)

- Spain Market for Acute low back pain (ALBP) by Therapies 2019-2033 (USD Million)

- United Kingdom

- United Kingdom Market for Acute low back pain (ALBP) 2019-2033 (USD Million)

- United Kingdom Market for Acute low back pain (ALBP) by Therapies 2019-2033 (USD Million)

- Japan

- Japan Market for Acute low back pain (ALBP) 2019-2033 (USD Million)

- Japan Market for Acute low back pain (ALBP) by Therapies 2019-2033 (USD Million)

Market Drivers and Constraints

- What Factors Are Driving the Market for Acute low back pain (ALBP)?

- What Factors Are Constraining the Market for Acute low back pain (ALBP)?

Social Media Analytics

- TikTok Videos: A Rising Engagement Platform for Non-Specific Acute Low Back Pain (ALBP) Treatment - 2022 Study Reveals