PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1924864

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1924864

Automated Guided Vehicle Market by Type, Navigation Technology - Global Forecast to 2032

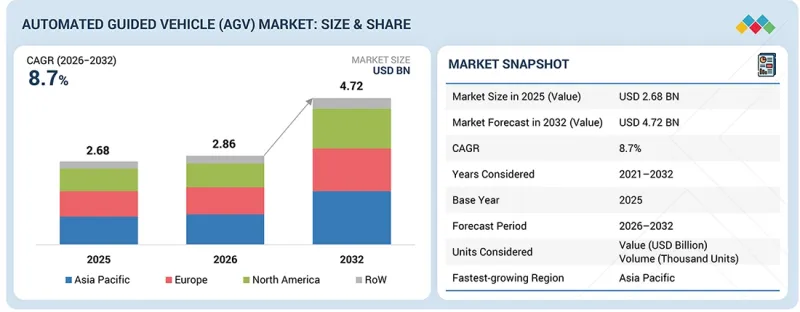

The global Automated Guided Vehicle (AGV) market is projected to grow from USD 2.86 billion in 2026 to USD 4.72 billion by 2032, registering a CAGR of 8.7 % during the forecast period. Growth is driven by increasing adoption of AGVs across factories, warehouses, and distribution facilities as organizations focus on improving internal material flow, reducing manual handling, and maintaining consistent operational output.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Navigation Technology and Region |

| Regions covered | North America, Europe, APAC, RoW |

Companies are expanding AGV deployments to support repetitive transport tasks, line feeding, towing, and pallet movement in structured environments where reliability and safety are critical. Demand is increasing for AGV systems that offer stable navigation, efficient traffic management, and dependable performance under continuous operation. Ongoing investment in factory modernization, logistics infrastructure expansion, and automation upgrades is further supporting market growth. As organizations prioritize efficiency, cost control, and scalable automation strategies, AGVs are becoming an integral component of long term material handling and operational optimization plans across global markets.

"Light-Duty AGVs to Hold a Significant Share in the Automated Guided Vehicle Market"

The light-duty AGV segment is expected to hold a significant share of the Automated Guided Vehicle market during the forecast period, supported by strong adoption in applications requiring frequent and short distance material movement. Light-duty AGVs are widely deployed for tasks such as tote handling, small pallet transport, kitting, and line side replenishment across factories, warehouses, and distribution facilities. Their lower acquisition cost, compact form factor, and ease of deployment make them suitable for facilities with space constraints and moderate payload requirements. Companies are adopting light-duty AGVs to automate repetitive internal transport, improve workplace safety, and reduce reliance on manual labor. These systems support efficient traffic flow and continuous operation, helping organizations maintain consistent throughput and operational control. As automation expands across small and mid scale facilities and retrofit projects, demand for light-duty AGVs continues to grow, reinforcing their importance within the overall AGV market.

"Laser Guidance to Grow at a Significant CAGR in the Automated Guided Vehicle Market"

The laser guidance segment is expected to grow at a significant CAGR in the Automated Guided Vehicle market during the forecast period, supported by rising demand for high navigation accuracy and stable performance in structured industrial environments. Laser guided AGVs are widely adopted in facilities that require precise positioning, repeatable routing, and consistent operation over long duty cycles. These systems are well suited for factories, warehouses, and distribution centres where layout stability and predictable material flow are critical. Companies are adopting laser guidance to support higher throughput, reduce navigation errors, and improve safety in shared traffic areas. Laser guided AGVs also enable faster commissioning and reliable operation without frequent path adjustments, making them attractive for large scale deployments. As organizations expand automation in environments that prioritize accuracy, reliability, and controlled workflows, demand for laser guided AGVs continues to increase, supporting strong growth for this segment.

"Asia Pacific Emerges as the Fastest Growing Region in the Automated Guided Vehicle Market"

The Asia Pacific region is expected to witness the highest growth in the Automated Guided Vehicle market during the forecast period, supported by rapid expansion of manufacturing capacity, large scale warehouse development, and rising adoption of automation across production and logistics facilities. Companies across the region are deploying AGVs to improve internal material flow, reduce manual handling, and maintain consistent throughput in high volume operations. Strong growth in factory automation, distribution infrastructure, and intra facility transport requirements is increasing demand for structured and repeatable AGV based material handling systems. Government support for industrial modernization, smart manufacturing initiatives, and automation focused investment programs is further strengthening market momentum. Asia Pacific also benefits from a strong production base, cost competitive manufacturing, and a growing ecosystem of AGV suppliers and system integrators, which accelerates deployment across both new facilities and retrofit projects. With continued investment in automation, safety improvement, and operational efficiency, Asia Pacific is expected to remain the fastest growing region in the global AGV market throughout the forecast period.

Breakdown of primaries

A variety of executives from key organizations operating in the Automated Guided Vehicle (AGV) market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 -40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: Directors - 40%, C-level - 45%, and Others - 15%

- By Region: Asia Pacific - 41%, North America - 26%, Europe - 28%, and RoW - 5%

Note: The RoW region includes the Middle East, Africa, and South America. Other designations include product, sales, and marketing managers. Three tiers of companies have been defined based on their total revenues: tier 3: revenue lesser than USD 100 million; tier 2: revenue between USD 100 million and USD 1 billion; and tier 1: revenue more than USD 1 billion.

Major players profiled in this report are as follows: Major companies operating in the Automated Guided Vehicle market include Daifuku Co., Ltd. (Japan), JBT (US), KION GROUP AG (Germany), Toyota Industries Corporation (Japan), KUKA SE & Co. KGaA (Germany), Jungheinrich AG (Germany), Scott (New Zealand), SSI SCHAEFER (Germany), Hyster-Yale Inc. (US), NEURA Mobile Robots GmbH (Germany), MEIDENSHA CORPORATION (Japan), MITSUBISHI LOGISNEXT CO., LTD (Japan), Oceaneering International, Inc. (US), AMERICA IN MOTION, INC. (US), Asseco CEIT, a.s. (Slovakia), Suzhou Casun Intelligent Robot Co., Ltd. (China), Jiangxi Danbao Robot Co., Ltd. (China), E80 Group S.p.A. (Italy), Global AGV (Denmark), Grenzebach Group (Germany), IDC Corporation (US), Nanchang Industrial Control Robot Co., Ltd. (China), SAFELOG GmbH (Germany), Simplex Robotics Pvt. Ltd. (India), System Logistics S.p.A. (Italy), and Balyo (France).

These companies compete through expansion of AGV portfolios, improvements in vehicle reliability and navigation performance, and alignment with structured material handling requirements across factories, warehouses, and distribution facilities. Strategic focus areas include scalable vehicle platforms, standardized safety compliance, flexible deployment models, and long term service support. Continued investment in automation programs, facility modernization, and internal logistics optimization is expected to sustain competition and drive steady innovation across the global AGV market.

The study provides a detailed competitive analysis of these key players in the Automated Guided Vehicle (AGV) market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

This report on the Automated Guided Vehicle (AGV) market presents a detailed analysis based on payload capacity, type, navigation technology, industry, and region. By payload capacity, the market is segmented into light-duty AGVs below 500 kg, medium-duty AGVs ranging from 500 to 1,500 kg, and heavy-duty AGVs above 1,500 kg to address varying material handling requirements. By type, the market includes tow vehicles, unit load carriers, pallet trucks, assembly line vehicles, forklift trucks, and other types such as automated guided carts and hybrid AGVs. By navigation technology, the market is segmented into laser guidance, magnetic guidance, inductive guidance, optical tape guidance, vision guidance, and other navigation technologies including inertial, beacon, and dead reckoning guidance. By industry, the market covers automotive, chemicals, aviation, semiconductor and electronics, e-commerce and retail, food and beverages, pharmaceuticals, medical devices, metals and heavy machinery, logistics/3PL, pulp and paper, and other industries such as printing and textile. The regional analysis covers North America, Europe, Asia Pacific, and Rest of the World. This segmentation supports detailed assessment of growth opportunities, adoption patterns, and technology developments shaping the global Automated Guided Vehicle (AGV) Market.

Reasons to buy the report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the Automated Guided Vehicle (AGV) market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (Rising demand for automation solutions in diverse industries, rising emphasis on improving workplace safety, transition from mass production toward flexible, customized manufacturing, rising demand for advanced material handling technologies, and accelerating growth of the e-commerce industry), restraints (High installation, maintenance, and switching costs, growing preference for mobile robots limits AGV demand, and infrastructure limitations in developing markets restrain AGV adoption), opportunities (Rising integration of Industry 4.0 technologies accelerates warehousing modernization, growing investment in AGVs by small and medium-sized enterprises, rapid industrialization in emerging markets creates strong demand for automation, rapid growth of the intralogistics sector in Southeast Asia, ongoing innovation expands the functional capabilities of AGVs), and challenges (Lower labour expenses in emerging markets pose a challenge to AGV adoption, operational downtime driven by technical issues) influencing the growth of the Automated Guided Vehicle (AGV) market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the Automated Guided Vehicle (AGV) market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Automated Guided Vehicle (AGV) market across varied regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the Automated Guided Vehicle (AGV) market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Daifuku Co., Ltd. (Japan), Toyota Industries Corporation (Japan), KUKA SE & Co. KGaA (Germany), KION GROUP AG (Germany), JBT (US) and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN AUTOMATED GUIDED VEHICLE MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMATED GUIDED VEHICLE MARKET

- 3.2 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE

- 3.3 AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY

- 3.4 AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY

- 3.5 AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY

- 3.6 AUTOMATED GUIDED VEHICLE MARKET IN NORTH AMERICA, BY INDUSTRY AND COUNTRY

- 3.7 AUTOMATED GUIDED VEHICLE MARKET, BY GEOGRAPHY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising demand for automation across diverse industries

- 4.2.1.2 Growing emphasis on improving workplace safety

- 4.2.1.3 Transition from mass production toward flexible, customized manufacturing

- 4.2.1.4 Surging demand for advanced material handling technologies

- 4.2.1.5 Booming e-commerce industry

- 4.2.2 RESTRAINTS

- 4.2.2.1 High installation, maintenance, and switching costs

- 4.2.2.2 Growing preference for mobile robots over AGVs

- 4.2.2.3 Infrastructure limitations in developing markets

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Transformation of warehousing through adoption of Industry 4.0 technologies

- 4.2.3.2 Growing investment in AGVs by small and medium-sized enterprises

- 4.2.3.3 Rapid industrialization and e-commerce expansion in emerging markets

- 4.2.3.4 Ongoing innovations to improve AGV performance

- 4.2.4 CHALLENGES

- 4.2.4.1 Lower labor expenses in emerging markets

- 4.2.4.2 Operational downtime due to technical issues

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 BARGAINING POWER OF SUPPLIERS

- 5.1.2 BARGAINING POWER OF BUYERS

- 5.1.3 THREAT OF NEW ENTRANTS

- 5.1.4 THREAT OF SUBSTITUTES

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL E-COMMERCE & RETAIL INDUSTRY

- 5.2.4 TRENDS IN AUTOMOTIVE INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 PRICING RANGE OF AUTOMATED GUIDED VEHICLES, BY KEY PLAYER, 2025

- 5.5.2 AVERAGE SELLING PRICE TREND OF AUTOMATED GUIDED VEHICLES, BY TYPE, 2021-2025

- 5.5.3 AVERAGE SELLING PRICE TREND OF TOW VEHICLES, BY REGION, 2021-2025

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (842710)

- 5.7.2 EXPORT SCENARIO (842710)

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 KEY CONFERENCES AND EVENTS, 2026

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 TOYOTA ADOPTS MASTERMOVER'S AGV300 TO ENHANCE PRODUCTIVITY AND REDUCE WASTE

- 5.10.2 SCOTT PROVIDES AGV AND PALLETISING SYSTEM TO ENHANCE PRODUCT AND WORKER SAFETY AND MINIMIZE DOWNTIME

- 5.10.3 E80 GROUP IMPLEMENTS LGVS AT METSA TISSUE'S WAREHOUSES TO IMPROVE OPERATIONAL PERFORMANCE

- 5.11 IMPACT OF 2025 US TARIFF - AUTOMATED GUIDED VEHICLE MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 ARTIFICIAL INTELLIGENCE

- 6.1.2 MACHINE LEARNING

- 6.2 ADJACENT TECHNOLOGIES

- 6.2.1 INDUSTRIAL INTERNET OF THINGS

- 6.2.2 NEXT-GENERATION WIRELESS TECHNOLOGIES

- 6.3 COMPLEMENTARY TECHNOLOGIES

- 6.3.1 COLLABORATIVE ROBOTS

- 6.3.2 DIGITAL TWIN TECHNOLOGY

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.5 PATENT ANALYSIS

- 6.6 IMPACT OF AI ON AUTOMATED GUIDED VEHICLE MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES FOLLOWED BY OEMS IN AUTOMATED GUIDED VEHICLE MARKET

- 6.6.3 CASE STUDIES RELATED TO AI IMPLEMENTATION IN AUTOMATED GUIDED VEHICLE MARKET

- 6.6.4 INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT AI-INTEGRATED AUTOMATED GUIDED VEHICLES

7 REGULATORY LANDSCAPE

- 7.1 REGULATORY LANDSCAPE AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.1.3 REGULATIONS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS OF VARIOUS INDUSTRIES

9 TECHNOLOGIES AND POTENTIAL APPLICATIONS OF AUTOMATED GUIDED VEHICLES

- 9.1 INTRODUCTION

- 9.2 STANDARD TECHNOLOGIES USED IN AUTOMATED GUIDED VEHICLES

- 9.2.1 LIDAR SENSORS

- 9.2.2 CAMERA VISION

- 9.3 POTENTIAL APPLICATIONS OF AUTOMATED GUIDED VEHICLES

- 9.3.1 AIRPORTS

- 9.3.2 CONSTRUCTION AND INFRASTRUCTURE DEVELOPMENT PROJECTS

10 BATTERY TYPES AND CHARGING ALTERNATIVES FOR AUTOMATED GUIDED VEHICLES

- 10.1 INTRODUCTION

- 10.2 TYPES OF BATTERIES USED IN AUTOMATED GUIDED VEHICLES

- 10.2.1 LEAD-ACID BATTERIES

- 10.2.2 LITHIUM-ION BATTERIES

- 10.2.3 NICKEL-BASED BATTERIES

- 10.2.4 PURE LEAD BATTERIES

- 10.3 BATTERY CHARGING ALTERNATIVES

- 10.3.1 AUTOMATIC AND OPPORTUNITY CHARGING

- 10.3.1.1 Wireless charging

- 10.3.2 BATTERY SWAP

- 10.3.2.1 Manual battery swap

- 10.3.2.2 Automatic battery swap

- 10.3.3 PLUG-IN CHARGING

- 10.3.3.1 Manual plug-in charging

- 10.3.3.2 Automatic plug-in charging

- 10.3.1 AUTOMATIC AND OPPORTUNITY CHARGING

11 COMPONENTS AND SERVICES OFFERED FOR AUTOMATED GUIDED VEHICLES

- 11.1 INTRODUCTION

- 11.2 HARDWARE

- 11.3 SOFTWARE AND SERVICES

12 RECENT TRENDS IN AUTOMATED GUIDED VEHICLES

- 12.1 INTRODUCTION

- 12.2 INTERNET OF THINGS CONNECTIVITY

- 12.3 ADOPTION OF COLLABORATIVE AGVS

- 12.4 SCALABILITY AND MODULAR DESIGN

- 12.5 ADVANCED NAVIGATION TECHNOLOGIES

- 12.6 ENERGY EFFICIENCY AND SUSTAINABILITY

- 12.7 INTEGRATION OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 12.8 EDGE COMPUTING FOR REAL-TIME DATA PROCESSING

13 APPLICATIONS OF AUTOMATED GUIDED VEHICLES

- 13.1 INTRODUCTION

- 13.2 PICK-AND-PLACE

- 13.3 PACKAGING AND PALLETIZING

- 13.4 ASSEMBLY AND STORAGE

14 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE

- 14.1 INTRODUCTION

- 14.2 TOW VEHICLES

- 14.2.1 POTENTIAL TO AUTOMATE MATERIAL MOVEMENT AND IMPROVE OPERATIONAL EFFICIENCY TO BOOST DEMAND

- 14.3 UNIT LOAD CARRIERS

- 14.3.1 FOCUS ON MINIMIZING PRODUCT DAMAGE WHILE TRANSPORTING TO EXTERNAL LOGISTICS DEPARTMENT TO DRIVE DEMAND

- 14.4 PALLET TRUCKS

- 14.4.1 ABILITY TO HANDLE PALLETS, SKELETON CONTAINERS, RACKS, TUBS, BOXES, AND ROLLS TO ACCELERATE ADOPTION

- 14.5 ASSEMBLY LINE VEHICLES

- 14.5.1 COST ADVANTAGES OVER CHAIN-BASED CONVEYANCE SYSTEMS TO SUPPORT DEPLOYMENT

- 14.6 FORKLIFT TRUCKS

- 14.6.1 PROFICIENCY IN HANDLING DIFFERENT PALLET SIZES AND LOAD FORMATS TO INCREASE DEMAND

- 14.7 OTHER TYPES

15 AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY

- 15.1 INTRODUCTION

- 15.2 LIGHT-DUTY AGVS

- 15.2.1 ABILITY TO EFFICIENTLY MANAGE SMALL LOADS AND REDUCE WORKFORCE FATIGUE TO ENHANCE ADOPTION

- 15.3 MEDIUM-DUTY AGVS

- 15.3.1 POTENTIAL TO REDUCE WORKPLACE CONGESTION AND EFFECTIVELY MANAGE INVENTORY TO FACILITATE DEPLOYMENT

- 15.4 HEAVY-DUTY AGVS

- 15.4.1 ABILITY TO HANDLE VERY HEAVY LOADS TO DRIVE SEGMENT GROWTH

16 AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY

- 16.1 INTRODUCTION

- 16.2 LASER GUIDANCE

- 16.2.1 ENHANCED ACCURACY AND FLEXIBILITY TO CONTRIBUTE TO MARKET EXPANSION

- 16.3 MAGNETIC GUIDANCE

- 16.3.1 SIMPLE INSTALLATION, ROBUST PERFORMANCE, AND MINIMAL MAINTENANCE TO ACCELERATE ADOPTION

- 16.4 INDUCTIVE GUIDANCE

- 16.4.1 ABILITY TO PERFORM EFFECTIVELY IN DUSTY AND HIGH-TRAFFIC INDUSTRIAL ENVIRONMENTS TO PROMOTE IMPLEMENTATION

- 16.5 OPTICAL TAPE GUIDANCE

- 16.5.1 EASE OF DEPLOYMENT AND HIGH FLEXIBILITY TO SUPPORT MARKET GROWTH

- 16.6 VISION GUIDANCE

- 16.6.1 HIGH RELIABILITY AND EASY MANEUVERABILITY IN COMPLEX SPACES TO BOOST ADOPTION

- 16.7 OTHER NAVIGATION TECHNOLOGIES

17 AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY

- 17.1 INTRODUCTION

- 17.2 AUTOMOTIVE

- 17.2.1 INCREASING DEMAND FOR AFTER-SALES SPARE PARTS TO SUPPORT MARKET GROWTH

- 17.3 CHEMICALS

- 17.3.1 SIGNIFICANT FOCUS ON ENHANCING SAFETY, EFFICIENCY, AND COMPETITIVENESS TO ACCELERATE MARKET GROWTH

- 17.4 AVIATION

- 17.4.1 RISING DEMAND FOR STREAMLINED AIRCRAFT PRODUCTION TO FUEL MARKET GROWTH

- 17.5 SEMICONDUCTOR & ELECTRONICS

- 17.5.1 EMPHASIS ON REVOLUTIONIZING CLEANROOM OPERATIONS TO DRIVE MARKET

- 17.6 E-COMMERCE & RETAIL

- 17.6.1 NECESSITY TO ENHANCE ORDER ACCURACY AND PROMPT DELIVERY TO FUEL ADOPTION

- 17.7 FOOD & BEVERAGES

- 17.7.1 SURGING DEMAND FOR FRESH, SAFE, AND READILY ACCESSIBLE FOOD PRODUCTS TO STIMULATE MARKET GROWTH

- 17.8 PHARMACEUTICALS

- 17.8.1 STRINGENT REGULATORY AND CLEANLINESS REQUIREMENTS TO SPIKE DEMAND

- 17.9 MEDICAL DEVICES

- 17.9.1 NEED TO FOLLOW INFECTION CONTROL PRACTICES AND IMPROVE WORKPLACE SAFETY TO PROPEL MARKET

- 17.10 METALS & HEAVY MACHINERY

- 17.10.1 SIGNIFICANT FOCUS ON IMPROVING SAFETY AND OPTIMIZING WORKFLOW TO SPUR DEMAND

- 17.11 LOGISTICS/3PL

- 17.11.1 EMPHASIS ON REDUCING WAREHOUSE SPACE AND LABOR COSTS TO ELEVATE ADOPTION

- 17.12 PULP & PAPER

- 17.12.1 NEED TO ADHERE TO SAFETY STANDARDS AND ENSURE HIGHER THROUGHPUT TO SPIKE DEPLOYMENT

- 17.13 OTHER INDUSTRIES

18 AUTOMATED GUIDED VEHICLE MARKET, BY REGION

- 18.1 INTRODUCTION

- 18.2 NORTH AMERICA

- 18.2.1 US

- 18.2.1.1 Established automotive and warehousing base to accelerate market growth

- 18.2.2 CANADA

- 18.2.2.1 Continued adoption of automation across key industries to support market growth

- 18.2.3 MEXICO

- 18.2.3.1 Strong manufacturing base to contribute to market growth

- 18.2.1 US

- 18.3 EUROPE

- 18.3.1 GERMANY

- 18.3.1.1 Strong focus on launching innovative and advanced AGVs to expedite market growth

- 18.3.2 UK

- 18.3.2.1 Thriving automotive sector to fuel market growth

- 18.3.3 FRANCE

- 18.3.3.1 Expansion of e-commerce sector to drive market

- 18.3.4 ITALY

- 18.3.4.1 Rising demand for smart logistics and automation solutions to foster market growth

- 18.3.5 SPAIN

- 18.3.5.1 Integration of AI, IoT, blockchain, 5G technologies in logistics to boost demand

- 18.3.6 NETHERLANDS

- 18.3.6.1 Advanced supply chain networks and modern warehousing infrastructure to spike demand

- 18.3.7 REST OF EUROPE

- 18.3.1 GERMANY

- 18.4 ASIA PACIFIC

- 18.4.1 CHINA

- 18.4.1.1 Increasing investments in transportation, warehousing, and logistics ecosystem to drive market

- 18.4.2 JAPAN

- 18.4.2.1 Rising labor costs and diversified industrial base to facilitate adoption

- 18.4.3 AUSTRALIA

- 18.4.3.1 Sustained automation across manufacturing, logistics, and mining operations to stimulate demand

- 18.4.4 SOUTH KOREA

- 18.4.4.1 Presence of global AGV players to propel market

- 18.4.5 INDIA

- 18.4.5.1 Emphasis on building smart factories to create growth opportunities

- 18.4.6 MALAYSIA

- 18.4.6.1 Thriving manufacturing and logistics sectors to promote AGV adoption

- 18.4.7 INDONESIA

- 18.4.7.1 Focus on expanding domestic manufacturing capacity to spur demand

- 18.4.8 SINGAPORE

- 18.4.8.1 Rising adoption of digital technologies across industries to fuel market growth

- 18.4.9 THAILAND

- 18.4.9.1 Ongoing infrastructure development projects to create lucrative opportunities

- 18.4.10 REST OF ASIA PACIFIC

- 18.4.1 CHINA

- 18.5 ROW

- 18.5.1 MIDDLE EAST

- 18.5.1.1 GCC

- 18.5.1.1.1 Saudi Arabia

- 18.5.1.1.1.1 Increasing emphasis on economic diversification under Vision 2030 to accelerate adoption

- 18.5.1.1.2 UAE

- 18.5.1.1.2.1 Rising demand for transportation, warehousing, and logistics services to drive market

- 18.5.1.1.3 Rest of GCC

- 18.5.1.1.1 Saudi Arabia

- 18.5.1.2 Rest of Middle East

- 18.5.1.1 GCC

- 18.5.2 SOUTH AMERICA

- 18.5.2.1 Government initiatives to automate food & beverages industry to spur demand

- 18.5.3 AFRICA

- 18.5.3.1 Growing imports of consumer goods to foster market growth

- 18.5.1 MIDDLE EAST

19 COMPETITIVE LANDSCAPE

- 19.1 INTRODUCTION

- 19.2 KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN, 2021-2025

- 19.3 REVENUE ANALYSIS, 2020-2024

- 19.4 MARKET SHARE ANALYSIS, 2025

- 19.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 19.6 BRAND/PRODUCT COMPARISON

- 19.6.1 DAIFUKU CO., LTD. (JAPAN)

- 19.6.2 JBT (US)

- 19.6.3 KION GROUP AG (GERMANY)

- 19.6.4 KUKA SE & CO. KGAA (GERMANY)

- 19.6.5 TOYOTA INDUSTRIES CORPORATION (JAPAN)

- 19.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025

- 19.7.1 STARS

- 19.7.2 EMERGING LEADERS

- 19.7.3 PERVASIVE PLAYERS

- 19.7.4 PARTICIPANTS

- 19.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2025

- 19.7.5.1 Company footprint

- 19.7.5.2 Region footprint

- 19.7.5.3 Navigation technology footprint

- 19.7.5.4 Type footprint

- 19.7.5.5 Industry footprint

- 19.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2025

- 19.8.1 PROGRESSIVE COMPANIES

- 19.8.2 RESPONSIVE COMPANIES

- 19.8.3 DYNAMIC COMPANIES

- 19.8.4 STARTING BLOCKS

- 19.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 19.8.5.1 Detailed list of key startups/SMEs

- 19.8.5.2 Competitive benchmarking of key startups/SMEs

- 19.9 COMPETITIVE SCENARIO

- 19.9.1 PRODUCT LAUNCHES

- 19.9.2 DEALS

- 19.9.3 EXPANSIONS

- 19.9.4 OTHER DEVELOPMENTS

20 COMPANY PROFILES

- 20.1 KEY PLAYERS

- 20.1.1 DAIFUKU CO., LTD.

- 20.1.1.1 Business overview

- 20.1.1.2 Products/Solutions/Services offered

- 20.1.1.3 Recent developments

- 20.1.1.3.1 Deals

- 20.1.1.3.2 Expansions

- 20.1.1.4 MnM view

- 20.1.1.4.1 Key strengths

- 20.1.1.4.2 Strategic choices

- 20.1.1.4.3 Weaknesses and competitive threats

- 20.1.2 JBT

- 20.1.2.1 Business overview

- 20.1.2.2 Products/Solutions/Services offered

- 20.1.2.3 Recent developments

- 20.1.2.3.1 Product launches

- 20.1.2.4 MnM view

- 20.1.2.4.1 Key strengths

- 20.1.2.4.2 Strategic choices

- 20.1.2.4.3 Weaknesses and competitive threats

- 20.1.3 KION GROUP AG

- 20.1.3.1 Business overview

- 20.1.3.2 Products/Solutions/Services offered

- 20.1.3.3 Recent developments

- 20.1.3.3.1 Product launches

- 20.1.3.3.2 Expansions

- 20.1.3.4 MnM view

- 20.1.3.4.1 Key strengths

- 20.1.3.4.2 Strategic choices

- 20.1.3.4.3 Weaknesses and competitive threats

- 20.1.4 TOYOTA INDUSTRIES CORPORATION

- 20.1.4.1 Business overview

- 20.1.4.2 Products/Solutions/Services offered

- 20.1.4.3 Recent developments

- 20.1.4.3.1 Product launches

- 20.1.4.3.2 Deals

- 20.1.4.4 MnM view

- 20.1.4.4.1 Key strengths

- 20.1.4.4.2 Strategic choices

- 20.1.4.4.3 Weaknesses and competitive threats

- 20.1.5 KUKA SE & CO. KGAA

- 20.1.5.1 Business overview

- 20.1.5.2 Products/Solutions/Services offered

- 20.1.5.3 Recent developments

- 20.1.5.3.1 Product launches

- 20.1.5.3.2 Deals

- 20.1.5.4 MnM view

- 20.1.5.4.1 Key strengths

- 20.1.5.4.2 Strategic choices

- 20.1.5.4.3 Weaknesses and competitive threats

- 20.1.6 SCOTT

- 20.1.6.1 Business overview

- 20.1.6.2 Products/Solutions/Services offered

- 20.1.6.3 Recent developments

- 20.1.6.3.1 Product launches

- 20.1.7 SSI SCHAEFER

- 20.1.7.1 Business overview

- 20.1.7.2 Products/Solutions/Services offered

- 20.1.7.3 Recent developments

- 20.1.7.3.1 Deals

- 20.1.7.3.2 Other developments

- 20.1.8 HYSTER-YALE, INC.

- 20.1.8.1 Business overview

- 20.1.8.2 Products/Solutions/Services offered

- 20.1.8.3 Recent developments

- 20.1.8.3.1 Developments

- 20.1.9 JUNGHEINRICH AG

- 20.1.9.1 Business overview

- 20.1.9.2 Products/Solutions/Services offered

- 20.1.9.3 Recent developments

- 20.1.9.3.1 Product launches

- 20.1.9.3.2 Deals

- 20.1.9.3.3 Expansions

- 20.1.10 MEIDENSHA CORPORATION

- 20.1.10.1 Business overview

- 20.1.10.2 Products/Solutions/Services offered

- 20.1.10.3 Recent developments

- 20.1.10.3.1 Product launches

- 20.1.11 MITSUBISHI LOGISNEXT CO., LTD.

- 20.1.11.1 Business overview

- 20.1.11.2 Products/Solutions/Services offered

- 20.1.11.3 Recent developments

- 20.1.11.3.1 Deals

- 20.1.12 OCEANEERING INTERNATIONAL, INC.

- 20.1.12.1 Business overview

- 20.1.12.2 Products/Solutions/Services offered

- 20.1.12.3 Recent developments

- 20.1.12.3.1 Expansions

- 20.1.12.3.2 Other developments

- 20.1.1 DAIFUKU CO., LTD.

- 20.2 OTHER PLAYERS

- 20.2.1 NEURA MOBILE ROBOTS GMBH

- 20.2.2 AMERICA IN MOTION, INC.

- 20.2.3 ASSECO CEIT, A.S.

- 20.2.4 SUZHOU CASUN INTELLIGENT ROBOT CO., LTD.

- 20.2.5 JIANGXI DANBAHE ROBOT CO., LTD.

- 20.2.6 E80 GROUP S.P.A.

- 20.2.7 GLOBAL AGV

- 20.2.8 GRENZEBACH GROUP

- 20.2.9 IDC CORPORATION

- 20.2.10 NANCHANG INDUSTRIAL CONTROL ROBOT CO., LTD.

- 20.2.11 SAFELOG GMBH

- 20.2.12 SIMPLEX ROBOTICS PVT. LTD.

- 20.2.13 SYSTEM LOGISTICS S.P.A.

- 20.2.14 BALYO

21 RESEARCH METHODOLOGY

- 21.1 RESEARCH DATA

- 21.1.1 SECONDARY AND PRIMARY RESEARCH

- 21.1.2 SECONDARY DATA

- 21.1.2.1 List of major secondary sources

- 21.1.2.2 Key data from secondary sources

- 21.1.3 PRIMARY DATA

- 21.1.3.1 Primary interviews with experts

- 21.1.3.2 Key data from primary sources

- 21.1.3.3 Key industry insights

- 21.1.3.4 Breakdown of primaries

- 21.2 MARKET SIZE ESTIMATION

- 21.2.1 BOTTOM-UP APPROACH

- 21.2.2 TOP-DOWN APPROACH

- 21.2.3 MARKET SIZE CALCULATION FOR BASE YEAR

- 21.3 MARKET FORECAST APPROACH

- 21.3.1 SUPPLY SIDE

- 21.3.2 DEMAND SIDE

- 21.4 DATA TRIANGULATION

- 21.5 RESEARCH ASSUMPTIONS

- 21.6 RESEARCH LIMITATIONS

- 21.7 RISK ASSESSMENT

22 APPENDIX

- 22.1 DISCUSSION GUIDE

- 22.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 22.3 CUSTOMIZATION OPTIONS

- 22.4 RELATED REPORTS

- 22.5 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS IN AUTOMATED GUIDED VEHICLE MARKET

- TABLE 2 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- TABLE 3 STRATEGIC FOCUS OF MAJOR COMPANIES IN AUTOMATED GUIDED VEHICLE MARKET

- TABLE 4 AUTOMATED GUIDED VEHICLE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 GDP GROWTH RATES (%), BY KEY COUNTRY, 2021-2030

- TABLE 6 ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 7 PRICING RANGE OF AUTOMATED GUIDED VEHICLES, BY KEY PLAYER, 2025

- TABLE 8 AVERAGE SELLING PRICE TREND OF AUTOMATED GUIDED VEHICLES, BY TYPE, 2021-2025 (USD)

- TABLE 9 AVERAGE SELLING PRICE TREND OF TOW VEHICLES, BY REGION, 2021-2025 (USD)

- TABLE 10 IMPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 AUTOMATED GUIDED VEHICLE MARKET: LIST OF KEY CONFERENCES AND EVENTS

- TABLE 13 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 14 TECHNOLOGY ROADMAP IN AUTOMATED GUIDED VEHICLE MARKET

- TABLE 15 AUTOMATED GUIDED VEHICLE MARKET: LIST OF KEY PATENTS, 2021-2024

- TABLE 16 TOP USE CASES AND MARKET POTENTIAL

- TABLE 17 BEST PRACTICES FOLLOWED BY COMPANIES IN AUTOMATED GUIDED VEHICLE MARKET

- TABLE 18 CASE STUDIES RELATED TO AI IMPLEMENTATION IN AUTOMATED GUIDED VEHICLES

- TABLE 19 INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 20 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 AUTOMATED GUIDED VEHICLE INDUSTRY STANDARDS

- TABLE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR INDUSTRIES (%)

- TABLE 26 KEY BUYING CRITERIA FOR MAJOR INDUSTRIES

- TABLE 27 UNMET NEEDS IN AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY

- TABLE 28 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 29 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 30 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (THOUSAND UNITS)

- TABLE 31 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (THOUSAND UNITS)

- TABLE 32 TOW VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 33 TOW VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 34 TOW VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 35 TOW VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 36 UNIT LOAD CARRIERS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 37 UNIT LOAD CARRIERS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 38 UNIT LOAD CARRIERS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 39 UNIT LOAD CARRIERS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 40 PALLET TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 41 PALLET TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 42 PALLET TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 43 PALLET TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 44 ASSEMBLY LINE VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 45 ASSEMBLY LINE VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 46 ASSEMBLY LINE VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 47 ASSEMBLY LINE VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 48 FORKLIFT TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 49 FORKLIFT TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 50 FORKLIFT TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 51 FORKLIFT TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 52 OTHER TYPES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 53 OTHER TYPES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 54 OTHER TYPES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 55 OTHER TYPES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 56 AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 57 AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 58 AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 59 AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 60 LASER GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 61 LASER GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 62 MAGNETIC GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 63 MAGNETIC GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 64 INDUCTIVE GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 65 INDUCTIVE GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 66 OPTICAL TAPE GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 67 OPTICAL TAPE GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 68 VISION GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 69 VISION GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 70 OTHER NAVIGATION TECHNOLOGIES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 71 OTHER NAVIGATION TECHNOLOGIES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 72 AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 73 AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 74 AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 75 AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 76 AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 77 AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 78 AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 79 AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 80 AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 81 AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 82 CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 83 CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 84 CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 85 CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 86 CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 87 CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 88 CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 89 CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 90 AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 91 AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 92 AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 93 AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 94 AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 95 AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 96 AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 97 AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 98 SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 99 SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 100 SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 101 SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 102 SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 103 SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 104 SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 105 SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 106 E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 107 E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 108 E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 109 E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 110 E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 111 E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 112 E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 113 E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 114 FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 115 FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 116 FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 117 FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 118 FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 119 FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 120 FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 121 FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 122 PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 123 PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 124 PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 125 PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 126 PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 127 PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 128 PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 129 PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 130 MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 131 MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 132 MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 133 MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 134 MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 135 MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 136 MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 137 MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 138 METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 139 METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 140 METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 141 METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 142 METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 143 METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 144 METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 145 METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 146 LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 147 LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 148 LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 149 LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 150 LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 151 LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 152 LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 153 LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 154 PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 155 PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 156 PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 157 PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 158 PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 159 PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 160 PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 161 PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 162 OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 163 OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 164 OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 165 OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 166 OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021-2025 (USD MILLION)

- TABLE 167 OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 168 OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 169 OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 170 AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 171 AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 172 NORTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 173 NORTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 174 NORTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 175 NORTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 176 US: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 177 US: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 178 CANADA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 179 CANADA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 180 MEXICO: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 181 MEXICO: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 182 EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 183 EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 184 EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 185 EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 186 GERMANY: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 187 GERMANY: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 188 UK: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 189 UK: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 190 FRANCE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 191 FRANCE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 192 ITALY: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 193 ITALY: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 194 SPAIN: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 195 SPAIN: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 196 NETHERLANDS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 197 NETHERLANDS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 198 REST OF EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 199 REST OF EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 200 ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 201 ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 202 ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 203 ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 204 CHINA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 205 CHINA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 206 JAPAN: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 207 JAPAN: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 208 AUSTRALIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 209 AUSTRALIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 210 SOUTH KOREA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 211 SOUTH KOREA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 212 INDIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 213 INDIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 214 MALAYSIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 215 MALAYSIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 216 INDONESIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 217 INDONESIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 218 SINGAPORE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 219 SINGAPORE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 220 THAILAND: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 221 THAILAND: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 222 REST OF ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 223 REST OF ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 224 ROW: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 225 ROW: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 226 ROW: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 227 ROW: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 228 MIDDLE EAST: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 229 MIDDLE EAST: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 230 MIDDLE EAST: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 231 MIDDLE EAST: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 232 GCC: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 233 GCC: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 234 SOUTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 235 SOUTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 236 AFRICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 237 AFRICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 238 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN AUTOMATED GUIDED VEHICLE MARKET, 2021-2025

- TABLE 239 AUTOMATED GUIDED VEHICLE MARKET: DEGREE OF COMPETITION

- TABLE 240 AUTOMATED GUIDED VEHICLE MARKET: REGION FOOTPRINT

- TABLE 241 AUTOMATED GUIDED VEHICLE MARKET: NAVIGATION TECHNOLOGY FOOTPRINT

- TABLE 242 AUTOMATED GUIDED VEHICLE MARKET: TYPE FOOTPRINT

- TABLE 243 AUTOMATED GUIDED VEHICLE MARKET: INDUSTRY FOOTPRINT

- TABLE 244 AUTOMATED GUIDED VEHICLE MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 245 AUTOMATED GUIDED VEHICLE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 246 AUTOMATED GUIDED VEHICLE MARKET: PRODUCT LAUNCHES, MARCH 2021 AND NOVEMBER 2025

- TABLE 247 AUTOMATED GUIDED VEHICLE MARKET: DEALS, MARCH 2021 AND NOVEMBER 2025

- TABLE 248 AUTOMATED GUIDED VEHICLE MARKET: EXPANSIONS, MARCH 2021 AND NOVEMBER 2025

- TABLE 249 AUTOMATED GUIDED VEHICLE MARKET: OTHER DEVELOPMENTS, MARCH 2021 AND NOVEMBER 2025

- TABLE 250 DAIFUKU CO., LTD.: COMPANY OVERVIEW

- TABLE 251 DAIFUKU CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 DAIFUKU CO., LTD.: DEALS

- TABLE 253 DAIFUKU CO., LTD.: EXPANSIONS

- TABLE 254 JBT: COMPANY OVERVIEW

- TABLE 255 JBT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 JBT: PRODUCT LAUNCHES

- TABLE 257 KION GROUP AG: BUSINESS OVERVIEW

- TABLE 258 KION GROUP AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 KION GROUP AG: PRODUCT LAUNCHES

- TABLE 260 KION GROUP AG: EXPANSIONS

- TABLE 261 TOYOTA INDUSTRIES CORPORATION: COMPANY OVERVIEW

- TABLE 262 TOYOTA INDUSTRIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 TOYOTA INDUSTRIES CORPORATION: PRODUCT LAUNCHES

- TABLE 264 TOYOTA INDUSTRIES CORPORATION: DEALS

- TABLE 265 KUKA SE & CO. KGAA: COMPANY OVERVIEW

- TABLE 266 KUKA SE & CO. KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 KUKA SE & CO. KGAA: PRODUCT LAUNCHES

- TABLE 268 KUKA SE & CO. KGAA: DEALS

- TABLE 269 SCOTT: COMPANY OVERVIEW

- TABLE 270 SCOTT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 SCOTT: PRODUCT LAUNCHES

- TABLE 272 SSI SCHAEFER: COMPANY OVERVIEW

- TABLE 273 SSI SCHAEFER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 SSI SCHAEFER: DEALS

- TABLE 275 SSI SCHAEFER: OTHER DEVELOPMENTS

- TABLE 276 HYSTER-YALE, INC.: COMPANY OVERVIEW

- TABLE 277 HYSTER-YALE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 HYSTER-YALE, INC.: DEVELOPMENTS

- TABLE 279 JUNGHEINRICH AG: COMPANY OVERVIEW

- TABLE 280 JUNGHEINRICH AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 JUNGHEINRICH AG: PRODUCT LAUNCHES

- TABLE 282 JUNGHEINRICH AG: DEALS

- TABLE 283 JUNGHEINRICH AG: EXPANSIONS

- TABLE 284 MEIDENSHA CORPORATION: COMPANY OVERVIEW

- TABLE 285 MEIDENSHA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 286 MEIDENSHA CORPORATION: PRODUCT LAUNCHES

- TABLE 287 MITSUBISHI LOGISNEXT CO., LTD.: COMPANY OVERVIEW

- TABLE 288 MITSUBISHI LOGISNEXT CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 MITSUBISHI LOGISNEXT CO., LTD.: DEALS

- TABLE 290 OCEANEERING INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 291 OCEANEERING INTERNATIONAL, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 OCEANEERING INTERNATIONAL, INC.: EXPANSIONS

- TABLE 293 OCEANEERING INTERNATIONAL, INC.: OTHER DEVELOPMENTS

- TABLE 294 NEURA MOBILE ROBOTS GMBH: COMPANY OVERVIEW

- TABLE 295 AMERICA IN MOTION, INC.: COMPANY OVERVIEW

- TABLE 296 ASSECO CEIT, A.S.: COMPANY OVERVIEW

- TABLE 297 SUZHOU CASUN INTELLIGENT ROBOT CO., LTD.: COMPANY OVERVIEW

- TABLE 298 JIANGXI DANBAHE ROBOT CO., LTD.: COMPANY OVERVIEW

- TABLE 299 E80 GROUP S.P.A.: COMPANY OVERVIEW

- TABLE 300 GLOBAL AGV: COMPANY OVERVIEW

- TABLE 301 GRENZEBACH GROUP: COMPANY OVERVIEW

- TABLE 302 IDC CORPORATION: COMPANY OVERVIEW

- TABLE 303 NANCHANG INDUSTRIAL CONTROL ROBOT CO., LTD.: COMPANY OVERVIEW

- TABLE 304 SAFELOG GMBH: COMPANY OVERVIEW

- TABLE 305 SIMPLEX ROBOTICS PVT. LTD.: COMPANY OVERVIEW

- TABLE 306 SYSTEM LOGISTICS S.P.A.: COMPANY OVERVIEW

- TABLE 307 BALYO: COMPANY OVERVIEW

- TABLE 308 LIST OF KEY SECONDARY SOURCES

- TABLE 309 PRIMARY INTERVIEW PARTICIPANTS

- TABLE 310 KEY DATA FROM PRIMARY SOURCES

- TABLE 311 AUTOMATED GUIDED VEHICLE MARKET: RISK ASSESSMENT

List of Figures

- FIGURE 1 AUTOMATED GUIDED VEHICLE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DURATION COVERED

- FIGURE 3 MARKET SCENARIO

- FIGURE 4 GLOBAL AUTOMATED GUIDED VEHICLE MARKET, 2021-2032

- FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN AUTOMATED GUIDED VEHICLE MARKET, 2021-2025

- FIGURE 6 DISRUPTIONS INFLUENCING GROWTH OF AUTOMATED GUIDED VEHICLE MARKET

- FIGURE 7 HIGH-GROWTH SEGMENTS IN AUTOMATED GUIDED VEHICLE MARKET, 2026-2032

- FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN AUTOMATED GUIDED VEHICLE MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD

- FIGURE 9 RISING DEMAND FOR AUTOMATION SOLUTIONS IN VARIOUS INDUSTRIES TO DRIVE MARKET

- FIGURE 10 TOW VEHICLES TO CAPTURE MAJORITY OF MARKET SHARE IN 2032

- FIGURE 11 LASER GUIDANCE TECHNOLOGY TO ACCOUNT FOR PROMINENT MARKET SHARE IN 2032

- FIGURE 12 AUTOMOTIVE INDUSTRY TO HOLD LEADING MARKET SHARE IN 2032

- FIGURE 13 MEDIUM-DUTY AGVS TO LEAD MARKET IN 2032

- FIGURE 14 E-COMMERCE & RETAIL INDUSTRY AND US TO HOLD LARGEST MARKET SHARE IN 2032

- FIGURE 15 CHINA TO BE FASTEST-GROWING MARKET FOR AUTOMATED GUIDED VEHICLES DURING FORECAST PERIOD

- FIGURE 16 AUTOMATED GUIDED VEHICLE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 IMPACT ANALYSIS OF DRIVERS

- FIGURE 18 IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 19 IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 20 IMPACT ANALYSIS OF CHALLENGES

- FIGURE 21 AUTOMATED GUIDED VEHICLE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 AUTOMATED GUIDED VEHICLE VALUE CHAIN ANALYSIS

- FIGURE 23 AUTOMATED GUIDED VEHICLE ECOSYSTEM

- FIGURE 24 AVERAGE SELLING PRICE TREND OF AUTOMATED GUIDED VEHICLES, BY TYPE, 2021-2025

- FIGURE 25 AVERAGE SELLING PRICE TREND OF TOW VEHICLES, BY REGION, 2021-2025

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 27 IMPORT SCENARIO FOR HS CODE 842710-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 28 EXPORT SCENARIO FOR HS CODE 842710-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 AUTOMATED GUIDED VEHICLE MARKET: PATENT ANALYSIS, 2015-2024

- FIGURE 31 DECISION-MAKING FACTORS CONSIDERED WHILE BUYING AUTOMATED GUIDED VEHICLES

- FIGURE 32 INFLUENCE OF STAKEHOLDERS FROM MAJOR INDUSTRIES ON BUYING PROCESS

- FIGURE 33 KEY BUYING CRITERIA FOR MAJOR INDUSTRIES

- FIGURE 34 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 35 EMERGING TECHNOLOGIES USED IN AUTOMATED GUIDED VEHICLES

- FIGURE 36 TYPES OF BATTERIES USED IN AUTOMATED GUIDED VEHICLES

- FIGURE 37 AUTOMATED GUIDED VEHICLE COMPONENTS AND SERVICES

- FIGURE 38 KEY APPLICATIONS OF AUTOMATED GUIDED VEHICLES

- FIGURE 39 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE

- FIGURE 40 TOW VEHICLES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2032

- FIGURE 41 AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY

- FIGURE 42 MEDIUM-DUTY AGVS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2032

- FIGURE 43 AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY

- FIGURE 44 LASER GUIDANCE NAVIGATION TECHNOLOGY TO CAPTURE LARGEST MARKET SHARE IN 2032

- FIGURE 45 AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY

- FIGURE 46 AUTOMOTIVE INDUSTRY TO HOLD LARGEST MARKET SHARE IN 2032

- FIGURE 47 AUTOMATED GUIDED VEHICLE MARKET, BY REGION

- FIGURE 48 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL AUTOMATED GUIDED VEHICLE MARKET FROM 2026 TO 2032

- FIGURE 49 ASIA PACIFIC TO HOLD LARGEST SHARE OF AUTOMATED GUIDED VEHICLE MARKET IN 2026

- FIGURE 50 NORTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET SNAPSHOT

- FIGURE 51 EUROPE: AUTOMATED GUIDED VEHICLE MARKET SNAPSHOT

- FIGURE 52 ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET SNAPSHOT

- FIGURE 53 ROW: AUTOMATED GUIDED VEHICLE MARKET SNAPSHOT

- FIGURE 54 REVENUE ANALYSIS OF KEY PLAYERS IN AUTOMATED GUIDED VEHICLE MARKET, 2020-2024

- FIGURE 55 AUTOMATED GUIDED VEHICLE MARKET SHARE ANALYSIS, 2025

- FIGURE 56 COMPANY VALUATION, 2025

- FIGURE 57 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 58 BRAND/PRODUCT COMPARISON

- FIGURE 59 AUTOMATED GUIDED VEHICLE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2025

- FIGURE 60 COMPANY FOOTPRINT

- FIGURE 61 AUTOMATED GUIDED VEHICLE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2025

- FIGURE 62 DAIFUKU CO., LTD.: COMPANY SNAPSHOT

- FIGURE 63 JBT: COMPANY SNAPSHOT

- FIGURE 64 KION GROUP AG: COMPANY SNAPSHOT

- FIGURE 65 TOYOTA INDUSTRIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 KUKA SE & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 67 SCOTT: COMPANY SNAPSHOT

- FIGURE 68 HYSTER-YALE, INC.: COMPANY SNAPSHOT

- FIGURE 69 JUNGHEINRICH AG: COMPANY SNAPSHOT

- FIGURE 70 MEIDENSHA CORPORATION: COMPANY SNAPSHOT

- FIGURE 71 MITSUBISHI LOGISNEXT CO., LTD.: COMPANY SNAPSHOT

- FIGURE 72 OCEANEERING INTERNATIONAL, INC.: COMPANY SNAPSHOT

- FIGURE 73 AUTOMATED GUIDED VEHICLE MARKET: RESEARCH DESIGN

- FIGURE 74 AUTOMATED GUIDED VEHICLE MARKET: RESEARCH APPROACH

- FIGURE 75 KEY DATA FROM SECONDARY SOURCES

- FIGURE 76 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 77 BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 78 AUTOMATED GUIDED VEHICLE MARKET: BOTTOM-UP APPROACH

- FIGURE 79 AUTOMATED GUIDED VEHICLE MARKET: TOP-DOWN APPROACH

- FIGURE 80 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 81 AUTOMATED GUIDED VEHICLE MARKET: DATA TRIANGULATION

- FIGURE 82 ASSUMPTIONS FOR RESEARCH STUDY