PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1858524

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1858524

Forklift Market by Propulsion (Electric, ICE, Fuel Cell), Tonnage Capacity, End-Use Industry, by Class (1, 2, 31, 32, 4/5), Operation, Application, Battery Type (Li-ion, Lead Acid), Lifting Capacity, Tire, Product Type, Region - Global Forecast to 2032

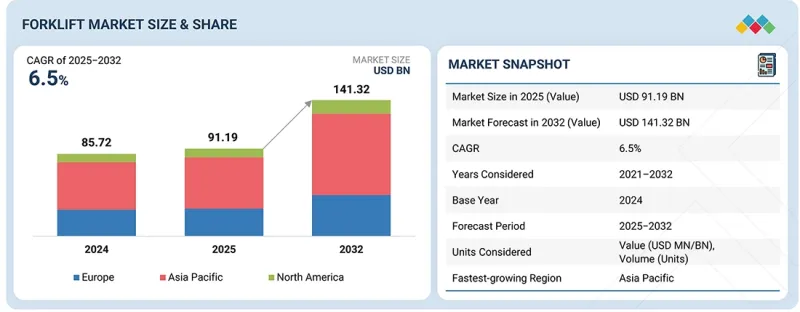

The forklift market is projected to grow from USD 91.19 billion in 2025 to USD 141.32 billion in 2032, at a CAGR of 6.5%. Forklifts are one of the most common intralogistics systems and are seen as efficient in handling materials for various applications. The compact size, heavy-weight carrying capacity, and versatility make forklifts the preferred choice in material handling operations. The Asia Pacific market is expected to grow and dominate the global forklift market over the forecast period. Major OEMs such as Toyota Industries Corporation, Kion Group, and Jungheinrich AG are driving a shift towards innovative electric and autonomous models that enhance productivity and efficiency.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2025 |

| Forecast Period | 2025-2032 |

| Units Considered | Value, and Volume (Units) |

| Segments | by Propulsion, Tonnage Capacity, End-Use Industry, by Class, Operation, Application, Battery Type, Lifting Capacity, Tire, Product Type, Region |

| Regions covered | Asia Pacific, North America, Europe, Rest of the world |

In addition, the emergence of artificial intelligence with real-time location monitoring and automated material handling capabilities in forklifts has revolutionized warehouse automation at the highest level, thereby encouraging global warehousing industry giants to increase the deployment of autonomous forklifts for optimized operations. Institutional entities like the U.S. National Institute for Occupational Safety and Health (NIOSH) and the Occupational Safety and Health Administration (OSHA) emphasize these advancements in the autonomous forklift market, noting that sensor-equipped forklifts can reduce workplace incidents by promoting safer navigation and load management.

"Electric forklifts are projected to remain dominant in the global market during the forecast period."

Electric forklifts represent the largest share of the global market. Classified as Class 1, Class 2, Class 3, and Class 2, these forklifts are electrically powered and account for over 70% of the market as of 2024. The demand for electric forklifts is on the rise due to the need to comply with strict emissions standards for industrial vehicles worldwide. Additionally, electric forklifts reduce ownership costs and offer a better return on investment (ROI) compared to internal combustion engine (ICE) forklifts.

The widespread adoption of lithium-ion batteries is another trend ensuring the dominance of electric forklifts. These lithium-ion batteries offer rapid charging, minimal maintenance, and a longer lifespan than traditional lead-acid types. For example, lithium iron phosphate (LFP) batteries are favored by most OEMs for their safety profile, long cycle life, and cost advantages, which make them attractive for multi-shift warehouse operations and cold storage environments. According to BloombergNEF, by December 2024, lithium-ion battery pack prices had fallen to a record low of USD 115 per kilowatt-hour, representing a 20% decline from 2023 and marking the largest annual drop since 2017. Thus, with advancements in battery technologies coupled with emerging stringent emission norms and demand for low-cost and efficient warehouse management, the demand for electric forklifts is expected to increase in the coming years.

"Forklift demand in the E-commerce industry is expected to grow at the fastest CAGR during the review period."

Forklifts are highly useful in the e-commerce industry as they enable faster and more efficient handling of goods, directly supporting the sector's growth. With consumer buying shifting from physical shops to digital platforms, forklifts help manage large volumes of goods in warehouses and distribution centers. They play a key role in meeting same-day or quick delivery demands by speeding up loading, unloading, and inventory movement. E-commerce players increasingly rely on advanced electric and autonomous forklifts, which integrate with innovative warehousing technologies to improve operational efficiency. Their usefulness is evident globally, though more pronounced in North America and Europe, where forklifts help e-commerce companies meet faster delivery commitments, often tied to premium services.

"Europe is estimated to be the second-largest forklift market during the forecast period."

By 2032, Europe is projected to be the second-biggest consumer market for forklifts worldwide. This can be attributed to stringent workplace safety guidelines, high labor costs, high real estate prices, which limit warehouse space, and the stringent European emission norms. Most of the forklift market in Europe falls in three countries, namely Germany, France, and the UK, which are experiencing high growth rates in e-commerce, retail, and manufacturing sectors.

In Europe, forklifts below 5 tons command the most significant and fastest-growing market share, reflecting the region's strong emphasis on space-efficient, high-throughput indoor material handling. By class, Class 3 (electric pedestrian trucks) and Class 2 (electric narrow aisle trucks) lead the market, driven by high demand in warehousing, retail, and automation-focused sectors across Germany, France, and the UK. The fastest-growing segment, however, is Class 1 (electric motor rider trucks), underpinned by rising e-commerce activity, accelerating automation investments, and stringent emission and safety standards that favor electric, ergonomic, and flexible forklift solutions for Europe's modern logistics environments. To conclude, Europe is leading the warehouse automation and material handling market due to high labor costs, limited space, and strict safety standards. Further, the surging pharma and chemicals industries are likely to continue boosting the forklift market in the European region.

The break-up of the profile of primary participants in the forklift market:

- By Company Type: Forklift OEMs - 80%, Others - 20%

- By Designation: C Level - 60%, Director-level - 30%, Others - 10%

- By Region: North America- 25%, Europe - 30%, Asia Pacific - 40%, Rest of the World-5%

Mitsubishi Logisnext Co., Ltd. (Japan) is the leading manufacturer of forklifts in the global market. The other key companies include Toyota Industries Corporation (Japan), KION Group AG (Germany), Jungheinrich AG (Germany), and Crown Equipment Corporation (US).

Research Coverage:

The study segments the forklift market and forecasts the market size based on Tonnage Capacity (below 5 tons, 5-10 tons, 11-36 tons, and above 36 tons), Application (indoor, outdoor, and indoor and outdoor), Class (Class 1, Class 2, Class 3 (Class 31, Class 32), and Class 4/5), Industry (3PL, food & beverage, automotive, pulp & paper, metals & heavy machinery, e-commerce, aviation, semiconductors & electronics, chemical, healthcare, and others), Propulsion (electric and ICE), Operation (manual and autonomous), Product Type (warehouse and counterbalance), by Battery Type (lithium-ion and lead-acid), Tire Type (cushion and pneumatic) and Region (Asia Pacific, Europe, North America, and Rest of the World).

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall forklift market and the subsegments. The report includes a comprehensive market share analysis, supply chain analysis, extensive lists and insights into component manufacturers, chapter segmentation based on materials, a thorough supply chain analysis, and a competitive landscape. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Rising GHG emissions, government incentives and policies, overall targets to reduce fleet-level emissions and increasing demand for emission-free vehicles), restraints (safety concerns in EV batteries and high development cost), opportunities (transition towards hydrogen fuel cell electric mobility), and challenges (high cost of developing charging infrastructure) that are influencing the growth of the forklift market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the forklift market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the forklift market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the forklift market

- Deep dive segments on the electric forklift market and their trends

- OEM analysis for electric forklifts

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the forklift market, such as Toyota Industries Corporation (Japan), KION Group AG (Germany), Jungheinrich AG (Germany), Crown Equipment Corporation (US), and Mitsubishi Logisnext Co. Ltd. (Japan)

The report also helps stakeholders understand the pulse of the forklift market by providing them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interview participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 UNMET NEEDS AND WHITE SPACES

- 4.1.1 UNMET NEEDS

- 4.1.2 WHITE SPACES

- 4.2 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.2.1 INTERCONNECTED MARKETS

- 4.2.2 CROSS-SECTOR OPPORTUNITIES

- 4.3 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.3.1 EMERGING BUSINESS MODELS

- 4.3.2 ECOSYSTEM SHIFTS

- 4.4 STRATEGIC MOVES BY OEMS AND TIER-1 SUPPLIERS

- 4.5 VC/PRIVATE EQUITY INVESTMENT TRENDS AND START-UP LANDSCAPE

- 4.5.1 INVESTMENT TRENDS

- 4.5.2 START-UP LANDSCAPE

- 4.6 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid growth in e-commerce and warehousing industries

- 5.2.1.2 Government incentives and regulations promoting growth of electric forklifts

- 5.2.1.3 Automation and fleet integration

- 5.2.2 RESTRAINTS

- 5.2.2.1 Expansion of third-party logistics services

- 5.2.2.2 Elevated demand for stacker cranes

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Evolution of refurbished and rental forklifts

- 5.2.3.2 Modular solutions to optimize customer productivity

- 5.2.3.3 Integration of AI, IoT, and predictive analytics for fleet optimization

- 5.2.4 CHALLENGES

- 5.2.4.1 High initial cost of electric forklifts

- 5.2.4.2 Substantial integration and technology cost of autonomous forklifts

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.4.2 AVERAGE SELLING PRICE OF FORKLIFTS OFFERED BY KEY PLAYERS

- 5.4.2.1 Linde

- 5.4.2.2 Hangcha

- 5.4.2.3 Manitou

- 5.4.2.4 Komatsu

- 5.4.2.5 CLARK

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 MITSUBISHI FORKLIFTS SUPPLIED ELECTRIC COUNTERBALANCE TRUCKS TO KELLOGG'S MANCHESTER SITE

- 5.5.2 TOYOTA DELIVERED SUSTAINABLE AGV SOLUTIONS FOR PANASONIC ENERGY

- 5.5.3 L'OREAL INSTALLED DEMATIC'S AUTONOMOUS FORKLIFTS TO REDUCE DELIVERY TIME

- 5.5.4 AER MANUFACTURING REPLACED AGING AUTONOMOUS FLOOR-TO-FLOOR MATERIAL HANDLING SYSTEMS WITH DEMATIC'S COMPACT AUTONOMOUS TUGGERS

- 5.5.5 MITSUBISHI FORKLIFTS SUPPLIED ELECTRIC FORKLIFTS TO CWT COMMODITIES

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 8427)

- 5.8.2 EXPORT SCENARIO (HS CODE 8427)

- 5.9 KEY CONFERENCES AND EVENTS

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 OEM ANALYSIS

- 5.11.1 BATTERY CAPACITY VS. LIFTING CAPACITY

- 5.11.2 LIFTING CAPACITY VS. LIFTING VOLTAGE

- 5.11.3 BATTERY VOLTAGE VS. MARKET SIZE OF FORKLIFTS

- 5.12 ROI OF CONVENTIONAL VS. ELECTRIC FORKLIFTS

- 5.13 BILL OF MATERIALS

- 5.14 TOTAL COST OF OWNERSHIP

- 5.15 TECHNOLOGY ANALYSIS

- 5.15.1 KEY TECHNOLOGIES

- 5.15.1.1 Autonomous forklifts

- 5.15.1.2 Electric powertrains

- 5.15.1.3 Internet of Things

- 5.15.2 COMPLEMENTARY TECHNOLOGIES

- 5.15.2.1 Industry 4.0

- 5.15.2.2 Hydrogen fuel cells

- 5.15.3 ADJACENT TECHNOLOGIES

- 5.15.3.1 5G connectivity

- 5.15.3.2 Solid-state batteries

- 5.15.1 KEY TECHNOLOGIES

- 5.16 PATENT ANALYSIS

- 5.17 IMPACT OF AI/GEN AI

- 5.18 REGULATORY LANDSCAPE

- 5.18.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.18.2 INTERNATIONAL STANDARDS

- 5.18.3 ENVIRONMENTAL AND EMISSION REGULATIONS

- 5.18.4 US

- 5.18.5 EUROPEAN UNION

- 5.18.6 CHINA

- 5.18.7 INDIA

- 5.18.8 INCENTIVES AND GREENFUNDING PROGRAMS

- 5.19 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.19.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.19.2 BUYING CRITERIA

6 FORKLIFT MARKET, BY PROPULSION

- 6.1 INTRODUCTION

- 6.2 ELECTRIC

- 6.2.1 EMPHASIS ON ENVIRONMENTAL SUSTAINABILITY TO DRIVE MARKET

- 6.3 ICE

- 6.3.1 ABILITY TO WITHSTAND HARSH WEATHER CONDITIONS TO DRIVE MARKET

- 6.3.2 GASOLINE

- 6.3.3 DIESEL

- 6.3.4 ALTERNATE FUEL

- 6.4 FUEL CELL

- 6.5 PRIMARY INSIGHTS

7 FORKLIFT MARKET, BY TONNAGE CAPACITY

- 7.1 INTRODUCTION

- 7.2 <5 TONS

- 7.2.1 NEED FOR OPERATIONAL FLEXIBILITY IN COMPACT WAREHOUSES TO DRIVE MARKET

- 7.3 5-10 TONS

- 7.3.1 RISE OF ELECTRIC INFRASTRUCTURE TO DRIVE MARKET

- 7.4 11-36 TONS

- 7.4.1 LARGE-SCALE ADOPTION IN LOGISTICS AND FREIGHT INDUSTRIES TO DRIVE MARKET

- 7.5 >36 TONS

- 7.5.1 EXTENSIVE USE IN HANDLING EXTREMELY HEAVY MATERIALS TO DRIVE MARKET

- 7.6 PRIMARY INSIGHTS

8 FORKLIFT MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 THIRD-PARTY LOGISTICS

- 8.2.1 INCREASED ADOPTION OF FORKLIFTS DUE TO FAST LOADING, TRANSPORTATION, AND UNLOADING OPERATIONS TO DRIVE MARKET

- 8.3 FOOD & BEVERAGES

- 8.3.1 PRESSURE ON MANUFACTURERS TO REDUCE OPERATIONAL COSTS TO DRIVE MARKET

- 8.4 AUTOMOTIVE

- 8.4.1 NEED FOR EFFICIENT INVENTORY MANAGEMENT TO DRIVE MARKET

- 8.5 E-COMMERCE

- 8.5.1 RISING DEMAND FOR SHORTER DELIVERY TIMES TO DRIVE MARKET

- 8.6 AVIATION

- 8.6.1 INCORPORATION OF FORKLIFTS IN MANUFACTURING AND ASSEMBLY OPERATIONS TO DRIVE MARKET

- 8.7 PULP & PAPER

- 8.7.1 SUBSTANTIAL INVESTMENTS IN AUTONOMOUS FORKLIFT SOLUTIONS TO DRIVE MARKET

- 8.8 CHEMICALS

- 8.8.1 FOCUS ON ENSURING WORKPLACE SAFETY AND MANAGING WORKFLOW EFFECTIVELY TO DRIVE MARKET

- 8.9 HEALTHCARE

- 8.9.1 STRICT REGULATORY REQUIREMENTS FOR PRODUCTION, STORAGE, AND DISTRIBUTION OF DRUGS TO DRIVE MARKET

- 8.10 SEMICONDUCTORS & ELECTRONICS

- 8.10.1 MANUFACTURERS' EMPHASIS ON ENHANCING INTRALOGISTICS OPERATIONS TO DRIVE MARKET

- 8.11 METALS & HEAVY MACHINERY

- 8.11.1 RISE IN INFRASTRUCTURAL DEVELOPMENT TO DRIVE MARKET

- 8.12 OTHERS

- 8.13 PRIMARY INSIGHTS

9 FORKLIFT MARKET, BY CLASS

- 9.1 INTRODUCTION

- 9.2 CLASS 1

- 9.2.1 PREDOMINANCE IN ASIA PACIFIC REGION TO DRIVE MARKET

- 9.3 CLASS 2

- 9.3.1 LIMITED MARKET DUE TO AVAILABILITY OF MORE VERSATILE OPTIONS

- 9.4 CLASS 3

- 9.4.1 SUSTAINABILITY TARGETS FOR ZERO-EMISSION EQUIPMENT TO DRIVE MARKET

- 9.4.2 CLASS 31

- 9.4.3 CLASS 32

- 9.4.4 CLASS 31 VS. CLASS 32 FORKLIFTS

- 9.5 CLASS 4/5

- 9.5.1 RELIABILITY OF INTERNAL COMBUSTION ENGINES TO DRIVE MARKET

- 9.6 PRIMARY INSIGHTS

10 FORKLIFT MARKET, BY OPERATION

- 10.1 INTRODUCTION

- 10.2 MANUAL

- 10.2.1 LOW INITIAL COST AND EASE OF INTEGRATION TO DRIVE MARKET

- 10.3 AUTONOMOUS

- 10.3.1 RAPID FORKLIFT DEVELOPMENT TO INCREASE WORKPLACE PRODUCTIVITY TO DRIVE MARKET

- 10.4 PRIMARY INSIGHTS

11 FORKLIFT MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 INDOOR

- 11.2.1 RAPIDLY EXPANDING E-COMMERCE AND LOGISTICS INDUSTRIES TO DRIVE MARKET

- 11.3 OUTDOOR

- 11.3.1 SIGNIFICANT PRESENCE OF CONSTRUCTION, MINING, AND MARINE FREIGHT INDUSTRIES IN NORTH AMERICA TO DRIVE MARKET

- 11.4 INDOOR & OUTDOOR

- 11.4.1 RISING NEED FOR DUAL-USE FORKLIFTS TO DRIVE MARKET

- 11.5 PRIMARY INSIGHTS

12 ELECTRIC FORKLIFT MARKET, BY BATTERY TYPE

- 12.1 INTRODUCTION

- 12.2 LITHIUM-ION

- 12.2.1 HIGH ENERGY DENSITY AND LONGER BATTERY LIFE THAN OTHER BATTERIES TO DRIVE MARKET

- 12.2.2 LITHIUM IRON PHOSPHATE

- 12.2.3 NICKEL MANGANESE COBALT

- 12.2.4 OTHERS

- 12.3 LEAD ACID

- 12.3.1 LARGE CURRENT CAPABILITY AND LOW MANUFACTURING COST TO DRIVE MARKET

- 12.4 PRIMARY INSIGHTS

13 ELECTRIC FORKLIFT MARKET, BY LIFTING CAPACITY

- 13.1 INTRODUCTION

- 13.2 <2 TONS

- 13.2.1 WIDE RANGE OF APPLICATIONS IN VARIOUS INDUSTRIES TO DRIVE MARKET

- 13.3 2-5 TONS

- 13.3.1 ADVANCEMENTS IN BATTERY TECHNOLOGY TO DRIVE MARKET

- 13.4 >5 TONS

- 13.4.1 INCREASED PREFERENCE FOR SUSTAINABLE FORKLIFTS WITH MORE LIFTING CAPACITY TO DRIVE MARKET

- 13.5 PRIMARY INSIGHTS

14 FORKLIFT MARKET, BY PRODUCT TYPE

- 14.1 INTRODUCTION

- 14.2 WAREHOUSE

- 14.2.1 ABILITY TO MANEUVER IN NARROW SPACES TO DRIVE MARKET

- 14.3 COUNTERBALANCE

- 14.3.1 NEED FOR STABLE HEAVY MATERIAL HANDLING OPERATIONS TO DRIVE MARKET

- 14.4 PRIMARY INSIGHTS

15 FORKLIFT MARKET, BY TIRE TYPE

- 15.1 INTRODUCTION

- 15.2 CUSHION

- 15.2.1 RISING DEMAND FOR LIFTING PACKETS IN WAREHOUSING AND MANUFACTURING INDUSTRIES TO DRIVE MARKET

- 15.3 PNEUMATIC

- 15.3.1 EXTENSIVE USE IN LIFTING HEAVY GOODS AND CARRIAGES TO DRIVE MARKET

- 15.4 PRIMARY INSIGHTS

16 FORKLIFT MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 ASIA PACIFIC

- 16.2.1 MACROECONOMIC OUTLOOK

- 16.2.2 CHINA

- 16.2.2.1 Growing demand for automation across industries to drive market

- 16.2.3 INDIA

- 16.2.3.1 Booming automobile and e-commerce industries to drive market

- 16.2.4 JAPAN

- 16.2.4.1 Lack of proper warehousing facilities to drive market

- 16.2.5 SOUTH KOREA

- 16.2.5.1 Demand for increased efficiency to drive market

- 16.3 EUROPE

- 16.3.1 MACROECONOMIC OUTLOOK

- 16.3.2 GERMANY

- 16.3.2.1 Robust logistics industry to drive market

- 16.3.3 UK

- 16.3.3.1 Need for efficient material handling solutions in automotive industry to drive market

- 16.3.4 FRANCE

- 16.3.4.1 Rapid expansion of online retail to drive market

- 16.3.5 ITALY

- 16.3.5.1 Advancements in domestic e-commerce industry to drive market

- 16.3.6 SPAIN

- 16.3.6.1 Strategic location for logistics and warehousing to drive market

- 16.3.7 RUSSIA

- 16.3.7.1 Steady growth in diverse industries to drive market

- 16.3.8 TURKEY

- 16.3.8.1 Rising internet penetration and expanding mobile commerce to drive market

- 16.3.9 EASTERN EUROPE

- 16.3.10 REST OF EUROPE

- 16.4 NORTH AMERICA

- 16.4.1 MACROECONOMIC OUTLOOK

- 16.4.2 US

- 16.4.2.1 Inclination toward automation to drive market

- 16.4.3 MEXICO

- 16.4.3.1 Growth of foreign manufacturing units to drive market

- 16.4.4 CANADA

- 16.4.4.1 Robust export infrastructure to drive market

- 16.5 REST OF THE WORLD

- 16.5.1 MACROECONOMIC OUTLOOK

- 16.5.2 AFRICA

- 16.5.2.1 Expansion of warehouses due to growing export activities to drive market

- 16.5.3 AUSTRALIA & OCEANIA

- 16.5.3.1 Growing industrial activities to drive market

- 16.6 PRIMARY INSIGHTS

17 COMPETITIVE LANDSCAPE

- 17.1 INTRODUCTION

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 17.3 MARKET SHARE ANALYSIS, 2024

- 17.4 REVENUE ANALYSIS, 2021-2024

- 17.5 COMPANY VALUATION AND FINANCIAL METRICS

- 17.6 PRODUCT/BRAND COMPARISON

- 17.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.7.1 STARS

- 17.7.2 EMERGING LEADERS

- 17.7.3 PERVASIVE PLAYERS

- 17.7.4 PARTICIPANTS

- 17.7.5 COMPANY FOOTPRINT

- 17.7.5.1 Company footprint

- 17.7.5.2 Region footprint

- 17.7.5.3 Propulsion footprint

- 17.7.5.4 Operation footprint

- 17.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 17.8.1 PROGRESSIVE COMPANIES

- 17.8.2 RESPONSIVE COMPANIES

- 17.8.3 DYNAMIC COMPANIES

- 17.8.4 STARTING BLOCKS

- 17.8.5 COMPETITIVE BENCHMARKING

- 17.8.5.1 List of start-ups/SMEs

- 17.8.5.2 Competitive benchmarking of start-ups/SMEs

- 17.9 COMPETITIVE SCENARIO

- 17.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 17.9.2 DEALS

- 17.9.3 EXPANSIONS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 TOYOTA INDUSTRIES CORPORATION

- 18.1.1.1 Business overview

- 18.1.1.2 Products offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Product launches/developments

- 18.1.1.3.2 Deals

- 18.1.1.3.3 Expansions

- 18.1.1.3.4 Other developments

- 18.1.1.4 MnM view

- 18.1.1.4.1 Key strengths

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses and competitive threats

- 18.1.2 KION GROUP AG

- 18.1.2.1 Business overview

- 18.1.2.2 Products offered

- 18.1.2.3 Recent developments

- 18.1.2.3.1 Product launches/developments

- 18.1.2.3.2 Deals

- 18.1.2.3.3 Expansions

- 18.1.2.4 MnM view

- 18.1.2.4.1 Key strengths

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses and competitive threats

- 18.1.3 JUNGHEINRICH AG

- 18.1.3.1 Business overview

- 18.1.3.2 Products offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Product launches/developments

- 18.1.3.3.2 Deals

- 18.1.3.3.3 Expansions

- 18.1.3.3.4 Other developments

- 18.1.3.4 MnM view

- 18.1.3.4.1 Key strengths

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses and competitive threats

- 18.1.4 MITSUBISHI LOGISNEXT CO., LTD.

- 18.1.4.1 Business overview

- 18.1.4.2 Products offered

- 18.1.4.3 Recent developments

- 18.1.4.3.1 Product launches/developments

- 18.1.4.3.2 Expansions

- 18.1.4.3.3 Other developments

- 18.1.4.4 MnM view

- 18.1.4.4.1 Key strengths

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses and competitive threats

- 18.1.5 CROWN EQUIPMENT CORPORATION

- 18.1.5.1 Business overview

- 18.1.5.2 Products offered

- 18.1.5.3 Recent developments

- 18.1.5.3.1 Product launches/developments

- 18.1.5.3.2 Expansions

- 18.1.5.3.3 Other developments

- 18.1.5.4 MnM view

- 18.1.5.4.1 Key strengths

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses and competitive threats

- 18.1.6 HYSTER-YALE MATERIALS HANDLING

- 18.1.6.1 Business overview

- 18.1.6.2 Products offered

- 18.1.6.3 Recent developments

- 18.1.6.3.1 Product launches/developments

- 18.1.6.3.2 Deals

- 18.1.6.3.3 Other developments

- 18.1.7 CLARK MATERIAL HANDLING COMPANY

- 18.1.7.1 Business overview

- 18.1.7.2 Products offered

- 18.1.7.3 Recent developments

- 18.1.7.3.1 Product launches/developments

- 18.1.7.3.2 Deals

- 18.1.7.3.3 Other developments

- 18.1.8 HYUNDAI CONSTRUCTION EQUIPMENT

- 18.1.8.1 Business overview

- 18.1.8.2 Products offered

- 18.1.8.3 Recent developments

- 18.1.8.3.1 Product launches/developments

- 18.1.8.3.2 Deals

- 18.1.8.3.3 Other developments

- 18.1.9 KOMATSU LTD.

- 18.1.9.1 Business overview

- 18.1.9.2 Products offered

- 18.1.9.3 Recent developments

- 18.1.9.3.1 Product launches/developments

- 18.1.9.3.2 Deals

- 18.1.10 BOBCAT COMPANY

- 18.1.10.1 Business overview

- 18.1.10.2 Products offered

- 18.1.10.3 Recent developments

- 18.1.10.3.1 Product launches/developments

- 18.1.10.3.2 Other developments

- 18.1.1 TOYOTA INDUSTRIES CORPORATION

- 18.2 OTHER PLAYERS

- 18.2.1 KALMAR

- 18.2.2 ANHUI HELI CO., LTD.

- 18.2.3 BYD COMPANY LTD.

- 18.2.4 GODREJ MATERIAL HANDLING

- 18.2.5 EP EQUIPMENT

- 18.2.6 LONKING

- 18.2.7 HANGCHA FORKLIFT

- 18.2.8 KONECRANES

- 18.2.9 COMBILIFT

- 18.2.10 VALLEE

- 18.2.11 FLEXI NARROW AISLE

- 18.2.12 MANITOU

- 18.2.13 HOIST MATERIAL HANDLING

- 18.2.14 AGILOX SERVICES GMBH

- 18.2.15 E80 GROUP S.P.A.

- 18.2.16 SCOTT AUTOMATION

- 18.2.17 BASTIAN SOLUTIONS

- 18.2.18 SEEGRID CORPORATION

- 18.2.19 VECNA ROBOTICS

- 18.2.20 MURATA MACHINERY, LTD.

19 RECOMMENDATIONS

- 19.1 ASIA PACIFIC TO BE LEADING MARKET FOR FORKLIFTS DURING FORECAST PERIOD

- 19.2 E-COMMERCE TO BE KEY FOCUS FOR FORKLIFT MANUFACTURERS

- 19.3 CONCLUSION

20 APPENDIX

- 20.1 INSIGHTS FROM INDUSTRY EXPERTS

- 20.2 DISCUSSION GUIDE

- 20.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.4 CUSTOMIZATION OPTIONS

- 20.5 RELATED REPORTS

- 20.6 AUTHOR DETAILS

List of Tables

- TABLE 1 CURRENCY EXCHANGE RATE, 2021-2024

- TABLE 2 MARKET DYNAMICS

- TABLE 3 FORKLIFT EMISSION NORMS

- TABLE 4 ADOPTION OF AUTONOMOUS FORKLIFTS

- TABLE 5 US THIRD-PARTY LOGISTICS MARKET

- TABLE 6 ADVANTAGES OF STACKER CRANES OVER FORKLIFTS

- TABLE 7 PROCESS OF REFURBISHING FORKLIFTS

- TABLE 8 AVERAGE COST OF RENTAL FORKLIFTS IN US

- TABLE 9 PRICE COMPARISON BETWEEN FORKLIFT MODELS

- TABLE 10 AUTOMATIC VS. MANUAL FORKLIFT COST COMPARISON

- TABLE 11 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD)

- TABLE 12 AVERAGE SELLING PRICE OF FORKLIFTS OFFERED BY LINDE, 2024 (USD)

- TABLE 13 AVERAGE SELLING PRICE OF FORKLIFTS OFFERED BY HANGCHA, 2024 (USD)

- TABLE 14 AVERAGE SELLING PRICE OF FORKLIFTS OFFERED BY MANITOU, 2024 (USD)

- TABLE 15 AVERAGE SELLING PRICE OF FORKLIFTS OFFERED BY KOMATSU, 2024 (USD)

- TABLE 16 AVERAGE SELLING PRICE OF FORKLIFTS OFFERED BY CLARK, 2024 (USD)

- TABLE 17 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 18 US: IMPORT SCENARIO FOR HS CODE 8427-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- TABLE 19 CANADA: IMPORT SCENARIO FOR HS CODE 8427-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- TABLE 20 FRANCE: IMPORT SCENARIO FOR HS CODE 8427-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- TABLE 21 NETHERLANDS: IMPORT SCENARIO FOR HS CODE 8427-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- TABLE 22 UK: IMPORT SCENARIO FOR HS CODE 8427-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- TABLE 23 CHINA: EXPORT SCENARIO FOR HS CODE 8427-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- TABLE 24 GERMANY: EXPORT SCENARIO FOR HS CODE 8427-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD)

- TABLE 25 US: EXPORT SCENARIO FOR HS CODE 8427-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- TABLE 26 ITALY: EXPORT SCENARIO FOR HS CODE 8427-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- TABLE 27 UK: EXPORT SCENARIO FOR HS CODE 8427-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- TABLE 28 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 29 LIST OF FUNDING

- TABLE 30 ROI OF CONVENTIONAL VS. ELECTRIC FORKLIFTS

- TABLE 31 BILL OF MATERIALS FOR FORKLIFTS

- TABLE 32 TOTAL COST OF OWNERSHIP OF ICE VS. ELECTRIC FORKLIFTS IN US, 2024

- TABLE 33 PATENT ANALYSIS

- TABLE 34 IMPACT OF AI/GEN AI ON FORKLIFT MARKET

- TABLE 35 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 36 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 37 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 38 US: TIER 4 EMISSION STANDARDS

- TABLE 39 PROPOSED TIER 5 STANDARDS FOR OFF-ROAD ENGINES

- TABLE 40 EUROPEAN UNION: STAGE V EMISSION STANDARDS

- TABLE 41 CHINA: CHINA IV EMISSION STANDARDS

- TABLE 42 INDIA: BS V EMISSION STANDARDS

- TABLE 43 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY OPERATION (%)

- TABLE 44 KEY BUYING CRITERIA, BY PROPULSION

- TABLE 45 FORKLIFT MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 46 FORKLIFT MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 47 FORKLIFT MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 48 FORKLIFT MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 49 ELECTRIC FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 50 ELECTRIC FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 51 ELECTRIC FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 ELECTRIC FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 53 ICE FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 54 ICE FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 55 ICE FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 ICE FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 57 FORKLIFT MARKET, BY TONNAGE CAPACITY, 2021-2024 (UNITS)

- TABLE 58 FORKLIFT MARKET, BY TONNAGE CAPACITY, 2025-2032 (UNITS)

- TABLE 59 FORKLIFT MARKET, BY TONNAGE CAPACITY, 2021-2024 (USD MILLION)

- TABLE 60 FORKLIFT MARKET, BY TONNAGE CAPACITY, 2025-2032 (USD MILLION)

- TABLE 61 <5 TON FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 62 <5 TON FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 63 <5 TON FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 <5 TON FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 65 5-10 TON FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 66 5-10 TON FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 67 5-10 TON FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 5-10 TON FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 69 11-36 TON FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 70 11-36 TON FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 71 11-36 TON FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 11-36 TON FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 73 >36 TON FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 74 >36 TON FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 75 >36 TON FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 >36 TON FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 77 FORKLIFT MARKET, BY END-USE INDUSTRY, 2021-2024 (UNITS)

- TABLE 78 FORKLIFT MARKET, BY END-USE INDUSTRY, 2025-2032 (UNITS)

- TABLE 79 FORKLIFT MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 80 FORKLIFT MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 81 THIRD-PARTY LOGISTICS: FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 82 THIRD-PARTY LOGISTICS: FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 83 THIRD-PARTY LOGISTICS: FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 THIRD-PARTY LOGISTICS: FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 85 FOOD & BEVERAGES: FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 86 FOOD & BEVERAGES: FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 87 FOOD & BEVERAGES: FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 FOOD & BEVERAGES: FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 89 AUTOMOTIVE: FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 90 AUTOMOTIVE: FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 91 AUTOMOTIVE: FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 AUTOMOTIVE: FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 93 E-COMMERCE: FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 94 E-COMMERCE: FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 95 E-COMMERCE: FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 E-COMMERCE: FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 97 AVIATION: FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 98 AVIATION: FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 99 AVIATION: FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 AVIATION: FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 101 PULP & PAPER: FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 102 PULP & PAPER: FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 103 PULP & PAPER: FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 PULP & PAPER: FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 105 CHEMICALS: FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 106 CHEMICALS: FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 107 CHEMICALS: FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 CHEMICALS: FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 109 HEALTHCARE: FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 110 HEALTHCARE: FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 111 HEALTHCARE: FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 HEALTHCARE: FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 113 SEMICONDUCTORS & ELECTRONICS: FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 114 SEMICONDUCTORS & ELECTRONICS: FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 115 SEMICONDUCTORS & ELECTRONICS: FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 SEMICONDUCTORS & ELECTRONICS: FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 117 METALS & HEAVY MACHINERY: FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 118 METALS & HEAVY MACHINERY: FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 119 METALS & HEAVY MACHINERY: FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 120 METALS & HEAVY MACHINERY: FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 121 OTHERS: FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 122 OTHERS: FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 123 OTHERS: FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 124 OTHERS: FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 125 TYPES OF FORKLIFT, BY CLASS

- TABLE 126 FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 127 FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 128 CLASS 1 FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 129 CLASS 1 FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 130 CLASS 2 FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 131 CLASS 2 FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 132 CLASS 3 FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 133 CLASS 3 FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 134 CLASS 31 FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 135 CLASS 31 FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 136 CLASS 32 FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 137 CLASS 32 FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 138 CLASS 31 VS. CLASS 32 FORKLIFTS

- TABLE 139 CLASS 4/5 FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 140 CLASS 4/5 FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 141 FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 142 FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 143 FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 144 FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 145 MANUAL FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 146 MANUAL FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 147 MANUAL FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 148 MANUAL FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 149 AUTONOMOUS FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 150 AUTONOMOUS FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 151 AUTONOMOUS FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 152 AUTONOMOUS FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 153 FORKLIFT MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 154 FORKLIFT MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 155 FORKLIFT MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 156 FORKLIFT MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 157 INDOOR FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 158 INDOOR FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 159 INDOOR FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 160 INDOOR FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 161 OUTDOOR FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 162 OUTDOOR FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 163 OUTDOOR FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 164 OUTDOOR FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 165 INDOOR & OUTDOOR FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 166 INDOOR & OUTDOOR FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 167 INDOOR & OUTDOOR FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 168 INDOOR & OUTDOOR FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 169 ELECTRIC FORKLIFT MARKET, BY BATTERY TYPE, 2021-2024 (UNITS)

- TABLE 170 ELECTRIC FORKLIFT MARKET, BY BATTERY TYPE, 2025-2032 (UNITS)

- TABLE 171 ELECTRIC FORKLIFT MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 172 ELECTRIC FORKLIFT MARKET, BY BATTERY TYPE, 2025-2032 (USD MILLION)

- TABLE 173 LITHIUM-ION ELECTRIC FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 174 LITHIUM-ION ELECTRIC FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 175 LITHIUM-ION ELECTRIC FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 176 LITHIUM-ION ELECTRIC FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 177 LEAD ACID ELECTRIC FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 178 LEAD ACID ELECTRIC FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 179 LEAD ACID ELECTRIC FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 180 LEAD ACID ELECTRIC FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 181 ELECTRIC FORKLIFT MARKET, BY LIFTING CAPACITY, 2021-2024 (UNITS)

- TABLE 182 ELECTRIC FORKLIFT MARKET, BY LIFTING CAPACITY, 2025-2032 (UNITS)

- TABLE 183 <2 TON ELECTRIC FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 184 <2 TON ELECTRIC FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 185 2-5 TON ELECTRIC FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 186 2-5 TON ELECTRIC FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 187 >5 TON ELECTRIC FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 188 >5 TON ELECTRIC FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 189 FORKLIFT MARKET, BY PRODUCT TYPE, 2021-2024 (UNITS)

- TABLE 190 FORKLIFT MARKET, BY PRODUCT TYPE, 2025-2032 (UNITS)

- TABLE 191 WAREHOUSE FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 192 WAREHOUSE FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 193 COUNTERBALANCE FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 194 COUNTERBALANCE FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 195 FORKLIFT MARKET, BY TIRE TYPE, 2021-2024 (UNITS)

- TABLE 196 FORKLIFT MARKET, BY TIRE TYPE, 2025-2032 (UNITS)

- TABLE 197 FORKLIFT MARKET, BY TIRE TYPE, 2021-2024 (USD MILLION)

- TABLE 198 FORKLIFT MARKET, BY TIRE TYPE, 2025-2032 (USD MILLION)

- TABLE 199 CUSHION FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 200 CUSHION FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 201 CUSHION FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 202 CUSHION FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 203 PNEUMATIC FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 204 PNEUMATIC FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 205 PNEUMATIC FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 206 PNEUMATIC FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 207 FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 208 FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 209 FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 210 FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 211 ASIA PACIFIC: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 212 ASIA PACIFIC: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 213 ASIA PACIFIC: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 214 ASIA PACIFIC: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 215 ASIA PACIFIC: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 216 ASIA PACIFIC: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 217 ASIA PACIFIC: FORKLIFT MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 218 ASIA PACIFIC: FORKLIFT MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 219 ASIA PACIFIC: FORKLIFT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 220 ASIA PACIFIC: FORKLIFT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 221 CHINA: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 222 CHINA: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 223 CHINA: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 224 CHINA: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 225 CHINA: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 226 CHINA: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 227 INDIA: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 228 INDIA: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 229 INDIA: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 230 INDIA: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 231 INDIA: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 232 INDIA: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 233 JAPAN: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 234 JAPAN: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 235 JAPAN: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 236 JAPAN: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 237 JAPAN: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 238 JAPAN: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 239 SOUTH KOREA: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 240 SOUTH KOREA: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 241 SOUTH KOREA: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 242 SOUTH KOREA: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 243 SOUTH KOREA: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 244 SOUTH KOREA: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 245 EUROPE: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 246 EUROPE: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 247 EUROPE: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 248 EUROPE: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 249 EUROPE: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 250 EUROPE: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 251 EUROPE: FORKLIFT MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 252 EUROPE: FORKLIFT MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 253 EUROPE: FORKLIFT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 254 EUROPE: FORKLIFT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 255 GERMANY: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 256 GERMANY: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 257 GERMANY: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 258 GERMANY: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 259 GERMANY: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 260 GERMANY: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 261 UK: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 262 UK: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 263 UK: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 264 UK: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 265 UK: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 266 UK: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 267 FRANCE: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 268 FRANCE: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 269 FRANCE: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 270 FRANCE: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 271 FRANCE: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 272 FRANCE: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 273 ITALY: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 274 ITALY: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 275 ITALY: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 276 ITALY: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 277 ITALY: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 278 ITALY: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 279 SPAIN: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 280 SPAIN: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 281 SPAIN: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 282 SPAIN: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 283 SPAIN: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 284 SPAIN: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 285 RUSSIA: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 286 RUSSIA: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 287 RUSSIA: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 288 RUSSIA: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 289 RUSSIA: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 290 RUSSIA: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 291 TURKEY: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 292 TURKEY: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 293 TURKEY: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 294 TURKEY: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 295 TURKEY: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 296 TURKEY: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 297 EASTERN EUROPE: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 298 EASTERN EUROPE: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 299 EASTERN EUROPE: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 300 EASTERN EUROPE: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 301 EASTERN EUROPE: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 302 EASTERN EUROPE: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 303 REST OF EUROPE: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 304 REST OF EUROPE: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 305 REST OF EUROPE: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 306 REST OF EUROPE: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 307 REST OF EUROPE: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 308 REST OF EUROPE: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 309 NORTH AMERICA: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 310 NORTH AMERICA: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 311 NORTH AMERICA: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 312 NORTH AMERICA: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 313 NORTH AMERICA: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 314 NORTH AMERICA: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 315 NORTH AMERICA: FORKLIFT MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 316 NORTH AMERICA: FORKLIFT MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 317 NORTH AMERICA: FORKLIFT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 318 NORTH AMERICA: FORKLIFT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 319 US: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 320 US: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 321 US: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 322 US: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 323 US: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 324 US: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 325 MEXICO: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 326 MEXICO: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 327 MEXICO: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 328 MEXICO: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 329 MEXICO: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 330 MEXICO: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 331 CANADA: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 332 CANADA: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 333 CANADA: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 334 CANADA: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 335 CANADA: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 336 CANADA: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 337 REST OF THE WORLD: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 338 REST OF THE WORLD: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 339 REST OF THE WORLD: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 340 REST OF THE WORLD: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 341 REST OF THE WORLD: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 342 REST OF THE WORLD: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 343 REST OF THE WORLD: FORKLIFT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 344 REST OF THE WORLD: FORKLIFT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 345 REST OF THE WORLD: FORKLIFT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 346 REST OF THE WORLD: FORKLIFT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 347 AFRICA: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 348 AFRICA: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 349 AFRICA: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 350 AFRICA: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 351 AFRICA: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 352 AFRICA: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 353 AUSTRALIA & OCEANIA: FORKLIFT MARKET, BY CLASS, 2021-2024 (UNITS)

- TABLE 354 AUSTRALIA & OCEANIA: FORKLIFT MARKET, BY CLASS, 2025-2032 (UNITS)

- TABLE 355 AUSTRALIA & OCEANIA: FORKLIFT MARKET, BY OPERATION, 2021-2024 (UNITS)

- TABLE 356 AUSTRALIA & OCEANIA: FORKLIFT MARKET, BY OPERATION, 2025-2032 (UNITS)

- TABLE 357 AUSTRALIA & OCEANIA: FORKLIFT MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 358 AUSTRALIA & OCEANIA: FORKLIFT MARKET, BY OPERATION, 2025-2032 (USD MILLION)

- TABLE 359 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 360 FORKLIFT MARKET: DEGREE OF COMPETITION, 2024

- TABLE 361 REGION FOOTPRINT

- TABLE 362 PROPULSION FOOTPRINT

- TABLE 363 OPERATION FOOTPRINT

- TABLE 364 LIST OF START-UPS/SMES

- TABLE 365 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 366 FORKLIFT MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2021-2025

- TABLE 367 FORKLIFT MARKET: DEALS, 2021-2025

- TABLE 368 FORKLIFT MARKET: EXPANSIONS, 2021-2025

- TABLE 369 TOYOTA INDUSTRIES CORPORATION: COMPANY OVERVIEW

- TABLE 370 TOYOTA INDUSTRIES CORPORATION: PRODUCTS OFFERED

- TABLE 371 TOYOTA INDUSTRIES CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 372 TOYOTA INDUSTRIES CORPORATION: DEALS

- TABLE 373 TOYOTA INDUSTRIES CORPORATION: EXPANSIONS

- TABLE 374 TOYOTA INDUSTRIES CORPORATION: OTHER DEVELOPMENTS

- TABLE 375 KION GROUP AG: COMPANY OVERVIEW

- TABLE 376 KION GROUP AG: PRODUCTS OFFERED

- TABLE 377 KION GROUP AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 378 KION GROUP AG: DEALS

- TABLE 379 KION GROUP AG: EXPANSIONS

- TABLE 380 JUNGHEINRICH AG: COMPANY OVERVIEW

- TABLE 381 JUNGHEINRICH AG: PRODUCTS OFFERED

- TABLE 382 JUNGHEINRICH AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 383 JUNGHEINRICH AG: DEALS

- TABLE 384 JUNGHEINRICH AG: EXPANSIONS

- TABLE 385 JUNGHEINRICH AG: OTHER DEVELOPMENTS

- TABLE 386 MITSUBISHI LOGISNEXT CO., LTD.: COMPANY OVERVIEW

- TABLE 387 MITSUBISHI LOGISNEXT CO., LTD.: PRODUCTS OFFERED

- TABLE 388 MITSUBISHI LOGISNEXT CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 389 MITSUBISHI LOGISNEXT CO., LTD.: EXPANSIONS

- TABLE 390 MITSUBISHI LOGISNEXT CO., LTD.: OTHER DEVELOPMENTS

- TABLE 391 CROWN EQUIPMENT CORPORATION: COMPANY OVERVIEW

- TABLE 392 CROWN EQUIPMENT CORPORATION: PRODUCTS OFFERED

- TABLE 393 CROWN EQUIPMENT CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 394 CROWN EQUIPMENT CORPORATION: EXPANSIONS

- TABLE 395 CROWN EQUIPMENT CORPORATION: OTHER DEVELOPMENTS

- TABLE 396 HYSTER-YALE MATERIALS HANDLING: COMPANY OVERVIEW

- TABLE 397 HYSTER-YALE MATERIALS HANDLING: PRODUCTS OFFERED

- TABLE 398 HYSTER-YALE MATERIALS HANDLING: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 399 HYSTER-YALE MATERIALS HANDLING: DEALS

- TABLE 400 HYSTER-YALE MATERIALS HANDLING: OTHER DEVELOPMENTS

- TABLE 401 CLARK MATERIAL HANDLING COMPANY: COMPANY OVERVIEW

- TABLE 402 CLARK MATERIAL HANDLING COMPANY: PRODUCTS OFFERED

- TABLE 403 CLARK MATERIAL HANDLING COMPANY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 404 CLARK MATERIAL HANDLING COMPANY: DEALS

- TABLE 405 CLARK MATERIAL HANDLING COMPANY: OTHER DEVELOPMENTS

- TABLE 406 HYUNDAI CONSTRUCTION EQUIPMENT: COMPANY OVERVIEW

- TABLE 407 HYUNDAI CONSTRUCTION EQUIPMENT: PRODUCTS OFFERED

- TABLE 408 HYUNDAI CONSTRUCTION EQUIPMENT: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 409 HYUNDAI CONSTRUCTION EQUIPMENT: DEALS

- TABLE 410 HYUNDAI CONSTRUCTION EQUIPMENT: OTHER DEVELOPMENTS

- TABLE 411 KOMATSU LTD.: COMPANY OVERVIEW

- TABLE 412 KOMATSU LTD.: PRODUCTS OFFERED

- TABLE 413 KOMATSU LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 414 KOMATSU LTD.: DEALS

- TABLE 415 BOBCAT COMPANY: COMPANY OVERVIEW

- TABLE 416 BOBCAT COMPANY: PRODUCTS OFFERED

- TABLE 417 BOBCAT COMPANY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 418 BOBCAT COMPANY: OTHER DEVELOPMENTS

- TABLE 419 KALMAR: COMPANY OVERVIEW

- TABLE 420 ANHUI HELI CO., LTD.: COMPANY OVERVIEW

- TABLE 421 BYD COMPANY LTD.: COMPANY OVERVIEW

- TABLE 422 GODREJ MATERIAL HANDLING: COMPANY OVERVIEW

- TABLE 423 EP EQUIPMENT: COMPANY OVERVIEW

- TABLE 424 LONKING: COMPANY OVERVIEW

- TABLE 425 HANGCHA FORKLIFT: COMPANY OVERVIEW

- TABLE 426 KONECRANES: COMPANY OVERVIEW

- TABLE 427 COMBILIFT: COMPANY OVERVIEW

- TABLE 428 VALLEE: COMPANY OVERVIEW

- TABLE 429 FLEXI NARROW AISLE: COMPANY OVERVIEW

- TABLE 430 MANITOU: COMPANY OVERVIEW

- TABLE 431 HOIST MATERIAL HANDLING: COMPANY OVERVIEW

- TABLE 432 AGILOX SERVICES GMBH: COMPANY OVERVIEW

- TABLE 433 E80 GROUP S.P.A.: COMPANY OVERVIEW

- TABLE 434 SCOTT AUTOMATION: COMPANY OVERVIEW

- TABLE 435 BASTIAN SOLUTIONS: COMPANY OVERVIEW

- TABLE 436 SEEGRID CORPORATION: COMPANY OVERVIEW

- TABLE 437 VECNA ROBOTICS: COMPANY OVERVIEW

- TABLE 438 MURATA MACHINERY, LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 FORKLIFT MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND- AND SUPPLY-SIDES

- FIGURE 9 KEY FACTORS IMPACTING FORKLIFT MARKET

- FIGURE 10 REPORT SUMMARY

- FIGURE 11 FORKLIFT MARKET, BY REGION

- FIGURE 12 FORKLIFT MARKET DYNAMICS

- FIGURE 13 GLOBAL RETAIL E-COMMERCE SALES, 2020-2024 (USD BILLION)

- FIGURE 14 MODULAR CONFIGURATION OPTIONS IN FORKLIFTS

- FIGURE 15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 16 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD)

- FIGURE 17 ECOSYSTEM ANALYSIS

- FIGURE 18 ECOSYSTEM MAP

- FIGURE 19 SUPPLY CHAIN ANALYSIS

- FIGURE 20 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 21 BATTERY CAPACITY VS. LIFTING CAPACITY

- FIGURE 22 LIFTING CAPACITY VS. LIFTING VOLTAGE

- FIGURE 23 BATTERY VOLTAGE VS. MARKET SIZE OF FORKLIFTS

- FIGURE 24 BILL OF MATERIALS FOR FORKLIFTS

- FIGURE 25 TOTAL COST OF OWNERSHIP FOR FORKLIFTS

- FIGURE 26 PATENTS ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY OPERATION

- FIGURE 28 KEY BUYING CRITERIA, BY PROPULSION

- FIGURE 29 FORKLIFT MARKET, BY PROPULSION, 2025 VS. 2032 (USD MILLION)

- FIGURE 30 FORKLIFT MARKET, BY TONNAGE CAPACITY, 2025 VS. 2032 (USD MILLION)

- FIGURE 31 FORKLIFT MARKET, BY END-USE INDUSTRY, 2025 VS. 2032 (USD MILLION)

- FIGURE 32 FORKLIFT MARKET, BY CLASS, 2025 VS. 2032 (UNITS)

- FIGURE 33 FORKLIFT MARKET, BY OPERATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 34 FORKLIFT MARKET, BY APPLICATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 35 ELECTRIC FORKLIFT MARKET, BY BATTERY TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 36 ELECTRIC FORKLIFT MARKET, BY LIFTING CAPACITY, 2025 VS. 2032 (UNITS)

- FIGURE 37 FORKLIFT MARKET, BY PRODUCT TYPE, 2025 VS. 2032 (UNITS)

- FIGURE 38 FORKLIFT MARKET, BY TIRE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 39 FORKLIFT MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 40 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 41 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 42 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 43 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 44 ASIA PACIFIC: FORKLIFT MARKET SNAPSHOT

- FIGURE 45 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 46 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 47 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 48 EUROPE: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 49 EUROPE: FORKLIFT MARKET SNAPSHOT

- FIGURE 50 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 51 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 52 NORTH AMERICA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 53 NORTH AMERICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 54 NORTH AMERICA: FORKLIFT MARKET SNAPSHOT

- FIGURE 55 REST OF THE WORLD: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 56 REST OF THE WORLD: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 57 REST OF THE WORLD: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 58 REST OF THE WORLD: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY

- FIGURE 59 REST OF THE WORLD: FORKLIFT MARKET, 2025 VS. 2032 (USD MILLION)

- FIGURE 60 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 61 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2024

- FIGURE 62 COMPANY VALUATION (USD BILLION)

- FIGURE 63 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 64 BRAND/PRODUCT COMPARISON

- FIGURE 65 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 66 COMPANY FOOTPRINT

- FIGURE 67 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 68 TOYOTA INDUSTRIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 KION GROUP AG: COMPANY SNAPSHOT

- FIGURE 70 JUNGHEINRICH AG: COMPANY SNAPSHOT

- FIGURE 71 MITSUBISHI LOGISNEXT CO., LTD.: COMPANY SNAPSHOT

- FIGURE 72 HYSTER-YALE MATERIALS HANDLING: COMPANY SNAPSHOT

- FIGURE 73 HYUNDAI CONSTRUCTION EQUIPMENT: COMPANY SNAPSHOT

- FIGURE 74 KOMATSU LTD.: COMPANY SNAPSHOT

- FIGURE 75 BOBCAT COMPANY: COMPANY SNAPSHOT