PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1877353

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1877353

IoT Market by Module Type (Hardware, Connectivity, Software, Services), Focus Areas (Smart Manufacturing, Smart Transportation/Mobility, Smart Energy & Utilities, Smart Healthcare, Smart Buildings, Smart Retail) and Region - Global Forecast to 2030

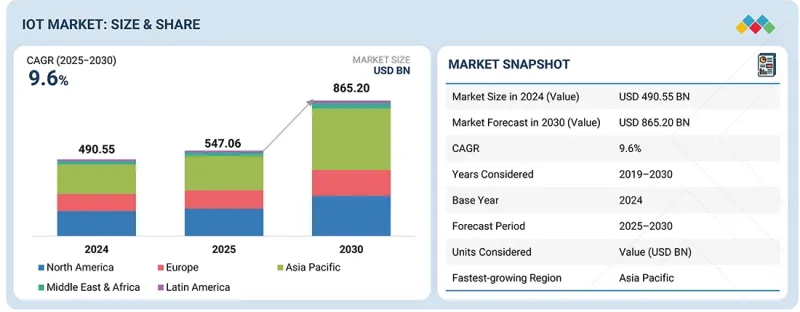

MarketsandMarkets: The IoT market is estimated to be worth USD 547.06 billion in 2025 and is projected to reach USD 865.20 billion by 2030, growing at a CAGR of 9.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD Billion |

| Segments | By Module Type, Hardware, Connectivity, Software, Service, Focus Area, And Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Major technology companies, including Cisco, IBM, Microsoft, and AWS, are driving IoT innovation through robust platforms, cloud ecosystems, and AI-integrated solutions. These firms are enabling organizations to easily deploy, manage, and scale IoT applications across diverse environments. Cisco's IoT Control Center, Microsoft Azure IoT Hub, and IBM Watson IoT exemplify how enterprise-grade solutions simplify connectivity, enhance security, and deliver actionable intelligence.

By integrating IoT data with machine learning and analytics tools, these companies enable industries to gain deeper insights and enhance decision-making. Strategic partnerships among tech giants, telecom operators, and hardware vendors are further fostering interoperability and innovation. As a result, enterprises are empowered to adopt end-to-end IoT ecosystems that optimize operations, strengthen cybersecurity, and unlock new business models.

"The satellite connectivity segment will witness the highest growth during the forecast period."

Satellite IoT is gaining momentum in sectors such as agriculture, maritime, mining, and logistics, where terrestrial networks are unavailable or unreliable. The emergence of low-Earth orbit (LEO) satellite constellations has significantly improved bandwidth, latency, and affordability, making satellite IoT viable for large-scale deployment. Companies are leveraging satellite-based solutions for asset tracking, environmental monitoring, and disaster response applications. The integration of satellite networks with 5G and edge computing further enhances real-time data processing and global connectivity. As the need for continuous, borderless communication grows, satellite IoT will become an essential enabler of ubiquitous connectivity, driving rapid market expansion across industries and geographies.

"The Modules/Sensors segment is expected to have the largest market size during the forecast period."

Modules and sensors enable real-time data collection and monitoring across various applications, including smart cities, industrial automation, healthcare, and logistics. The proliferation of low-cost sensors and advancements in MEMS (Micro-Electro-Mechanical Systems) technology have accelerated the integration of sensors in both consumer and industrial devices. Connectivity modules, such as Bluetooth, Wi-Fi, and cellular support, enable seamless device communication across distributed networks. Sensors are also becoming increasingly intelligent, integrating with edge AI to analyze data locally and enhance decision-making efficiency. Additionally, the growing demand for environmental, motion, and temperature sensors in smart infrastructure and autonomous systems is fueling market expansion. With IoT deployments scaling globally, the modules and sensors segment remains central to enabling accurate, continuous data flow within interconnected systems.

"Asia Pacific is expected to record the highest growth rate during the forecast period."

The Internet of Things (IoT) market in the Asia Pacific region is witnessing rapid expansion, driven by large-scale digital transformation initiatives and government-backed smart infrastructure projects. Countries such as China, Japan, South Korea, and India are leading the regional growth due to strong industrial automation, increasing adoption of smart city solutions, and advancements in 5G connectivity. The region's manufacturing and transportation sectors are at the forefront of IoT deployment, using connected sensors and data analytics to enhance efficiency and reduce operational costs. Moreover, the growing demand for predictive maintenance and real-time monitoring across various industries is driving the acceleration of IoT adoption. Asia Pacific is projected to remain one of the fastest-growing IoT markets globally, supported by ongoing investments in edge computing and AI-integrated IoT ecosystems.

Breakdown of primaries

The study offers insights from a range of industry experts, including solution vendors and Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level -35%, D-level - 30%, and Others - 35%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 25%, Middle East & Africa - 9%, Latin America - 6%

The major players in the IoT market include Microsoft (US), Amazon Web Services, Inc. (US), Huawei (China), Cisco (US), Intel (US), Qualcomm (US), Texas Instruments (US), Siemens (US), ABB (Switzerland), IBM (US), SAP (Germany), Hitachi (Japan), PTC (US), STMicroelectronics (ST) (Switzerland), NXP Semiconductors (Netherlands), HP (US), TE Connectivity (Switzerland), Advantech (Taiwan), Bosch (Germany) TDK Corporation (Japan), Omron Corporation (Japan), Honeywell (US), Oracle (US), Software AG (Germany), STC (Saudi Arabia), SAMSUNG (South Korea), Ericsson (Sweden), Avnet (US), Alibaba Cloud (China), HQSoftware (Estonia), Blues (US), Telit Cinterion (US), Particle (US), ClearBlade (Texas), Ayla Networks (US), Losant (Ohio), and emnify (Germany). These players have adopted various growth strategies, including partnerships, agreements, collaborations, new product launches, enhancements, and acquisitions, to expand their footprint in the IoT market.

Research Coverage

The market study encompasses the IoT market size and growth potential across various segments: hardware (modules/sensors, security hardware, other hardware), connectivity (cellular, LP-WAN, satellite, other connectivity), software (IoT platforms, application software, analytics software, security & safety software, other software), and service (professional services, managed services). The focus area segment includes smart transportation/mobility, smart buildings, smart energy & utilities, smart healthcare, smart agriculture, smart manufacturing, smart retail, and other focus areas. The regional analysis covers North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global IoT market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape, gain valuable insights, and develop effective go-to-market strategies. Moreover, the report will provide stakeholders with insights into the market's pulse, offering them information on key market drivers, restraints, challenges, and opportunities.

The report provides the following insights.

- Analysis of key drivers (expansion of 5G and Edge computing for faster and reliable connectivity, broader availability and maturation of LPWAN and cellular IoT that cut connectivity cost and enable new low-power use cases), restraints (rising cybersecurity and data privacy concerns, Interoperability and integration challenges), opportunities (expansion of space-based IoT networks for global connectivity, emergence of emotion-aware IoT devices for personalized experiences), and challenges (cross-border data governance and differing privacy rules that complicate global IoT rollouts, divergent regulations and standards raise compliance costs and deter global scale) influencing the growth of the IoT market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the IoT market

- Market Development: The report provides comprehensive information about lucrative markets, analyzing the IoT market across various regions

- Market Diversification: Comprehensive information about new products and services, untapped geographies, recent developments, and investments in the IoT market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players: Microsoft (US), Amazon Web Services, Inc. (US), Huawei (China), Cisco (US), Intel (US), Qualcomm (US), Texas Instruments (US), Siemens (US), ABB (Switzerland), IBM (US), SAP (Germany), Hitachi (Japan), PTC (US), STMicroelectronics (ST) (Switzerland), NXP Semiconductors (Netherlands), HP (US), TE Connectivity (Switzerland), Advantech (Taiwan), Bosch (Germany) TDK Corporation (Japan), Omron Corporation (Japan), Honeywell (US), Oracle (US), Software AG (Germany), STC (Saudi Arabia), SAMSUNG (South Korea), Ericsson (Sweden), Avnet (US), Alibaba Cloud (China), HQSoftware (Estonia), Blues (US), Telit Cinterion (US), Particle (US), ClearBlade (Texas), Ayla Networks (US), Losant (Ohio), and emnify (Germany)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIONS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN IOT MARKET

- 3.2 IOT MARKET, BY MODULE TYPE AND REGION

- 3.3 IOT MARKET, BY MODULE TYPE

- 3.4 IOT MARKET, BY CONNECTIVITY

- 3.5 IOT MARKET, BY SOFTWARE

- 3.6 IOT MARKET, BY SERVICES

- 3.7 IOT MARKET, BY FOCUS AREA

4 MARKET OVERVIEW AND INDUSTRY TRENDS

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Expansion of 5G and edge computing for faster, reliable connectivity

- 4.2.1.2 Broader availability and maturation of LPWAN and cellular IoT that reduce connectivity costs and enable new low-power use cases

- 4.2.2 RESTRAINTS

- 4.2.2.1 Rising cybersecurity and data privacy concerns

- 4.2.2.2 Interoperability and integration challenges

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Expansion of space-based IoT networks

- 4.2.3.2 Digital twin technology integration across industries

- 4.2.4 CHALLENGES

- 4.2.4.1 Cross-border data governance and differing privacy rules that complicate global IoT rollouts

- 4.2.4.2 Divergent regulations and standards raise compliance costs and deter global scale

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.3.1 INTERCONNECTED MARKETS

- 4.3.2 CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.4.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES MODEL ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL IOT INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE PRICING ANALYSIS, BY HARDWARE

- 5.6.2 INDICATIVE PRICING ANALYSIS, BY SUBSCRIPTION TYPE

- 5.7 TRADE ANALYSIS

- 5.7.1 EXPORT SCENARIO OF MEASURING OR CHECKING INSTRUMENTS, APPLIANCES, AND MACHINES NOT ELSEWHERE SPECIFIED

- 5.7.2 IMPORT SCENARIO OF MEASURING OR CHECKING INSTRUMENTS, APPLIANCES, AND MACHINES NOT ELSEWHERE SPECIFIED

- 5.8 KEY CONFERENCES AND EVENTS

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 NESTLE LEVERAGED AWS TO UNLOCK SCALABILITY AND USE SERVERLESS ARCHITECTURE

- 5.11.2 TITAN INTERNATIONAL ENSURED BUSINESS CONTINUITY WITH ORACLE ERP CLOUD

- 5.11.3 ELECTRIC RACING ACADEMY (ERA) IMPROVED RACING EXPERIENCE AND PROVIDED REAL-TIME DATA BY DEPLOYING SOFTWARE AG'S APPLICATION INTEGRATION SOLUTION

- 5.11.4 EATON ACCELERATED INDUSTRY 4.0 TRANSFORMATION USING PTC'S FACTORY INSIGHTS-AS-A-SERVICE FOR HIGH IMPACT

- 5.11.5 PITNEY BOWES EMBRACED INDUSTRIAL INTERNET USING GE PREDIX TO TRANSFORM ITS PRODUCTION MAIL BUSINESS

- 5.12 IMPACT OF 2025 US TARIFF - IOT MARKET

- 5.12.1 INTRODUCTION

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRY/REGION

- 5.12.4.1 US

- 5.12.4.2 Europe

- 5.12.4.3 Asia Pacific

- 5.12.5 IMPACT ON IOT END USERS

6 STRATEGIC DISRUPTION: PATENTS, DIGITAL, AND AI ADOPTIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 SENSORS AND ACTUATORS

- 6.1.2 CONNECTIVITY TECHNOLOGIES

- 6.1.3 EDGE COMPUTING

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 LWM2M (LIGHTWEIGHT MACHINE-TO-MACHINE PROTOCOL)

- 6.2.2 DIGITAL TWIN

- 6.2.3 SECURE OTA/FIRMWARE UPDATE FRAMEWORKS

- 6.3 TECHNOLOGY/PRODUCT ROADMAP FOR IOT MARKET

- 6.3.1 SHORT-TERM ROADMAP (2023-2025)

- 6.3.2 MID-TERM ROADMAP (2026-2028)

- 6.3.3 LONG-TERM ROADMAP (2029-2030)

- 6.4 PATENT ANALYSIS

- 6.4.1 LIST OF MAJOR PATENTS

- 6.5 IMPACT OF AI/GENERATIVE AI ON IOT MARKET

- 6.5.1 TOP USE CASES AND MARKET POTENTIAL OF GENERATIVE AI IN IOT

- 6.5.2 BEST PRACTICES OF IOT MARKET

- 6.5.3 CASE STUDIES OF AI IMPLEMENTATION IN IOT MARKET

- 6.5.3.1 Connected Factory & Predictive Maintenance - Siemens (MindSphere) on AWS

- 6.5.3.2 Asset Management & Predictive Maintenance - DP World (IBM Maximo)

- 6.5.3.3 Audi collaborated with Cisco to build smart factory

- 6.5.3.4 Bosch/Industrial OEMs, maintenance 4.0 & factory optimization

- 6.5.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.5.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN IOT

7 REGULATORY LANDSCAPE AND COMPLIANCE

- 7.1 REGULATORY LANDSCAPE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.1.1 International Telecommunication Union (ITU)

- 7.1.1.2 Internet of Things Consortium (IoTC)

- 7.1.2 INDUSTRY STANDARDS

- 7.1.2.1 North America

- 7.1.2.1.1 US

- 7.1.2.1.2 Canada

- 7.1.2.2 Europe

- 7.1.2.3 Asia Pacific

- 7.1.2.3.1 China

- 7.1.2.3.2 Japan

- 7.1.2.3.3 India

- 7.1.2.4 Middle East & Africa

- 7.1.2.4.1 GCC Countries

- 7.1.2.4.2 South Africa

- 7.1.2.5 Latin America

- 7.1.2.5.1 Brazil

- 7.1.2.1 North America

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS IN VARIOUS END-USE VERTICALS

9 IOT MARKET, BY MODULE TYPE

- 9.1 INTRODUCTION

- 9.1.1 IOT MARKET, BY MODULE TYPE: DRIVERS

- 9.2 HARDWARE

- 9.2.1 DEMAND FOR RELIABLE AND CERTIFIED ENDPOINTS IN INDUSTRIAL AND MEDICAL APPLICATIONS

- 9.3 CONNECTIVITY

- 9.3.1 RISE IN ADOPTION OF MOBILE IOT APPLICATIONS AND NEED FOR LOW-POWER, LONG-RANGE IOT CONNECTIVITY IN INDUSTRIAL AND SMART CITY APPLICATIONS

- 9.4 SOFTWARE

- 9.4.1 REQUIREMENT TO CONVERT TELEMETRY INTO ACTIONABLE INSIGHT THROUGH SCALABLE PLATFORMS, ADVANCED ANALYTICS, AND INTEROPERABLE APIS

- 9.5 SERVICES

- 9.5.1 NEED TO REDUCE IMPLEMENTATION RISK AND OPERATIONAL BURDEN BY USING PROFESSIONAL EXPERTISE AND MANAGED OPERATIONS

10 IOT MARKET, BY HARDWARE

- 10.1 INTRODUCTION

- 10.1.1 IOT HARDWARE: MARKET DRIVERS

- 10.2 MODULES/SENSORS

- 10.2.1 GROWTH IN INDUSTRIAL AUTOMATION, WITH REQUIREMENTS MAINLY IN AGRICULTURE AND AUTOMOTIVE SECTORS

- 10.3 SECURITY HARDWARE

- 10.3.1 INCREASE IN PROCUREMENT MANDATES THAT REQUIRE HARDWARE-BASED SECURITY PRIMITIVES AND CERTIFIED TAMPER RESISTANCE

- 10.4 OTHER HARDWARE

11 IOT MARKET, BY CONNECTIVITY

- 11.1 INTRODUCTION

- 11.1.1 IOT CONNECTIVITY: MARKET DRIVERS

- 11.2 CELLULAR

- 11.2.1 ROLLOUT OF 5G NETWORKS, GROWING ADOPTION OF MOBILE IOT APPLICATIONS, AND ADVANCEMENTS IN CELLULAR PROTOCOLS

- 11.3 LP-WAN

- 11.3.1 NEED FOR LOW-POWER, LONG-RANGE IOT CONNECTIVITY IN INDUSTRIAL AND SMART CITY APPLICATIONS

- 11.4 SATELLITE

- 11.4.1 NEED FOR GLOBAL REACH AND REDUNDANCY LAYER WHERE TERRESTRIAL NETWORKS ARE NOT AVAILABLE

- 11.5 OTHER CONNECTIVITY

12 IOT MARKET, BY SOFTWARE

- 12.1 INTRODUCTION

- 12.1.1 IOT SOFTWARE: MARKET DRIVERS

- 12.2 IOT PLATFORMS

- 12.2.1 ENABLING DEVICE CONNECTIVITY AND INTEGRATION, STREAMLINING DATA MANAGEMENT FOR EFFICIENT OPERATIONS ACROSS INDUSTRIES

- 12.3 APPLICATION SOFTWARE

- 12.3.1 AUTOMATING PROCESSES AND ENHANCING OPERATIONAL EFFICIENCY TO OFFER TAILORED SOLUTIONS FOR VARIOUS SECTORS

- 12.4 ANALYTICS SOFTWARE

- 12.4.1 TRANSFORMING LARGE IOT DATASETS INTO ACTIONABLE INSIGHTS, DRIVING SMARTER DECISION-MAKING AND IMPROVED PERFORMANCE

- 12.5 SECURITY & SAFETY SOFTWARE

- 12.5.1 ENSURING PROTECTION AGAINST CYBER THREATS AND SAFEGUARDING INTEGRITY OF IOT SYSTEMS AND CRITICAL DATA

- 12.6 OTHER SOFTWARE

13 IOT MARKET, BY SERVICE

- 13.1 INTRODUCTION

- 13.1.1 IOT SERVICES: MARKET DRIVERS

- 13.2 PROFESSIONAL SERVICES

- 13.2.1 GROWTH OF HYBRID/REMOTE WORK REQUIRES SUCCESSFUL SYSTEM INTEGRATION AND DEPLOYMENT SUPPORT

- 13.2.2 IMPLEMENTATION SERVICES

- 13.2.3 STRATEGY & SYSTEM DESIGN SERVICES

- 13.3 MANAGED SERVICES

- 13.3.1 DEMAND FOR PREDICTABLE, EXPERT OPERATIONAL MANAGEMENT FOR DEVICE MANAGEMENT, DATA PROCESSING, AND SYSTEM MAINTENANCE

14 IOT MARKET, BY FOCUS AREA

- 14.1 INTRODUCTION

- 14.1.1 IOT FOCUS AREAS: MARKET DRIVERS

- 14.2 SMART TRANSPORTATION/MOBILITY

- 14.2.1 DEMAND FOR EFFICIENT SELF-DRIVING CARS AND IMPROVED TRAFFIC FLOW MANAGEMENT TO DRIVE MARKET

- 14.3 SMART BUILDINGS

- 14.3.1 ENERGY EFFICIENCY AND ENVIRONMENTAL SUSTAINABILITY TO DRIVE SEGMENT

- 14.4 SMART ENERGY & UTILITIES

- 14.4.1 GLOBAL SHIFT TOWARD RENEWABLE AND STABLE POWER SYSTEMS

- 14.5 SMART HEALTHCARE

- 14.5.1 NEED FOR REMOTE CARE AND CONTINUOUS PATIENT MONITORING

- 14.6 SMART AGRICULTURE

- 14.6.1 PRESSURE TO IMPROVE YIELD WHILE REDUCING RESOURCE USE

- 14.7 SMART MANUFACTURING

- 14.7.1 NEED FOR SIMULATING AND PREDICTING EQUIPMENT PERFORMANCE

- 14.8 SMART RETAIL

- 14.8.1 NEED TO COMPETE WITH ECOMMERCE THROUGH AUTOMATION AND PERSONALIZATION

- 14.9 OTHER FOCUS AREAS

15 IOT MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 US

- 15.2.1.1 Government directives and norms to enhance IoT security and compatibility in various sectors to drive market

- 15.2.2 CANADA

- 15.2.2.1 Investment in smart city initiatives to promote adoption of IoT technologies for enhanced city living to drive market

- 15.2.1 US

- 15.3 EUROPE

- 15.3.1 UK

- 15.3.1.1 First country to legally mandate cybersecurity standards for IoT devices under Product Security and Telecommunications Infrastructure (PSTI) regime

- 15.3.2 GERMANY

- 15.3.2.1 IoT technologies adopted by manufacturing sector to create more efficient and flexible production processes to drive demand

- 15.3.3 FRANCE

- 15.3.3.1 Paris aims to become top smart city by 2050 through its 'Paris Smart City 2050' initiative

- 15.3.4 ITALY

- 15.3.4.1 Growth in IoT applications, especially in smart city and energy management projects, to drive market

- 15.3.5 REST OF EUROPE

- 15.3.1 UK

- 15.4 ASIA PACIFIC

- 15.4.1 CHINA

- 15.4.1.1 Investments in 5G networks and IoT infrastructure to drive market

- 15.4.2 JAPAN

- 15.4.2.1 Use of cost-effective IoT platforms in cloud that allow smaller companies to grow operations with improved connectivity options to drive demand

- 15.4.3 INDIA

- 15.4.3.1 Incentives to VC-funded startups focused on IoT technologies to promote growth in sector to drive demand

- 15.4.4 REST OF ASIA PACIFIC

- 15.4.1 CHINA

- 15.5 MIDDLE EAST & AFRICA

- 15.5.1 UAE

- 15.5.1.1 Focus on IoT integration and sustainable urban development due to high internet usage and tech-savvy population to drive demand

- 15.5.2 KSA

- 15.5.2.1 Vision 2030's strategic plan of sustainable initiatives to drive market

- 15.5.3 SOUTH AFRICA

- 15.5.3.1 Adoption of IoT technologies demonstrates deliberate dedication to digital transformation

- 15.5.3.2 Rest of Middle East & Africa

- 15.5.1 UAE

- 15.6 LATIN AMERICA

- 15.6.1 BRAZIL

- 15.6.1.1 Manufacturing companies seek advantages from partnerships to eliminate obstacles to IoT implementation

- 15.6.2 MEXICO

- 15.6.2.1 Supportive regulatory environment and growing fintech ecosystem to drive market

- 15.6.3 REST OF LATIN AMERICA

- 15.6.1 BRAZIL

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 16.3 REVENUE ANALYSIS, 2022-2024

- 16.4 MARKET SHARE ANALYSIS, 2024

- 16.5 BRAND/PRODUCT COMPARISON

- 16.6 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6.1 COMPANY VALUATION

- 16.6.2 FINANCIAL METRICS

- 16.7 COMPANY EVALUATION MATRIX: HARDWARE, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.8 COMPANY EVALUATION MATRIX: SOFTWARE, 2024

- 16.8.1 STARS

- 16.8.2 EMERGING LEADERS

- 16.8.3 PERVASIVE PLAYERS

- 16.8.4 PARTICIPANTS

- 16.8.5 COMPANY FOOTPRINT: KEY PLAYERS (HARDWARE AND SOFTWARE), 2024

- 16.8.5.1 Company footprint

- 16.8.5.2 Regional footprint

- 16.8.5.3 Module type footprint

- 16.8.5.4 Focus area footprint

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 16.9.2 DEALS

17 COMPANY PROFILES

- 17.1 INTRODUCTION

- 17.2 KEY PLAYERS

- 17.2.1 MICROSOFT

- 17.2.1.1 Business overview

- 17.2.1.2 Products/Solutions/Services offered

- 17.2.1.3 Recent developments

- 17.2.1.3.1 Product launches & enhancements

- 17.2.1.3.2 Deals

- 17.2.1.4 MnM view

- 17.2.1.4.1 Right to win

- 17.2.1.4.2 Strategic choices

- 17.2.1.4.3 Weaknesses and competitive threats

- 17.2.2 HUAWEI

- 17.2.2.1 Business overview

- 17.2.2.2 Products offered

- 17.2.2.3 Recent developments

- 17.2.2.3.1 Product launches

- 17.2.2.3.2 Deals

- 17.2.2.4 MnM view

- 17.2.2.4.1 Right to win

- 17.2.2.4.2 Strategic choices

- 17.2.2.4.3 Weaknesses and competitive threats

- 17.2.3 AMAZON WEB SERVICES, INC.

- 17.2.3.1 Business overview

- 17.2.3.2 Products/Solutions/Services offered

- 17.2.3.3 Recent developments

- 17.2.3.3.1 Product launches & enhancements

- 17.2.3.3.2 Deals

- 17.2.3.4 MnM view

- 17.2.3.4.1 Right to win

- 17.2.3.4.2 Strategic choices

- 17.2.3.4.3 Weaknesses and competitive threats

- 17.2.4 CISCO SYSTEMS, INC.

- 17.2.4.1 Business overview

- 17.2.4.2 Products offered

- 17.2.4.3 Recent developments

- 17.2.4.3.1 Product launches

- 17.2.4.3.2 Deals

- 17.2.4.4 MnM view

- 17.2.4.4.1 Right to win

- 17.2.4.4.2 Strategic choices

- 17.2.4.4.3 Weaknesses and competitive threats

- 17.2.5 INTEL CORPORATION

- 17.2.5.1 Business overview

- 17.2.5.2 Products offered

- 17.2.5.3 Recent developments

- 17.2.5.3.1 Product launches

- 17.2.5.3.2 Deals

- 17.2.5.4 MnM view

- 17.2.5.4.1 Right to win

- 17.2.5.4.2 Strategic choices

- 17.2.5.4.3 Weaknesses and competitive threats

- 17.2.6 QUALCOMM TECHNOLOGIES, INC.

- 17.2.6.1 Business overview

- 17.2.6.2 Products offered

- 17.2.6.3 Recent developments

- 17.2.6.3.1 Product launches

- 17.2.6.3.2 Deals

- 17.2.7 TEXAS INSTRUMENTS INCORPORATED

- 17.2.7.1 Business overview

- 17.2.7.2 Products offered

- 17.2.7.3 Recent developments

- 17.2.7.3.1 Product launches

- 17.2.8 SIEMENS

- 17.2.8.1 Business overview

- 17.2.8.2 Products offered

- 17.2.8.3 Recent developments

- 17.2.8.3.1 Product launches

- 17.2.8.3.2 Deals

- 17.2.9 ABB

- 17.2.9.1 Business overview

- 17.2.9.2 Products offered

- 17.2.9.3 Recent developments

- 17.2.9.3.1 Deals

- 17.2.10 IBM

- 17.2.10.1 Business overview

- 17.2.10.2 Products/Solutions/Services offered

- 17.2.10.3 Recent developments

- 17.2.11 SAP

- 17.2.12 HITACHI

- 17.2.13 PTC

- 17.2.14 STMICROELECTRONICS

- 17.2.15 NXP SEMICONDUCTORS

- 17.2.16 HPE

- 17.2.17 TE CONNECTIVITY

- 17.2.18 ADVANTECH

- 17.2.19 BOSCH

- 17.2.20 TDK CORPORATION

- 17.2.21 OMRON CORPORATION

- 17.2.22 HONEYWELL

- 17.2.23 ORACLE

- 17.2.24 SOFTWARE AG

- 17.2.25 STC

- 17.2.26 SAMSUNG

- 17.2.27 ERICSSON

- 17.2.28 AVNET

- 17.2.29 ALIBABA CLOUD

- 17.2.1 MICROSOFT

- 17.3 STARTUPS/SMES

- 17.3.1 HQSOFTWARE

- 17.3.2 PARTICLE

- 17.3.3 CLEARBLADE

- 17.3.4 AYLA NETWORKS

- 17.3.5 LOSANT IOT

- 17.3.6 EMNIFY

- 17.3.7 BLUES

- 17.3.8 TELIT CINTERION

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY DATA

- 18.1.2 PRIMARY DATA

- 18.1.2.1 Primary interviews with experts

- 18.1.2.2 Breakdown of primary profiles

- 18.1.2.3 Key data from primary sources

- 18.1.2.4 Key industry insights

- 18.2 DATA TRIANGULATION

- 18.3 MARKET SIZE ESTIMATION

- 18.3.1 TOP-DOWN APPROACH

- 18.3.2 BOTTOM-UP APPROACH

- 18.4 MARKET FORECAST

- 18.4.1 FACTOR ANALYSIS

- 18.5 RESEARCH ASSUMPTIONS

- 18.6 LIMITATIONS

19 ADJACENT/RELATED MARKETS

- 19.1 INTRODUCTION

- 19.2 5G IOT MARKET

- 19.2.1 MARKET DEFINITION

- 19.2.2 MARKET OVERVIEW

- 19.2.3 5G IOT MARKET, BY COMPONENT

- 19.2.4 5G IOT MARKET, BY NETWORK TYPE

- 19.2.5 5G IOT MARKET, BY ORGANIZATION SIZE

- 19.2.6 5G IOT MARKET, TYPE

- 19.2.7 5G IOT MARKET, BY END USER

- 19.2.8 5G IOT MARKET, BY REGION

- 19.3 IOT SOLUTIONS AND SERVICES MARKET

- 19.3.1 MARKET DEFINITION

- 19.3.2 MARKET OVERVIEW

- 19.3.3 IOT SOLUTIONS AND SERVICES MARKET, BY COMPONENT

- 19.3.4 IOT SOLUTIONS AND SERVICES MARKET, BY DEPLOYMENT MODE

- 19.3.5 IOT SOLUTIONS AND SERVICES MARKET, BY ORGANIZATION SIZE

- 19.3.6 IOT SOLUTIONS & SERVICES MARKET, BY FOCUS AREA

- 19.3.7 IOT SOLUTIONS & SERVICES MARKET, BY REGION

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

- 20.5 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES, 2022-2024

- TABLE 3 IMPACT OF PORTER'S FIVE FORCES ON IOT MARKET

- TABLE 4 GDP PERCENTAGE CHANGE, BY KEY COUNTRIES, 2021-2029

- TABLE 5 IOT MARKET: ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICE OF KEY PLAYERS FOR IOT HARDWARE PROVIDERS (USD)

- TABLE 7 INDICATIVE PRICING LEVELS OF IOT SOLUTIONS, BY SUBSCRIPTION TYPE (USD)

- TABLE 8 IOT MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 9 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 10 EXPECTED CHANGE IN PRICES AND SUCH ASLY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE FOCUS AREAS

- TABLE 17 IOT MARKET: UNMET NEEDS IN KEY END-USE VERTICALS

- TABLE 18 IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 19 IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 20 IOT HARDWARE MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 21 IOT HARDWARE MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 22 IOT CONNECTIVITY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 23 IOT CONNECTIVITY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 24 IOT SOFTWARE MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 25 IOT SOFTWARE MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 26 IOT SERVICES MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 27 IOT SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 28 IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 29 IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 30 IOT MODULES/SENSORS MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 31 IOT MODULES/SENSORS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 32 IOT SECURITY HARDWARE MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 33 IOT SECURITY HARDWARE MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 34 IOT OTHER HARDWARE MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 35 IOT OTHER HARDWARE MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 36 IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 37 IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 38 IOT CELLULAR CONNECTIVITY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 39 IOT CELLULAR CONNECTIVITY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 40 IOT LP-WAN CONNECTIVITY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 41 IOT LP-WAN CONNECTIVITY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 42 IOT SATELLITE CONNECTIVITY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 43 IOT SATELLITE CONNECTIVITY MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 44 OTHER IOT CONNECTIVITY TYPES MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 45 OTHER IOT CONNECTIVITY TYPES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 46 IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 47 IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 48 IOT PLATFORMS MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 49 IOT PLATFORMS MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 50 IOT APPLICATION SOFTWARE MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 51 IOT APPLICATION SOFTWARE MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 52 IOT ANALYTICS SOFTWARE MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 53 IOT ANALYTICS SOFTWARE MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 54 IOT SECURITY & SAFETY SOFTWARE MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 55 IOT SECURITY & SAFETY SOFTWARE MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 56 OTHER IOT SOFTWARE MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 57 OTHER IOT SOFTWARE MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 58 IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 59 IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 60 IOT PROFESSIONAL SERVICES MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 61 IOT PROFESSIONAL SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 62 IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 63 IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 64 IOT IMPLEMENTATION SERVICES MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 65 IOT IMPLEMENTATION SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 66 IOT STRATEGY & SYSTEM DESIGN SERVICES MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 67 IOT STRATEGY & SYSTEM DESIGN SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 68 IOT MANAGED SERVICES MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 69 IOT MANAGED SERVICES MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 70 IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 71 IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 72 IOT MARKET FOR SMART TRANSPORTATION/MOBILITY, BY REGION, 2019-2024 (USD BILLION)

- TABLE 73 IOT MARKET FOR SMART TRANSPORTATION/MOBILITY, BY REGION, 2025-2030 (USD BILLION)

- TABLE 74 IOT MARKET FOR SMART BUILDINGS, BY REGION, 2019-2024 (USD BILLION)

- TABLE 75 IOT MARKET FOR SMART BUILDINGS, BY REGION, 2025-2030 (USD BILLION)

- TABLE 76 IOT MARKET FOR SMART ENERGY & UTILITIES, BY REGION, 2019-2024 (USD BILLION)

- TABLE 77 IOT MARKET FOR SMART ENERGY & UTILITIES, BY REGION, 2025-2030 (USD BILLION)

- TABLE 78 IOT MARKET FOR SMART HEALTHCARE, BY REGION, 2019-2024 (USD BILLION)

- TABLE 79 IOT MARKET FOR SMART HEALTHCARE, BY REGION, 2025-2030 (USD BILLION)

- TABLE 80 IOT MARKET FOR SMART AGRICULTURE, BY REGION, 2019-2024 (USD BILLION)

- TABLE 81 IOT MARKET FOR SMART AGRICULTURE, BY REGION, 2025-2030 (USD BILLION)

- TABLE 82 IOT MARKET FOR SMART MANUFACTURING, BY REGION, 2019-2024 (USD BILLION)

- TABLE 83 IOT MARKET FOR SMART MANUFACTURING, BY REGION, 2025-2030 (USD BILLION)

- TABLE 84 IOT MARKET FOR SMART RETAIL, BY REGION, 2019-2024 (USD BILLION)

- TABLE 85 IOT MARKET FOR SMART RETAIL, BY REGION, 2025-2030 (USD BILLION)

- TABLE 86 IOT MARKET FOR OTHER FOCUS AREAS, BY REGION, 2019-2024 (USD BILLION)

- TABLE 87 IOT MARKET FOR OTHER FOCUS AREAS, BY REGION, 2025-2030 (USD BILLION)

- TABLE 88 IOT MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 89 IOT MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 90 NORTH AMERICA: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 91 NORTH AMERICA: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 92 NORTH AMERICA: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 93 NORTH AMERICA: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 94 NORTH AMERICA: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 95 NORTH AMERICA: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 96 NORTH AMERICA: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 97 NORTH AMERICA: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 98 NORTH AMERICA: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 99 NORTH AMERICA: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 100 NORTH AMERICA: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 101 NORTH AMERICA: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 102 NORTH AMERICA: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 103 NORTH AMERICA: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 104 NORTH AMERICA: IOT MARKET, BY COUNTRY, 2019-2024 (USD BILLION)

- TABLE 105 NORTH AMERICA: IOT MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 106 US: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 107 US: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 108 US: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 109 US: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 110 US: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 111 US: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 112 US: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 113 US: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 114 US: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 115 US: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 116 US: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 117 US: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 118 US: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 119 US: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 120 CANADA: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 121 CANADA: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 122 CANADA: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 123 CANADA: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 124 CANADA: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 125 CANADA: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 126 CANADA: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 127 CANADA: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 128 CANADA: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 129 CANADA: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 130 CANADA: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 131 CANADA: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 132 CANADA: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 133 CANADA: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 134 EUROPE: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 135 EUROPE: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 136 EUROPE: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 137 EUROPE: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 138 EUROPE: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 139 EUROPE: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 140 EUROPE: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 141 EUROPE: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 142 EUROPE: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 143 EUROPE: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 144 EUROPE: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 145 EUROPE: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 146 EUROPE: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 147 EUROPE: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 148 EUROPE: IOT MARKET, BY COUNTRY, 2019-2024 (USD BILLION)

- TABLE 149 EUROPE: IOT MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 150 UK: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 151 UK: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 152 UK: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 153 UK: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 154 UK: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 155 UK: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 156 UK: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 157 UK: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 158 UK: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 159 UK: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 160 UK: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 161 UK: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 162 UK: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 163 UK: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 164 GERMANY: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 165 GERMANY: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 166 GERMANY: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 167 GERMANY: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 168 GERMANY: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 169 GERMANY: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 170 GERMANY: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 171 GERMANY: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 172 GERMANY: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 173 GERMANY: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 174 GERMANY: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 175 GERMANY: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 176 GERMANY: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 177 GERMANY: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 178 FRANCE: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 179 FRANCE: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 180 FRANCE: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 181 FRANCE: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 182 FRANCE: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 183 FRANCE: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 184 FRANCE: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 185 FRANCE: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 186 FRANCE: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 187 FRANCE: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 188 FRANCE: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 189 FRANCE: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 190 FRANCE: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 191 FRANCE: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 192 ITALY: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 193 ITALY: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 194 ITALY: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 195 ITALY: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 196 ITALY: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 197 ITALY: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 198 ITALY: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 199 ITALY: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 200 ITALY: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 201 ITALY: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 202 ITALY: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 203 ITALY: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 204 ITALY: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 205 ITALY: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 206 ASIA PACIFIC: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 207 ASIA PACIFIC: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 208 ASIA PACIFIC: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 209 ASIA PACIFIC: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 210 ASIA PACIFIC: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 211 ASIA PACIFIC: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 212 ASIA PACIFIC: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 213 ASIA PACIFIC: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 214 ASIA PACIFIC: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 215 ASIA PACIFIC: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 216 ASIA PACIFIC: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 217 ASIA PACIFIC: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 218 ASIA PACIFIC: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 219 ASIA PACIFIC: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 220 ASIA PACIFIC: IOT MARKET, BY COUNTRY, 2019-2024 (USD BILLION)

- TABLE 221 ASIA PACIFIC: IOT MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 222 CHINA: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 223 CHINA: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 224 CHINA: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 225 CHINA: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 226 CHINA: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 227 CHINA: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 228 CHINA: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 229 CHINA: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 230 CHINA: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 231 CHINA: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 232 CHINA: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 233 CHINA: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 234 CHINA: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 235 CHINA: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 236 JAPAN: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 237 JAPAN: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 238 JAPAN: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 239 JAPAN: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 240 JAPAN: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 241 JAPAN: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 242 JAPAN: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 243 JAPAN: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 244 JAPAN: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 245 JAPAN: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 246 JAPAN: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 247 JAPAN: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 248 JAPAN: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 249 JAPAN: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 250 INDIA: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 251 INDIA: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 252 INDIA: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 253 INDIA: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 254 INDIA: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 255 INDIA: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 256 INDIA: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 257 INDIA: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 258 INDIA: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 259 INDIA: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 260 INDIA: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 261 INDIA: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 262 INDIA: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 263 INDIA: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 264 MIDDLE EAST & AFRICA: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 265 MIDDLE EAST & AFRICA: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 266 MIDDLE EAST & AFRICA: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 267 MIDDLE EAST & AFRICA: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 268 MIDDLE EAST & AFRICA: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 269 MIDDLE EAST & AFRICA: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 270 MIDDLE EAST & AFRICA: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 271 MIDDLE EAST & AFRICA: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 272 MIDDLE EAST & AFRICA: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 273 MIDDLE EAST & AFRICA: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 274 MIDDLE EAST & AFRICA: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 275 MIDDLE EAST & AFRICA: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 276 MIDDLE EAST & AFRICA: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 277 MIDDLE EAST & AFRICA: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 278 MIDDLE EAST & AFRICA: IOT MARKET, BY COUNTRY, 2019-2024 (USD BILLION)

- TABLE 279 MIDDLE EAST & AFRICA: IOT MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 280 UAE: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 281 UAE: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 282 UAE: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 283 UAE: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 284 UAE: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 285 UAE: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 286 UAE: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 287 UAE: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 288 UAE: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 289 UAE: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 290 UAE: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 291 UAE: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 292 UAE: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 293 UAE: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 294 KSA: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 295 KSA: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 296 KSA: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 297 KSA: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 298 KSA: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 299 KSA: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 300 KSA: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 301 KSA: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 302 KSA: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 303 KSA: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 304 KSA: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 305 KSA: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 306 KAS: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 307 KSA: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 308 SOUTH AFRICA: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 309 SOUTH AFRICA: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 310 SOUTH AFRICA: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 311 SOUTH AFRICA: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 312 SOUTH AFRICA: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 313 SOUTH AFRICA: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 314 SOUTH AFRICA: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 315 SOUTH AFRICA: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 316 SOUTH AFRICA: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 317 SOUTH AFRICA: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 318 SOUTH AFRICA: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 319 SOUTH AFRICA: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 320 SOUTH AFRICA: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 321 SOUTH AFRICA: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 322 LATIN AMERICA: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 323 LATIN AMERICA: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 324 LATIN AMERICA: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 325 LATIN AMERICA: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 326 LATIN AMERICA: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 327 LATIN AMERICA: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 328 LATIN AMERICA: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 329 LATIN AMERICA: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 330 LATIN AMERICA: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 331 LATIN AMERICA: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 332 LATIN AMERICA: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 333 LATIN AMERICA: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 334 LATIN AMERICA: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 335 LATIN AMERICA: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 336 LATIN AMERICA: IOT MARKET, BY COUNTRY, 2019-2024 (USD BILLION)

- TABLE 337 LATIN AMERICA: IOT MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 338 BRAZIL: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 339 BRAZIL: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 340 BRAZIL: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 341 BRAZIL: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 342 BRAZIL: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 343 BRAZIL: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 344 BRAZIL: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 345 BRAZIL: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 346 BRAZIL: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 347 BRAZIL: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 348 BRAZIL: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 349 BRAZIL: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 350 BRAZIL: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 351 BRAZIL: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 352 MEXICO: IOT MARKET, BY MODULE TYPE, 2019-2024 (USD BILLION)

- TABLE 353 MEXICO: IOT MARKET, BY MODULE TYPE, 2025-2030 (USD BILLION)

- TABLE 354 MEXICO: IOT MARKET, BY HARDWARE, 2019-2024 (USD BILLION)

- TABLE 355 MEXICO: IOT MARKET, BY HARDWARE, 2025-2030 (USD BILLION)

- TABLE 356 MEXICO: IOT MARKET, BY CONNECTIVITY, 2019-2024 (USD BILLION)

- TABLE 357 MEXICO: IOT MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 358 MEXICO: IOT MARKET, BY SOFTWARE, 2019-2024 (USD BILLION)

- TABLE 359 MEXICO: IOT MARKET, BY SOFTWARE, 2025-2030 (USD BILLION)

- TABLE 360 MEXICO: IOT MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 361 MEXICO: IOT MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 362 MEXICO: IOT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD BILLION)

- TABLE 363 MEXICO: IOT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD BILLION)

- TABLE 364 MEXICO: IOT MARKET, BY FOCUS AREA, 2019-2024 (USD BILLION)

- TABLE 365 MEXICO: IOT MARKET, BY FOCUS AREA, 2025-2030 (USD BILLION)

- TABLE 366 OVERVIEW OF STRATEGIES DEPLOYED BY KEY IOT MARKET PLAYERS, 2022-2025

- TABLE 367 IOT MARKET: DEGREE OF COMPETITION

- TABLE 368 IOT MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 369 IOT MARKET: MODULE TYPE FOOTPRINT, 2024

- TABLE 370 IOT MARKET: FOCUS AREA FOOTPRINT, 2024

- TABLE 371 IOT MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, FEBRUARY 2021-OCTOBER 2025

- TABLE 372 IOT MARKET: DEALS, MARCH 2022-AUGUST 2025

- TABLE 373 MICROSOFT: COMPANY OVERVIEW

- TABLE 374 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 375 MICROSOFT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 376 MICROSOFT: DEALS

- TABLE 377 HUAWEI: COMPANY OVERVIEW

- TABLE 378 HUAWEI: PRODUCTS OFFERED

- TABLE 379 HUAWEI: PRODUCT LAUNCHES

- TABLE 380 HUAWEI: DEALS

- TABLE 381 AMAZON WEB SERVICES, INC.: COMPANY OVERVIEW

- TABLE 382 AMAZON WEB SERVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 383 AMAZON WEB SERVICES, INC.: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 384 AMAZON WEB SERVICES, INC.: DEALS

- TABLE 385 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 386 CISCO SYSTEMS, INC.: PRODUCTS OFFERED

- TABLE 387 CISCO SYSTEMS, INC.: PRODUCT LAUNCHES

- TABLE 388 CISCO SYSTEMS, INC.: DEALS

- TABLE 389 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 390 INTEL CORPORATION: PRODUCTS OFFERED

- TABLE 391 INTEL CORPORATION: PRODUCT LAUNCHES

- TABLE 392 INTEL CORPORATION: DEALS

- TABLE 393 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 394 QUALCOMM TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 395 QUALCOMM TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 396 QUALCOMM TECHNOLOGIES, INC.: DEALS

- TABLE 397 TEXAS INSTRUMENTS INCORPORATED: BUSINESS OVERVIEW

- TABLE 398 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS OFFERED

- TABLE 399 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES

- TABLE 400 SIEMENS: COMPANY OVERVIEW

- TABLE 401 SIEMENS: PRODUCTS OFFERED

- TABLE 402 SIEMENS: PRODUCT LAUNCHES

- TABLE 403 SIEMENS DEALS

- TABLE 404 ABB: COMPANY OVERVIEW

- TABLE 405 ABB: PRODUCTS OFFERED

- TABLE 406 ABB: DEALS

- TABLE 407 IBM: COMPANY OVERVIEW

- TABLE 408 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 409 IBM: DEALS

- TABLE 410 PRIMARY INTERVIEWS WITH EXPERTS

- TABLE 411 FACTOR ANALYSIS

- TABLE 412 5G IOT MARKET, BY COMPONENT, 2020-2028 (USD MILLION)

- TABLE 413 5G IOT MARKET, BY NETWORK TYPE, 2020-2028 (USD MILLION)

- TABLE 414 5G IOT MARKET, BY ORGANIZATION SIZE, 2020-2028 (USD MILLION)

- TABLE 415 5G IOT MARKET, BY TYPE, 2020-2028 (USD MILLION)

- TABLE 416 5G IOT MARKET, BY END USER, 2020-2028 (USD MILLION)

- TABLE 417 5G IOT MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 418 IOT SOLUTIONS AND SERVICES MARKET, BY COMPONENT, 2016-2021 (USD BILLION)

- TABLE 419 IOT SOLUTIONS AND SERVICES MARKET, BY COMPONENT, 2022-2027 (USD BILLION)

- TABLE 420 IOT MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD BILLION)

- TABLE 421 IOT MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD BILLION)

- TABLE 422 IOT SOLUTIONS AND SERVICES MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD BILLION)

- TABLE 423 IOT SOLUTIONS AND SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD BILLION)

- TABLE 424 IOT SOLUTIONS AND SERVICES MARKET, BY FOCUS AREA, 2016-2021 (USD BILLION)

- TABLE 425 IOT SOLUTIONS AND SERVICES MARKET, BY FOCUS AREA, 2022-2027 (USD BILLION)

- TABLE 426 IOT SOLUTIONS AND SERVICES MARKET, BY REGION, 2016-2021 (USD BILLION)

- TABLE 427 IOT SOLUTIONS AND SERVICES MARKET, BY REGION, 2022-2027 (USD BILLION)

List of Figures

- FIGURE 1 IOT MARKET SEGMENTATION

- FIGURE 2 YEARS CONSIDERED

- FIGURE 3 MARKET SCENARIO

- FIGURE 4 GLOBAL IOT MARKET TREND, 2025-2030 (USD BILLION)

- FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN IOT MARKET, 2020-2025

- FIGURE 6 DISRUPTIVE TRENDS INFLUENCING GROWTH OF IOT MARKET

- FIGURE 7 HIGH-GROWTH SEGMENTS IN IOT MARKET, 2024

- FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 9 RAPID DIGITAL TRANSFORMATION AND INDUSTRIAL AUTOMATION TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 10 MODULES/SENSORS ACCOUNTED FOR LARGEST MARKET SHARE IN 2025

- FIGURE 11 HARDWARE SEGMENT IS SET TO DOMINATE IOT MARKET IN 2025

- FIGURE 12 CELLULAR SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 13 IOT PLATFORMS TO ACCOUNT FOR LEADING SHARE OF IOT MARKET IN 2025

- FIGURE 14 PROFESSIONAL SERVICES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2025

- FIGURE 15 SMART TRANSPORTATION/MOBILITY TO ACCOUNT FOR LARGEST SHARE OF IOT MARKET IN 2025

- FIGURE 16 IOT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 IOT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 19 IOT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 KEY PLAYERS IN IOT MARKET ECOSYSTEM

- FIGURE 21 AVERAGE SELLING PRICE TREND OF KEY PLAYERS FOR IOT HARDWARE PROVIDERS (USD)

- FIGURE 22 EXPORTS OF PARTS SUITABLE FOR USE SOLELY OR PRINCIPALLY WITH FLAT PANEL DISPLAY MODULES, TRANSMISSION, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 23 IMPORTS OF MEASURING OR CHECKING INSTRUMENTS, APPLIANCES, AND MACHINES NOT ELSEWHERE SPECIFIED, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 INVESTMENT AND FUNDING SCENARIO, 2020-2024 (USD BILLION)

- FIGURE 26 LIST OF MAJOR PATENTS FOR IOT

- FIGURE 27 USE CASES AND MARKET POTENTIAL OF GENERATIVE AI IN IOT

- FIGURE 28 IOT MARKET: DECISION-MAKING FACTORS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE FOCUS AREAS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE FOCUS AREAS

- FIGURE 31 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 32 CONNECTIVITY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 SECURITY HARDWARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 SATELLITE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 SECURITY AND SAFETY SOFTWARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 MANAGED SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 SMART HEALTHCARE VERTICAL TO RECORD HIGHEST GROWTH RATE

- FIGURE 38 NORTH AMERICA: IOT MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: IOT MARKET SNAPSHOT

- FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS IN IOT MARKET, 2022-2024

- FIGURE 41 SHARES OF LEADING COMPANIES IN IOT MARKET, 2024

- FIGURE 42 IOT MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 43 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 44 FINANCIAL METRICS OF KEY VENDORS, 2025

- FIGURE 45 IOT MARKET: COMPANY EVALUATION MATRIX (HARDWARE), 2024

- FIGURE 46 IOT MARKET: COMPANY EVALUATION MATRIX (SOFTWARE), 2024

- FIGURE 47 IOT MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 48 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 49 HUAWEI: COMPANY SNAPSHOT

- FIGURE 50 AMAZON WEB SERVICES, INC.: COMPANY SNAPSHOT

- FIGURE 51 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 52 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 54 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 55 SIEMENS: COMPANY SNAPSHOT

- FIGURE 56 ABB: COMPANY SNAPSHOT

- FIGURE 57 IBM: COMPANY SNAPSHOT

- FIGURE 58 IOT MARKET: RESEARCH DESIGN

- FIGURE 59 KEY DATA FROM SECONDARY SOURCES

- FIGURE 60 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 61 KEY DATA FROM PRIMARY SOURCES

- FIGURE 62 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 63 DATA TRIANGULATION

- FIGURE 64 RESEARCH METHODOLOGY: APPROACH 1

- FIGURE 65 APPROACH 1 (SUPPLY SIDE): REVENUE OF IOT MARKET

- FIGURE 66 APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF IOT VENDORS

- FIGURE 67 TOP-DOWN APPROACH

- FIGURE 68 BOTTOM-UP APPROACH