PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1906299

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1906299

Cloud FinOps Market Size by Application (Cost Management & Optimization, Budgeting & Forecasting, Cost Allocation & Chargeback, Reporting & Analytics, Workload Management & Optimization), Deployment (Single Cloud, Multi Cloud) - Global Forecast to 2030

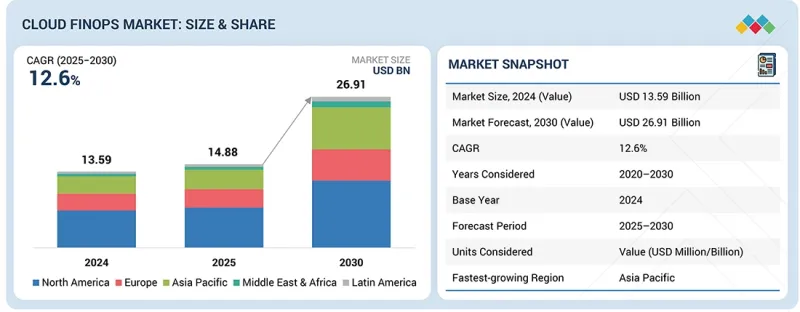

The global cloud FinOps market is expanding rapidly, with a projected market size anticipated to rise from about USD 14.88 billion in 2025 to USD 26.91 billion by 2030, featuring a CAGR of 12.6%. The global cloud FinOps market is expanding steadily, driven by rising regulatory audits that compel enterprises to implement robust financial control mechanisms across cloud environments and ensure compliance-ready cost governance.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Offering, Application/Capability, Deployment, Service Model, Organization Size, Vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

As cloud usage scales, cloud FinOps is enhancing data visibility by consolidating spend, usage, and allocation metrics, enabling stronger accountability and continuous optimization across finance, engineering, and business teams. The integration of dedicated cloud FinOps teams into existing organizational structures is further formalizing cloud financial management, aligning consumption decisions with budget ownership and operational priorities.

At the same time, cloud FinOps is significantly improving investment value realization by directly linking cloud spend to application performance, unit economics, and measurable business outcomes, thereby shifting enterprises toward value-based consumption models. However, market growth is restrained by fragmented financial and usage data systems that obstruct centralized cloud cost intelligence across multi-cloud estates. Persistent unnecessary cloud expense, driven by idle resources, overprovisioning, and inefficient purchasing models, continues to dilute optimization efforts. In addition, resistance to switching to cloud FinOps solutions, often due to cultural inertia and siloed ownership, slows adoption and maturity. Despite these challenges, increasing compliance pressure and cloud complexity reinforce cloud FinOps as a critical discipline for sustained financial governance.

"By vertical, healthcare & life sciences are estimated to account for the fastest growth rate during the forecast period."

Healthcare and life sciences organizations are accelerating their cloud adoption to support clinical systems, research analytics, imaging, genomics, and AI-driven diagnostics, while operating under strict regulatory and cost constraints. Cloud expenditure in this vertical is driven by data-intensive workloads, long-running analytics, and mission-critical applications where performance and compliance cannot be compromised. As a result, cloud FinOps adoption focuses on cost transparency, workload tiering, and allocation models aligned to care units, research programs, and therapeutic areas.

FinOps capabilities help organizations strike a balance between innovation and financial discipline by ensuring cloud usage remains predictable, auditable, and aligned with clinical and research priorities. In April 2025, Health Catalyst expanded its collaboration with Microsoft Azure to help healthcare providers improve operational and financial performance through cloud-based analytics platforms, where cost visibility and governance are integral to large-scale data processing. In July 2024, GE HealthCare and AWS deepened their strategic collaboration to support scalable imaging, diagnostics, and AI workloads in the cloud, underscoring the importance of disciplined cost management for high-volume and compute-intensive healthcare applications. These initiatives demonstrate that healthcare cloud modernization is increasingly paired with innovation and structured financial governance. For healthcare and life sciences organizations, FinOps is essential for sustaining a responsible cloud-driven transformation. It enables cost accountability, supports compliance readiness, and ensures that cloud investments directly contribute to improved patient outcomes, enhanced research efficiency, and increased operational resilience.

"Large enterprises are estimated to account for the largest market share during the forecast period."

Large enterprises represent a significant adoption segment within the cloud FinOps market due to the scale, complexity, and financial impact of their cloud environments. These organizations operate extensive multi-cloud and hybrid estates that span regions, business units, and product teams, making centralized visibility and consistent governance essential. FinOps capabilities for large enterprises emphasize advanced cost allocation, enterprise-wide reporting, predictive budgeting, and policy-driven governance that aligns engineering consumption with corporate financial controls. Integration with ERP, DevOps, and IT operations platforms is crucial for embedding FinOps into enterprise workflows and maintaining accountability across teams.

Strategic partnerships underscore enterprise demand for structured FinOps execution. In March 2025, Accenture expanded its collaboration with AWS to scale FinOps advisory and managed services for large enterprises seeking continuous optimization and governance across global cloud estates and complex cost structures. Additionally, in October 2024, IBM strengthened its cloud financial management portfolio by expanding enterprise integrations across hybrid and multi-cloud environments, bringing deeper cost transparency and governance to large organizations with complex allocation and compliance requirements. For emerging vendors and solution providers, large enterprises present an opportunity to deliver differentiated FinOps capabilities that complement hyperscaler tooling while addressing gaps in scale, integration, and governance depth. Solutions that offer automation, cross-cloud normalization, and seamless integration with enterprise ERP, ITSM, and DevOps ecosystems will be best positioned for adoption. Providers that can demonstrate measurable cost outcomes, support complex allocation models, and scale across global environments can establish long-term strategic relevance as large enterprises continue to formalize FinOps as a core financial and operational discipline.

"North America leads the cloud FinOps market due to early hyperscale cloud maturity, strict regulatory and audit requirements, and widespread enterprise adoption of native and third-party FinOps platforms to manage large-scale, multi-account cloud spend."

The cloud FinOps market in North America is shaped by advanced cloud maturity, stringent regulatory oversight, and the large-scale adoption of multi-cloud operating models by enterprises. Organizations across the US and Canada face heightened scrutiny from financial audits, data governance mandates, and internal compliance frameworks, driving strong demand for structured cloud financial control. Enterprises are increasingly embedding FinOps practices into core operations to manage complex spending patterns across compute, data platforms, and AI workloads.

North America also benefits from a mature ecosystem of hyperscale cloud providers, FinOps tooling vendors, and professional services firms that support rapid implementation and operationalization of FinOps frameworks. The increasing concentration of cloud spending among large enterprises, digital-native companies, and public sector agencies has intensified the need for real-time cost attribution, chargeback, and policy-driven budget enforcement. Additionally, widespread adoption of consumption-based pricing models has elevated the importance of continuous optimization and value realization. These factors position North America as a highly sophisticated cloud FinOps market, where financial governance is tightly integrated with cloud engineering and business decision-making.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the cloud FinOps market.

- By Company: Tier 1 - 33%, Tier 2 - 27%, and Tier 3 - 40%

- By Designation: C-level Executives - 46%, D-level Executives - 22%, and others - 32%

- By Region: North America - 40%, Europe - 28%, Asia Pacific - 27%, and Rest of the World - 5%

The report includes a study of key players offering cloud FinOps products. It profiles major vendors in the cloud FinOps market. The major market players include AWS (US), Microsoft (US), Google (US), Oracle (US), IBM (US), Hitachi (Japan), VMware (US), ServiceNow (US), Datadog (US), Flexera (US), Lumen Technologies (US), DoiT (US), Nutanix (US), Amdocs (US), BMC Software (US), HCL (India), Virtasant (US), OpenText (Canada), Accenture (Ireland), ManageEngine (US), SoftwareOne (US), CoreStack (US), Virtana (US), Cast AI (US), Anodot (US), Harness (US), CloudZero (US), PepperData (US), Spot (US), Unravel Data (US), and KubeCost (US).

Research Coverage

This research report categorizes the cloud FinOps market based on offering (solutions [native solutions, third party solutions], services [managed cloud FinOps services, professional services {FinOps advisory & strategy services, implementation & integration services, support & maintenance}]), application/capability (cost management & optimization, budgeting & forecasting, cost allocation & chargeback, reporting & analytics, workload optimization & management, other applications), deployment (deployment environment [single cloud, multi-cloud], deployment mode [public, private, hybrid]), service model (IaaS, PaaS, SaaS), organization size (large enterprises, SMEs), and vertical (IT & ITeS, BFSI, retail & consumer goods, healthcare & life sciences, media & entertainment, manufacturing, telecommunications, government & public sector, other verticals [energy & utilities, education]) and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the market. A detailed analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, and mergers and acquisitions; and recent developments associated with the cloud FinOps market. This report also covers the competitive analysis of upcoming startups in the market ecosystem.

Reason to buy this report

The report would provide market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall cloud FinOps market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (rising regulatory audits compel enterprises to implement financial control mechanisms, cloud FinOps enhances data visibility for accountability and optimization, Integrating cloud FinOps team into existing organizational structure, cloud FinOps significantly improves investment value realization), restraints (fragmented financial data systems obstruct centralized cloud cost intelligence deployment, unnecessary cloud expense (cloud waste), resistance to switch to cloud FinOps solutions), opportunities (embedding FinOps into SaaS offerings enables differentiated value propositions, opportunity to maximize Cloud ROI using cloud FinOps strategies, Leveraging automation tools to streamline FinOps implementation), and challenges (scaling FinOps maturity across global business units strains operating consistency, effective management of relationships and negotiations with several cloud service providers)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the cloud FinOps market

- Market Development: Comprehensive information about lucrative markets - the report analyses the cloud FinOps market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the cloud FinOps market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as AWS (US), Microsoft (US), Google (US), Oracle (US), IBM (US), Hitachi (Japan), VMware (US), ServiceNow (US), Datadog (US), Flexera (US), Lumen Technologies (US), DoiT (US), Nutanix (US), Amdocs (US), BMC Software (US), HCL (India), Virtasant (US), OpenText (Canada), Accenture (Ireland), ManageEngine (US), SoftwareOne (US), CoreStack (US), Virtana (US), Cast AI (US), Anodot (US), Harness (US), CloudZero (US), PepperData (US), Spot (US), Unravel Data (US), KubeCost (US); the report also helps stakeholders understand the cloud FinOps market's pulse and provides information on key market drivers, restraints, challenges, and opportunities

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE AND GROWTH RATE

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CLOUD FINOPS MARKET

- 3.2 CLOUD FINOPS MARKET, BY OFFERING

- 3.3 CLOUD FINOPS MARKET, BY APPLICATION/CAPABILITY

- 3.4 CLOUD FINOPS MARKET, BY DEPLOYMENT ENVIRONMENT

- 3.5 CLOUD FINOPS MARKET, BY DEPLOYMENT MODE

- 3.6 CLOUD FINOPS MARKET, BY ORGANIZATION SIZE

- 3.7 CLOUD FINOPS MARKET, BY SERVICE MODEL

- 3.8 CLOUD FINOPS MARKET, BY VERTICAL

- 3.9 CLOUD FINOPS MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising regulatory audits compel enterprises to implement financial control mechanisms

- 4.2.1.2 Cloud FinOps enhances data visibility for accountability and optimization

- 4.2.1.3 Integrating cloud FinOps team into existing organizational structure

- 4.2.1.4 Cloud FinOps culture significantly improves investment value realization

- 4.2.2 RESTRAINTS

- 4.2.2.1 Fragmented financial data systems obstruct centralized cloud cost intelligence deployment

- 4.2.2.2 Unnecessary cloud expenses (cloud waste)

- 4.2.2.3 Resistance to switching to cloud FinOps solutions

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Embedding FinOps into SaaS offerings enables differentiated value propositions

- 4.2.3.2 Opportunity to maximize cloud ROI using cloud FinOps strategies

- 4.2.3.3 Leveraging automation tools to streamline FinOps implementation

- 4.2.4 CHALLENGES

- 4.2.4.1 Scaling FinOps maturity across global business units strains operating consistency

- 4.2.4.2 Effective management of relationships and negotiations with several cloud service providers

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN CLOUD FINOPS MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.5.1 EMERGING BUSINESS MODELS

- 4.5.1.1 Cloud FinOps business models

- 4.5.2 ECOSYSTEM SHIFTS

- 4.5.1 EMERGING BUSINESS MODELS

- 4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.6.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF BUYERS

- 5.1.4 BARGAINING POWER OF SUPPLIERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS & FORECASTS

- 5.2.3 TRENDS IN GLOBAL CLOUD PERFORMANCE MANAGEMENT INDUSTRY

- 5.2.4 TRENDS IN GLOBAL INTEGRATED CLOUD MANAGEMENT PLATFORM INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.3.1 CLOUD SERVICE PROVIDERS

- 5.3.2 CLOUD FINOPS PLATFORMS AND TOOLS

- 5.3.3 MANAGED SERVICE PROVIDERS AND CONSULTING FIRMS

- 5.3.4 ENTERPRISE IT AND FINANCE DEPARTMENTS

- 5.3.5 SOFTWARE AND SOLUTION INTEGRATORS

- 5.3.6 REGULATORY AND COMPLIANCE BODIES

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING ANALYSIS

- 5.5.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTION

- 5.5.3 AVERAGE SELLING PRICE TREND

- 5.6 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 OPENTEXT OPTIMIZES CLOUD SPEND WITH HCMX FINOPS EXPRESS

- 5.9.2 ARKANSAS DEPARTMENT OF FINANCE AND ADMINISTRATION ENHANCES IT SECURITY AND COMPLIANCE WITH MANAGEENGINE ADAUDIT PLUS

- 5.9.3 ZORGSPECTRUM OPTIMIZES CLOUD SPENDING AND EFFICIENCY WITH SOFTWAREONE'S FINOPS

- 5.9.4 CORESTACK HELPS LOGICALIS TRANSFORM FINOPS INTO NEW BUSINESS OPPORTUNITIES

- 5.9.5 AWS OFFERED ENHANCED ACCOUNTABILITY AND GOVERNANCE ACROSS MEDIBANK'S BUSINESS UNITS

- 5.9.6 ABN AMRO REFINED COST OPTIMIZATION EFFORTS WITH MICROSOFT AZURE

- 5.9.7 ADOPTION OF APPTIO HELPED TUI GROUP ACHIEVE INFORMED CLOUD INVESTMENT DECISION-MAKING AND BETTER BUDGET TRACKING

- 5.10 IMPACT OF 2025 US TARIFF - CLOUD FINOPS MARKET

- 5.10.1 INTRODUCTION

- 5.10.2 KEY TARIFF RATES

- 5.10.3 PRICE IMPACT ANALYSIS

- 5.10.4 IMPACT ON COUNTRY/REGION

- 5.10.4.1 US

- 5.10.4.2 Europe

- 5.10.4.3 Asia Pacific

- 5.10.5 IMPACT ON VERTICALS

- 5.10.5.1 IT & ITeS

- 5.10.5.2 BFSI

- 5.10.5.3 Retail & Consumer Goods

- 5.10.5.4 Healthcare & Life Sciences

- 5.10.5.5 Media & Entertainment

- 5.10.5.6 Manufacturing

- 5.10.5.7 Telecommunications

- 5.10.5.8 Government & Public Sector

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 6.1 TECHNOLOGY ANALYSIS

- 6.1.1 KEY EMERGING TECHNOLOGIES

- 6.1.1.1 Real-Time cloud cost visibility platforms

- 6.1.1.2 Automated cost optimization engines

- 6.1.1.3 Cloud financial governance and policy management systems

- 6.1.2 COMPLEMENTARY TECHNOLOGIES

- 6.1.2.1 Cloud metering and usage analytics infrastructure

- 6.1.2.2 Tagging automation and metadata governance platforms

- 6.1.2.3 Cost allocation and chargeback systems

- 6.1.3 ADJACENT TECHNOLOGIES

- 6.1.3.1 Multi-cloud management platforms

- 6.1.3.2 Cloud billing exchange and marketplace systems

- 6.1.1 KEY EMERGING TECHNOLOGIES

- 6.2 TECHNOLOGY/PRODUCT ROADMAP

- 6.2.1 SHORT-TERM (2025-2027) | BILLING STANDARDIZATION AND AUTOMATION OF WASTE REDUCTION

- 6.2.1.1 Material development

- 6.2.1.2 Product innovations

- 6.2.1.3 Market adoption

- 6.2.2 MID-TERM (2027-2030) | ENGINEERING INTEGRATED AND BUSINESS ALIGNED FINOPS

- 6.2.2.1 Material development

- 6.2.2.2 Product innovations

- 6.2.2.3 Market adoption

- 6.2.3 LONG-TERM (2030-2035+) | AUTONOMOUS AND FINANCIALLY GOVERNED CLOUD OPERATIONS

- 6.2.3.1 Material development

- 6.2.3.2 Product innovations

- 6.2.3.3 Market adoption

- 6.2.1 SHORT-TERM (2025-2027) | BILLING STANDARDIZATION AND AUTOMATION OF WASTE REDUCTION

- 6.3 PATENT ANALYSIS

- 6.4 FUTURE APPLICATIONS

- 6.4.1 AUTONOMOUS SERVICE ORCHESTRATION AND SELF-HEALING CLOUD OPERATIONS

- 6.4.2 GREEN FINOPS AND SUSTAINABILITY-LINKED COST OPTIMIZATION

- 6.4.3 KUBERNETES-NATIVE FINOPS AND MICRO-SERVICE COST INTELLIGENCE

- 6.4.4 FINSECOPS-DRIVEN POLICY-AS-CODE FINOPS

- 6.4.5 UNIT-ECONOMICS-CENTRIC FINOPS AND SAAS PROFITABILITY ENGINEERING

- 6.5 IMPACT OF AI/GENERATIVE AI ON CLOUD FINOPS MARKET

- 6.5.1 TOP USE CASES AND MARKET POTENTIAL

- 6.5.2 BEST PRACTICES IN CLOUD FINOPS

- 6.5.3 CASE STUDY OF AI IMPLEMENTATION IN CLOUD FINOPS MARKET

- 6.5.4 INTERCONNECTED ADJACENCY ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.5.5 CLIENT READINESS TO ADOPT GENERATIVE AI IN CLOUD FINOPS MARKET

- 6.6 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.6.1 NOPS: INFORM

- 6.6.2 CORESTACK: FINOPS+

7 REGULATORY LANDSCAPE

- 7.1 REGULATORY LANDSCAPE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS, BY REGION

- 7.1.2.1 North America

- 7.1.2.2 Europe

- 7.1.2.3 Asia Pacific

- 7.1.2.4 Middle East & South Africa

- 7.1.2.5 Latin America

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS IN VARIOUS END-USER INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS

9 CLOUD FINOPS MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.1.1 OFFERING: CLOUD FINOPS MARKET DRIVERS

- 9.2 SOLUTIONS

- 9.2.1 ESSENTIAL FOR ENFORCING FINANCIAL DISCIPLINE AND VALUE ACCOUNTABILITY ACROSS CLOUD ENVIRONMENTS

- 9.2.2 NATIVE SOLUTIONS

- 9.2.2.1 Cloud financial governance driven by embedding cost controls directly into cloud operations

- 9.2.3 THIRD-PARTY SOLUTIONS

- 9.2.3.1 Unified cost governance and accountability enabled across complex multi-cloud environments

- 9.3 SERVICES

- 9.3.1 ENTERPRISES ENABLED TO OPERATIONALIZE COST GOVERNANCE AND SUSTAIN FINANCIAL ACCOUNTABILITY AT SCALE

- 9.3.2 MANAGED CLOUD FINOPS SERVICES

- 9.3.2.1 Operationalizing continuous cost optimization and governance for complex cloud environments

- 9.3.3 PROFESSIONAL SERVICES

- 9.3.3.1 Organizations enabled to operationalize cloud FinOps with sustained governance and measurable cost control

- 9.3.3.2 FinOps advisory & strategy services

- 9.3.3.3 Implementation & integration services

- 9.3.3.4 Support & maintenance

10 CLOUD FINOPS MARKET, BY APPLICATION/CAPABILITY

- 10.1 INTRODUCTION

- 10.1.1 APPLICATION/CAPABILITY: CLOUD FINOPS MARKET DRIVERS

- 10.2 COST MANAGEMENT & OPTIMIZATION

- 10.2.1 EMPOWERING ENTERPRISES TO REDUCE WASTE AND IMPROVE FINANCIAL ACCOUNTABILITY IN CLOUD OPERATIONS

- 10.2.2 CLOUD RATE OPTIMIZATION

- 10.2.3 RIGHTSIZING RECOMMENDATIONS

- 10.2.4 OTHER APPLICATIONS

- 10.3 BUDGETING & FORECASTING

- 10.3.1 PROVIDING FINANCIAL TRANSPARENCY AND PLANNING CONTROL TO ALIGN CLOUD EXPENDITURES WITH ORGANIZATIONAL GOALS

- 10.3.2 BUDGET PLANNING & CONTROLS

- 10.3.3 VARIANCE & TREND ANALYSIS

- 10.3.4 AUTOMATED BUDGET ALERTS

- 10.3.5 OTHER BUDGETING & FORECASTING APPLICATIONS

- 10.4 COST ALLOCATION & CHARGEBACK

- 10.4.1 DRIVING FINANCIAL OWNERSHIP AND TRANSPARENCY ACROSS SHARED CLOUD ENVIRONMENTS

- 10.4.2 COST & USAGE DATA INGESTION

- 10.4.3 CHARGEBACK AUTOMATION

- 10.4.4 OTHER COST ALLOCATION & CHARGEBACK APPLICATIONS

- 10.5 REPORTING & ANALYTICS

- 10.5.1 CONVERTING CLOUD CONSUMPTION DATA INTO ACTIONABLE FINANCIAL INTELLIGENCE

- 10.5.2 COST DASHBOARDS & KPIS

- 10.5.3 UNIT ECONOMICS

- 10.5.4 OTHER REPORTING & ANALYTICS APPLICATIONS

- 10.6 WORKLOAD OPTIMIZATION & MANAGEMENT

- 10.6.1 ALIGNING CLOUD PERFORMANCE REQUIREMENTS WITH CONTINUOUS COST EFFICIENCY

- 10.6.2 COMPUTE & STORAGE RIGHTSIZING

- 10.6.3 KUBERNETES COST OPTIMIZATION

- 10.6.4 OTHER WORKLOAD OPTIMIZATION & MANAGEMENT APPLICATIONS

- 10.7 OTHER APPLICATIONS

11 CLOUD FINOPS MARKET, BY DEPLOYMENT

- 11.1 INTRODUCTION

- 11.1.1 DEPLOYMENT: CLOUD FINOPS MARKET DRIVERS

- 11.2 DEPLOYMENT ENVIRONMENT

- 11.2.1 TAILORING FINOPS IMPLEMENTATION TO SINGLE-CLOUD OR MULTI-CLOUD OPERATIONAL REQUIREMENTS

- 11.2.2 SINGLE CLOUD

- 11.2.2.1 Enabling streamlined FinOps execution through deep native cost integration and governance

- 11.2.3 MULTI-CLOUD

- 11.2.3.1 Requiring unified FinOps governance to maintain cost control across providers

- 11.3 DEPLOYMENT MODE

- 11.3.1 DEPLOYMENT MODE DETERMINES HOW FINOPS GOVERNANCE AND COST CONTROLS ARE APPLIED ACROSS CLOUD INFRASTRUCTURES

- 11.3.2 PUBLIC

- 11.3.2.1 Requiring continuous FinOps control to manage variable and consumption-driven cloud expenditure

- 11.3.3 PRIVATE

- 11.3.3.1 Bringing consumption-based accountability to dedicated infrastructure environments

- 11.3.4 HYBRID

- 11.3.4.1 Unifying financial governance across public and private cloud environments

12 CLOUD FINOPS MARKET, BY SERVICE MODEL

- 12.1 INTRODUCTION

- 12.1.1 SERVICE MODEL: CLOUD FINOPS MARKET DRIVERS

- 12.2 IAAS

- 12.2.1 CONTROLLING HIGHLY VARIABLE INFRASTRUCTURE SPEND THROUGH CONTINUOUS VISIBILITY AND OPTIMIZATION

- 12.3 PAAS

- 12.3.1 DELIVERING VISIBILITY AND GOVERNANCE TAILORED TO MANAGED PLATFORM CONSUMPTION PATTERNS

- 12.4 SAAS

- 12.4.1 ENFORCING FINANCIAL DISCIPLINE ACROSS GROWING SUBSCRIPTION-BASED APPLICATION PORTFOLIOS

13 CLOUD FINOPS MARKET, BY ORGANIZATION SIZE

- 13.1 INTRODUCTION

- 13.1.1 ORGANIZATION SIZE: CLOUD FINOPS MARKET DRIVERS

- 13.2 LARGE ENTERPRISES

- 13.2.1 RELYING ON FINOPS TO GOVERN COMPLEX CLOUD SPEND AND ENFORCE FINANCIAL ACCOUNTABILITY AT SCALE

- 13.3 SMES

- 13.3.1 SMES LEVERAGE FINOPS TO CONTROL CLOUD COSTS EFFICIENTLY WHILE SUSTAINING GROWTH AND AGILITY

14 CLOUD FINOPS MARKET, BY VERTICAL

- 14.1 INTRODUCTION

- 14.1.1 VERTICAL: CLOUD FINOPS MARKET DRIVERS

- 14.2 IT & ITES

- 14.2.1 ENABLING IT & ITES ORGANIZATIONS TO GOVERN CLOUD COSTS WHILE SUSTAINING DELIVERY EFFICIENCY AND MARGIN DISCIPLINE

- 14.2.2 IT & ITES: USE CASES

- 14.2.2.1 Project-based cost attribution and margin control

- 14.2.2.2 DevOps and CI/CD cost Governance

- 14.2.2.3 Other IT & ITeS use cases

- 14.3 BFSI

- 14.3.1 ENABLING BFSI INSTITUTIONS TO BALANCE CLOUD INNOVATION WITH STRICT FINANCIAL GOVERNANCE AND REGULATORY CONTROL

- 14.3.2 BFSI: USE CASES

- 14.3.2.1 Regulatory-aligned cost allocation and audit readiness

- 14.3.2.2 Cost governance for risk analytics and fraud detection workloads

- 14.3.2.3 Other BFSI use cases

- 14.4 RETAIL & CONSUMER GOODS

- 14.4.1 HELPING RETAIL & CONSUMER GOODS DELIVER COST-ALIGNED CLOUD SCALABILITY ACROSS FLUCTUATING DEMAND AND OMNICHANNEL OPERATIONS

- 14.4.2 RETAIL & CONSUMER GOODS: USE CASES

- 14.4.2.1 Seasonal demand cost optimization

- 14.4.2.2 Marketing and personalization spend governance

- 14.4.2.3 Other retail & consumer goods use cases

- 14.5 HEALTHCARE & LIFE SCIENCES

- 14.5.1 ENABLING HEALTHCARE ORGANIZATIONS TO SCALE CLOUD INNOVATION WITH COMPLIANT AND ACCOUNTABLE COST GOVERNANCE

- 14.5.2 HEALTHCARE & LIFE SCIENCES: USE CASES

- 14.5.2.1 Clinical and imaging workload cost governance

- 14.5.2.2 Research and clinical trial cost management

- 14.5.2.3 Other healthcare & life sciences use cases

- 14.6 MEDIA & ENTERTAINMENT

- 14.6.1 ENABLING MEDIA & ENTERTAINMENT FIRMS TO GOVERN DYNAMIC CLOUD COSTS WHILE OPTIMIZING CONTENT DELIVERY AND AUDIENCE ENGAGEMENT OUTCOMES

- 14.6.2 MEDIA & ENTERTAINMENT: USE CASES

- 14.6.2.1 Streaming and live event cost governance

- 14.6.2.2 Content production and rendering cost optimization

- 14.6.2.3 Other media & entertainment use cases

- 14.7 MANUFACTURING

- 14.7.1 ENABLING MANUFACTURERS TO ALIGN CLOUD SPENDING WITH PRODUCTION EFFICIENCY AND INDUSTRIAL PERFORMANCE OUTCOMES

- 14.7.2 MANUFACTURING: USE CASES

- 14.7.2.1 Engineering simulation and digital twin cost optimization

- 14.7.2.2 Smart factory and IoT analytics cost governance

- 14.7.2.3 Other manufacturing use cases

- 14.8 TELECOMMUNICATIONS

- 14.8.1 ALLOWING TELECOM OPERATORS TO GOVERN LARGE-SCALE CLOUD SPENDING WHILE SUSTAINING NETWORK PERFORMANCE AND SERVICE RELIABILITY

- 14.8.2 TELECOMMUNICATIONS: USE CASES

- 14.8.2.1 Network analytics and cloud data platform cost governance

- 14.8.2.2 Cloud native network function cost management

- 14.8.2.3 Other telecommunications use cases

- 14.9 GOVERNMENT & PUBLIC SECTOR

- 14.9.1 SUPPORTING GOVERNMENT AND PUBLIC SECTOR ORGANIZATIONS IN GOVERNING CLOUD SPENDING WITH TRANSPARENCY, ACCOUNTABILITY, AND FISCAL DISCIPLINE

- 14.9.2 GOVERNMENT & PUBLIC SECTOR: USE CASES

- 14.9.2.1 Budget-aligned cloud spend governance

- 14.9.2.2 Shared services and multi-agency cost allocation

- 14.9.2.3 Other government & public sector use cases

- 14.10 OTHER VERTICALS

15 CLOUD FINOPS MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 US

- 15.2.1.1 Cloud FinOps adoption to accelerate through hyperscaler integration and platform consolidation

- 15.2.2 CANADA

- 15.2.2.1 Cloud FinOps adoption to strengthen through Governance-led enterprise and public sector demand

- 15.2.1 US

- 15.3 EUROPE

- 15.3.1 UK

- 15.3.1.1 Intensifying through public sector scale and enterprise governance

- 15.3.2 GERMANY

- 15.3.2.1 Advancing through cost Governance and cloud-native optimization

- 15.3.3 FRANCE

- 15.3.3.1 Momentum builds around sovereign cloud, regulation, and cost accountability

- 15.3.4 ITALY

- 15.3.4.1 Digital maturity, automation, and aging assets to reshape spare parts management landscape

- 15.3.5 REST OF EUROPE

- 15.3.1 UK

- 15.4 ASIA PACIFIC

- 15.4.1 CHINA

- 15.4.1.1 Accelerating adoption through large-scale cloud consumption and cost discipline

- 15.4.2 INDIA

- 15.4.2.1 Accelerating adoption through scale, cost sensitivity, and automation

- 15.4.3 JAPAN

- 15.4.3.1 Adoption deepens through governance, automation, and engineering integration

- 15.4.4 AUSTRALIA & NEW ZEALAND

- 15.4.4.1 Embedding financial discipline into cloud operations as enterprises move beyond basic cost control

- 15.4.5 REST OF ASIA PACIFIC

- 15.4.1 CHINA

- 15.5 MIDDLE EAST & AFRICA

- 15.5.1 GCC COUNTRIES

- 15.5.1.1 Saudi Arabia

- 15.5.1.1.1 Institutionalizing cloud FinOps to enforce cost accountability across Saudi Arabia's expanding cloud ecosystem

- 15.5.1.2 UAE

- 15.5.1.2.1 Embedding cloud FinOps to enforce cost accountability and governance across UAE's rapidly expanding cloud ecosystem

- 15.5.1.3 Other GCC countries

- 15.5.1.1 Saudi Arabia

- 15.5.2 SOUTH AFRICA

- 15.5.2.1 Operationalizing cloud FinOps to enforce cost governance and accountability across South Africa's expanding multi-cloud environments

- 15.5.3 REST OF MIDDLE EAST & AFRICA

- 15.5.1 GCC COUNTRIES

- 15.6 LATIN AMERICA

- 15.6.1 BRAZIL

- 15.6.1.1 Formalizing cloud financial governance as enterprises prioritize automation, cost accountability, and spend discipline

- 15.6.2 MEXICO

- 15.6.2.1 Institutionalizing cloud financial governance as enterprises demand automation, accountability, and tighter cost control

- 15.6.3 REST OF LATIN AMERICA

- 15.6.1 BRAZIL

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.3 REVENUE ANALYSIS, 2020-2024

- 16.4 MARKET SHARE ANALYSIS, 2024

- 16.5 BRAND/PRODUCT COMPARISON

- 16.5.1 MICROSOFT

- 16.5.2 AWS

- 16.5.3 GOOGLE

- 16.5.4 IBM

- 16.5.5 ORACLE

- 16.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.6.1 STARS

- 16.6.2 EMERGING LEADERS

- 16.6.3 PERVASIVE PLAYERS

- 16.6.4 PARTICIPANTS

- 16.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.6.5.1 Company footprint

- 16.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.7.1 PROGRESSIVE COMPANIES

- 16.7.2 RESPONSIVE COMPANIES

- 16.7.3 DYNAMIC COMPANIES

- 16.7.4 STARTING BLOCKS

- 16.7.5 COMPETITIVE BENCHMARKING: STARTUP/SMES, 2024

- 16.7.5.1 Detailed list of key startups/SMEs

- 16.7.5.2 Competitive benchmarking of key startups/SMEs

- 16.8 COMPANY VALUATION AND FINANCIAL METRICS

- 16.8.1 COMPANY VALUATION OF KEY VENDORS

- 16.8.2 FINANCIAL METRICS OF KEY VENDORS

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

17 COMPANY PROFILES

- 17.1 INTRODUCTION

- 17.2 MAJOR PLAYERS

- 17.2.1 AWS

- 17.2.1.1 Business overview

- 17.2.1.2 Products/Solutions/Services offered

- 17.2.1.3 Recent developments

- 17.2.1.3.1 Product launches and enhancements

- 17.2.1.3.2 Deals

- 17.2.1.4 MnM view

- 17.2.1.4.1 Right to win

- 17.2.1.4.2 Strategic choices

- 17.2.1.4.3 Weaknesses and competitive threats

- 17.2.2 MICROSOFT

- 17.2.2.1 Business overview

- 17.2.2.2 Products/Solutions/Services offered

- 17.2.2.3 Recent developments

- 17.2.2.3.1 Product launches and enhancements

- 17.2.2.3.2 Deals

- 17.2.2.4 MnM view

- 17.2.2.4.1 Right to win

- 17.2.2.4.2 Strategic choices

- 17.2.2.4.3 Weaknesses and competitive threats

- 17.2.3 GOOGLE

- 17.2.3.1 Business overview

- 17.2.3.2 Products/Solutions/Services offered

- 17.2.3.3 Recent developments

- 17.2.3.3.1 Product launches and enhancements

- 17.2.3.3.2 Deals

- 17.2.3.4 MnM view

- 17.2.3.4.1 Right to win

- 17.2.3.4.2 Strategic choices

- 17.2.3.4.3 Weaknesses and competitive threats

- 17.2.4 ORACLE

- 17.2.4.1 Business overview

- 17.2.4.2 Products/Solutions/Services offered

- 17.2.4.3 Recent developments

- 17.2.4.3.1 Product launches and enhancements

- 17.2.4.3.2 Deals

- 17.2.4.4 MnM view

- 17.2.4.4.1 Right to win

- 17.2.4.4.2 Strategic choices

- 17.2.4.4.3 Weaknesses and competitive threats

- 17.2.5 IBM

- 17.2.5.1 Business overview

- 17.2.5.2 Products/Solutions/Services offered

- 17.2.5.3 Recent developments

- 17.2.5.3.1 Recent developments

- 17.2.5.3.2 Deals

- 17.2.5.4 MnM view

- 17.2.5.4.1 Right to win

- 17.2.5.4.2 Strategic choices

- 17.2.5.4.3 Weaknesses and competitive threats

- 17.2.6 HITACHI

- 17.2.6.1 Business overview

- 17.2.6.2 Products/Solutions/Services offered

- 17.2.6.3 Recent developments

- 17.2.6.3.1 Product launches and enhancements

- 17.2.7 VMWARE

- 17.2.7.1 Business overview

- 17.2.7.2 Products/Solutions/Services offered

- 17.2.7.3 Recent developments

- 17.2.7.3.1 Product launches and enhancements

- 17.2.8 SERVICENOW

- 17.2.8.1 Business overview

- 17.2.8.2 Products/Solutions/Services offered

- 17.2.8.3 Recent developments

- 17.2.8.3.1 Product launches and enhancements

- 17.2.8.3.2 Deals

- 17.2.9 DATADOG

- 17.2.9.1 Business overview

- 17.2.9.2 Products/Solutions/Services offered

- 17.2.9.3 Recent developments

- 17.2.9.3.1 Product launches and enhancements

- 17.2.9.3.2 Deals

- 17.2.10 FLEXERA

- 17.2.10.1 Business overview

- 17.2.10.2 Products/Solutions/Services offered

- 17.2.10.3 Recent developments

- 17.2.10.3.1 Deals

- 17.2.11 ZESTY

- 17.2.11.1 Business overview

- 17.2.11.2 Products/Solutions/Services offered

- 17.2.11.3 Recent developments

- 17.2.11.3.1 Product launches

- 17.2.11.3.2 Deals

- 17.2.1 AWS

- 17.3 OTHER PLAYERS

- 17.3.1 NUTANIX

- 17.3.2 AMDOCS

- 17.3.3 BMC SOFTWARE

- 17.3.4 HCL

- 17.3.5 VIRTASANT

- 17.3.6 OPENTEXT

- 17.3.7 ACCENTURE

- 17.3.8 MANAGEENGINE

- 17.3.9 SOFTWAREONE

- 17.3.10 CORESTACK

- 17.3.11 VIRTANA

- 17.3.12 CAST AI

- 17.3.13 ANODOT

- 17.3.14 HARNESS

- 17.3.15 CLOUDZERO

- 17.3.16 PEPPERDATA

- 17.3.17 SPOT

- 17.3.18 UNRAVEL DATA

- 17.3.19 CENTILYTICS

- 17.3.20 KUBECOST

- 17.3.21 FINOUT

- 17.3.22 HYPERGLANCE

- 17.3.23 DELOITTE

- 17.3.24 ALIBABA CLOUD

- 17.3.25 ZESTY

- 17.3.26 NOPS

- 17.3.27 CLOUDAVOCADO

- 17.3.28 HASHICORP

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH APPROACH

- 18.1.1 SECONDARY DATA

- 18.1.2 PRIMARY DATA

- 18.1.2.1 Breakdown of primary profiles

- 18.1.2.2 Key industry insights

- 18.2 DATA TRIANGULATION

- 18.3 MARKET SIZE ESTIMATION

- 18.4 MARKET FORECAST

- 18.5 RESEARCH ASSUMPTIONS

- 18.6 STUDY LIMITATIONS

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES, 2019-2024

- TABLE 3 IMPACT OF PORTER'S FIVE FORCES ON CLOUD FINOPS MARKET

- TABLE 4 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 5 CLOUD FINOPS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 INDICATIVE PRICING ANALYSIS OF CLOUD FINOPS MARKET, BY KEY PLAYER

- TABLE 7 CLOUD FINOPS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 8 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 9 LIST OF GRANTED PATENTS IN CLOUD FINOPS MARKET, 2023-2025

- TABLE 10 TOP USE CASES AND MARKET POTENTIAL

- TABLE 11 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 12 WIPRO AND GOOGLE CLOUD AI-DRIVEN CLOUD FINOPS OPTIMIZATION AND ENTERPRISE TRANSFORMATION

- TABLE 13 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPLICATIONS FOR MARKET PLAYERS

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 19 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 20 CLOUD FINOPS MARKET: UNMET NEEDS IN KEY END-USER INDUSTRIES

- TABLE 21 CLOUD FINOPS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 22 CLOUD FINOPS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 23 CLOUD FINOPS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 24 CLOUD FINOPS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 25 CLOUD FINOPS SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 CLOUD FINOPS SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 NATIVE CLOUD FINOPS SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 NATIVE CLOUD FINOPS SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 THIRD-PARTY CLOUD FINOPS SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 THIRD-PARTY CLOUD FINOPS SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 CLOUD FINOPS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 32 CLOUD FINOPS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 33 CLOUD FINOPS SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 CLOUD FINOPS SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 MANAGED CLOUD FINOPS SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 MANAGED CLOUD FINOPS SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 CLOUD FINOPS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 38 CLOUD FINOPS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 39 PROFESSIONAL CLOUD FINOPS SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 PROFESSIONAL CLOUD FINOPS SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 FINOPS ADVISORY & STRATEGY SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 FINOPS ADVISORY & STRATEGY SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 IMPLEMENTATION & INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 IMPLEMENTATION & INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 SUPPORT & MAINTENANCE SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 SUPPORT & MAINTENANCE SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 CLOUD FINOPS MARKET, BY APPLICATION/CAPABILITY, 2020-2024 (USD MILLION)

- TABLE 48 CLOUD FINOPS MARKET, BY APPLICATION/CAPABILITY, 2025-2030 (USD MILLION)

- TABLE 49 CLOUD FINOPS MARKET IN COST MANAGEMENT & OPTIMIZATION, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 CLOUD FINOPS MARKET IN COST MANAGEMENT & OPTIMIZATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 CLOUD FINOPS MARKET IN BUDGETING & FORECASTING, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 CLOUD FINOPS MARKET IN BUDGETING & FORECASTING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 CLOUD FINOPS MARKET IN COST ALLOCATION & CHARGEBACK, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 CLOUD FINOPS MARKET IN COST ALLOCATION & CHARGEBACK, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 CLOUD FINOPS MARKET IN REPORTING & ANALYTICS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 CLOUD FINOPS MARKET IN REPORTING & ANALYTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 CLOUD FINOPS MARKET IN WORKLOAD OPTIMIZATION & MANAGEMENT, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 CLOUD FINOPS MARKET IN WORKLOAD OPTIMIZATION & MANAGEMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 CLOUD FINOPS MARKET IN OTHER APPLICATIONS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 CLOUD FINOPS MARKET IN OTHER APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 CLOUD FINOPS MARKET, BY DEPLOYMENT ENVIRONMENT, 2020-2024 (USD MILLION)

- TABLE 62 CLOUD FINOPS MARKET, BY DEPLOYMENT ENVIRONMENT, 2025-2030 (USD MILLION)

- TABLE 63 SINGLE CLOUD FINOPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 SINGLE CLOUD FINOPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 MULTI-CLOUD FINOPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 MULTI-CLOUD FINOPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 CLOUD FINOPS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 68 CLOUD FINOPS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 69 PUBLIC CLOUD FINOPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 PUBLIC CLOUD FINOPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 PRIVATE CLOUD FINOPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 PRIVATE CLOUD FINOPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 HYBRID CLOUD FINOPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 74 HYBRID CLOUD FINOPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 CLOUD FINOPS MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 76 CLOUD FINOPS MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 77 IAAS IN CLOUD FINOPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 78 IAAS IN CLOUD FINOPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 PAAS IN CLOUD FINOPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 80 PAAS IN CLOUD FINOPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 SAAS IN CLOUD FINOPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 82 SAAS IN CLOUD FINOPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 84 CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 85 CLOUD FINOPS MARKET FOR LARGE ENTERPRISES, BY REGION, 2020-2024 (USD MILLION)

- TABLE 86 CLOUD FINOPS MARKET FOR LARGE ENTERPRISES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 CLOUD FINOPS MARKET FOR SMES, BY REGION, 2020-2024 (USD MILLION)

- TABLE 88 CLOUD FINOPS MARKET FOR SMES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 CLOUD FINOPS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 90 CLOUD FINOPS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 91 CLOUD FINOPS MARKET IN IT & ITES, BY REGION, 2020-2024 (USD MILLION)

- TABLE 92 CLOUD FINOPS MARKET IN IT & ITES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 CLOUD FINOPS MARKET IN BFSI, BY REGION, 2020-2024 (USD MILLION)

- TABLE 94 CLOUD FINOPS MARKET IN BFSI, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 CLOUD FINOPS MARKET IN RETAIL & CONSUMER GOODS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 96 CLOUD FINOPS MARKET IN RETAIL & CONSUMER GOODS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 CLOUD FINOPS MARKET IN HEALTHCARE & LIFE SCIENCES, BY REGION, 2020-2024 (USD MILLION)

- TABLE 98 CLOUD FINOPS MARKET IN HEALTHCARE & LIFE SCIENCES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 CLOUD FINOPS MARKET IN MEDIA & ENTERTAINMENT, BY REGION, 2020-2024 (USD MILLION)

- TABLE 100 CLOUD FINOPS MARKET IN MEDIA & ENTERTAINMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 CLOUD FINOPS MARKET IN MANUFACTURING, BY REGION, 2020-2024 (USD MILLION)

- TABLE 102 CLOUD FINOPS MARKET IN MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 CLOUD FINOPS MARKET IN TELECOMMUNICATIONS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 104 CLOUD FINOPS MARKET IN TELECOMMUNICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 CLOUD FINOPS MARKET IN GOVERNMENT & PUBLIC SECTOR, BY REGION, 2020-2024 (USD MILLION)

- TABLE 106 CLOUD FINOPS MARKET IN GOVERNMENT & PUBLIC SECTOR, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 CLOUD FINOPS MARKET IN OTHER VERTICALS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 108 CLOUD FINOPS MARKET IN OTHER VERTICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 CLOUD FINOPS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 110 CLOUD FINOPS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: CLOUD FINOPS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: CLOUD FINOPS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: CLOUD FINOPS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 114 NORTH AMERICA: CLOUD FINOPS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: CLOUD FINOPS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: CLOUD FINOPS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: CLOUD FINOPS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 118 NORTH AMERICA: CLOUD FINOPS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: CLOUD FINOPS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 120 NORTH AMERICA: CLOUD FINOPS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: CLOUD FINOPS MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 122 NORTH AMERICA: CLOUD FINOPS MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 123 NORTH AMERICA: CLOUD FINOPS MARKET, BY DEPLOYMENT ENVIRONMENT, 2020-2024 (USD MILLION)

- TABLE 124 NORTH AMERICA: CLOUD FINOPS MARKET, BY DEPLOYMENT ENVIRONMENT, 2025-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: CLOUD FINOPS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 126 NORTH AMERICA: CLOUD FINOPS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 127 NORTH AMERICA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 128 NORTH AMERICA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 129 NORTH AMERICA: CLOUD FINOPS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 130 NORTH AMERICA: CLOUD FINOPS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: CLOUD FINOPS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 132 NORTH AMERICA: CLOUD FINOPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 133 US: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 134 US: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 135 CANADA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 136 CANADA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 137 EUROPE: CLOUD FINOPS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 138 EUROPE: CLOUD FINOPS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 139 EUROPE: CLOUD FINOPS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 140 EUROPE: CLOUD FINOPS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 141 EUROPE: CLOUD FINOPS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 142 EUROPE: CLOUD FINOPS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 143 EUROPE: CLOUD FINOPS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 144 EUROPE: CLOUD FINOPS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 145 EUROPE: CLOUD FINOPS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 146 EUROPE: CLOUD FINOPS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 EUROPE: CLOUD FINOPS MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 148 EUROPE: CLOUD FINOPS MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 149 EUROPE: CLOUD FINOPS MARKET, BY DEPLOYMENT ENVIRONMENT, 2020-2024 (USD MILLION)

- TABLE 150 EUROPE: CLOUD FINOPS MARKET, BY DEPLOYMENT ENVIRONMENT, 2025-2030 (USD MILLION)

- TABLE 151 EUROPE: CLOUD FINOPS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 152 EUROPE: CLOUD FINOPS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 153 EUROPE: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 154 EUROPE: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 155 EUROPE: CLOUD FINOPS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 156 EUROPE: CLOUD FINOPS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 157 EUROPE: CLOUD FINOPS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 158 EUROPE: CLOUD FINOPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 159 UK: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 160 UK: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 161 GERMANY: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 162 GERMANY: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 163 FRANCE: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 164 FRANCE: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 165 ITALY: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 166 ITALY: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 167 REST OF EUROPE: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 168 REST OF EUROPE: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 169 ASIA PACIFIC: CLOUD FINOPS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 170 ASIA PACIFIC: CLOUD FINOPS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: CLOUD FINOPS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 172 ASIA PACIFIC: CLOUD FINOPS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: CLOUD FINOPS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 174 ASIA PACIFIC: CLOUD FINOPS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 175 ASIA PACIFIC: CLOUD FINOPS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 176 ASIA PACIFIC: CLOUD FINOPS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 177 ASIA PACIFIC: CLOUD FINOPS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 178 ASIA PACIFIC: CLOUD FINOPS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 179 ASIA PACIFIC: CLOUD FINOPS MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 180 ASIA PACIFIC: CLOUD FINOPS MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: CLOUD FINOPS MARKET, BY DEPLOYMENT ENVIRONMENT, 2020-2024 (USD MILLION)

- TABLE 182 ASIA PACIFIC: CLOUD FINOPS MARKET, BY DEPLOYMENT ENVIRONMENT, 2025-2030 (USD MILLION)

- TABLE 183 ASIA PACIFIC: CLOUD FINOPS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 184 ASIA PACIFIC: CLOUD FINOPS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 185 ASIA PACIFIC: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 186 ASIA PACIFIC: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 187 ASIA PACIFIC: CLOUD FINOPS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 188 ASIA PACIFIC: CLOUD FINOPS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: CLOUD FINOPS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 190 ASIA PACIFIC: CLOUD FINOPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 191 CHINA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 192 CHINA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 193 INDIA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 194 INDIA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 195 JAPAN: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 196 JAPAN: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 197 AUSTRALIA AND NEW ZEALAND: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 198 AUSTRALIA AND NEW ZEALAND: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 199 REST OF ASIA PACIFIC: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 200 REST OF ASIA PACIFIC: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY DEPLOYMENT ENVIRONMENT, 2020-2024 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY DEPLOYMENT ENVIRONMENT, 2025-2030 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 223 GCC COUNTRIES: CLOUD FINOPS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 224 GCC COUNTRIES: CLOUD FINOPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 225 GCC COUNTRIES: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 226 GCC COUNTRIES: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 227 SAUDI ARABIA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 228 SAUDI ARABIA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 229 UAE: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 230 UAE: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 231 OTHER GCC COUNTRIES: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 232 OTHER GCC COUNTRIES: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 233 SOUTH AFRICA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 234 SOUTH AFRICA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 235 REST OF MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 236 REST OF MIDDLE EAST & AFRICA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 237 LATIN AMERICA: CLOUD FINOPS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 238 LATIN AMERICA: CLOUD FINOPS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 239 LATIN AMERICA: CLOUD FINOPS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 240 LATIN AMERICA: CLOUD FINOPS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 241 LATIN AMERICA: CLOUD FINOPS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 242 LATIN AMERICA: CLOUD FINOPS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 243 LATIN AMERICA: CLOUD FINOPS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 244 LATIN AMERICA: CLOUD FINOPS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 245 LATIN AMERICA: CLOUD FINOPS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 246 LATIN AMERICA: CLOUD FINOPS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 247 LATIN AMERICA: CLOUD FINOPS MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 248 LATIN AMERICA: CLOUD FINOPS MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 249 LATIN AMERICA: CLOUD FINOPS MARKET, BY DEPLOYMENT ENVIRONMENT, 2020-2024 (USD MILLION)

- TABLE 250 LATIN AMERICA: CLOUD FINOPS MARKET, BY DEPLOYMENT ENVIRONMENT, 2025-2030 (USD MILLION)

- TABLE 251 LATIN AMERICA: CLOUD FINOPS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 252 LATIN AMERICA: CLOUD FINOPS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 253 LATIN AMERICA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 254 LATIN AMERICA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 255 LATIN AMERICA: CLOUD FINOPS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 256 LATIN AMERICA: CLOUD FINOPS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 257 LATIN AMERICA: CLOUD FINOPS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 258 LATIN AMERICA: CLOUD FINOPS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 259 BRAZIL: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 260 BRAZIL: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 261 MEXICO: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 262 MEXICO: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 263 REST OF LATIN AMERICA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 264 REST OF LATIN AMERICA: CLOUD FINOPS MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 265 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

- TABLE 266 MARKET SHARE OF KEY VENDORS, 2024

- TABLE 267 CLOUD FINOPS MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 268 CLOUD FINOPS MARKET: OFFERING FOOTPRINT, 2024

- TABLE 269 CLOUD FINOPS MARKET: VERTICAL FOOTPRINT, 2024

- TABLE 270 CLOUD FINOPS MARKET: LIST OF KEY STARTUPS/SMES, 2024

- TABLE 271 CLOUD FINOPS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 272 CLOUD FINOPS MARKET: PRODUCT LAUNCHES, NOVEMBER 2021-NOVEMBER 2025

- TABLE 273 CLOUD FINOPS MARKET: DEALS, NOVEMBER 2021-OCTOBER 2025

- TABLE 274 AWS: COMPANY OVERVIEW

- TABLE 275 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 277 AWS: DEALS

- TABLE 278 MICROSOFT: COMPANY OVERVIEW

- TABLE 279 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 281 MICROSOFT: DEALS

- TABLE 282 GOOGLE: COMPANY OVERVIEW

- TABLE 283 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 285 GOOGLE: DEALS

- TABLE 286 ORACLE: COMPANY OVERVIEW

- TABLE 287 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 289 ORACLE: DEALS

- TABLE 290 IBM: COMPANY OVERVIEW

- TABLE 291 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 IBM: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 293 IBM: DEALS

- TABLE 294 HITACHI: COMPANY OVERVIEW

- TABLE 295 HITACHI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 HITACHI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 297 VMWARE: COMPANY OVERVIEW

- TABLE 298 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 VMWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 300 VMWARE: DEALS

- TABLE 301 SERVICENOW: COMPANY OVERVIEW

- TABLE 302 SERVICENOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 303 SERVICENOW: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 304 SERVICENOW: DEALS

- TABLE 305 DATADOG: COMPANY OVERVIEW

- TABLE 306 DATADOG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 307 DATADOG: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 308 DATADOG: DEALS

- TABLE 309 FLEXERA: COMPANY OVERVIEW

- TABLE 310 FLEXERA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 311 FLEXERA: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 312 FLEXERA: DEALS

- TABLE 313 ZESTY: COMPANY OVERVIEW

- TABLE 314 ZESTY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 ZESTY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 316 ZESTY: DEALS

- TABLE 317 FACTOR ANALYSIS

- TABLE 318 RESEARCH ASSUMPTIONS

List of Figures

- FIGURE 1 CLOUD FINOPS MARKET SEGMENTATION

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 4 CLOUD FINOPS MARKET GROWTH TREND, BY OFFERING, 2025-2030 (USD MILLION)

- FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN CLOUD FINOPS MARKET, 2022-2025

- FIGURE 6 DISRUPTIVE TRENDS IMPACTING GROWTH OF CLOUD FINOPS MARKET

- FIGURE 7 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN CLOUD FINOPS MARKET, 2025

- FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 9 RISING EQUIPMENT UPTIME DEMANDS AND SERVICE COMPLEXITY TO DRIVE MARKET

- FIGURE 10 CLOUD FINOPS SOLUTIONS TO ACCOUNT FOR DOMINANT MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 COST MANAGEMENT & OPTIMIZATION TO ACCOUNT FOR LARGEST SHARE AMONG APPLICATIONS DURING FORECAST PERIOD

- FIGURE 12 MULTI-CLOUD FINOPS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 PUBLIC CLOUD DEPLOYMENT TO SIGNIFICANTLY LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 LARGE ENTERPRISES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 SAAS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 IT & ITES TO LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 NORTH AMERICA TO EMERGE AS MOST SIGNIFICANT MARKET IN NEXT FIVE YEARS

- FIGURE 18 CLOUD FINOPS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 KEY PRIORITIES OF FINOPS PRACTITIONERS

- FIGURE 20 CLOUD FINOPS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 CLOUD FINOPS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 CLOUD FINOPS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTION, 2024 (USD)

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 CLOUD FINOPS MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 26 PATENTS APPLIED AND GRANTED, 2015-2025

- FIGURE 27 FUTURE APPLICATIONS OF CLOUD FINOPS

- FIGURE 28 CLOUD FINOPS MARKET: DECISION-MAKING FACTOR

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 31 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 32 SOLUTIONS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 33 COST MANAGEMENT & OPTIMIZATION TO BE LARGEST APPLICATION/CAPABILITY

- FIGURE 34 MULTI CLOUD TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 35 PUBLIC DEPLOYMENT MODE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 36 SAAS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 37 LARGE ENTERPRISES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 38 IT & ITES TO DOMINATE CLOUD FINOPS MARKET DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA TO REGISTER LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA: CLOUD FINOPS MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: CLOUD FINOPS MARKET SNAPSHOT

- FIGURE 42 REVENUE ANALYSIS OF KEY VENDORS, 2020-2024 (USD MILLION)

- FIGURE 43 CLOUD FINOPS MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 44 CLOUD FINOPS MARKET: COMPARATIVE ANALYSIS FOR PRODUCTS

- FIGURE 45 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 46 CLOUD FINOPS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 CLOUD FINOPS MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 48 CLOUD FINOPS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 COMPANY VALUATION OF KEY VENDORS, 2025 (USD BILLION)

- FIGURE 50 FINANCIAL METRICS OF KEY VENDORS, 2025

- FIGURE 51 YEAR-TO-DATE (YTD) PRICE, TOTAL RETURN, AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 52 AWS: COMPANY SNAPSHOT

- FIGURE 53 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 54 GOOGLE: COMPANY SNAPSHOT

- FIGURE 55 ORACLE: COMPANY SNAPSHOT

- FIGURE 56 IBM: COMPANY SNAPSHOT

- FIGURE 57 HITACHI: COMPANY SNAPSHOT

- FIGURE 58 SERVICENOW: COMPANY SNAPSHOT

- FIGURE 59 DATADOG: COMPANY SNAPSHOT

- FIGURE 60 CLOUD FINOPS MARKET: RESEARCH DESIGN

- FIGURE 61 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 62 INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 63 CLOUD FINOPS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 64 SUPPLY SIDE ANALYSIS

- FIGURE 65 BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF CLOUD FINOPS VENDORS

- FIGURE 66 ILLUSTRATION OF VENDOR REVENUE ESTIMATION (SUPPLY SIDE)

- FIGURE 67 REVENUE GENERATED FROM OFFERINGS (DEMAND SIDE)

- FIGURE 68 CLOUD FINOPS MARKET (DEMAND SIDE)