PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1800743

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1800743

Transportation Management System Market by Solutions (Planning & Execution, Order Management, Analytics & Reporting, Routing & Tracking), Transportation Mode (Roadways, Railways, Airways, Maritime), and End User - Global Forecast to 2030

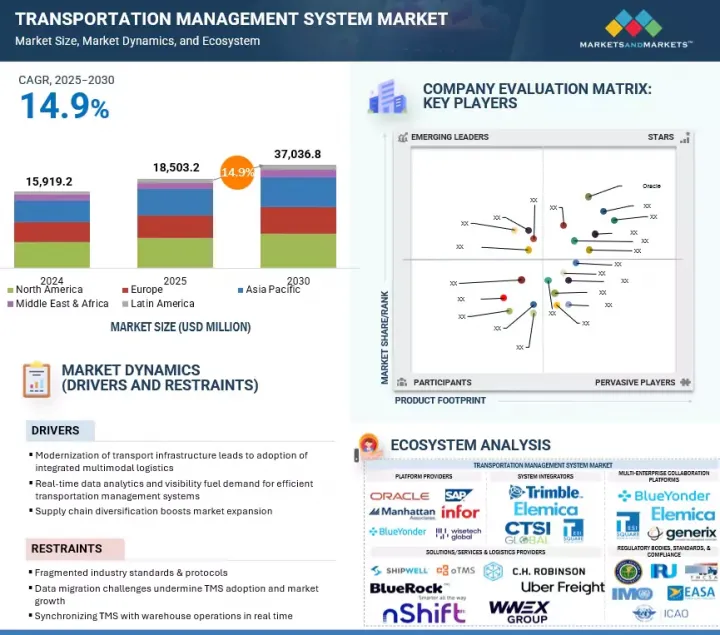

The transportation management system (TMS) market is estimated to be USD 18,503.2 million in 2025 and is projected to reach USD 37,036.8 million by 2030 at a CAGR of 14.9%. Technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) are significantly enhancing TMS capabilities.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | Offering (solutions and services), transportation mode, end user, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

AI and ML algorithms can predict demand patterns, optimize routes in real-time, and automate decision-making processes, reducing human error and increasing efficiency. IoT devices provide real-time data from vehicles and shipments, allowing for proactive management of transportation operations. These technologies improve operational efficiency and enable better strategic planning and forecasting.

However, fragmented standards in freight documentation, telematics, and regulatory filings hinder TMS adoption by increasing costs and limiting scalability for logistics providers. Carriers often use proprietary EDI formats, Europe favors XML, and emerging markets prioritize API-first JSON schemas. This protocol fragmentation restricts market growth and undermines economies of scale.

"Managed services segment is projected to register the highest CAGR during the forecast period"

The managed services segment is projected to register the highest CAGR in the transportation management system (TMS) market, fueled by the growing demand for end-to-end logistics optimization, real-time freight visibility, and scalable, cost-effective transportation solutions. Managed services allow businesses to outsource complex transportation planning, execution, and analytics, enabling them to focus on core operations while benefiting from expert process management and advanced technology. Leading industry examples, such as C.H. Robinson's Managed TMS and Uber Freight's technology-enabled managed transportation services, demonstrate how global shippers are leveraging managed solutions for continuous process improvement, lower operational costs, and enhanced service quality.

Recent trends include the integration of artificial intelligence, machine learning, and real-time tracking, which support omnichannel logistics and proactive issue resolution. As companies invest more in digital transformation and customizable logistics strategies, managed services are increasingly essential for driving supply chain resilience and strategic advantage in an evolving market landscape.

"Third-party logistics providers end user segment is expected to hold the largest market share during the forecast period"

The third-party logistics providers (3PLs) end user segment is projected to be the largest contributor to the transportation management system (TMS) market due to its pivotal role in streamlining and optimizing complex supply chains for a diverse range of clients. 3PLs act as supply chain integrators, leveraging TMS platforms to manage high transaction volumes and coordinate multi-modal shipments across global networks. Their operations demand advanced capabilities such as real-time freight visibility, dynamic routing, automated carrier selection, and seamless integration with shippers' ERP and warehouse systems.

Industry leaders, such as C.H. Robinson, have demonstrated the transformative power of TMS through technology-enabled managed transportation services, offering shippers flexible, scalable, and data-driven logistics solutions. Similarly, WWEX Group and Uber Freight have utilized TMS-driven digital brokerage platforms to enhance shipment transparency, improve carrier engagement, and deliver superior customer service. The centrality of 3PLs in orchestrating end-to-end logistics, combined with their adoption of cutting-edge TMS solutions, positions them as the largest and most influential end-user group in the TMS market.

"Asia Pacific will register the highest growth rate while North America will hold the largest market during the forecast period"

Asia Pacific is poised to achieve the highest growth rate, propelled by accelerated digitalization, ambitious government infrastructure projects, and regulatory advancements. China and India are rolling out large-scale smart city and logistics corridor initiatives, while governments across the region are actively incentivizing cloud adoption and real-time data integration in transport networks. New regulations, such as Singapore's environmental compliance standards and Japan's push for digital freight documentation, support sustainable logistics and operational transparency. Regional TMS providers are rapidly launching AI-powered, cloud-based platforms tailored for local e-commerce and supply chain needs, further fueling Asia Pacific's robust TMS market expansion.

The North American market remains the global leader, propelled by significant technological innovations, critical regulatory changes, and strategic growth initiatives within the industry. This dominance is underpinned by the swift transition to cloud-based solutions, comprehensive integration of Internet of Things (IoT) frameworks, and the advanced use of artificial intelligence for dynamic routing and real-time data analytics. These developments substantially enhance operational visibility and efficiency for logistics providers and shippers, optimizing supply chain performance and responsiveness.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 18%, Tier 2 - 44%, and Tier 3 - 38%

- By Designation: C-level - 32%, D-level - 36%, and Managers - 32%

- By Region: North America - 38%, Europe - 26%, Asia Pacific - 18%, Middle East & Africa - 10%, and Latin America - 8%.

The major players in the TMS market are Oracle (US), SAP (Germany), Manhattan Associates (US), C.H. Robinson (US), Trimble (US), Wisetech Global (Australia), Descartes (Canada), Generix Group (France), Korber AG (Germany), Blue Yonder (US), Uber Freight (US), Alpega Group (Belgium), WWEX Group (US), and Infor (US). These players have adopted various growth strategies, such as partnerships, agreements, collaborations, new product launches, product enhancements, and acquisitions, to expand their TMS footprint.

Research Coverage

The market study covers the TMS market size across different segments. It aims to estimate the market size and the growth potential across various segments, including offering (solutions and services), transportation mode, end user, vertical, and regions. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global TMS market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

1. Analysis of key drivers (Modernization of transport infrastructure leading to adoption of integrated multimodal logistics, Real-time data analytics and visibility fuels demand for efficient transportation management systems, Supply chain diversification is a catalyst for market expansion), restraints (Fragmented industry standards & protocols, Data migration challenges undermine TMS adoption and market growth, Synchronizing TMS with warehouse operations in real time), opportunities (Push for sustainability and green logistics, Smart-city and urban logistics integration, Advanced reverse-logistics orchestration), and challenges (Trade tensions and tariff volatility suppress market momentum, System integration complexities between TMS and enterprise systems, Bridging EDI and API workflows for seamless TMS integration) influencing the growth of the transportation management system market

2. Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product and service launches in the TMS market

3. Market Development: Comprehensive information about lucrative markets - the report analyses various regions' TMS markets

4. Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the TMS market

5. Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Oracle (US), SAP (Germany), Manhattan Associates (US), C.H. Robinson (US), Trimble (US), Wisetech Global (Australia), Descartes (Canada), Generix Group (France), Korber AG (Germany), Blue Yonder (US), Uber Freight (US), Alpega Group (Belgium), WWEX Group (US), and Infor (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 TRANSPORTATION MANAGEMENT SYSTEM MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TRANSPORTATION MANAGEMENT SYSTEM MARKET

- 4.2 NORTH AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END-USERS AND COUNTRY

- 4.3 ASIA PACIFIC: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE AND COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Modernization of transport infrastructure leading to adoption of integrated multimodal logistics

- 5.2.1.2 Real-time data analytics and visibility to fuel demand for efficient transportation management systems

- 5.2.1.3 Supply chain diversification to fuel market expansion

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fragmented industry standards & protocols

- 5.2.2.2 Data migration challenges undermine TMS adoption and market growth

- 5.2.2.3 Synchronizing TMS with warehouse operations in real time

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Push for sustainability and green logistics

- 5.2.3.2 Smart city and urban logistics integration

- 5.2.3.3 Advanced reverse-logistics orchestration

- 5.2.4 CHALLENGES

- 5.2.4.1 Trade tensions and tariff volatility suppress market momentum

- 5.2.4.2 System integration complexities between TMS and enterprise systems

- 5.2.4.3 Bridging EDI and API workflows for seamless TMS integration

- 5.2.1 DRIVERS

- 5.3 HISTORY OF TRANSPORTATION MANAGEMENT SYSTEM

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 PLATFORM PROVIDERS

- 5.4.2 SYSTEM INTEGRATORS

- 5.4.3 SOLUTIONS/SERVICES & LOGISTICS PROVIDERS

- 5.4.4 MULTI-ENTERPRISE COLLABORATION PLATFORMS

- 5.4.5 REGULATORY BODIES, STANDARDS, & COMPLIANCE

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 CASE STUDY 1: TETRA PAK MODERNIZES GLOBAL LOGISTICS WITH ORACLE CLOUD

- 5.5.2 CASE STUDY 2: SAP HELPS XIWEI BUILD EFFICIENT TRANSPORTATION AND DELIVERY PLATFORM

- 5.5.3 CASE STUDY 3: CARHARTT IMPLEMENTS MANHATTAN TMS SOLUTION IN SUPPLY CHAIN

- 5.5.4 CASE STUDY 4: BILLERUD RESHAPES OUTBOUND LOGISTICS WITH MERCURYGATE TMS

- 5.5.5 CASE STUDY 5: TRIMBLE TRANSPORTATION SOLUTIONS DRIVE EFFICIENCY AND INNOVATION AT MCCOY GROUP

- 5.5.6 CASE STUDY 6: AVERY DENNISON ADOPTS TRANSPLACE TMS TO SIMPLIFY CUSTOMS COMPLIANCE IN US AND MEXICO

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF TMS SOLUTIONS & SERVICES, BY KEY PLAYERS, 2024

- 5.7.2 INDICATIVE PRICING FOR TMS SOLUTIONS (PER MONTH), TRANSPORTATION MODE, 2024

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Artificial Intelligence & Machine Learning

- 5.8.1.2 Cloud-native & SaaS Architecture

- 5.8.1.3 Internet of Things & Telematics Integration

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Enterprise Resource Planning

- 5.8.2.2 E-Commerce & Order Management Platforms

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Autonomous & Connected Vehicles

- 5.8.3.2 Warehouse Management Systems

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.9.1 METHODOLOGY

- 5.9.2 TRANSPORTATION MANAGEMENT SYSTEM MARKET: KEY PATENTS (2016-2025)

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.1.1 International Organization for Standardization

- 5.12.1.1.1 ISO/IEC JTC 1

- 5.12.1.1.2 ISO/IEC 27001

- 5.12.1.1.3 ISO/IEC 19770

- 5.12.1.1.4 ISO/IEC JTC 1/SWG 5

- 5.12.1.1.5 ISO/IEC JTC 1/SC 31

- 5.12.1.1.6 ISO/IEC JTC 1/SC 27

- 5.12.1.1.7 ISO/IEC JTC 1/WG 7

- 5.12.1.2 General Data Protection Regulation

- 5.12.1.3 Federal Motor Carrier Safety Administration (FMCSA)

- 5.12.1.4 Federal Highway Administration (FHWA)

- 5.12.1.5 Maritime Administration (MARAD)

- 5.12.1.6 Federal Aviation Administration (FAA)

- 5.12.1.7 Federal Railroad Administration (FRA)

- 5.12.1.8 Institute of Electrical and Electronics Engineers

- 5.12.1.9 CEN/ISO

- 5.12.1.10 CEN/CENELEC

- 5.12.1.11 European Telecommunications Standards Institute

- 5.12.1.12 ITU-T

- 5.12.1.1 International Organization for Standardization

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS IN 2025-2026

- 5.15 TECHNOLOGY ROADMAP FOR TRANSPORTATION MANAGEMENT SYSTEM MARKET

- 5.15.1 SHORT-TERM ROADMAP (2025-2026)

- 5.15.2 MID-TERM ROADMAP (2027-2028)

- 5.15.3 LONG-TERM ROADMAP (2029-2030)

- 5.16 IMPACT OF AI/GENERATIVE AI ON TRANSPORTATION MANAGEMENT SYSTEM MARKET

- 5.16.1 USE CASES OF AI/GENERATIVE AI IN TRANSPORTATION MANAGEMENT SYSTEM MARKET

- 5.17 INVESTMENT AND FUNDING SCENARIO, 2024

- 5.18 BEST PRACTICES IN TRANSPORTATION MANAGEMENT SYSTEM MARKET

- 5.19 CURRENT AND EMERGING BUSINESS MODELS

- 5.20 TOOLS, FRAMEWORKS, AND TECHNIQUES USED IN TRANSPORTATION MANAGEMENT

- 5.21 IMPACT OF 2025 US TARIFF-TRANSPORTATION MANAGEMENT SYSTEM MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.3.1 Strategic shifts and emerging trends

- 5.21.4 IMPACT ON COUNTRY/REGION

- 5.21.4.1 US

- 5.21.4.2 China

- 5.21.4.3 Europe

- 5.21.4.4 Asia Pacific (excluding China)

- 5.21.5 IMPACT ON END USERS

- 5.21.5.1 3PLs

- 5.21.5.2 Shippers

- 5.21.5.3 Freight forwarders

- 5.21.5.4 Other end users

6 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: TRANSPORTATION MANAGEMENT SYSTEM MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 NEED FOR ENHANCED TRANSPORT MANAGEMENT AND RISE OF DIGITALIZATION TO FUEL DEMAND

- 6.2.2 PLANNING & EXECUTION

- 6.2.3 ORDER MANAGEMENT

- 6.2.4 AUDIT, PAYMENT, & CLAIMS

- 6.2.5 ANALYTICS & REPORTING

- 6.2.6 ROUTING & TRACKING

- 6.2.7 OTHER SOLUTIONS

- 6.3 SERVICES

- 6.3.1 RISING DEMAND FOR OPTIMIZED LOGISTICS STRATEGIES TAILORED TO SPECIFIC BUSINESS NEEDS TO DRIVE MARKET

- 6.3.2 PROFESSIONAL SERVICES

- 6.3.2.1 Consulting

- 6.3.2.2 Integration & Implementation

- 6.3.2.3 Support & Maintenance

- 6.3.3 MANAGED SERVICES

7 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE

- 7.1 INTRODUCTION

- 7.1.1 TRANSPORTATION MODE: TRANSPORTATION MANAGEMENT SYSTEM MARKET DRIVERS

- 7.2 ROADWAYS

- 7.2.1 INCREASING ON-ROAD COMMERCIAL TRANSPORTATION TO FUEL MARKET GROWTH

- 7.3 RAILWAYS

- 7.3.1 CUSTOMER-CENTRIC ROUTE OPTIMIZATION OPTIONS TO DRIVE MARKET

- 7.4 AIRWAYS

- 7.4.1 INCREASING INTERNATIONAL E-COMMERCE TO LEAD TO SEGMENT GROWTH

- 7.5 MARITIME

- 7.5.1 RISING INTERNATIONAL MARITIME TRANSPORT COSTS TO BOOST DEMAND FOR MANAGEMENT SYSTEMS

8 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.1.1 END USER: TRANSPORTATION MANAGEMENT SYSTEM MARKET DRIVERS

- 8.2 3PLS

- 8.2.1 NEED TO ELIMINATE MANUAL WORK AND INCREASE EFFICIENCY TO FUEL MARKET GROWTH

- 8.3 SHIPPERS

- 8.3.1 NEED TO IMPROVE SUPPLY CHAIN AND CUSTOMER RELATIONSHIPS TO DRIVE MARKET

- 8.4 FREIGHT FORWARDERS

- 8.4.1 MANAGE AND OPTIMIZE COMPLEX LOGISTICS OPERATIONS ACROSS GLOBAL SUPPLY CHAINS

- 8.5 OTHER END USERS

9 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET DRIVERS

- 9.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.3 US

- 9.2.3.1 Established presence of key TMS players and advanced IT infrastructure drive market

- 9.2.4 CANADA

- 9.2.4.1 Strategic investments in infrastructure and technology to drive market

- 9.3 EUROPE

- 9.3.1 EUROPE: TRANSPORTATION MANAGEMENT SYSTEM MARKET DRIVERS

- 9.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.3 UK

- 9.3.3.1 Government initiatives supported by collaborations and partnerships to drive market

- 9.3.4 GERMANY

- 9.3.4.1 Major investments by public and private sectors to drive market

- 9.3.5 FRANCE

- 9.3.5.1 Major investments by government in ICT infrastructure to drive market

- 9.3.6 SPAIN

- 9.3.6.1 Significant government investments in transportation sector to drive market

- 9.3.7 ITALY

- 9.3.7.1 Major opportunities for TMS vendors to fuel market growth

- 9.3.8 NORDIC COUNTRIES

- 9.3.8.1 Significant shift toward cloud-based TMS solutions to boost market

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: TRANSPORTATION MANAGEMENT SYSTEM MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.3 CHINA

- 9.4.3.1 Need for robust infrastructure for transportation management to boost growth

- 9.4.4 INDIA

- 9.4.4.1 Digitalization across business verticals to drive market

- 9.4.5 JAPAN

- 9.4.5.1 R&D capabilities and regulatory reforms by government to drive market

- 9.4.6 AUSTRALIA & NEW ZEALAND

- 9.4.6.1 Growing need for safety and reducing carbon emissions to boost market

- 9.4.7 SOUTH KOREA

- 9.4.7.1 Investments in advanced technologies to drive market

- 9.4.8 SOUTHEAST ASIA

- 9.4.8.1 Rising investments in infrastructure and digital transformation to boost market

- 9.4.9 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.3 GCC COUNTRIES

- 9.5.3.1 Rapid urbanization and focus on cost reduction to drive market

- 9.5.3.2 Kingdom of Saudi Arabia

- 9.5.3.2.1 Government initiatives to develop advanced logistics and transportation systems to fuel market growth

- 9.5.3.3 United Arab Emirates

- 9.5.3.3.1 Data-driven transportation services facilitating seamless transits to drive market

- 9.5.3.4 Rest of GCC Countries

- 9.5.4 SOUTH AFRICA

- 9.5.4.1 High spending on IT infrastructure to fuel market

- 9.5.5 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MARKET DRIVERS

- 9.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.3 BRAZIL

- 9.6.3.1 Low IT spending, meager cloud adoption, and limited investments from vendors to boost market

- 9.6.4 MEXICO

- 9.6.4.1 Stable logistics market and technical expertise in cloud adoption to drive market

- 9.6.5 ARGENTINA

- 9.6.5.1 Growing digitalization to drive market

- 9.6.6 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2025

- 10.7.5.1 Company footprint

- 10.7.5.2 Regional footprint

- 10.7.5.3 Offering footprint

- 10.7.5.4 Transportation Mode footprint

- 10.7.5.5 End User footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUP/SMES, 2025

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2025

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- 11.1.1 ORACLE

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 SAP

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 MANHATTAN ASSOCIATES

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 C.H. ROBINSON

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 BLUE YONDER

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 TRIMBLE

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.7 WISETECH GLOBAL

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.8 DESCARTES

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches

- 11.1.8.3.2 Deals

- 11.1.9 GENERIX GROUP

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.10 KORBER AG

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 UBER FREIGHT

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches

- 11.1.11.3.2 Deals

- 11.1.12 ALPEGA GROUP

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Deals

- 11.1.13 WWEX GROUP

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Deals

- 11.1.14 INFOR

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches

- 11.1.14.3.2 Deals

- 11.1.1 ORACLE

- 11.2 OTHER PLAYERS

- 11.2.1 KINAXIS

- 11.2.2 SHIPWELL

- 11.2.3 APTEAN

- 11.2.4 RATELINX

- 11.2.5 OTMS

- 11.2.6 NSHIFT

- 11.2.7 BLUEROCK TMS

- 11.2.8 ELEMICA

- 11.2.9 TESISQUARE

- 11.2.10 VTRADEX

- 11.2.11 SHIPTIFY

- 11.2.12 LOGISTICALLY

- 11.2.13 INTELLITRANS

- 11.2.14 ALLOTRAC

- 11.2.15 REVENOVA

- 11.2.16 PRINCETON TMX

- 11.2.17 CTSI GLOBAL

- 11.2.18 PCS SOFTWARE

- 11.2.19 SHIPSY

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.1.1 LIMITATIONS

- 12.2 SMART TRANSPORTATION MARKET - GLOBAL FORECAST TO 2029

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.2.1 Smart transportation market, by transportation mode

- 12.2.2.2 Smart transportation market, by roadway

- 12.2.2.3 Smart transportation market, by railway

- 12.2.2.4 Smart transportation market, by airway

- 12.2.2.5 Smart transportation market, by maritime

- 12.2.2.6 Smart transportation market, by end user

- 12.2.2.7 Smart transportation market, by region

- 12.3 FLEET MANAGEMENT MARKET - GLOBAL FORECAST TO 2028

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.2.1 Fleet management market, by component

- 12.3.2.2 Fleet management market, by fleet type

- 12.3.2.3 Fleet management market, by vertical

- 12.3.2.4 Fleet management market, by region

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 RISK ASSESSMENT

- TABLE 3 RESEARCH ASSUMPTIONS

- TABLE 4 TRANSPORTATION MANAGEMENT SYSTEM MARKET: ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE OF TMS SOLUTIONS & SERVICES, BY KEY PLAYERS, 2024

- TABLE 6 INDICATIVE PRICING FOR TMS SOLUTIONS (PER MONTH), BY TRANSPORTATION MODE, 2024

- TABLE 7 LIST OF MAJOR PATENTS GRANTED

- TABLE 8 TRANSPORTATION MANAGEMENT SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 15 TRANSPORTATION MANAGEMENT SYSTEM MARKET: CONFERENCES AND EVENTS, 2025 & 2026

- TABLE 16 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 18 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 19 SOLUTIONS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 20 SOLUTIONS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 22 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 23 PLANNING & EXECUTION: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 24 PLANNING & EXECUTION: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 ORDER MANAGEMENT: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 ORDER MANAGEMENT: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 AUDIT, PAYMENT, & CLAIMS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 AUDIT, PAYMENT, & CLAIMS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 ANALYTICS & REPORTING: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 ANALYTICS & REPORTING: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 ROUTING & TRACKING: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 ROUTING & TRACKING: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 OTHER SOLUTIONS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 OTHER SOLUTIONS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 SERVICES: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 SERVICES: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 38 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 39 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 40 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 41 CONSULTING: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 CONSULTING: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 INTEGRATION & IMPLEMENTATION: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 INTEGRATION & IMPLEMENTATION: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 SUPPORT & MAINTENANCE: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 SUPPORT & MAINTENANCE: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 MANAGED SERVICES: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 MANAGED SERVICES: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2020-2024 (USD MILLION)

- TABLE 50 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2025-2030 (USD MILLION)

- TABLE 51 ROADWAYS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 ROADWAYS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 RAILWAYS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 RAILWAYS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 AIRWAYS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 AIRWAYS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 MARITIME: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 MARITIME: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 60 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 61 3PLS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 3PLS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 SHIPPERS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 SHIPPERS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 FREIGHT FORWARDERS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 FREIGHT FORWARDERS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 OTHER END USERS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 OTHER END USERS: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 72 NORTH AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 74 NORTH AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2020-2024 (USD MILLION)

- TABLE 80 NORTH AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2025-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 82 NORTH AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 84 NORTH AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 US: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 86 US: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 87 US: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 88 US: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 89 US: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 90 US: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 91 US: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 92 US: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 93 US: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2020-2024 (USD MILLION)

- TABLE 94 US: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2025-2030 (USD MILLION)

- TABLE 95 US: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 96 US: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 97 EUROPE: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 98 EUROPE: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 99 EUROPE: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 100 EUROPE: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 101 EUROPE: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 102 EUROPE: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 103 EUROPE: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 104 EUROPE: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2020-2024 (USD MILLION)

- TABLE 106 EUROPE: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 108 EUROPE: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 110 EUROPE: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 UK: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 112 UK: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 113 UK: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 114 UK: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 115 UK: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 116 UK: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 117 UK: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 118 UK: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 119 UK: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2020-2024 (USD MILLION)

- TABLE 120 UK: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2025-2030 (USD MILLION)

- TABLE 121 UK: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 122 UK: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 124 ASIA PACIFIC: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 128 ASIA PACIFIC: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 130 ASIA PACIFIC: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2020-2024 (USD MILLION)

- TABLE 132 ASIA PACIFIC: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 134 ASIA PACIFIC: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 136 ASIA PACIFIC: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 137 CHINA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 138 CHINA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 139 CHINA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 140 CHINA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 141 CHINA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 142 CHINA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 143 CHINA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 144 CHINA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 145 CHINA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2020-2024 (USD MILLION)

- TABLE 146 CHINA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2025-2030 (USD MILLION)

- TABLE 147 CHINA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 148 CHINA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2020-2024 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2025-2030 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY GCC COUNTRY, 2020-2024 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY GCC COUNTRY, 2025-2030 (USD MILLION)

- TABLE 165 KSA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 166 KSA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 167 KSA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 168 KSA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 169 KSA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 170 KSA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 171 KSA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 172 KSA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 173 KSA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2020-2024 (USD MILLION)

- TABLE 174 KSA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2025-2030 (USD MILLION)

- TABLE 175 KSA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 176 KSA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 177 LATIN AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 178 LATIN AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 179 LATIN AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 180 LATIN AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 181 LATIN AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 182 LATIN AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 183 LATIN AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 184 LATIN AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 185 LATIN AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2020-2024 (USD MILLION)

- TABLE 186 LATIN AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2025-2030 (USD MILLION)

- TABLE 187 LATIN AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 188 LATIN AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 189 LATIN AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 190 LATIN AMERICA: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 191 BRAZIL: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 192 BRAZIL: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 193 BRAZIL: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 194 BRAZIL: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 195 BRAZIL: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 196 BRAZIL: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 197 BRAZIL: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 198 BRAZIL: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 199 BRAZIL: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2020-2024 (USD MILLION)

- TABLE 200 BRAZIL: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2025-2030 (USD MILLION)

- TABLE 201 BRAZIL: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 202 BRAZIL: TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 203 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN TRANSPORTATION MANAGEMENT SYSTEM MARKET

- TABLE 204 TRANSPORTATION MANAGEMENT SYSTEM MARKET: DEGREE OF COMPETITION

- TABLE 205 TRANSPORTATION MANAGEMENT SYSTEM MARKET: REGION FOOTPRINT

- TABLE 206 TRANSPORTATION MANAGEMENT SYSTEM MARKET: OFFERING FOOTPRINT

- TABLE 207 TRANSPORTATION MANAGEMENT SYSTEM MARKET: TRANSPORTATION MODE FOOTPRINT

- TABLE 208 TRANSPORTATION MANAGEMENT SYSTEM MARKET: END USER FOOTPRINT

- TABLE 209 TRANSPORTATION MANAGEMENT SYSTEM MARKET: KEY STARTUPS/SMES

- TABLE 210 TRANSPORTATION MANAGEMENT SYSTEM MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 211 TRANSPORTATION MANAGEMENT SYSTEM MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, 2022-2025

- TABLE 212 TRANSPORTATION MANAGEMENT SYSTEM MARKET: DEALS, 2022-2025

- TABLE 213 ORACLE: COMPANY OVERVIEW

- TABLE 214 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 ORACLE: PRODUCT LAUNCHES

- TABLE 216 ORACLE: DEALS

- TABLE 217 SAP: COMPANY OVERVIEW

- TABLE 218 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 SAP: PRODUCT LAUNCHES

- TABLE 220 DEALS

- TABLE 221 MANHATTAN ASSOCIATES: COMPANY OVERVIEW

- TABLE 222 MANHATTAN ASSOCIATES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 MANHATTAN ASSOCIATES: PRODUCT LAUNCHES

- TABLE 224 MANHATTAN ASSOCIATES: DEALS

- TABLE 225 C.H. ROBINSON: COMPANY OVERVIEW

- TABLE 226 C.H. ROBINSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 C.H. ROBINSON: PRODUCT LAUNCHES

- TABLE 228 C.H. ROBINSON: DEALS

- TABLE 229 BLUE YONDER: COMPANY OVERVIEW

- TABLE 230 BLUE YONDER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 BLUE YONDER: PRODUCT LAUNCHES

- TABLE 232 BLUE YONDER: DEALS

- TABLE 233 TRIMBLE: COMPANY OVERVIEW

- TABLE 234 TRIMBLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 TRIMBLE: PRODUCT LAUNCHES

- TABLE 236 TRIMBLE: DEALS

- TABLE 237 WISETECH GLOBAL: COMPANY OVERVIEW

- TABLE 238 WISETECH GLOBAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 WISETECH GLOBAL: PRODUCT LAUNCHES

- TABLE 240 WISETECH GLOBAL: DEALS

- TABLE 241 DESCARTES: COMPANY OVERVIEW

- TABLE 242 DESCARTES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 DESCARTES: PRODUCT LAUNCHES

- TABLE 244 DESCARTES: DEALS

- TABLE 245 GENERIX GROUP: COMPANY OVERVIEW

- TABLE 246 GENERIX GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 GENERIX GROUP: DEALS

- TABLE 248 KORBER AG: COMPANY OVERVIEW

- TABLE 249 KORBER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 KORBER AG: DEALS

- TABLE 251 UBER FREIGHT: COMPANY OVERVIEW

- TABLE 252 UBER FREIGHT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 UBER FREIGHT: PRODUCT LAUNCHES

- TABLE 254 UBER FREIGHT: DEALS

- TABLE 255 ALPEGA GROUP: COMPANY OVERVIEW

- TABLE 256 ALPEGA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 ALPEGA GROUP: DEALS

- TABLE 258 WWEX GROUP: COMPANY OVERVIEW

- TABLE 259 WWEX GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 WWEX GROUP: DEALS

- TABLE 261 INFOR: COMPANY OVERVIEW

- TABLE 262 INFOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 INFOR: PRODUCT LAUNCHES

- TABLE 264 INFOR: DEALS

- TABLE 265 SMART TRANSPORTATION MARKET, BY TRANSPORTATION MODE, 2019-2023 (USD MILLION)

- TABLE 266 SMART TRANSPORTATION MARKET, BY TRANSPORTATION MODE, 2024-2029 (USD MILLION)

- TABLE 267 SMART TRANSPORTATION MARKET, BY ROADWAY, 2019-2023 (USD MILLION)

- TABLE 268 SMART TRANSPORTATION MARKET, BY ROADWAY, 2024-2029 (USD MILLION)

- TABLE 269 SMART TRANSPORTATION MARKET, BY RAILWAY, 2019-2023 (USD MILLION)

- TABLE 270 SMART TRANSPORTATION MARKET, BY RAILWAY, 2024-2029 (USD MILLION)

- TABLE 271 SMART TRANSPORTATION MARKET, BY AIRWAY, 2019-2023 (USD MILLION)

- TABLE 272 SMART TRANSPORTATION MARKET, BY AIRWAY, 2024-2029 (USD MILLION)

- TABLE 273 SMART TRANSPORTATION MARKET, BY MARITIME, 2019-2023 (USD MILLION)

- TABLE 274 SMART TRANSPORTATION MARKET, BY MARITIME, 2024-2029 (USD MILLION)

- TABLE 275 SMART TRANSPORTATION MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 276 SMART TRANSPORTATION MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 277 SMART TRANSPORTATION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 278 SMART TRANSPORTATION MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 279 FLEET MANAGEMENT MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 280 FLEET MANAGEMENT MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 281 FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2018-2022 (USD MILLION)

- TABLE 282 FLEET MANAGEMENT MARKET, BY FLEET TYPE, 2023-2028 (USD MILLION)

- TABLE 283 FLEET MANAGEMENT MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 284 FLEET MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 285 FLEET MANAGEMENT MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 286 FLEET MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 TRANSPORTATION MANAGEMENT SYSTEM MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 TRANSPORTATION MANAGEMENT SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKUP OF PROFILES OF PRIMARY PARTICIPANTS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 TRANSPORTATION MANAGEMENT SYSTEM MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM SOLUTIONS/SERVICES

- FIGURE 6 TRANSPORTATION MANAGEMENT SYSTEM MARKET: TOP-DOWN APPROACH

- FIGURE 7 TRANSPORTATION MANAGEMENT SYSTEM MARKET: DATA TRIANGULATION

- FIGURE 8 TRANSPORTATION MANAGEMENT MARKET, 2023-2030

- FIGURE 9 TRANSPORTATION MANAGEMENT SYSTEM MARKET: REGIONAL SNAPSHOT

- FIGURE 10 INCREASING DEMAND FOR TRANSPORTATION MANAGEMENT SYSTEMS FROM E-COMMERCE SECTOR TO DRIVE MARKET

- FIGURE 11 3PLS AND US TO DOMINATE NORTH AMERICAN MARKET IN 2025

- FIGURE 12 ROADWAYS SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC MARKET IN 2025

- FIGURE 13 TRANSPORTATION MANAGEMENT SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 14 HISTORY OF TRANSPORTATION MANAGEMENT SYSTEM

- FIGURE 15 TRANSPORTATION MANAGEMENT SYSTEM ECOSYSTEM

- FIGURE 16 VALUE CHAIN ANALYSIS

- FIGURE 17 AVERAGE SELLING PRICE OF TMS SOLUTIONS & SERVICES, BY KEY PLAYERS, 2024 (PER MONTH)

- FIGURE 18 MAJOR PATENTS IN TRANSPORTATION MANAGEMENT SYSTEM MARKET

- FIGURE 19 TRANSPORTATION MANAGEMENT SYSTEM MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 20 TRANSPORTATION MANAGEMENT SYSTEMS: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 23 USE CASES OF AI/GENERATIVE AI IN TRANSPORTATION MANAGEMENT SYSTEM MARKET

- FIGURE 24 INVESTMENT AND FUNDING SCENARIO OF MAJOR TRANSPORTATION MANAGEMENT SYSTEM COMPANIES, 2024 (USD MILLION)

- FIGURE 25 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 26 PLANNING & EXECUTION SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 27 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 28 INTEGRATION & DEPLOYMENT SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 29 AIRWAYS SEGMENT TO GROW FASTEST DURING FORECAST PERIOD

- FIGURE 30 FREIGHT FORWARDERS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 TRANSPORTATION MANAGEMENT SYSTEM MARKET: REGIONAL SNAPSHOT

- FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 34 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 35 TRANSPORTATION MANAGEMENT SYSTEM: MARKET SHARE ANALYSIS OF KEY VENDORS, 2024

- FIGURE 36 COMPANY VALUATION OF KEY VENDORS IN TRANSPORTATION MANAGEMENT SYSTEM MARKET

- FIGURE 37 FINANCIAL METRICS OF KEY TRANSPORTATION MANAGEMENT SYSTEM VENDORS

- FIGURE 38 TRANSPORTATION MANAGEMENT SYSTEM MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 39 TRANSPORTATION MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2025

- FIGURE 40 TRANSPORTATION MANAGEMENT SYSTEM MARKET: COMPANY FOOTPRINT

- FIGURE 41 TRANSPORTATION MANAGEMENT SYSTEM MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2025

- FIGURE 42 ORACLE: COMPANY SNAPSHOT

- FIGURE 43 SAP: COMPANY SNAPSHOT

- FIGURE 44 MANHATTAN ASSOCIATES: COMPANY SNAPSHOT

- FIGURE 45 C.H. ROBINSON: COMPANY SNAPSHOT

- FIGURE 46 TRIMBLE: COMPANY SNAPSHOT

- FIGURE 47 WISETECH GLOBAL: COMPANY SNAPSHOT

- FIGURE 48 DESCARTES: COMPANY SNAPSHOT

- FIGURE 49 UBER FREIGHT: COMPANY SNAPSHOT