PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1838150

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1838150

Bioplastics & Biopolymers Market by Product Type (Biodegradable, Non-biodegradable), End-use Industry (Packaging, Automotive, Textile, Consumer Goods, Agriculture), Raw Material (Sugarcane, Wheat, Corn Starch), & Region - Global Forecast to 2030

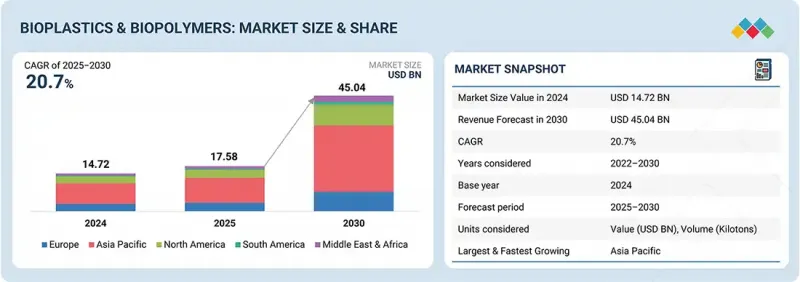

The bioplastics & biopolymers market is expected to reach USD 45.04 billion by 2030, up from USD 17.58 billion in 2025, growing at a CAGR of 20.07% during the forecast period. This market is driven by increasing environmental concerns, strict government regulations on single-use plastics, and rising consumer demand for sustainable options.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) Volume (Kiloton) |

| Segments | Product Type, Raw Material, End-Use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

The availability of renewable raw materials, such as sugarcane, corn, and cassava, combined with technological advances that improve product performance, is further boosting adoption across packaging, agriculture, automotive, and consumer goods. However, growth faces challenges like higher production costs compared to traditional plastics, limited large-scale infrastructure for composting and recycling, and competition with food crops for raw materials.

"Cassava is the fastest-growing segment in the bioplastics & biopolymers market during the forecast period."

Cassava is rapidly becoming the fastest-growing raw material in the bioplastics & biopolymers market due to its high starch content, widespread availability in tropical regions, and relatively low cultivation costs. It serves as an efficient feedstock for producing biodegradable plastics, making it an attractive alternative to petroleum-based materials. Countries like Thailand and Indonesia are leading production, supported by government initiatives and increasing demand for eco-friendly packaging solutions. With the global focus on sustainable raw materials rising, cassava-based bioplastics are gaining popularity as a scalable and cost-effective option.

"The biodegradable plastics segment is the largest in the bioplastics & biopolymers market during the forecast period."

Biodegradable plastics are a type of plastics designed to break down naturally into water, carbon dioxide, and biomass through the activity of microorganisms, making them much less harmful to the environment compared to traditional plastics. They are frequently made from renewable resources such as starch, sugarcane, cassava, or other plant-based materials, though some biodegradable plastics can also be produced from petrochemicals with biodegradable additives. Major types include PLA (polylactic acid), PHA (polyhydroxyalkanoates), starch blends, and PBS (polybutylene succinate), each providing distinct performance benefits. Biodegradable plastics are increasingly used in packaging, agricultural films, disposable cutlery, consumer products, and even medical applications-thanks to their combination of functionality and sustainability. Market expansion is driven by stricter government bans on single-use plastics, strong corporate sustainability commitments, and growing consumer demand for eco-friendly products.

"The Asia Pacific market is projected to be the largest market for bioplastics & biopolymers during the forecast period."

The Asia Pacific region holds a leading position in the bioplastics & biopolymers market due to a mix of strategic, economic, and environmental factors. Rapid industrialization and urban growth in countries like China, India, and Japan have increased the demand for sustainable alternatives to traditional plastics. Additionally, the region benefits from abundant raw materials such as starch, sugarcane, and cellulose, which are vital for producing bioplastics. Strong government initiatives and policies supporting environmental sustainability, along with significant investments in research and development, have further sped up market growth. Furthermore, the presence of major manufacturers and suppliers in the region gives a competitive advantage, allowing for cost-effective production and distribution. Growing consumer awareness about environmental pollution and the rising adoption of eco-friendly packaging solutions have also helped Asia-Pacific maintain its leading role in the global bioplastics and biopolymer market.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments, and the information was gathered through secondary research.

The breakdown of primary interviews is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 35%, Asia Pacific: 30%, South America: 5%, Middle East & Africa 5%

NatureWorks LLC (US), Braskem (Brazil), BASF SE (Germany), TotalEnergies Corbion (Netherlands), Versalis S.P.A (Italy), Biome Bioplastics Limited (UK), Mitsubishi Chemical Group Corporation (Japan), Biotec Biologische Naturverpackungen GmbH & Co. (Germany), Plantic Technologies Limited (Australia), and Toray Industries, Inc. (Japan) are some of the key players in the bioplastics & biopolymers market.

The study includes an in-depth competitive analysis of these key players in the authentication and brand

market protection, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study examines the bioplastics & biopolymers market across various segments. It aims to estimate the market size and growth potential in different areas based on product type, raw material type, end-use industry, and region. The study also includes a detailed competitive analysis of key market players, their company profiles, observations related to their products and business offerings, recent developments they have undertaken, and the key growth strategies they have adopted to strengthen their position in the bioplastics & biopolymers market.

Key Benefits of Buying the Report

The report is expected to help market leaders and new entrants identify the closest revenue estimates for the overall bioplastics & biopolymers market, including its segments and sub-segments. It aims to assist stakeholders in understanding the competitive landscape, gaining insights to strengthen their businesses, and developing effective go-to-market strategies. Additionally, the report provides stakeholders with a pulse on the market, offering information on key drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (shift in consumer preference toward bio-based plastics, government focus on green procurement policies and regulations), restraints (higher prices of biodegradable plastics than that of alternatives), opportunities (high potential in emerging economies), challenges (segregation and processing of bioplastics)

- Market Development: Comprehensive information about lucrative markets - the report analyses the bioplastics & biopolymers market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the bioplastics & biopolymers market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product and service offerings of leading players such as NatureWorks LLC (US), Braskem (Brazil), BASF SE (Germany), TotalEnergies Corbion (Netherlands), Versalis S.P.A (Italy), Biome Bioplastics Limited (UK), Mitsubishi Chemical Group Corporation (Japan), Biotec Biologische Naturverpackungen GmbH & Co. (Germany), Plantic Technologies Limited (Australia), and Toray Industries, Inc. (Japan), among others are the top manufacturers covered in the bioplastics & biopolymers market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Interviewees from demand and supply sides

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for arriving at market size using bottom-up approach

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BIOPLASTICS & BIOPOLYMERS MARKET

- 4.2 BIOPLASTICS & BIOPOLYMERS MARKET, PRODUCT TYPE

- 4.3 BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY

- 4.4 BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Consumer preference for bio-based plastics

- 5.2.1.2 Extensive use in packaging applications

- 5.2.1.3 Emphasis on green procurement policies and regulations

- 5.2.2 RESTRAINTS

- 5.2.2.1 Performance constraints of bioplastics

- 5.2.2.2 Higher prices of biodegradable plastics than those of alternatives

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of new applications

- 5.2.3.2 High potential in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Segregation and processing of bioplastics

- 5.2.4.2 Expensive and complex production process

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 RAW MATERIAL ANALYSIS

- 5.5.1 SUGARCANE/SUGAR BEET

- 5.5.2 CORN STARCH

- 5.5.3 POTATO

- 5.5.4 VEGETABLE OIL

- 5.5.5 SWITCHGRASS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 NORTH AMERICA

- 5.7.2 EUROPE

- 5.7.2.1 Germany

- 5.7.2.2 France

- 5.7.2.3 Spain

- 5.7.2.4 UK

- 5.7.2.5 Sweden

- 5.7.3 ASIA PACIFIC

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 Australia & New Zealand

- 5.7.3.5 Other Asian Countries

- 5.7.4 MIDDLE EAST & AFRICA AND SOUTH AMERICA

- 5.7.4.1 South America

- 5.7.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.8.2 AVERAGE SELLING PRICE, BY KEY PLAYER AND APPLICATION

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 390770)

- 5.9.2 EXPORT SCENARIO (HS CODE 390770)

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Biopolymers made from microorganisms

- 5.10.1.2 Bioplastics made from fish scales

- 5.10.1.3 Bioplastics made from red fruit

- 5.10.1.4 Bioplastics made from OLIVe PITS

- 5.10.1.5 Recyclable bioplastics made from lobster shells

- 5.10.1.6 Volta technology

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 PHA biodegradable plastics

- 5.10.2.2 Smart PLGA systems

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 PATENT TYPE

- 5.11.3 JURISDICTION ANALYSIS

- 5.11.4 TOP 10 PATENT APPLICANTS

- 5.11.5 TOP PATENT OWNERS

- 5.12 MACROECONOMIC INDICATORS

- 5.12.1 GDP TRENDS AND FORECASTS

- 5.13 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 KEY CONFERENCES AND EVENTS

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 SHANGHAI TUOZHOU EMPLOYS NATUREWORKS' 3D PRINTING GRADE INGEO PLA 3D700

- 5.15.2 MINNESOTA TWINS' PARTNERSHIP WITH ECO-PRODUCTS AND NATUREWORKS

- 5.15.3 EUROBOTTLE UTILIZES FKUR'S BIOPLASTICS

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 INVESTMENT AND FUNDING SCENARIO

6 BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL

- 6.1 INTRODUCTION

- 6.2 SUGAR CANE/SUGAR BEET

- 6.2.1 EXTENSIVE USE IN BIOPLASTIC PRODUCTION TO DRIVE MARKET

- 6.3 POTATO/TAPIOCA

- 6.3.1 GROWING APPLICATIONS IN FOOD SERVICE INDUSTRY TO DRIVE MARKET

- 6.4 CORN STARCH

- 6.4.1 LARGE-SCALE ADOPTION IN FOOD PACKAGING AND SURGICAL DEVICES TO DRIVE MARKET

- 6.5 SWITCHGRASS

- 6.5.1 ONGOING RESEARCH INTO PHA POLYMERS TO DRIVE MARKET

- 6.6 VEGETABLE OIL

- 6.6.1 RISING USE IN MEDICAL IMPLANTS AND SPORTSWEAR TO DRIVE MARKET

- 6.7 CASSAVA

- 6.7.1 UNTAPPED POTENTIAL FOR DEVELOPMENT OF BIOPLASTICS TO DRIVE MARKET

- 6.8 WHEAT

- 6.8.1 PREFERENCE FOR FLEXIBLE PACKAGING SOLUTIONS TO DRIVE MARKET

- 6.9 OTHER RAW MATERIALS

7 BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 BIODEGRADABLE

- 7.2.1 CONCERNS RELATED TO ENVIRONMENTAL POLLUTION TO DRIVE MARKET

- 7.2.2 POLYBUTYLENE ADIPATE TEREPHTHALATE

- 7.2.3 POLYBUTYLENE SUCCINATE

- 7.2.4 POLYLACTIC ACID

- 7.2.5 POLYHYDROXYALKANOATE

- 7.2.6 STARCH-BASED

- 7.2.7 CELLULOSE FILM

- 7.2.8 OTHERS

- 7.3 NON-BIODEGRADABLE/BIO-BASED

- 7.3.1 EXPANSION OF PRODUCTION FACILITIES TO DRIVE MARKET

- 7.3.2 BIO-BASED POLYETHYLENE

- 7.3.3 BIO-BASED POLYAMIDE

- 7.3.4 BIO-BASED POLYETHYLENE TEREPHTHALATE

- 7.3.5 BIO-BASED POLYTRIMETHYLENE TEREPHTHALATE

- 7.3.6 BIO-BASED POLYPROPYLENE

- 7.3.7 POLYETHYLENE FURANOATE

- 7.3.8 OTHERS

8 BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 PACKAGING

- 8.2.1 STRINGENT REGULATIONS TO CURB POLLUTION TO DRIVE MARKET

- 8.2.2 FLEXIBLE

- 8.2.3 RIGID

- 8.3 TEXTILES

- 8.3.1 EXTENSIVE USE IN APPAREL, YARN SPINNING, FABRIC FORMATION TO DRIVE MARKET

- 8.4 CONSUMER GOODS

- 8.4.1 INCLINATION TOWARD GREEN PRODUCTS TO DRIVE MARKET

- 8.5 AUTOMOTIVE & TRANSPORT

- 8.5.1 NEW REGULATIONS FOR CONTROLLING GREENHOUSE GAS EMISSIONS TO DRIVE MARKET

- 8.6 AGRICULTURE & HORTICULTURE

- 8.6.1 FOCUS ON ENHANCING CROP PRODUCTIVITY AND IMPROVING SOIL QUALITY TO DRIVE MARKET

- 8.7 BUILDING & CONSTRUCTION

- 8.7.1 EMERGING APPLICATIONS IN 3D FLOORING SOLUTIONS AND DRAPES TO DRIVE MARKET

- 8.8 COATINGS & ADHESIVES

- 8.8.1 COMPLIANCE WITH BANS OF SPECIFIC PLASTIC PRODUCTS TO DRIVE MARKET

- 8.9 ELECTRONICS & ELECTRICALS

- 8.9.1 RISING DEMAND FOR PERSONAL AND PORTABLE ENERGY SOLUTIONS TO DRIVE MARKET

- 8.10 OTHER END-USE INDUSTRIES

9 BIOPLASTICS & BIOPOLYMERS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Government push for bioplastic adoption to drive market

- 9.2.2 CANADA

- 9.2.2.1 Stringent regulations governing use of plastics to drive market

- 9.2.3 MEXICO

- 9.2.3.1 Advancements in technology and research to drive market

- 9.2.1 US

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Extensive use of bioplastics in flexible packaging industry to drive market

- 9.3.2 FRANCE

- 9.3.2.1 Favorable government initiatives to drive market

- 9.3.3 SPAIN

- 9.3.3.1 Waste management initiatives and public awareness to drive market

- 9.3.4 UK

- 9.3.4.1 Implementation of policies to reduce plastic waste to drive market

- 9.3.5 ITALY

- 9.3.5.1 Robust food packaging industry to drive market

- 9.3.6 GREECE

- 9.3.6.1 Plastic ban campaigns to drive demand

- 9.3.7 REST OF EUROPE

- 9.3.1 GERMANY

- 9.4 ASIA PACIFIC

- 9.4.1 CHINA

- 9.4.1.1 Substantial consumption of plastic to drive market

- 9.4.2 INDIA

- 9.4.2.1 Population growth to drive market

- 9.4.3 JAPAN

- 9.4.3.1 Emphasis on environmental issues and sustainable development to drive market

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Incentives for production and adoption of biodegradable plastics to drive market

- 9.4.5 THAILAND

- 9.4.5.1 Large-scale cassava production to drive market

- 9.4.6 REST OF ASIA PACIFIC

- 9.4.1 CHINA

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.5.1.1 SAUDI ARABIA

- 9.5.1.1.1 Stringent regulations on plastic usage to drive market

- 9.5.1.2 UAE

- 9.5.1.2.1 Introduction of bio-based materials to drive market

- 9.5.1.3 Rest of GCC Countries

- 9.5.1.1 SAUDI ARABIA

- 9.5.2 SOUTH AFRICA

- 9.5.2.1 Progress in bioplastics research and development to drive market

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Rigorous environmental regulations to drive market

- 9.6.2 ARGENTINA

- 9.6.2.1 Ban on single-use plastic bags to drive market

- 9.6.3 REST OF SOUTH AMERICA

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STAR PLAYERS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.4.1 Company footprint

- 10.7.4.2 Region footprint

- 10.7.4.3 Product type footprint

- 10.7.4.4 Raw material footprint

- 10.7.4.5 End-use industry footprint

- 10.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING

- 10.8.5.1 List of start-ups/SMEs

- 10.8.5.2 Competitive benchmarking of start-ups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 NATUREWORKS LLC

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches/developments

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 BRASKEM

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 BASF SE

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches/developments

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 TOTALENERGIES CORBION

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.3.2 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 VERSALIS S.P.A

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches/developments

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 BIOME BIOPLASTICS LTD

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 MnM view

- 11.1.7 MITSUBISHI CHEMICAL GROUP CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 MnM view

- 11.1.8 BIOTEC BIOLOGISCHE NATURVERPACKUNGEN GMBH & CO. KG

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 MnM view

- 11.1.9 PLANTIC TECHNOLOGIES

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 MnM view

- 11.1.10 TORAY INDUSTRIES

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches/developments

- 11.1.10.4 MnM view

- 11.1.1 NATUREWORKS LLC

- 11.2 OTHER PLAYERS

- 11.2.1 LYONDELLBASEL

- 11.2.2 FKUR

- 11.2.3 AVANTIUM

- 11.2.4 LOTTE CHEMICAL

- 11.2.5 GREEN DOT BIOPLASTICS

- 11.2.6 SABIC

- 11.2.7 CARDIA BIOPLASTICS

- 11.2.8 INEOS STYROLUTION

- 11.2.9 KINGFA SCI. CO. LTD

- 11.2.10 BIO-ON

- 11.2.11 JIN HUI LONG HIGH TECHNOLOGY CO. LTD

- 11.2.12 TEKNOR APEX

- 11.2.13 PARSA POLYMER SHARIF

- 11.2.14 KANEKA CORPORATION

- 11.2.15 ARCTIC BIOMATERIALS

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 MARKET DEFINITION, BY PRODUCT TYPE

- TABLE 2 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 PER CAPITA GDP TRENDS, 2020-2022 (USD)

- TABLE 6 GDP GROWTH ESTIMATE AND PROJECTION OF KEY COUNTRIES, 2023-2027

- TABLE 7 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 10 BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2022-2024 (USD MILLION)

- TABLE 11 BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2025-2030 (USD MILLION)

- TABLE 12 BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2022-2024 (KILOTON)

- TABLE 13 BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2025-2030 (KILOTON)

- TABLE 14 BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 15 BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 16 BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 17 BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 18 BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 19 BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 20 BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 21 BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 22 BIOPLASTICS & BIOPOLYMERS MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 23 BIOPLASTICS & BIOPOLYMERS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 BIOPLASTICS & BIOPOLYMERS MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 25 BIOPLASTICS & BIOPOLYMERS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 26 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 27 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 28 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 29 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 30 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 31 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 32 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 33 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 34 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2022-2024 (USD MILLION)

- TABLE 35 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2025-2030 (USD MILLION)

- TABLE 36 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2022-2024 (KILOTON)

- TABLE 37 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2025-2030 (KILOTON)

- TABLE 38 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 39 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 40 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 41 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 42 US: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 43 US: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 44 US: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 45 US: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 46 CANADA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 47 CANADA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 48 CANADA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 49 CANADA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 50 MEXICO: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 51 MEXICO: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 52 MEXICO: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 53 MEXICO: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 54 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 55 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 56 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 57 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 58 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 59 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 60 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 61 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 62 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2022-2024 (USD MILLION)

- TABLE 63 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2025-2030 (USD MILLION)

- TABLE 64 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2022-2024 (KILOTON)

- TABLE 65 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2025-2030 (KILOTON)

- TABLE 66 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 67 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 68 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 69 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 70 GERMANY: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 71 GERMANY: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 72 GERMANY: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 73 GERMANY: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 74 FRANCE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 75 FRANCE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 76 FRANCE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 77 FRANCE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 78 SPAIN: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 79 SPAIN: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 80 SPAIN: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 81 SPAIN: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 82 UK: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 83 UK: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 84 UK: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 85 UK: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 86 ITALY: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 87 ITALY: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 88 ITALY: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 89 ITALY: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 90 GREECE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 91 GREECE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 92 GREECE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 93 GREECE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 94 REST OF EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 95 REST OF EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 96 REST OF EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 97 REST OF EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 98 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 99 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 100 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 101 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 102 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 103 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 104 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 105 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 106 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2022-2024 (USD MILLION)

- TABLE 107 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2025-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2022-2024 (KILOTON)

- TABLE 109 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2025-2030 (KILOTON)

- TABLE 110 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 111 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 113 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 114 CHINA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 115 CHINA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 116 CHINA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 117 CHINA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 118 INDIA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 119 INDIA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 120 INDIA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 121 INDIA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 122 JAPAN: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 123 JAPAN: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 124 JAPAN: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 125 JAPAN: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 126 SOUTH KOREA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 127 SOUTH KOREA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 128 SOUTH KOREA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 129 SOUTH KOREA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 130 THAILAND: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 131 THAILAND: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 132 THAILAND: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 133 THAILAND: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 134 REST OF ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 135 REST OF ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 137 REST OF ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 138 MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 141 MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 142 MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 145 MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 146 MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2022-2024 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2025-2030 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2022-2024 (KILOTON)

- TABLE 149 MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2025-2030 (KILOTON)

- TABLE 150 MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 153 MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 154 SAUDI ARABIA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 155 SAUDI ARABIA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 156 SAUDI ARABIA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 157 SAUDI ARABIA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 158 UAE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 159 UAE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 160 UAE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 161 UAE: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 162 REST OF GCC COUNTRIES: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 163 REST OF GCC COUNTRIES: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 164 REST OF GCC COUNTRIES: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 165 REST OF GCC COUNTRIES: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 166 SOUTH AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 167 SOUTH AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 168 SOUTH AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 169 SOUTH AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 170 REST OF MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 171 REST OF MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 172 REST OF MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 173 REST OF MIDDLE EAST & AFRICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 174 SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 175 SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 176 SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 177 SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 178 SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 179 SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 180 SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2022-2024 (KILOTON)

- TABLE 181 SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 182 SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2022-2024 (USD MILLION)

- TABLE 183 SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2025-2030 (USD MILLION)

- TABLE 184 SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2022-2024 (KILOTON)

- TABLE 185 SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2025-2030 (KILOTON)

- TABLE 186 SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 187 SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 188 SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 189 SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 190 BRAZIL: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 191 BRAZIL: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 192 BRAZIL: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 193 BRAZIL: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 194 ARGENTINA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 195 ARGENTINA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 196 ARGENTINA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 197 ARGENTINA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 198 REST OF SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 199 REST OF SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 200 REST OF SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 201 REST OF SOUTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 202 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- TABLE 203 BIOPLASTICS & BIOPOLYMERS MARKET: DEGREE OF COMPETITION

- TABLE 204 REGION FOOTPRINT

- TABLE 205 PRODUCT TYPE FOOTPRINT

- TABLE 206 RAW MATERIAL FOOTPRINT

- TABLE 207 END-USE INDUSTRY FOOTPRINT

- TABLE 208 LIST OF START-UPS/SMES

- TABLE 209 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 210 BIOPLASTICS & BIOPOLYMERS MARKET: PRODUCT LAUNCHES/ DEVELOPMENTS, 2020-2025

- TABLE 211 BIOPLASTICS & BIOPOLYMERS MARKET: DEALS, 2020-2025

- TABLE 212 BIOPLASTICS & BIOPOLYMERS MARKET: EXPANSIONS, 2020-2025

- TABLE 213 NATUREWORKS LLC: COMPANY OVERVIEW

- TABLE 214 NATUREWORKS LLC: PRODUCTS OFFERED

- TABLE 215 NATUREWORKS LLC: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 216 NATUREWORKS LLC: DEALS

- TABLE 217 NATUREWORKS LLC: EXPANSIONS

- TABLE 218 BRASKEM: COMPANY OVERVIEW

- TABLE 219 BRASKEM: PRODUCTS OFFERED

- TABLE 220 BRASKEM: DEALS

- TABLE 221 BRASKEM: EXPANSIONS

- TABLE 222 BASF SE: COMPANY OVERVIEW

- TABLE 223 BASF SE: PRODUCTS OFFERED

- TABLE 224 BASF SE: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 225 BASF SE: DEALS

- TABLE 226 TOTALENERGIES CORBION: COMPANY OVERVIEW

- TABLE 227 TOTALENERGIES CORBION: PRODUCTS OFFERED

- TABLE 228 TOTALENERGIES CORBION: DEALS

- TABLE 229 TOTALENERGIES CORBION: EXPANSIONS

- TABLE 230 VERSALIS S.P.A: COMPANY OVERVIEW

- TABLE 231 VERSALIS S.P.A: PRODUCTS OFFERED

- TABLE 232 VERSALIS S.P.A: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 233 VERSALIS S.P.A: DEALS

- TABLE 234 BIOME BIOPLASTICS LTD: COMPANY OVERVIEW

- TABLE 235 BIOME BIOPLASTICS LTD: PRODUCTS OFFERED

- TABLE 236 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 237 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCTS OFFERED

- TABLE 238 BIOTEC BIOLOGISCHE NATURVERPACKUNGEN GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 239 BIOTEC BIOLOGISCHE NATURVERPACKUNGEN GMBH & CO. KG: PRODUCTS OFFERED

- TABLE 240 PLANTIC TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 241 PLANTIC TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 242 TORAY INDUSTRIES: COMPANY OVERVIEW

- TABLE 243 TORAY INDUSTRIES: PRODUCTS OFFERED

- TABLE 244 TORAY INDUSTRIES: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 245 LYONDELLBASEL: COMPANY OVERVIEW

- TABLE 246 FKUR: COMPANY OVERVIEW

- TABLE 247 AVANTIUM: COMPANY OVERVIEW

- TABLE 248 LOTTE CHEMICAL: COMPANY OVERVIEW

- TABLE 249 GREEN DOT BIOPLASTICS: COMPANY OVERVIEW

- TABLE 250 SABIC: COMPANY OVERVIEW

- TABLE 251 CARDIA BIOPLASTICS: COMPANY OVERVIEW

- TABLE 252 INEOS STYROLUTION: COMPANY OVERVIEW

- TABLE 253 KINGFA SCI. CO. LTD: COMPANY OVERVIEW

- TABLE 254 BIO-ON: COMPANY OVERVIEW

- TABLE 255 JIN HUI LONG HIGH TECHNOLOGY CO. LTD: COMPANY OVERVIEW

- TABLE 256 TEKNOR APEX: COMPANY OVERVIEW

- TABLE 257 PARSA POLYMER SHARIF: COMPANY OVERVIEW

- TABLE 258 KANEKA CORPORATION: COMPANY OVERVIEW

- TABLE 259 ARCTIC BIOMATERIALS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 BIOPLASTICS & BIOPOLYMERS MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 BIODEGRADABLE SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 8 SUGARCANE/SUGAR BEET SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 9 PACKAGING TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 STRINGENT GOVERNMENT REGULATIONS TO DRIVE MARKET

- FIGURE 12 BIODEGRADABLE SEGMENT TO BE LARGER THAN NON-BIODEGRADABLE/ BIO-BASED SEGMENT DURING FORECAST PERIOD

- FIGURE 13 AGRICULTURE & HORTICULTURE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 14 THAILAND TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 BIOPLASTICS & BIOPOLYMERS MARKET DYNAMICS

- FIGURE 16 SEGREGATION AND PROCESSING OF BIOPLASTICS

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 VALUE CHAIN ANALYSIS

- FIGURE 19 ECOSYSTEM MAP

- FIGURE 20 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2030 (USD/KG)

- FIGURE 21 AVERAGE SELLING PRICE, BY KEY PLAYER AND APPLICATION, 2024 (USD/KG)

- FIGURE 22 IMPORT DATA FOR HS CODE 390770-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 23 EXPORT DATA FOR HS CODE 390770-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 24 PATENT PUBLICATION TRENDS

- FIGURE 25 TOP 10 PATENT APPLICANTS

- FIGURE 26 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO, 2021-2023 (USD MILLION)

- FIGURE 30 BIOPLASTICS & BIOPOLYMERS MARKET, BY RAW MATERIAL, 2025-2030 (USD MILLION)

- FIGURE 31 BIOPLASTICS & BIOPOLYMERS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- FIGURE 32 BIOPLASTICS & BIOPOLYMERS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- FIGURE 33 BIOPLASTICS & BIOPOLYMERS MARKET, BY COUNTRY, 2025-2030

- FIGURE 34 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET SNAPSHOT

- FIGURE 35 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET SNAPSHOT

- FIGURE 37 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2022-2024

- FIGURE 38 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 39 COMPANY VALUATION (USD BILLION)

- FIGURE 40 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 41 BRAND/PRODUCT COMPARISON

- FIGURE 42 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 COMPANY FOOTPRINT

- FIGURE 44 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 45 BRASKEM: COMPANY SNAPSHOT

- FIGURE 46 BASF SE: COMPANY SNAPSHOT

- FIGURE 47 VERSALIS S.P.A: COMPANY SNAPSHOT

- FIGURE 48 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 TORAY INDUSTRIES: COMPANY SNAPSHOT