PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1698612

PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1698612

Digital ID & Verification in the UK Market: 2025-2029

'25.5 Million Brits to Install Digital Identity Apps by 2029, as GOV.UK App Accelerates Adoption'

| KEY STATISTICS | |

|---|---|

| Digital ID revenue in the UK in 2025: | $780m |

| Digital ID revenue in the UK in 2029: | $1.6bn |

| Total digital ID revenue growth between 2025-2029: | 110% |

| Forecast period: | 2025-2029 |

Overview

Our "UK-focused Digital ID & Verification" Market research suite provides detailed analysis of this emerging market; enabling digital identity service providers to gain an understanding of key trends and challenges, potential growth opportunities, and the competitive environment.

Providing multiple options that can be purchased separately, the research suite includes access to data mapping the future growth of the digital identity and verification market in the UK, and an in-depth written study. This study reveals the latest opportunities and trends within the market; containing an extensive analysis of 15 leading digital identity service providers within the space that have operations within the UK. Aspects such as the frameworks being introduced, the demands of different sectors, and the driving and challenging factors affecting adoption of digital identities are explored throughout the report.

Collectively, these elements provide an effective tool for understanding this emerging market; allowing digital identity vendors to set out their future strategies to provide effective and streamlined onboarding and digital identity tools to their UK-based customers. Its unparalleled coverage makes this research suite an incredibly useful resource for gauging the future of this complex market.

All report content is delivered in the English language.

Key Features

- Market Dynamics: Insights into key digital identity trends and market expansion challenges within the digital identity and verification market in the UK. It addresses challenges posed by public perception, impending government frameworks and bills, and analyses how these will impact digital identities in different sectors, such as digital banking, eCommerce, and digital government services. The research also provides a future outlook on the landscape of digital identities and the verification of them.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the UK market, accompanied by key strategic recommendations for digital identity service providers on emerging trends, and how the market is expected to evolve.

- Benchmark Industry Forecasts: The forecasts for the digital identity and verification market in the UK include total digital ID revenue, number of checks carried out, and the total number of digital identity apps installed. This dataset not only provides a magnified market view, but is also split between two key verticals:

- Digital Identity

- Digital Identity Verification

The forecasts include data on different digital identity platforms; specifically third-party and civic identity apps. Furthermore, it provides an insight into digital identity verification in the UK, split by eCommerce, banking, eGovernment, and other verification services; split by smartphone and desktop accesses.

Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 15 digital identity and verification vendors, via the Juniper Research Competitor Leaderboard, featuring analysis around major players in the UK digital identity industry.

The 15 vendors consist of:

|

|

|

Market Data & Forecasts

The market-leading research suite for the digital identity and verification UK market includes access to the full set of forecast data; consisting of 226 tables and over 2,400 datapoints.

Metrics in the research suite include:

|

|

These metrics are provided for the following key market verticals:

|

|

The Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics; displayed for the UK across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool allows the user review metrics for the UK in the forecast period. Users can refine the metrics displayed via the search bar.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions. 5 interactive scenarios.

SAMPLE VIEW

Market Trends & Forecasts PDF Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations and a walk-through of the forecasts.

Table of Contents

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Market Landscape

- 2.1. Introduction

- 2.2. History of Digital Identity in the UK

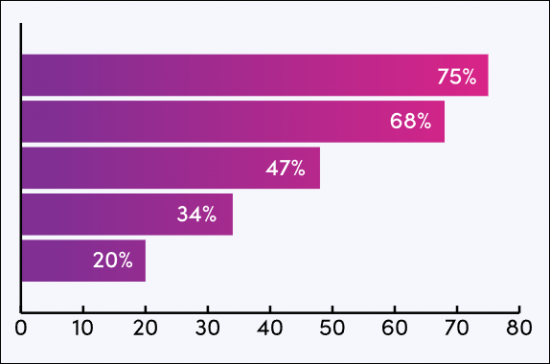

- Figure 2.1: Opinion on Digital ID Cards in the UK, Split by Political Party Affiliation, 2024

- Figure 2.2: How the GOV.UK App Could Look

- 2.3. Digital Identity & Verification Regulatory Developments in the UK

- 2.3.1. Trust Framework

- i. Certification

- ii. Public Registers & Trust Marks

- 2.3.2. Data (Use and Access) Bill

- i. Information Gateway

- 2.3.3. Data Protection and Digital Information Bill

- 2.3.1. Trust Framework

- 2.4. How Does the UK's Approach to Digital Identities Differ?

- 2.5. Drivers of Digital Identity and Verification in the UK

- 2.5.1. Government Initiatives

- Figure 2.3: GOV.UK Wallet and App

- 2.5.2. Economic Growth Potential

- 2.5.3. Evolving Fraud Landscape

- 2.5.4. Increased Public Uptake of Digital Services

- 2.5.1. Government Initiatives

- 2.6. Challenges to Digital Identity & Verification in the UK

- 2.6.1. Accessibility Issues

- 2.6.2. Regulatory and Compliance Hurdles

- 2.6.3. Security Risks

- 2.6.4. Third-party Conflict

3. Segment Analysis

- 3.1. Onboarding

- i. Know Your Customer and Anti-money Laundering

- ii. The Financial Markets Standards Board

- iii. Disclosure and Barring Service

- 3.2. eGovernment

- 3.2.1. Digital ID in eGovernment

- Figure 3.1: Relationship to the Trust Framework

- 3.2.2. Digital ID Verification in eGovernment

- 3.2.1. Digital ID in eGovernment

- 3.3. eCommerce

- Figure 3.2: Total Transaction Value for Remote Physical & Digital Goods Purchases ($m), in the UK, 2024-2029

- 3.3.1. Digital ID in eCommerce

- 3.3.2. Digital ID Verification in eCommerce

- 3.4. Digital Travel Documents

- 3.4.1. Digital ID in Digital Travel Documents

- 3.4.2. Digital ID Verification in Digital Travel Documents

4. Juniper Research Digital ID & Verification in the UK Competitor Leaderboard

- Table 4.1: Juniper Research Competitor Leaderboard Digital ID & Verification Vendors Included & Product Portfolios

- Figure 4.2: Juniper Research Competitor Leaderboard for Digital ID & Verification in the UK

- Figure 4.3: Juniper Research Digital ID & Verification in the UK Vendors & Positioning

- Table 4.4: Juniper Research Competitor Leaderboard Heatmap for Digital ID & Verification in the UK

- 4.1. Vendor Profiles

- 4.1.1. Amiqus

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 4.1.2. Experian

- i. Corporate

- Table 4.5: Experian, UK Financial Snapshot ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.1.3. Facephi

- i. Corporate

- Table 4.6: Facephi, Financial Snapshot ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.1.4. GBG

- i. Corporate

- Table 4.7: GBG, Financial Snapshot ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.1.5. IBM

- i. Corporate

- Table 4.8: IBM Financial Snapshot ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.1.6. iProov

- i. Corporate

- Table 4.9: iProov, Funding Rounds ($m), 2015, 2017, & 2022

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.1.7. Jumio

- i. Corporate

- Table 4.10: Jumio, Funding Rounds ($m), 2011, 2012, 2016, & 2021

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.1.8. LexisNexis Risk Solutions

- i. Corporate

- Table 4.11: LexisNexis Risk Solutions, Financial Snapshot ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.1.9. Luciditi

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 4.1.10. OneID

- i. Corporate

- Table 4.12: OneID, Funding Rounds ($m), 2023 & 2025

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.1.11. Onfido

- i. Corporate

- Table 4.13: Onfido, Funding Rounds ($m), 2018, 2019, & 2020

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.1.12. TrustID

- i. Corporate

- Table 4.14: TrustID, Finding Rounds ($m), 2010, 2011, & 2013

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.1.13. Veridas

- i. Corporate

- Table 4.15: Veridas, Funding Rounds ($m), 2020 & 2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.1.14. Veriff

- i. Corporate

- Table 4.16: Veriff, Funding Rounds ($m), 2018, 2020, 2021, & 2022

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.1.15. Yoti

- i. Corporate

- Table 4.17: Yoti, Funding Rounds ($m), 2013, 2019, 2022, & 2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 4.1.1. Amiqus

- 4.2. Juniper Research Leaderboard Assessment Methodology

- 4.2.1. Limitations & Interpretation

- Table 4.18: Juniper Research Digital ID & Verification in the UK Assessment Criteria

- 4.2.1. Limitations & Interpretation

5. Market Forecasts

- 5.1. Methodology & Assumptions

- Figure 5.1: Digital Identity Apps Forecast Methodology

- Figure 5.2: Civic Digital Identity Forecast Methodology

- Figure 5.3: Digital Identity Revenue Forecast Methodology

- Figure 5.4: Banking Verification Forecast Methodology

- Figure 5.5: eGovernment Verification Forecast Methodology

- Figure 5.6: eCommerce Verification Forecast Methodology

- Figure 5.7: Other Verification Services Forecast Methodology

6. Digital Identity Apps Forecasts

- 6.1. Digital Identity Apps

- 6.1.1. Number of Digital Identity Apps Installed

- Figure & Table 6.1: Total Number of Digital Identity Apps Installed (m), in the UK, 2025-2029

- Table 6.2: Number of Digital Identity Apps Installed (m), Split by Type, in the UK, 2025-2029

- 6.1.2. Digital Identity Revenue, Split by Revenue Area

- Figure & Table 6.3: Digital Identity Revenue, Split by Revenue Area ($m), in the UK, 2025-2029

- Table 6.4: Total Digital Identity Revenue per Annum (%), in the UK, 2025-2029

- 6.1.3. Total Platform Revenue Generated from Third-party Identity Apps

- Figure & Table 6.5: Total Platform Revenue Generated from Third-party Identity Apps ($m), in the UK, 2025-2029

- Table 6.6: Total Number of Third-party Digital Identity Apps Installed (m), in the UK, 2025-2029

- 6.1.4. Total Platform Revenue from Civic Identity Apps

- Figure & Table 6.7: Total Platform Revenue from Civic Identity Apps ($m), in the UK, 2025-2029

- Table 6.8: Number of People with Digital Identity Documents Who Have Civic Identity Apps (m), in the UK, 2025-2029

- 6.1.5. Total Digital Identity Card Infrastructure Spend

- Figure & Table 6.9: Total Digital Identity Card Infrastructure Spend ($m), in the UK, 2025-2029

- Table 6.10: Number of People with Digital Identity Cards (m), in the UK, 2025-2029

- 6.1.6. Total Digital Identity Platform Spend

- Figure & Table 6.11: Total Digital Identity Platform Spend ($m), in the UK, 2025-2029

- 6.1.1. Number of Digital Identity Apps Installed

7. Digital Identity Verification Forecasts

- 7.1. Digital Identity Verification

- 7.1.1. Total Volume of Digital Identity Verification Checks per Annum

- Figure & Table 7.1: Total Volume of Digital Identity Verification Checks per Annum (m), in the UK, 2025-2029

- Table 7.2: Total Volume of Digital Identity Verification Checks (m), Split by Area, in the UK, 2025-2029

- 7.1.2. Total Spend on Digital Identity Verification Checks per Annum

- Figure & Table 7.3: Total Spend on Digital Identity Verification Checks per Annum ($m), in the UK, 2025-2029

- Table 7.4: Total Spend on Digital Identity Verification Checks ($m), Split by Revenue Area, in the UK, 2025-2029

- 7.1.3. Total Government Spend on Digital Identity Verification Checks for eGovernment Services per Annum

- Figure & Table 7.5: Total Government Spend on Digital Identity Verification Checks for eGovernment Services per Annum ($m), in the UK, 2025-2029

- Table 7.6: Total Volume of eGovernment Services Accesses Secured by Digital Identity Verification (m), in the UK, 2025-2029

- 7.1.4. Total Spend on Digital Identity Verification for Other Verification Services

- Figure & Table 7.7: Total Spend on Digital Identity Verification for Other Verification Services ($m), in the UK, 2025-2029

- Table 7.8: Total Number of Digital Identity Verification Checks for Other Verification Services (m), in the UK, 2025-2029

- 7.1.1. Total Volume of Digital Identity Verification Checks per Annum

- 7.2. Related Research