PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1526419

PUBLISHER: Juniper Research Ltd | PRODUCT CODE: 1526419

Global Payment Card Technologies Market: 2024-2029

'Payment Card Technology Spend to Reach $13.6 Billion Globally by 2029, as Banks Target Premium Users.'

| KEY STATISTICS | |

|---|---|

| Payment card technology spend in 2024: | $9.8bn |

| Payment card technology spend in 2029: | $13.6bn |

| 2024 to 2029 market growth: | 39% |

| Forecast period: | 2024-2029 |

Overview

Our "Payment Card Technologies" research report provides a detailed evaluation and analysis of the ways in which the payment card is changing; impacting the wider payments industry. This includes the way in which banks and other issues are adjusting their credit card, debit card and prepaid card ranges to use new card types to appeal to different demographics. This includes high net worth individuals with premium offerings, and environmentally minded individuals with sustainably made cards. The suite considers how methods such as contactless technology and metal cards are providing a better customer experience at both payment terminals and for online transactions. The research also considers future trends and challenges within the card technology market, such as the need for greater personalisation, competition from other payment types, and intensifying competition for banks.

In addition, the report contains a Juniper Research Competitor Leaderboard; giving readers a comprehensive understanding of the competitive dynamics in this space. The Competitor Leaderboard positions 15 payment card manufacturers; delivering an invaluable resource for stakeholders seeking to understand the competitive landscape in the payment cards market.

The research suite contains a detailed dataset; providing forecasts for payment card adoption, shipments and revenue across a number of different segments.

Collectively, these elements provide a critical tool for understanding this rapidly emerging market outlook; allowing card manufacturers, banks and fintechs to shape their future strategy. This research suite's unparalleled coverage makes it an incredibly useful resource for projecting the future of this highly uncertain market.

Key Features

- Market Dynamics: A strategic analysis of the major drivers, challenges, and innovations shaping the adoption and development of the payment card technologies industry, including the shift from offering basic contactless cards to more advanced physical card offerings, the rise of personalisation, and the use of premium features to attract high net worth customers.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the payment card technology market, accompanied by strategic recommendations for stakeholders, such as card manufacturers, card networks, banks, credit card companies, fintechs and other card issuers.

- Benchmark Industry Forecasts: Includes forecasts for the total number of payment cards in circulation, annual shipments and spend, split by different card types. This data is split by 8 key forecast regions and 60 countries.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 15 card manufacturers, via the Juniper Research Competitor Leaderboard.

SAMPLE VIEW

Market Data & Forecasts PDF Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations and a walk-through of the forecasts.

Market Trends & Strategies Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasts

The market-leading research suite for the "Payment Card Technologies" includes access to the full set of forecast data of 37 tables and over 15,200 datapoints. Metrics in the research suite include:

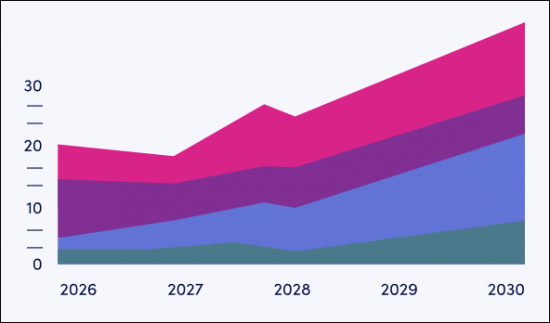

- Number of Payment Cards in Service

- Payment Card Shipments

- Payment Card Technology Spend

The data is split by the following types of cards:

- Metal cards

- Biometric cards

- LED-equipped cards

- Dynamic CVV cards

- Standard contactless cards

The forecast also includes the number of cards that will feature sustainable materials.

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics; displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via 5 interactive scenarios.

Market Trends & Strategies Report

Juniper Research's new report examines the Payment Card Technologies landscape in detail; assessing current trends and factors shaping the market, such as the growing shift to offering varied card types, the need to personalise card offerings, and the impact of competition from other payment mechanisms for card issuers. The report delivers comprehensive analysis of the strategic opportunities for card manufacturers; addressing key verticals, developing challenges, and how stakeholders should navigate these.

Competitor Leaderboard Report

Juniper Research's Competitor Leaderboard provides detailed evaluation and market positioning for 15 leading payment card manufacturers. The vendors in the Competitor Leaderboard are positioned either as established leaders, leading challengers or disruptors and challengers, based on capacity and capability assessments.

The vendors in the Competitor Leaderboard include:

|

|

Backed by a robust and comprehensive scoring methodology, Juniper Research's Competitor Leaderboard allows readers to gain greater insight into leading market players; enabling them to view which companies have the highest market prospects and the strategies being implemented.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Market Landscape

- 2.1. Introduction

- 2.2. Definitions and Organisation of the Market

- Figure 2.1: Card Technologies Driving Innovation

- 2.2.1. Contactless Payment Cards

- 2.2.2. Biometric Payment Cards

- Figure 2.3: Mastercard Biometric Card

- 2.2.3. Metal Cards

- 2.2.4. Dynamic CSC/CVV

- Figure 2.4: Dynamic CSC/CVC Card Technology

- 2.2.5. LED Cards

- 2.2.6. Recycled Cards

- Figure 2.5: Card Recycling Box in HSBC Branches

- 2.2.7. Wood Cards

- Figure 2.6: Thales Gemalto Wood Card

- 2.2.8. Payment Wearables

- Figure 2.7: CashCuff Shirt in Use

- 2.3. Types of Vendors

- Figure 2.8: Different Roles in Cards Market

- 2.4. The History of Payment Cards

- Figure 2.9: Milestones in Credit Card Development

- 2.5. Key Trends Driving Payment Card Innovation

- 2.5.1. The Rise of Digital

- 2.5.2. Intensifying Competition within Banking

- Figure 2.11: Prominent Digital Banks & Their User Bases

3. Segment Analysis

- 3.1. Introduction

- 3.1.1. Contactless Cards

- i. The Use Case and Its Place in the Market

- ii. The Benefits of the Technology

- iii. The Challenges of Adoption

- iv. Future Outlook

- 3.1.2. Recycled/Eco Cards

- i. The Use Case and Its Place in the Market

- ii. The Benefits of the Technology

- iii. The Challenges of Adoption

- iv. Future Outlook

- 3.1.3. Biometric Cards

- i. The Use Case and its Place in the Market

- Figure 3.1: Components of Biometric Payment Card

- ii. The Benefits of the Technology

- iii. The Challenges of Adoption

- iv. Future Outlook

- i. The Use Case and its Place in the Market

- 3.1.4. Metal Cards

- i. The Use Case and its Place in the Market

- ii. The Benefits of the Technology

- iii. The Challenges of Adoption

- iv. Future Outlook

- 3.1.5. Dynamic CVV Cards

- i. The Use Case and its Place in the Market

- Figure 3.2: Thales Gemalto Dynamic Code Card

- ii. The Benefits of the Technology

- iii. The Challenges of Adoption

- Figure 3.3: BBVA Aqua Dynamic CVV in app

- iv. Future Outlook

- i. The Use Case and its Place in the Market

- 3.1.6. LED Cards

- i. The Use Case and Its Place in the Market

- ii. The Benefits of the Technology

- iii. The Challenges of Adoption

- iv. Future Outlook

- 3.1.7. Payment Wearables

- i. The Use Case and Its Place in the Market

- ii. The Benefits of the Technology

- iii. The Challenges of Adoption

- iv. Future Outlook

- 3.1.1. Contactless Cards

4. Country Readiness Index & Analysis

- 4.1. Introduction

- Figure 4.1: Juniper Research's 8 Key Regions Definition

- Figure 4.2: Juniper Research Country Readiness Index Scoring Criteria: Payment Card Technologies

- Figure 4.3: Juniper Research Country Readiness Index: Payment Card Technologies

- Figure 4.4: Payment Card Technologies Country Readiness Index: Market Segments

- 4.2. Focus Markets

- 4.2.1. Card-heavy Markets Showing Best Prospects

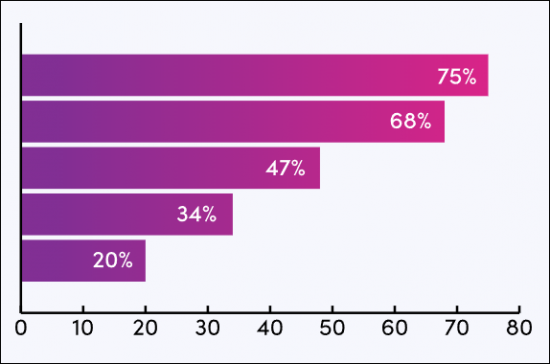

- Figure 4.5: Proportion of Adult Population who Hold a Bank Account (%), Selected Countries, 2024

- 4.2.2. Affluence Important Due To 'Premium' Nature of Card Offerings

- Figure 4.6: GDP per Capita ($), Selected Countries, 2024

- 4.2.3. Country Level Assessment: India

- 4.2.1. Card-heavy Markets Showing Best Prospects

- 4.3. Growth Markets

- 4.3.1. Relatively Low Card Penetration

- Figure 4.7: Average Number of Cards in Service per Adult (Over 15), 2024, Selected Countries

- 4.3.2. Relatively Low Levels of Affluence

- 4.3.1. Relatively Low Card Penetration

- 4.4. Saturated Markets

- 4.4.1. Card Payments Reaching Saturation

- Figure 4.8: Average Number of Cards in Service per Adult (Over 15), 2024, Selected Countries

- 4.4.2. Country Level Assessment: China

- 4.4.1. Card Payments Reaching Saturation

- 4.5. Developing Markets

- Table 4.9: Juniper Research's Country Readiness Index Heatmap: North America

- Table 4.10: Juniper Research's Country Readiness Index Heatmap: Latin America

- Table 4.11: Juniper Research's Country Readiness Index Heatmap: West Europe

- Table 4.12: Juniper Research's Country Readiness Index Heatmap: Central & East Europe

- Table 4.13: Juniper Research's Country Readiness Index Heatmap: Far East & China

- Table 4.14: Juniper Research's Country Readiness Index Heatmap: Indian Subcontinent

- Table 4.15: Juniper Research's Country Readiness Index Heatmap: Rest of Asia Pacific

- Figure 4.16: Juniper Research's Country Readiness Index Heatmap: Africa & Middle East

Competitor Leaderboard

1. Juniper Research Competitor Leaderboard

- 1.1. Why Read This Report

- Table 1.1: Juniper Research Competitor Leaderboard Vendors: Payment Card Technologies

- Figure 1.2: Juniper Research Competitor Leaderboard - Payment Card Technologies

- Table 1.3: Juniper Research Competitor Leaderboard: Payment Card Technologies Vendor Ranking

- Table 1.4: Juniper Research Competitor Leaderboard Payment Card Technologies - Heatmap

2. Company Profiles

- 2.1. Payment Card Technologies Vendor Profiles

- 2.1.1. allpay cards

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.2. CompoSecure

- i. Corporate

- Table 2.1: CompoSecure Financial Snapshot ($m), FY 2021-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.3. CPI Card Group

- i. Corporate

- Table 2.2: CPI Financial Snapshot ($m), FY 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.4. dzcard

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.5. Eastcompeace

- i. Corporate

- Table 2.3: Eastcompeace Financial Snapshot ($m), FY 2021-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.6. Fingerprints

- i. Corporate

- Table 2.4: Fingerprints Financial Snapshot ($m), FY 2021-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- Figure 2.5: Fingerprints Biometric Card

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.7. Giesecke+Devrient

- i. Corporate

- Table 2.6: G&D Financial Information Snapshot (Euro-m), 2020-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.8. Goldpac

- i. Corporate

- Table 2.7: Goldpac Financial Information Snapshot ($m), 2021-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.9. IDEMIA

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.10. KONA I

- i. Corporate

- Table 2.8: KONA I Financial Information Snapshot ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.11. Perfect Plastic

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.12. Thales Group

- i. Corporate

- Table 2.9: Thales' Financial Information Snapshot, (Euro-bn), 2020-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- Figure 2.10: Gemalto Voice Payment Card Pairing

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.13. Toppan Gravity

- i. Corporate

- Figure 2.11: Toppan Holdings Inc Financial Results, FY 23 & 24, USD $m

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.14. Valid

- i. Corporate

- Figure 2.12: Valid Financial Results, 2021 to 2023, USD $m

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.15. Watchdata

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.1. allpay cards

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.2.1. Limitations & Interpretation

- Table 2: Juniper Research Leaderboard Assessment Criteria: Payment Card Technologies

- 2.2.1. Limitations & Interpretation

Data & Forecasting

1. Introduction & Methodology

- 1.1. Introduction

- Figure 1.1: Card Technologies Driving Innovation

- 1.2. Forecast Introduction

- 1.2.1. Methodology & Assumptions

- Figure 1.2: Metal Cards Forecast Methodology

- Figure 1.3: Biometric Cards Forecast Methodology

- Figure 1.4: Dynamic CVV Cards Forecast Methodology

- Figure 1.5: Basic Contactless Cards Forecast Methodology

- 1.2.1. Methodology & Assumptions

2. Forecast Summary

- 2.1. Payment Card Technologies Forecasts

- 2.1.1. Payments Cards In Service

- Figure & Table 2.1: Total Number of Payment Cards in Issue (Including Debit, Credit & ATM Cards), Year End (m), Split by 8 Key Regions, 2024-2029

- 2.1.2. Payments Cards Shipments

- Figure & Table 2.2: Total Payment Card Shipments (m), Split by 8 Key Regions, 2024-2029

- Table 2.3: Total Payment Card Shipments, Split by Technology (m), 2024-2029

- 2.1.3. Payments Cards Revenue

- Figure & Table 2.4: Card Technology Revenue ($m), Split by 8 Key Regions, 2024-2029

- Table 2.5: Card Technology Revenue, Split by Technology ($m), 2024-2029

- 2.1.1. Payments Cards In Service

3. Metal Cards

- 3.1. Metal Cards Forecasts

- 3.1.1. Metal Cards in Service

- Figure & Table 3.1: Number of Payment Cards in Service which are Metal (m), Split by 8 Key Regions, 2024-2029

- 3.1.2. Metal Cards Shipments

- Figure & Table 3.2: Total Metal Card Shipments per annum (m), Split by 8 Key Regions, 2024-2029

- 3.1.3. Metal Cards Revenue

- Figure & Table 3.3: Total Metal Card Revenue ($m), Split by 8 Key Regions, 2024-2029

- 3.1.1. Metal Cards in Service

4. Biometric Cards

- 4.1. Biometric Cards Forecasts

- 4.1.1. Biometric Payment Cards in Service

- Figure & Table 4.1: Number of Payment Cards in Service which Feature Biometrics (m), Split by 8 Key Regions, 2024-2029

- 4.1.2. Biometric Payment Cards Shipments

- Figure & Table 4.2: Total Biometric Payment Card Shipments per annum (m), Split by 8 Key Regions, 2024-2029

- 4.1.3. Biometric Payment Cards Revenue

- Figure & Table 4.3: Total Biometric Payment Card Revenue ($m), Split by 8 Key Regions, 2024-2029

- 4.1.1. Biometric Payment Cards in Service

5. Dynamic CVV Cards

- 5.1. Dynamic CVV Payment Cards Forecasts

- 5.1.1. Dynamic CVV Payment Cards in Service

- Figure & Table 5.1: Number of Payment Cards in Service which Feature Dynamic CVV Codes (m), Split by 8 Key Regions, 2024-2029

- 5.1.2. Dynamic CVV Payment Cards Shipments

- Figure & Table 5.2: Total Dynamic CVV Payment Card Shipments per annum (m), Split by 8 Key Regions, 2024-2029

- 5.1.3. Dynamic CVV Payment Cards Revenue

- Figure & Table 5.3: Total Dynamic CVV Payment Card Revenue ($m), Split by 8 Key Regions, 2024-2029

- 5.1.1. Dynamic CVV Payment Cards in Service

6. LED Cards

- 6.1. LED Payment Cards Forecasts

- 6.1.1. LED Payment Cards in Service

- Figure & Table 6.1: Number of Payment Cards in Service which Feature Built in LED (m), Split by 8 Key Regions, 2024-2029

- 6.1.2. LED Payment Cards Shipments

- Figure & Table 6.2: LED Payment Card Shipments (m), Split by 8 Key Regions, 2024-2029

- 6.1.3. LED Payment Cards Revenue

- Figure & Table 6.3: Total LED Payment Card Revenue ($m), Split by 8 Key Regions, 2024-2029

- 6.1.1. LED Payment Cards in Service

7. Recycled Cards

- 7.1. Recycled Payment Cards Shipped

- Figure & Table 7.1: Number of Payment Cards Shipped Featuring Sustainable Materials (m), Split by 8 Key Regions, 2024-2029