PUBLISHER: IoT Analytics GmbH | PRODUCT CODE: 1567373

PUBLISHER: IoT Analytics GmbH | PRODUCT CODE: 1567373

Global Cloud Projects Report and Database 2024

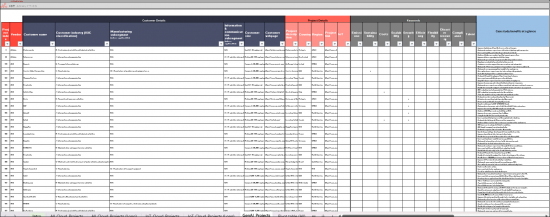

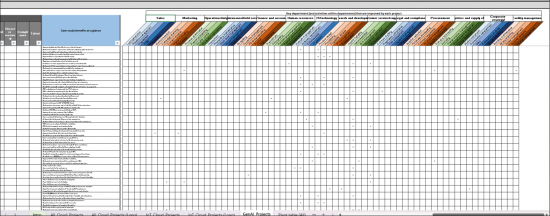

About the database

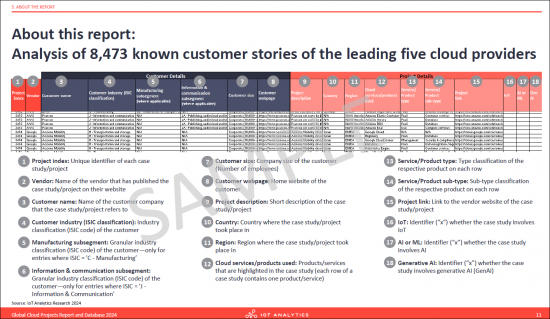

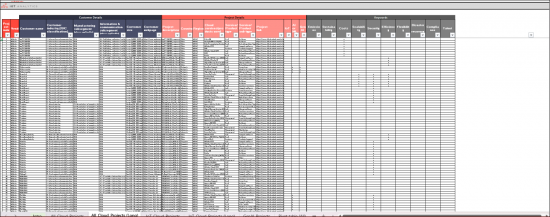

The "Global Cloud Projects Report and Database 2024" is a structured repository of 8,374 projects from five of the largest cloud vendors (Microsoft, AWS, Google, Oracle, Alibaba).

SAMPLE VIEW

All projects in the list represent public information and have been published on the respective vendor's website (as of June 2024). In order for a project to be included in the list, it needs to include either a public cloud IaaS or cloud PaaS service from one of the five vendors. The list has 40,677 total entries as every individual cloud service for every project is listed. Accompanying the database is a 188-page report analyzing 8,000 customer implementations of the largest cloud vendors, including a deep dive into IoT cloud projects.

SAMPLE VIEW

has the highest share. The surge of AI can be seen by the products that grew the most in the past year (mentions in case studies) which are Amazon SageMaker, Azure OpenAI Service, and Google Vertex AI for AWS, Microsoft, and Google respectively.

Questions answered:

- How do AWS, Microsoft, Google, Oracle, and Alibaba compare by country/region/industry/customer size?

- How many case studies did each hyperscaler add in the past year and where (region/industry/size)?

- How does this dataset compare to 2023? What are the most notable changes (services/industries/regions)?

- How many AI and GenAI case studies were added in the past year? Which vendors are leading and which industries are featured the most?

- Who are some of the key clients for each hyperscaler by industry?

- Which cloud services are most often used and which cloud services are the fastest growing?

- How many IoT projects is each vendor highlighting?

- In which industries are IoT projects most prominent?

- Which cloud products compliment (i.e., appear most often) the IoT projects?

SAMPLE VIEW

Companies mentioned:

A selection of companies mentioned in the report.

|

|

|

Table of Contents

1. Executive summary

2. Introduction

- 1. Starting point: The "cloud" remains important

- 2. The cloud market (hyperscalers only) reached $XX in 2023-XX leading

- 3. What is the "cloud"-definition

- 4. 6 Public cloud building blocks

- 5. Each of the six building blocks consists of multiple elements

3. About the report

- 1. About this report: Analysis of 8,473 known customer stories of the leading five cloud providers

- 2. About this report-methodology

- 3. About this report-products that are in scope

- 4. About this report: Extra analysis present in the Excel database

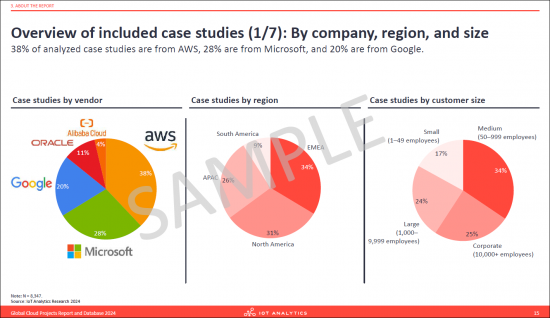

- 5. Overview of included case studies (1/7): By company, region, and size

- 6. Overview of included case studies (2/7): By industry

- 7. Overview of included case studies (3/7): By manufacturing subsegment

- 8. Overview of included case studies (4/7): By industry and region

- 9. Overview of included case studies (5/7): By top 10 countries

- 10. Overview of included case studies (6/7): By product type

- 11. Overview of included case studies (7/7): By product sub-type

- 12. 5 representative case studies in the Excel database: 1. Bosch (Microsoft)

- 13. 5 representative case studies in the Excel database: 2. Toyota (AWS)

- 14. 5 representative case studies in the Excel database: 3. ASML (Google)

- 15. 5 representative case studies in the Excel database: 4. Siemens Mobility (Oracle)

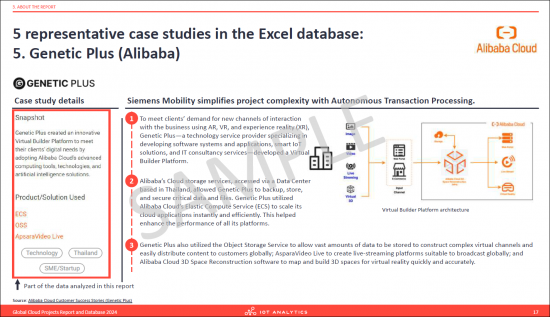

- 16. 5 representative case studies in the Excel database: 5. Genetic Plus (Alibaba)

4. New case studies

- 1. Chapter 4: New case studies - Overview and key takeaways

- 2. Case studies included in this chapter

- 3. New case studies overview (1/4): By vendor

- 4. New case studies overview (2/4): By industry

- 5. New case studies overview (3/4): By manufacturing subsegment

- 6. New case studies overview (4/4): By region

- 7. New AI case studies (1/2): Overview

- 8. New AI case studies (2/2): GenAI overview

- 9. New case studies by vendor (1/2): Industry overview

- 10. New case studies by vendor (2/2): Regional overview

- 11. Fastest growing products by vendor (1/3): AWS

- 12. How is AWS marketing its highest growth products?

- 13. Fastest growing products by vendor (2/3): Microsoft

- 14. How is Microsoft marketing its highest growth products?

- 15. Fastest growing products by vendor (3/3): Google

- 16. How is Google marketing its highest growth products?

5. Cloud vendor comparison

- 1. Chapter 5: Cloud vendor comparison - Overview and key takeaways

- 2. Cloud vendor overview: Main players have different customer footprints

- 3. Regional vendor comparison (1/7): Overview

- 4. Regional vendor comparison (2/7): By region

- 5. Regional vendor comparison (3/7): By top 10 countries

- 6. Regional vendor comparison (4/7): North America

- 7. Regional vendor comparison (5/7): EMEA

- 8. Regional vendor comparison (6/7): APAC

- 9. Regional vendor comparison (7/7): South America

- 10. Vendor comparison by industry served (1/5): Overview

- 11. Vendor comparison by industry served (2/5): Key customers by industry

- 12. Vendor comparison by industry served (3/5): Mfg. subsegments

- 13. Vendor comparison by industry served (4/5): Manufacturing customers

- 14. Vendor comparison by industry served (5/5): ICT subsegments

- 15. Vendor comparison by customer size: Overview

- 16. Vendor comparison by product type (1/2): Overview

- 17. Vendor comparison by product type (2/2): By product sub-type

6. Cloud products/services comparison

- 1. Chapter 6: Cloud products/services comparison - Overview and key takeaways

- 2. 20 most highlighted products across all case studies

- 3. Five industries with the most case studies

- 4. Industry deep dives (1/3): ICT & Manufacturing

- 5. Industry deep dives (2/3): Finance & Retail

- 6. Industry deep dives (3/3): Health

- 7. Case studies by product type

- 8. Product type deep dives (1/3): PaaS & IaaS

- 9. Product type deep dives (2/3): Applications & Management

- 10. Product type deep dives (3/3): Services & Runtime software

- 11. Product sub-type distribution (1/3): PaaS

- 12. Product sub-type distribution (2/3): IaaS & Applications

- 13. Product sub-type distribution (3/3): Mgmt., Services, Runtime S/W

7. Deep-dive: IoT

- 1. Chapter 7: Deep-dive: IoT - Overview and key takeaways

- 2. Deep dive IoT: Overview

- 3. Deep dive IoT: Cloud vendor overview

- 4. IoT products included in the case studies

- 5. Breakdown of IoT case studies

- 6. IoT case studies by industry

- 7. Vendor IoT case study distribution (1/3): By region

- 8. Vendor IoT case study distribution (2/3): By industry

- 9. Vendor IoT case study distribution (3/3): By manufacturing segment

- 10. Products that complement IoT* case studies

8. Deep-dive: AI

- 1. Chapter 8: Deep-dive: AI - Overview and key takeaways

- 2. Deep dive AI: Overview

- 3. Deep dive AI: Cloud vendor overview

- 4. New AI case studies (1/3): By segment

- 5. New AI case studies (2/3): By manufacturing subsegment

- 6. New AI case studies (3/3): By vendor and industry

- 7. AI/ML products included in the case studies

- 8. Breakdown of AI case studies

- 9. AI case studies by industry

- 10. AI case studies by benefits

- 11. Vendor AI case study distribution (1/3) by region

- 12. Vendor AI case study distribution (2/3) by industry

- 13. Vendor AI case study distribution (3/3) by manufacturing subsegment

- 14. Products that complement AI case studies

- 15. New Generative AI case studies (1/2): By segment

- 16. New Generative AI case studies (2/2): By manufacturing subsegment

- 17. Break-out: What are manufacturers doing with GenAI?

- 18. Departments that benefit from GenAI case studies

- 19. Key processes that are improved by GenAI case studies by department

- 20. Where is GenAI used? - Heatmap of GenAI across 70 enterprise activities

9. Deep-dive: Vendors

- 1. Chapter 9: Deep-dive: Vendors - Overview and key takeaways

- 2. Microsoft case studies by region and customer size

- 3. Microsoft case studies by industry

- 4. Microsoft case studies by manufacturing subsegment

- 5. Case study regional distribution for the 10 largest industries

- 6. Case study industry distribution in each region

- 7. Product types in Microsoft case studies

- 8. 15 most often used Microsoft products

- 9. Product sub-type distribution (1/3): PaaS

- 10. Product sub-type distribution (2/3): Applications & IaaS

- 11. Product sub-type distribution (3/3): Management, services, and runtime

- 12. AWS case studies by region and customer size

- 13. AWS case studies by industry

- 14. AWS case studies by manufacturing subsegment

- 15. Case study regional distribution for the 10 largest industries

- 16. Case study industry distribution in each region

- 17. Product types in AWS case studies

- 18. 15 most often used AWS products

- 19. Product sub-type distribution (1/3): PaaS

- 20. Product sub-type distribution (2/3): Applications & IaaS

- 21. Product sub-type distribution (3/3): Management, services, and runtime

- 22. Google case studies by region and customer size

- 23. Google case studies by industry

- 24. Google case studies by manufacturing subsegment

- 25. Case study regional distribution for the 10 largest industries

- 26. Case study industry distribution in each region

- 27. Product types in Google case studies

- 28. 15 most often used Google products

- 29. Product sub-type distribution (1/3): PaaS

- 30. Product sub-type distribution (2/3): Applications & IaaS

- 31. Product sub-type distribution (3/3): Management, services, and runtime

- 32. Oracle case studies by region and customer size

- 33. Oracle case studies by industry

- 34. Oracle case studies by manufacturing subsegment

- 35. Case study regional distribution for the 10 largest industries

- 36. Case study industry distribution in each region

- 37. Product types in Oracle case studies

- 38. 15 most often used Oracle products

- 39. Product sub-type distribution (1/3): PaaS

- 40. Product sub-type distribution (2/3): Applications & IaaS

- 41. Product sub-type distribution (3/3): Management, services, and runtime

- 42. Alibaba case studies by region and customer size

- 43. Alibaba case studies by industry

- 44. Alibaba case studies by manufacturing segment

- 45. Case study regional distribution for the 10 largest industries

- 46. Case study industry distribution in each region

- 47. Product types in Alibaba case studies

- 48. 15 most often used Alibaba products

- 49. Product sub-type distribution (1/3): PaaS

- 50. Product sub-type distribution (2/3): Applications & IaaS

- 51. Product sub-type distribution (3/3): Management, services, and runtime

10. Appendix

11. About IoT Analytics