PUBLISHER: Industry Experts | PRODUCT CODE: 1697454

PUBLISHER: Industry Experts | PRODUCT CODE: 1697454

Global Carbon Fibers & Carbon Fiber Reinforced Plastics (CFRP) Market - Products, Applications and Production Capacities

Global Carbon Fibers & Carbon Fiber Reinforced Plastics (CFRP) Market Trends and Outlook

The lightweight properties of carbon fibers play a pivotal role in reducing carbon dioxide (CO2) emissions across the lifecycle of products, addressing critical global environmental challenges. This advantage has driven their growing adoption in key industries, including wind energy, aerospace, automotive, and pressure vessels. In aerospace and automotive sectors, manufacturers are leveraging carbon fiber to enhance fuel efficiency by producing lighter, more aerodynamic aircraft and vehicles. Meanwhile, the wind energy industry has embraced carbon fiber for manufacturing larger, more efficient turbine blades, optimizing energy output. Carbon fiber's high strength-to-weight ratio also makes it ideal for constructing robust, lightweight storage vessels for alternative fuels like hydrogen, aligning with the push for sustainable transportation.

The market faced a significant downturn in 2020 due to the COVID-19 pandemic, which disrupted almost all major end-use sectors. Demand for carbon fibers worldwide recovered sharply during 2021-2022 period driven by recovery in commercial aerospace and industrial applications coupled with robust growth in sports equipment and wind turbine blades production, but experienced a subsequent drop in 2023, primarily due to a significant decrease in demand from the wind energy sector, which is a major consumer of carbon fiber for turbine blades; this reduced, demand led to a surplus in the market and consequently lower prices.

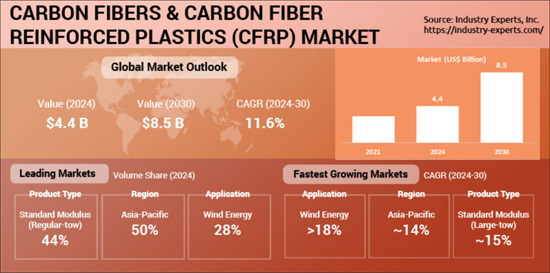

The demand for carbon fiber is poised for significant growth, driven by megatrends such as the push toward carbon neutrality and advancements in sustainable technologies. Global carbon fiber demand is expected to reach close to 274 thousand metric tons by 2030, growing at a robust CAGR of 13.2% from 2024 to 2030. In terms of value, the global carbon fiber market is projected to reach US$8.5 billion by 2030. The global market for carbon fiber reinforced plastics (CFRP) was valued at $28 billion in 2024 and projected to expand at a CAGR of 11.4% in reaching $54 billion by 2030. Key applications fueling this growth include pressure vessels for compressed natural gas (CNG), renewable natural gas (RNG), and hydrogen (CHG) storage, as well as wind turbine blades, existing commercial aircraft models, and gas diffusion layer base materials for fuel cells.

Major companies operating in the global Carbon Fibers market include: Toray (including Zoltek), Teijin, Mitsubishi Chemical, SGL Carbon, Kureha, Hexcel, Formosa Plastics, Syensqo, DowAksa, Hyosung Advanced Materials, UMATEX Group, Zhongfu Shenying, Jilin Chemical Fiber Group (along with Jilin Jinggong), Jiangsu Hengshen and Weihai Tuozhan Fiber among others.

Global Carbon Fibers Production Capacity

The worldwide installed production capacity of carbon fibers was approximately 263k metric tons in 2024. To meet the rising demand across multiple industries, major manufacturers have expanded their production capacities globally, while new entrants are also venturing into this lucrative market. Between 2016 and 2024, the global carbon fiber production capacity grew at a compound annual growth rate (CAGR) of 9.7%. Notably, since 2019, this growth accelerated driven by significant capacity additions in China and investments by leading companies such as Toray (Zoltek), Teijin, Hyosung, and Hexcel.

Recent announcements from key players and new entrants from China suggest that if all planned projects are completed as scheduled, global carbon fiber production capacity could reach 575k metric tons by 2030. Currently, the global market is led by prominent manufacturers, including Toray (which also owns Zoltek), Jilin Chemical Fiber, Mitsubishi Chemical, SGL Carbon, Hexcel, Teijin, and Zhongfu Shenying. Toray holds the largest market share, accounting for over 20% of the global installed capacity.

Carbon Fibers & Carbon Fiber Reinforced Plastics (CFRP) Regional Market Analysis

The global Carbon Fibers & Carbon Fiber Reinforced Plastics (CFRP) market has been, for the purpose of this report, categorized into four major regions, namely North America, Europe, Asia-Pacific and Rest of World. These regional markets further analyzed for 16 independent countries across North America - The United States and Canada; Europe - Denmark, France, Germany, Italy, Spain and the United Kingdom; and Asia-Pacific - China, India, Japan, South Korea and Taiwan; and Rest of World - Brazil, Russia and Turkiye. With a share of 42.5% in 2024, Asia-Pacific is the largest market for Carbon Fibers worldwide in terms of value and also slated to record the fastest value CAGR of 13% between 2024 and 2030, reaching US$3.9 billion by 2030.

Global Carbon Fibers & Carbon Fiber Reinforced Plastics (CFRP) Market Analysis by Application

The market for global Carbon Fibers & Carbon Fiber Reinforced Plastics (CFRP) applications analyzed in this report include Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive, Pressure Vessels, Construction & Infrastructure, Molding Compounds, Oil & Gas, and Other Industrial applications. Wind Energy constitutes the largest end-use application for carbon fibers worldwide, with a volume share of 28% in 2024. Maintaining a 2024-2030 CAGR of 18%, global consumption of Carbon Fibers in Wind Energy sector is further projected to reach 97 thousand metric tons by 2030. In terms of growth between 2024 and 2030, Pressure Vessels applications of Carbon Fibers are slated to grow at a second fastest volume CAGR of 16% during that period.

Fiberglass (Glass Wool) Insulation Market Report Scope

This global report on Carbon Fibers & Carbon Fiber Reinforced Plastics (CFRP) analyzes the market based on type and application. This report also reveals historical and current carbon fiber installed production capacities and future expansions by all carbon fiber manufacturers across the globe. In addition to providing profiles of major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of carbon fiber industry.

| KEY METRICS | |

|---|---|

| Historical Period: | 2021-2023 |

| Base Year: | 2024 |

| Forecast Period: | 2024-2030 |

| Units: | Volume consumption in Metric Tons (Tonnes) and Value market in US$. |

| Companies Mentioned: | 130+ |

Global Carbon Fibers & Carbon Fiber Reinforced Plastics (CFRP) Market by Geographic Region

- North America (The United States and Canada)

- Europe (Denmark, France, Germany, Italy, Spain, The United Kingdom and Rest of Europe)

- Asia-Pacific (China, India, Japan, South Korea, Taiwan and Rest of Asia-Pacific)

- Rest of World (Brazil, Russia, Turkiye and Other ROW)

Global Carbon Fibers Market by Product Type

- Standard Modulus (Large-tow)

- Standard Modulus (Regular-tow)

- Intermediate Modulus

- High Modulus

Global Carbon Fibers & Carbon Fiber Reinforced Plastics (CFRP) Market by Application

- Aerospace & Defense

- Sports & Leisure

- Wind Energy

- Automotive

- Pressure Vessels

- Construction & Infrastructure

- Molding Compounds

- Oil & Gas

- Other Industrial

Global Carbon Fibers Installed (Theoretical) Production Capacity

- Carbon Fiber Installed Production Capacity by Manufacturer and Plant Location

- Carbon Fiber Installed (Theoretical) Production Capacity by Country and Region

- Carbon Fiber Installed (Theoretical) Production Capacity by Source (PAN-based, Pitch-based)

TABLE OF CONTENTS

PART A: GLOBAL MARKET PERSPECTIVE

1. INTRODUCTION

- Global Carbon Fibers End-use Applications Market Trends and Outlook

- Global Carbon Fibers Regional Market Trends and Outlook

- Global Carbon Fibers Production Capacity Trends and Outlook

- 1.1. Product Outline

- 1.1.1. Carbon Fibers

- 1.1.1.1. Structure and Properties of Carbon Fibers

- 1.1.1.1.1. Mechanical Properties

- 1.1.1.1.2. Thermal and Electrical Properties

- 1.1.1.1.3. Superior X-Ray Permeability

- 1.1.1.2. Classification of Carbon Fibers

- 1.1.1.2.1. Classification Based on Raw Materials Used

- 1.1.1.2.1.1. PAN-Based Carbon Fiber

- 1.1.1.2.1.2. Pitch-Based Carbon Fiber

- 1.1.1.2.2. Classification Based on Mechanical Properties

- 1.1.1.2.2.1. Standard Elastic Modulus (HT) Regular-tow Carbon Fibers

- 1.1.1.2.2.2. Standard Elastic Modulus (HT) Large-tow Carbon Fibers

- 1.1.1.2.2.3. Intermediate Elastic Modulus (IM) Carbon Fibers

- 1.1.1.2.2.4. High Elastic Modulus (HM) Carbon Fibers

- 1.1.1.2.3. Classification Based on the Final Heat Treatment Temperature

- 1.1.1.2.3.1. High-heat-treatment Carbon Fibers (HTT)

- 1.1.1.2.3.2. Intermediate-heat-treatment Carbon Fibers (IHT)

- 1.1.1.2.3.3. Low-heat-treatment Carbon Fibers (LHT)

- 1.1.1.2.3.4. Classification Based on Secondary Processing

- 1.1.1.2.3.5. Fiber

- 1.1.1.2.3.6. Tow

- 1.1.1.2.3.7. Staple Yarn

- 1.1.1.2.3.8. Woven Fabric

- 1.1.1.2.3.9. Braid

- 1.1.1.2.3.10. Chopped Fiber

- 1.1.1.2.3.11. Milled Fiber

- 1.1.1.2.3.12. Felt or Mat

- 1.1.1.2.3.13. Paper

- 1.1.1.2.3.14. Prepreg

- 1.1.1.2.1. Classification Based on Raw Materials Used

- 1.1.1.3. Manufacturing Process of Carbon Fibers

- 1.1.1.3.1. PAN-Based Carbon Fiber

- 1.1.1.3.1.1. Polymerization

- 1.1.1.3.1.2. Spinning

- 1.1.1.3.1.3. Oxidation

- 1.1.1.3.1.4. Carbonization

- 1.1.1.3.1.5. Surface Treatment and Sizing

- 1.1.1.3.2. Pitch-Based Carbon Fiber

- 1.1.1.3.2.1. Pitch Reforming and Refining

- 1.1.1.3.2.2. Spinning

- 1.1.1.3.2.3. Oxidation

- 1.1.1.3.2.4. Carbonization and Graphitization

- 1.1.1.3.1. PAN-Based Carbon Fiber

- 1.1.1.4. Carbon Fibers Based on Other Precursors

- 1.1.1.4.1. Cellulosic Carbon Fibers

- 1.1.1.4.2. Lignin Carbon Fibers

- 1.1.1.4.3. Other Precursor Materials

- 1.1.1.4.3.1. What needs to be done?

- 1.1.1.1. Structure and Properties of Carbon Fibers

- 1.1.2. Carbon Fiber Composites

- 1.1.2.1. Carbon Fiber Reinforced Plastics - CFRPs (Polymer Matrix Composites)

- 1.1.2.1.1. Resin Systems Used in CFRP

- 1.1.2.2. Carbon-Carbon Composites (Carbon Matrix Composites)

- 1.1.2.3. Metal Matrix Composites

- 1.1.2.4. Ceramic Matrix Composites

- 1.1.2.5. Hybrid Composites

- 1.1.2.6. Manufacturing Processes of Carbon Fiber Composites

- 1.1.2.6.1. Hand Lay-Up

- 1.1.2.6.2. Molding

- 1.1.2.6.3. Compression Molding

- 1.1.2.6.4. Bladder Molding

- 1.1.2.6.5. Vacuum Bagging

- 1.1.2.6.6. Autoclave

- 1.1.2.6.7. Out-of-Autoclave

- 1.1.2.6.8. Resin Infusion

- 1.1.2.6.9. Resin Transfer Molding (RTM)

- 1.1.2.6.10. Vacuum Assisted Resin Transfer Molding (VARTM)

- 1.1.2.6.11. Filament Winding

- 1.1.2.6.12. Pultrusion

- 1.1.2.6.13. Automated Fiber Placement (AFP) and Automated Tape Laying (ATL)

- 1.1.2.6.14. Other Composite Manufacturing Processes

- 1.1.2.1. Carbon Fiber Reinforced Plastics - CFRPs (Polymer Matrix Composites)

- 1.1.1. Carbon Fibers

- 1.2. End Use Applications - A Snapshot

- 1.2.1. Aerospace and Defense

- 1.2.2. Sports and Leisure Applications

- 1.2.3. Automotive & Transportation

- 1.2.4. Wind Energy

- 1.2.5. Pressure Vessels

- 1.2.6. Construction and Infrastructure

- 1.2.7. Molding Compounds Applications

- 1.2.8. Oil and Gas Applications

- 1.2.9. Other Industrial Applications

2. KEY MARKET TRENDS

- 2.1. Unlocking the Future: Composites Opportunities and Emerging Trends in eVTOL Aircraft

- 2.1.1. Carbon Fiber Composites Play a Pivotal Role in eVTOL Development

- 2.2. China's Aggressive Carbon Fiber Expansion: Global Market Implications

- 2.2.1. North America: Maturing Market with Balanced Growth

- 2.2.2. Asia-Pacific: Rapid Expansion and Overcapacity Risks

- 2.2.3. Europe and Japan: Moderate Growth with Strategic Focus

- 2.2.4. Global Market Implications and Future Outlook

- 2.2.5. China's Carbon Fiber Ambitions: Technology and Market Risks May Challenge Expansion Plans

- 2.2.6. Leading Players Response to China Competition

- 2.3. Burgeoning Opportunities for Carbon Fibers in High-pressure Gas Storage Vessels

- 2.3.1. Advancements in Hydrogen Fuel Cell Vehicles

- 2.3.2. Expansion in Carbon Fiber Production for Pressure Vessels

- 2.3.3. Rising Production of Pressure Vessels and Hydrogen Systems

- 2.3.4. Innovation in Type V Linerless Pressure Vessels

- 2.3.5. Emergence of Liquid and Cryo-Compressed Hydrogen Storage

- 2.4. Advances in Low-Cost Carbon Fiber Manufacturing

- 2.4.1. Innovative Low-Cost Carbon Fiber Production from Oil Residues: A Breakthrough by KAUST

- 2.4.2. Oak Ridge National Laboratory Leads in Developing Low-Cost Carbon Fiber Production Methods

- 2.4.3. Plants as Alternatives to Petroleum for Making Carbon Fibers

- 2.4.4. Coal Offers Opportunity for Low-Cost Carbon Fibers

- 2.4.5. Low-Cost Carbon Fiber from Biomass

3. INDUSTRY LANDSCAPE

- 3.1. An Overview of the Carbon Fibers Supply Chain

- 3.2. Global Carbon Fibers Production Capacities

- 3.2.1. Carbon Fibers (PAN & Pitch) Installed Capacities by Geographic Region

- 3.2.2. Carbon Fibers (PAN & Pitch) Installed Capacities by Precursor Type

- 3.2.2.1. PAN-Based Carbon Fiber Installed Capacities by Geographic Region

- 3.2.3. Carbon Fibers (PAN & Pitch) Installed Capacities by Country

- 3.2.4. Carbon Fibers (PAN & Pitch) Installed Capacities by Manufacturer

- 3.2.4.1. PAN-Based Carbon Fibers Installed Capacities by Country

- 3.2.4.2. PAN-Based Carbon Fibers Installed Capacities by Manufacturer

- 3.2.4.3. Pitch-Based Carbon Fibers Installed Capacities by Country

- 3.2.4.4. Pitch-Based Carbon Fibers Installed Capacities by Manufacturer

- 3.2.4.5. Installed Capacities of Major Carbon Fiber Manufacturers by their Operating Country

- 3.2.4.5.1. Toray Industries

- 3.2.4.5.2. Teijin Carbon

- 3.2.4.5.3. Mitsubishi Chemical

- 3.2.4.5.4. SGL Carbon

- 3.2.4.5.5. Hexcel Corporation

- 3.2.4.5.6. Hyosung Advanced Materials

- 3.2.4.5.7. Jilin Chemical Fiber Group

- 3.3. Carbon Fibers Manufacturers

- 3.3.1. 4M Carbon Fiber Corp. (United States)

- 3.3.2. Advanced Carbon Products, LLC (United States)

- 3.3.3. Anshan Sinocarb Carbon Fibers Co., Ltd. (China)

- 3.3.4. Bluestar Fibres Corporation (China)

- 3.3.5. Changsheng (Langfang) Technology Co., Ltd. (China)

- 3.3.6. DowAksa (Turkey)

- 3.3.7. Formosa Plastics Corporation (Taiwan)

- 3.3.8. GanSu HaoShi Carbon Fiber Co., Ltd. (China)

- 3.3.9. Harper International Corp. (United States)

- 3.3.10. Hexcel Corporation (United States)

- 3.3.11. Hyosung Advanced Materials (South Korea)

- 3.3.12. Jiangsu Hengshen Co., Ltd. (China)

- 3.3.13. Jindal Advanced Materials Private Limited (India)

- 3.3.14. Jilin Chemical Fiber Group Co., Ltd. (China)

- 3.3.15. Jinggong Group Co. Ltd. (China)

- 3.3.16. Kureha Corporation (Japan)

- 3.3.17. Mitsubishi Chemical Corporation (Japan)

- 3.3.18. Newtech Group Co., Ltd. (China)

- 3.3.19. Nippon Graphite Fiber Corporation (Japan)

- 3.3.20. Osaka Gas Chemicals Co Ltd. (Japan)

- 3.3.21. Reliance Industries Ltd. (India)

- 3.3.22. SGL Carbon SE (Germany)

- 3.3.23. Shandong Guotai Dacheng Technology Co., Ltd. (China)

- 3.3.24. Shandong Yongcheng New Materials Co. Ltd. (China)

- 3.3.25. SINOPEC Shanghai Petrochemical Company Limited (China)

- 3.3.26. Syensqo SA (Belgium)

- 3.3.27. Taekwang Industrial Co., Ltd. (South Korea)

- 3.3.28. Teijin Limited (Japan)

- 3.3.29. Toray Industries, Inc. (Japan)

- 3.3.30. UHT Unitech Co., Ltd. (Taiwan)

- 3.3.31. UMATEX, ROSATOM State Corporation (Russia)

- 3.3.32. Weihai Guangwei Composites Co., Ltd. (China)

- 3.3.33. Xinjiang Runjust New Material Co. Ltd (China)

- 3.3.34. Zhongfu Shenying Carbon Fiber Co., Ltd. (China)

- 3.4. Carbon Fibers Recyclers

- 3.4.1. Carbon Conversions, Inc. (United States)

- 3.4.2. Carbon Fiber Recycle Industry Co., Ltd. (Japan)

- 3.4.3. Carbon Fiber Recycling, Inc. (United States)

- 3.4.4. CFK Valley Stade Recycling GmbH & Co KG (Germany)

- 3.4.5. ELG Carbon Fibre Ltd. (United Kingdom)

- 3.4.6. Hadeg Recycling GmbH (Germany)

- 3.4.7. Shocker Composites, LLC (United States)

- 3.4.8. Vartega Inc (United States)

- 3.4.9. WIPAG Deutschland GmbH (Germany)

- 3.4.10. YF International BV (Netherlands)

- 3.5. Carbon Fiber Composites Manufacturers

- 3.5.1. A&P Technology (United States)

- 3.5.2. Aciturri Aeronautica (Spain)

- 3.5.3. Adherent Technologies, Inc. (United States)

- 3.5.4. Advanced International Multitech Co., Ltd. (Taiwan)

- 3.5.5. Airborne (Netherlands)

- 3.5.6. Albany Engineered Composites (United States)

- 3.5.7. ALBIS Distribution GmbH & Co. KG (Germany)

- 3.5.8. Aldila, Inc. (United States)

- 3.5.9. Asian Composites Manufacturing Sdn Bhd (Malaysia)

- 3.5.10. Aurora Flight Sciences Corporation (United States)

- 3.5.11. Automated Dynamics (United States)

- 3.5.12. Bally Ribbon Mills (United States)

- 3.5.13. BGF Industries, Inc. (Porcher Group) (United States)

- 3.5.14. Bond-Laminates GmbH (Germany)

- 3.5.15. CIT Composite Materials Italy (Italy)

- 3.5.16. Composite Technology Development, Inc. (United States)

- 3.5.17. Composites Horizons Inc (United States)

- 3.5.18. ENEOS Corporation (Japan)

- 3.5.19. Euro Advanced Carbon Fiber Composites GmbH (Germany)

- 3.5.20. F.S. Fehrer Automotive GmbH (Germany)

- 3.5.21. Faber Industrie SpA (Italy)

- 3.5.22. Fabric Development Inc (United States)

- 3.5.23. Fibertech Co., Ltd. (South Korea)

- 3.5.24. Fothergill Engineered Fabrics Limited (United Kingdom)

- 3.5.25. Fritzmeier Composite GmbH & CO KG (Germany)

- 3.5.26. GKN Aerospace (United Kingdom)

- 3.5.27. Gurit Holding AG (Switzerland)

- 3.5.28. Hankuk Carbon Co., Ltd. (South Korea)

- 3.5.29. Hexagon Composites ASA (Norway)

- 3.5.30. Hexcel Reinforcements UK Limited (United Kingdom)

- 3.5.31. Jiangsu Aosheng Composite Materials Hi-Tech Co., Ltd. (China)

- 3.5.32. Kaman Corporation (United States)

- 3.5.33. Kineco Limited (India)

- 3.5.34. KORDSA Teknik Tekstil A.S. (Turkey)

- 3.5.35. Korea Aerospace Industries Ltd (South Korea)

- 3.5.36. Kureha (Shanghai) Carbon Fiber Materials Co., Ltd. (China)

- 3.5.37. LATI Industria Termoplastici SpA (Italy)

- 3.5.38. Lehmann&Voss&Co. (Germany)

- 3.5.39. Leonardo SpA (Italy)

- 3.5.40. LM Wind Power (Denmark)

- 3.5.41. Luxfer Gas Cylinders (Luxfer Group) (United Kingdom)

- 3.5.42. Magna International Inc. (Canada)

- 3.5.43. MENZOLIT GmbH (Germany)

- 3.5.44. Metal Mate Co., Ltd. (Thailand)

- 3.5.45. Metyx (Turkey)

- 3.5.46. Mitsubishi Heavy Industries Ltd (Japan)

- 3.5.47. Mubea Carbo Tech GmbH (Austria)

- 3.5.48. Nippon Carbon Co., Ltd. (Japan)

- 3.5.49. Nordex SE (Germany)

- 3.5.50. Oxeon AB (Sweden)

- 3.5.51. Park Aerospace Corp. (United States)

- 3.5.52. PGTEX China Co., Ltd. (China)

- 3.5.53. Plasan Carbon Composites, Inc. (United States)

- 3.5.54. Porcher Industries SA (France)

- 3.5.55. Premium Aerotec GmbH (Germany)

- 3.5.56. Quantum Fuel Systems LLC (United States)

- 3.5.57. Riverscarbon Technologies Ltd (New Zealand)

- 3.5.58. Rockman Advanced Composites Pvt Ltd (India)

- 3.5.59. Roding Automobile GmbH (Germany)

- 3.5.60. RTP Company (United States)

- 3.5.61. Sakai Industries Ltd (Japan)

- 3.5.62. SAKAI OVEX Co., Ltd. (Japan)

- 3.5.63. Saudi Basic Industries Corporation (Saudi Arabia)

- 3.5.64. SAERTEX GmbH & Co. KG (Germany)

- 3.5.65. SEKISUI Aerospace (United States)

- 3.5.66. Showa Aircraft Industry Co., Ltd. (Japan)

- 3.5.67. Siemens Gamesa Renewable Energy S.A. (Spain)

- 3.5.68. Sigmatex (UK) Limited (United Kingdom)

- 3.5.69. Sika AG (Switzerland)

- 3.5.70. SK Chemicals Co., Ltd. (South Korea)

- 3.5.71. Spirit Aerosystems Inc (United States)

- 3.5.72. Steelhead Composites, LLC (United States)

- 3.5.73. Strata Manufacturing PJSC (Mubadala Development Company) (United Arab Emirates)

- 3.5.74. Sunwell (Jiangsu) Carbon Fiber Composite Co., Ltd. (China)

- 3.5.75. Suzlon Energy Ltd. (India)

- 3.5.76. Taiwan Electric Insulator Co., Ltd. (Taiwan)

- 3.5.77. Technical Fibre Products Ltd (United Kingdom)

- 3.5.78. Tex Tech Industries, Inc. (United States)

- 3.5.79. Topkey Corporation (Taiwan)

- 3.5.80. Toray Advanced Composites (Netherlands)

- 3.5.81. The GILL Corporation (United States)

- 3.5.82. TPI Composites, Inc. (United States)

- 3.5.83. Trek Bicycle Corporation (United States)

- 3.5.84. Unicarbon (Lithuania)

- 3.5.85. UST Mamiya (United States)

- 3.5.86. Collins Aerospace (United States)

- 3.5.87. Vectorply Corporation (United States)

- 3.5.88. Vestas Wind Systems A/S (Denmark)

- 3.5.89. Worthington Industries, Inc. (United States)

- 3.5.90. Weihai Guangwei Composites Co., Ltd. (China)

- 3.6. Key Business and Product Trends

- 3.6.1. March 2025

- 3.6.1.1. Apply Carbon France Unveils its New Identity Procotex France

- 3.6.1.2. Syensqo & Vartega Collaborate for the Recycling of Carbon Fiber Waste

- 3.6.2. March 2025

- 3.6.2.1. Collins Aerospace Opens New Engineering Development and Test Center (EDTC) in Bengaluru, India

- 3.6.3. March 2025

- 3.6.3.1. Hexcel and FIDAMC Partner up for the Evolution of Composite Materials

- 3.6.4. March 2025

- 3.6.4.1. Teijin Carbon Launches Tenax(TM) IMS65 E23 36K 1630tex

- 3.6.5. March 2025

- 3.6.5.1. Teijin Carbon launches new Sustainable Carbon Fiber Brand: Tenax Next(TM)

- 3.6.6. February 2025

- 3.6.6.1. Bodo Moller Chemie and DowAksa Collaborate for Sustainable Future with Resins and Fibers

- 3.6.7. February 2025

- 3.6.7.1. 4M Carbon Fiber and Carboscreen Partner up to Enhance Carbon Fiber Manufacturing with the Power of AI

- 3.6.8. February 2025

- 3.6.8.1. ALBIER opens new Subsidiary "ALBIS Maghreb" in Tangier, Morocco

- 3.6.9. February 2025

- 3.6.9.1. Albany International Corp. Shuts Down Manufacturing Operation in Italy Facility

- 3.6.10. February 2025

- 3.6.10.1. LM Wind Power has announced the Closing of its Brazilian blade factory

- 3.6.11. February 2025

- 3.6.11.1. LeMond Carbon Reveals Plans of a New Manufacturing Plant in UK

- 3.6.12. January 2025

- 3.6.12.1. Spirit Aerosystems Sells its Subsidiary to Tex Tech Industries

- 3.6.13. December 2024

- 3.6.13.1. Sonaca Acquires Stake in Aciturri Aerostructures for Sustainable Aviation

- 3.6.14. November 2024

- 3.6.14.1. Hengshen Co. receives Approval for Establishing 'Zhenjiang Key Laboratory for High-Performance Carbon Fiber and Composites'

- 3.6.15. November 2024

- 3.6.15.1. Saertex and Biesterfeld Enter into a Distribution Partnership

- 3.6.16. November 2024

- 3.6.16.1. Harper International Commissions Two Carbon Fiber Lines in China

- 3.6.17. November 2024

- 3.6.17.1. 4M Carbon Fiber Launches 50-Ton Plasma Oxidation Qualification Line

- 3.6.18. October 2024

- 3.6.18.1. Kineco Completely Acquires Kineco Kaman Subsidiary

- 3.6.19. September 2024

- 3.6.19.1. SPC's Large-Tow Composite Reinforces Heavy-Duty Boom Project

- 3.6.20. September 2024

- 3.6.20.1. SAERTEX enters Austrian Market with Distributor USNER Chemicals

- 3.6.21. August 2024

- 3.6.21.1. Sigmatex Expands its North American Facility

- 3.6.22. August 2024

- 3.6.22.1. Collins Aerospace breaks ground on Expansion in Spokane facility

- 3.6.23. August 2024

- 3.6.23.1. Aurora Announces Expansion of its Mississippi Facility

- 3.6.24. July 2024

- 3.6.24.1. TFP, TFP Hydrogen Products Attain new Brand Name James Cropper

- 3.6.25. July 2024

- 3.6.25.1. Jindal Advanced Materials Aims to Boost FRP Rebar Capacity Five-Fold by 2026

- 3.6.26. July 2024

- 3.6.26.1. Spirit Aerosystems Announces its Acquisition by Boeing

- 3.6.27. June 2024

- 3.6.27.1. Kordsa Announces the Opening of Advanced Materials Technical Center in California

- 3.6.28. April 2024

- 3.6.28.1. INOMETA Launces new Air Supply System INOlink -R

- 3.6.29. April 2024

- 3.6.30. Arcline Acquires Kaman Corporation

- 3.6.30. March 2024

- 3.6.30.1. Jindal Advanced Materials and MAE S.p.A. Collaborate to set up a New Carbon fiber Plant

- 3.6.31. March 2024

- 3.6.31.1. Hexcel has Announced the Launch of its New Product HexTow-R IM9 24K Carbon Fiber

- 3.6.32. March 2024

- 3.6.32.1. Jilin Chemical Fiber Expands Carbon Fiber Industry with 400,000-Ton Project

- 3.6.33. February 2024

- 3.6.33.1. TeXtreme Announces Launch of New Product TeXtreme-R 360-degree

- 3.6.34. February 2024

- 3.6.34.1. LEHVOSS Group consolidates US subsidiaries to form LEHVOSS North America Inc.

- 3.6.35. January 2024

- 3.6.35.1. Boeing Announces the Acquisition of Aerospace Composites Malaysia (ACM)

- 3.6.36. January 2024

- 3.6.36.1. Toray Announces Launch of TORAYCA(TM) M46X Carbon Fiber

- 3.6.37. December 2023

- 3.6.37.1. Solvay Announces the Completion of Syensqo spin-off

- 3.6.38. December 2023

- 3.6.38.1. Worthington Industries, Inc. Announces the Separation of its Steel Processing Business

- 3.6.39. November 2023

- 3.6.39.1. Leonardo and Hera Collaborate for Aerospace Carbon Fiber Recycling

- 3.6.40. October 2023

- 3.6.40.1. Toray Launches New Product TORAYCA(TM) T1200

- 3.6.41. October 2023

- 3.6.41.1. Otto Krahn Group Merges Mocom and Wipag

- 3.6.42. September 2023

- 3.6.42.1. Hankuk Carbon Co., Ltd. Acquires Hankuk Advanced Materials Co., Ltd.

- 3.6.43. September 2023

- 3.6.43.1. Xinjiang Runjust New Material Co opens New Production Base

- 3.6.44. September 2023

- 3.6.44.1. Brembo SGL Carbon Ceramic Brakes Expands its Production Capacity in Germany and Italy

- 3.6.45. September 2023

- 3.6.45.1. Changsheng Announces Mass Producing of T1000 grade carbon fiber

- 3.6.46. September 2023

- 3.6.46.1. Hyosung Expands Facilities Owing to the Rising Demand for Carbon Fiber

- 3.6.47. August 2023

- 3.6.47.1. METYX Partners with BUFA Composite Systems GmbH & Co. KG

- 3.6.48. August 2023

- 3.6.48.1. UHT Unitech Company Announces the Completion of its Advanced Thermoplastic Carbon Fiber Composite Factory, Nantou

- 3.6.49. June 2023

- 3.6.49.1. ARK partners with TeXtreme

- 3.6.50. June 2023

- 3.6.50.1. Spirit Enters into a Strategic Collaboration with Solvay

- 3.6.51. June 2023

- 3.6.51.1. Solvay and Syensqo Revealed as New Entities

- 3.6.52. June 2023

- 3.6.52.1. Siemens Gamesa Launches SG 4.4-164 high-capacity factor turbine

- 3.6.53. April 2023

- 3.6.53.1. Jilin Chemical Fiber Launches Major Carbon Fiber Projects

- 3.6.54. April 2023

- 3.6.54.1. C12 Technology and Carbon Conversations Enter into Collaborative Project

- 3.6.55. March 2023

- 3.6.55.1. Nordex Group Aims to Achieve Carbon Fiber Recovery by 2032

- 3.6.56. March 2023

- 3.6.56.1. SGL Carbon Launches New Product SIGRAFIL-R C T50-4.9/235 carbon fiber

- 3.6.57. March 2023

- 3.6.57.1. Hexcel Launces New Center of Research & Technology Excellence in Utah

- 3.6.58. December 2022

- 3.6.58.1. Hyosung develops Ultra-High-Tensile Carbon Fiber: H3065 (T-1000 class)

- 3.6.59. October 2022

- 3.6.59.1. Sinopec Launches China's First 10,000-Ton 48K Large-Tow Carbon Fiber Line

- 3.6.60. June 2022

- 3.6.60.1. DowAksa opens new Production Plant in Yalova, Turkey

- 3.6.1. March 2025

4. GLOBAL MARKET OVERVIEW

- 4.1. Global Carbon Fibers Market

- 4.1.1. Global Carbon Fiber Production Capacity and Demand Outlook

- 4.1.2. Global Carbon Fibers Market Overview by End-use Application

- 4.1.2.1. Global Carbon Fibers End-Use Application Market Overview by Geographic Region

- 4.1.2.1.1. Aerospace & Defense

- 4.1.2.1.2. Sports & Leisure

- 4.1.2.1.3. Wind Energy

- 4.1.2.1.4. Automotive & Transportation

- 4.1.2.1.5. Pressure Vessels

- 4.1.2.1.6. Construction/Infrastructure

- 4.1.2.1.7. Molding Compounds

- 4.1.2.1.8. Oil & Gas

- 4.1.2.1.9. Other Industrial Applications

- 4.1.2.1. Global Carbon Fibers End-Use Application Market Overview by Geographic Region

- 4.1.3. Global Carbon Fibers Market Overview by Product Type

- 4.1.3.1. Global Carbon Fibers Product Type Market Overview by Geographic Region

- 4.1.3.1.1. Standard Modulus Large-tow Carbon Fibers

- 4.1.3.1.2. Standard Modulus Regular-tow Carbon Fibers

- 4.1.3.1.3. Intermediate Modulus Carbon Fibers

- 4.1.3.1.4. High Modulus Carbon Fibers

- 4.1.3.1. Global Carbon Fibers Product Type Market Overview by Geographic Region

- 4.2. Global Carbon Fiber Reinforced Plastics (CFRP) Market

- 4.2.1. Global Carbon Fiber Reinforced Plastics (CFRP) Market Overview by Manufacturing Process

- 4.2.2. Global Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

PART B: REGIONAL MARKET PERSPECTIVE

- Global Carbon Fibers Market Overview by Geographic Region

- Global Carbon Fiber Reinforced Plastics (CFRP) Market Overview by Geographic Region

REGIONAL MARKET OVERVIEW

5. NORTH AMERICA

- 5.1. North American Carbon Fibers Market

- 5.1.1. North American Carbon Fibers Production Capacity and Demand Outlook

- 5.1.2. North American Carbon Fibers Market Overview by Geographic Region

- 5.1.3. North American Carbon Fibers Market Overview by End-use Application

- 5.1.4. North American Carbon Fibers Market Overview by Product Type

- 5.2. North American Carbon Fiber Reinforced Plastics (CFRP) Market

- 5.2.1. North American Carbon Fiber Reinforced Plastics (CFRP) Market Overview by Geographic Region

- 5.2.2. North American Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 5.3. Country-wise Analysis of North American Carbon Fibers & CFRP Market

- 5.3.1. THE UNITED STATES

- 5.3.1.1. United States Carbon Fibers Market

- 5.3.1.1.1. United States Carbon Fibers Market Overview by End-use Application

- 5.3.1.1.2. United States Carbon Fibers Market Overview by Product Type

- 5.3.1.2. United States Carbon Fiber Reinforced Plastics (CFRP) Market

- 5.3.1.2.1. United States Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 5.3.1.1. United States Carbon Fibers Market

- 5.3.2. CANADA

- 5.3.2.1. Canadian Carbon Fibers Market

- 5.3.2.1.1. Canadian Carbon Fibers Market Overview by End-use Application

- 5.3.2.1.2. Canadian Carbon Fibers Market Overview by Product Type

- 5.3.2.2. Canadian Carbon Fiber Reinforced Plastics (CFRP) Market

- 5.3.2.2.1. Canadian Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 5.3.2.1. Canadian Carbon Fibers Market

- 5.3.1. THE UNITED STATES

6. EUROPE

- 6.1. European Carbon Fibers Market

- 6.1.1. European Carbon Fibers Production Capacity and Demand Outlook

- 6.1.2. European Carbon Fibers Market Overview by Geographic Region

- 6.1.3. European Carbon Fibers Market Overview by End-use Application

- 6.1.4. European Carbon Fibers Market Overview by Product Type

- 6.2. European Carbon Fiber Reinforced Plastics (CFRP) Market

- 6.2.1. European Carbon Fiber Reinforced Plastics (CFRP) Market Overview by Geographic Region

- 6.2.2. European Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 6.3. Country-wise Analysis of European Carbon Fibers & CFRP Market

- 6.3.1. FRANCE

- 6.3.1.1. French Carbon Fibers Market

- 6.3.1.1.1. French Carbon Fibers Market Overview by End-use Application

- 6.3.1.1.2. French Carbon Fibers Market Overview by Product Type

- 6.3.1.2. French Carbon Fiber Reinforced Plastics (CFRP) Market

- 6.3.1.2.1. French Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 6.3.1.1. French Carbon Fibers Market

- 6.3.2. GERMANY

- 6.3.2.1. German Carbon Fibers Market

- 6.3.2.1.1. German Carbon Fibers Market Overview by End-use Application

- 6.3.2.1.2. German Carbon Fibers Market Overview by Product Type

- 6.3.2.2. German Carbon Fiber Reinforced Plastics (CFRP) Market

- 6.3.2.2.1. German Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 6.3.2.1. German Carbon Fibers Market

- 6.3.3. ITALY

- 6.3.3.1. Italian Carbon Fibers Market

- 6.3.3.1.1. Italian Carbon Fibers Market Overview by End-use Application

- 6.3.3.1.2. Italian Carbon Fibers Market Overview by Product Type

- 6.3.3.2. Italian Carbon Fiber Reinforced Plastics (CFRP) Market

- 6.3.3.2.1. Italian Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 6.3.3.1. Italian Carbon Fibers Market

- 6.3.4. DENMARK

- 6.3.4.1. Danish Carbon Fibers Market

- 6.3.4.1.1. Danish Carbon Fibers Market Overview by End-use Application

- 6.3.4.1.2. Danish Carbon Fibers Market Overview by Product Type

- 6.3.4.2. Danish Carbon Fiber Reinforced Plastics (CFRP) Market

- 6.3.4.2.1. Danish Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 6.3.4.1. Danish Carbon Fibers Market

- 6.3.5. SPAIN

- 6.3.5.1. Spanish Carbon Fibers Market

- 6.3.5.1.1. Spanish Carbon Fibers Market Overview by End-use Application

- 6.3.5.1.2. Spanish Carbon Fibers Market Overview by Product Type

- 6.3.5.2. Spanish Carbon Fiber Reinforced Plastics (CFRP) Market

- 6.3.5.2.1. Spanish Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 6.3.5.1. Spanish Carbon Fibers Market

- 6.3.6. THE UNITED KINGDOM

- 6.3.6.1. United Kingdom Carbon Fibers Market

- 6.3.6.1.1. United Kingdom Carbon Fibers Market Overview by End-use Application

- 6.3.6.1.2. United Kingdom Carbon Fibers Market Overview by Product Type

- 6.3.6.2. United Kingdom Carbon Fiber Reinforced Plastics (CFRP) Market

- 6.3.6.2.1. United Kingdom Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 6.3.6.1. United Kingdom Carbon Fibers Market

- 6.3.7. REST OF EUROPE

- 6.3.7.1. Rest of Europe Carbon Fibers Market

- 6.3.7.1.1. Rest of Europe Carbon Fibers Market Overview by End-use Application

- 6.3.7.1.2. Rest of Europe Carbon Fibers Market Overview by Product Type

- 6.3.7.2. Rest of Europe Carbon Fiber Reinforced Plastics (CFRP) Market

- 6.3.7.2.1. Rest of Europe Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 6.3.7.1. Rest of Europe Carbon Fibers Market

- 6.3.1. FRANCE

7. ASIA-PACIFIC

- 7.1. Asia-Pacific Carbon Fibers Market

- 7.1.1. Asia-Pacific Carbon Fibers Production Capacity and Demand Outlook

- 7.1.2. Asia-Pacific Carbon Fibers Market Overview by Geographic Region

- 7.1.3. Asia-Pacific Carbon Fibers Market Overview by End-use Application

- 7.1.4. Asia-Pacific Carbon Fibers Market Overview by Product Type

- 7.2. Asia-Pacific Carbon Fiber Reinforced Plastics (CFRP) Market

- 7.2.1. Asia-Pacific Carbon Fiber Reinforced Plastics (CFRP) Market Overview by Geographic Region

- 7.2.2. Asia-Pacific Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 7.3. Country-wise Analysis of Asia-Pacific Carbon Fibers & CFRP Market

- 7.3.1. CHINA

- 7.3.1.1. Chinese Carbon Fibers Market

- 7.3.1.1.1. Chinese Carbon Fibers Market Overview by End-use Application

- 7.3.1.1.2. Chinese Carbon Fibers Market Overview by Product Type

- 7.3.1.2. Chinese Carbon Fiber Reinforced Plastics (CFRP) Market

- 7.3.1.2.1. Chinese Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 7.3.1.1. Chinese Carbon Fibers Market

- 7.3.2. INDIA

- 7.3.2.1. Indian Carbon Fibers Market

- 7.3.2.1.1. Indian Carbon Fibers Market Overview by End-use Application

- 7.3.2.1.2. Indian Carbon Fibers Market Overview by Product Type

- 7.3.2.2. Indian Carbon Fiber Reinforced Plastics (CFRP) Market

- 7.3.2.2.1. Indian Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 7.3.2.1. Indian Carbon Fibers Market

- 7.3.3. JAPAN

- 7.3.3.1. Japanese Carbon Fibers Market

- 7.3.3.1.1. Japanese Carbon Fibers Market Overview by End-use Application

- 7.3.3.1.2. Japanese Carbon Fibers Market Overview by Product Type

- 7.3.3.2. Japanese Carbon Fiber Reinforced Plastics (CFRP) Market

- 7.3.3.2.1. Japanese Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 7.3.3.1. Japanese Carbon Fibers Market

- 7.3.4. SOUTH KOREA

- 7.3.4.1. South Korean Carbon Fibers Market

- 7.3.4.1.1. South Korean Carbon Fibers Market Overview by End-use Application

- 7.3.4.1.2. South Korean Carbon Fibers Market Overview by Product Type

- 7.3.4.2. South Korean Carbon Fiber Reinforced Plastics (CFRP) Market

- 7.3.4.2.1. South Korean Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 7.3.4.1. South Korean Carbon Fibers Market

- 7.3.5. TAIWAN

- 7.3.5.1. Taiwanese Carbon Fibers Market

- 7.3.5.1.1. Taiwanese Carbon Fibers Market Overview by End-use Application

- 7.3.5.1.2. Taiwanese Carbon Fibers Market Overview by Product Type

- 7.3.5.2. Taiwanese Carbon Fiber Reinforced Plastics (CFRP) Market

- 7.3.5.2.1. Taiwanese Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 7.3.5.1. Taiwanese Carbon Fibers Market

- 7.3.6. REST OF ASIA-PACIFIC

- 7.3.6.1. Rest of Asia-Pacific Carbon Fibers Market

- 7.3.6.1.1. Rest of Asia-Pacific Carbon Fibers Market Overview by End-use Application

- 7.3.6.1.2. Rest of Asia-Pacific Carbon Fibers Market Overview by Product Type

- 7.3.6.2. Rest of Asia-Pacific Carbon Fiber Reinforced Plastics (CFRP) Market

- 7.3.6.2.1. Rest of Asia-Pacific Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 7.3.6.1. Rest of Asia-Pacific Carbon Fibers Market

- 7.3.1. CHINA

8. REST OF WORLD

- 8.1. Rest of World Carbon Fibers Market

- 8.1.1. Rest of World Carbon Fibers Production Capacity and Demand Outlook

- 8.1.2. Rest of World Carbon Fibers Market Overview by Geographic Region

- 8.1.3. Rest of World Carbon Fibers Market Overview by End-use Application

- 8.1.4. Rest of World Carbon Fibers Market Overview by Product Type

- 8.2. Rest of World Carbon Fiber Reinforced Plastics (CFRP) Market

- 8.2.1. Rest of World Carbon Fiber Reinforced Plastics (CFRP) Market Overview by Geographic Region

- 8.2.2. Rest of World Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 8.3. Country-wise Analysis of Rest of World Carbon Fibers & CFRP Market

- 8.3.1. BRAZIL

- 8.3.1.1. Brazilian Carbon Fibers Market

- 8.3.1.1.1. Brazilian Carbon Fibers Market Overview by End-use Application

- 8.3.1.1.2. Brazilian Carbon Fibers Market Overview by Product Type

- 8.3.1.2. Brazilian Carbon Fiber Reinforced Plastics (CFRP) Market

- 8.3.1.2.1. Brazilian Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 8.3.1.1. Brazilian Carbon Fibers Market

- 8.3.2. RUSSIA

- 8.3.2.1. Russian Carbon Fibers Market

- 8.3.2.1.1. Russian Carbon Fibers Market Overview by End-use Application

- 8.3.2.1.2. Russian Carbon Fibers Market Overview by Product Type

- 8.3.2.2. Russian Carbon Fiber Reinforced Plastics (CFRP) Market

- 8.3.2.2.1. Russian Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 8.3.2.1. Russian Carbon Fibers Market

- 8.3.3. TURKIYE

- 8.3.3.1. Turkish Carbon Fibers Market

- 8.3.3.1.1. Turkish Carbon Fibers Market Overview by End-use Application

- 8.3.3.1.2. Turkish Carbon Fibers Market Overview by Product Type

- 8.3.3.2. Turkish Carbon Fiber Reinforced Plastics (CFRP) Market

- 8.3.3.2.1. Turkish Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 8.3.3.1. Turkish Carbon Fibers Market

- 8.3.4. OTHER REST OF WORLD

- 8.3.4.1. Other Rest of World Carbon Fibers Market

- 8.3.4.1.1. Other Rest of World Carbon Fibers Market Overview by End-use Application

- 8.3.4.1.2. Other Rest of World Carbon Fibers Market Overview by Product Type

- 8.3.4.2. Other Rest of World Carbon Fiber Reinforced Plastics (CFRP) Market

- 8.3.4.2.1. Other Rest of World Carbon Fiber Reinforced Plastics (CFRP) Market Overview by End-use Application

- 8.3.4.1. Other Rest of World Carbon Fibers Market

- 8.3.1. BRAZIL

PART C: GUIDE TO THE INDUSTRY

- 1. Manufacturers of Carbon Fibers and CF precursors, Carbon Fiber Production Technology Companies

- 2. Carbon Fibers Recycling Companies

- 3. Carbon Fiber Composites Manufacturers

PART D: ANNEXURE

- 1. RESEARCH METHODOLOGY

- 2. FEEDBACK

Charts & Graphs

PART A: GLOBAL MARKET PERSPECTIVE

- Chart 1: Global Carbon Fibers Market Analysis (2021-2030) in Volume (Metric Tons) and Value (US$ Million)

- Chart 2: Global Carbon Fibers Market (2021, 2024 & 2030) by End-use Application

- Chart 3: Global Carbon Fibers Market (2021, 2024 and 2030) by Geographic Region

- Chart 4: Global Carbon Fibers Production Capacities (2016-2030) by Geographic Region - North America, Europe, Japan, Asia-Pacific and Rest of World in Metric Tons

- Chart 5: Global Carbon Fibers Consumption in Aerospace & Defense Applications (2021, 2024 & 2030) by Geographic Region - NorthAmerica, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 6: Global Carbon Fibers Consumption in Sports & Leisure Applications (2021, 2024 & 2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 7: Global Carbon Fibers Consumption in Automotive Applications (2021, 2024 & 2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 8: Global Carbon Fibers Consumption in Wind Energy Applications (2021, 2024 & 2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 9: Global Carbon Fibers Consumption in Pressure Vessels Applications (2021, 2024 & 2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 10: Global Carbon Fibers Consumption in Construction & Infrastructure Applications (2021, 2024 & 2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 11: Global Carbon Fibers Consumption in Molding Compound Applications (2021, 2024 & 2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 12: Global Carbon Fibers Consumption in Oil & Gas Applications (2021, 2024 & 2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 13: Global Carbon Fibers Consumption in Other Industrial Applications (2021, 2024 & 2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 14: Global Carbon Fibers Production Capacity and Consumption Analysis (2021-2030) by Geographic Region - Volume in Metric

- Chart 15: Global Carbon Fibers Installed Production Capacities (2016-2030) by Manufacturer in Metric Tons

- Chart 16: Global Carbon Fibers (PAN & Pitch) Installed Capacities (2016-2030) by Geographic Region - North America, Europe, Japan, Asia-Pacific and Rest of World in Metric Tons

- Chart 17: Global Carbon Fibers (PAN & Pitch) Installed Capacities (2016-2030) by Precursor Type - PAN-Based and Pitch-Based in Metric Tons

- Chart 18: Global PAN-Based Carbon Fibers Installed Capacities (2016-2030) by Geographic Region - North America, Europe, Japan, Asia-Pacific and Rest of World in Metric Tons

- Chart 19: Global Carbon Fibers (PAN & Pitch) Installed Capacities (2016-2030) by Country - China, The United States, Japan, Mexico, South Korea, Hungary, Taiwan, France, The United Kingdom, Germany, Turkey, Spain, Russia, India and Vietnam in Metric Tons

- Chart 20: Glance at 2024 Global Market Share (%) of Carbon Fibers (PAN& Pitch) Installed Capacities by Manufacturer

- Chart 21: Global PAN-Based Carbon Fibers Installed Capacities (2016-2030) by Country - China, The United States, Japan, Mexico, South Korea, Hungary, Taiwan, France, The United Kingdom, Germany, Turkey, Spain, Russia, India and Vietnam in Metric Tons

- Chart 22: Glance at 2024 Global Market Share (%) of PAN-Based Carbon Fibers Installed Capacities by Manufacturer

- Chart 23: Global Pitch-Based Carbon Fibers Installed Capacities (2016-2030) by Country - The UnitedStates, Japan and China in Metric Tons

- Chart 24: Glance at 2024 Global Market Share (%) of Pitch-Based Carbon Fibers Installed Capacities by Manufacturer

- Chart 25: Toray Carbon Fibers Installed Capacities (2016-2030) by Subsidiary and Country in Metric Tons

- Chart 26: Teijin Carbon Fibers Installed Capacities (2016-2024) by Subsidiary and Country in Metric Tons

- Chart 27: Mitsubishi Chemical Carbon Fibers Installed Capacities (2016-2024) by Subsidiary and Country in Metric Tons

- Chart 28: SGL Carbon Fibers Installed Capacities (2016-2024) by Subsidiary and Country in Metric Tons

- Chart 29: Hexcel Carbon Fibers Installed Capacities (2016-2024) by Subsidiary and Country in Metric Tons

- Chart 30: Hyosung Carbon Fibers Installed Capacities (2016-2030) by Subsidiary and Country in Metric Tons

- Chart 31: Jilin Chemical Carbon Fibers Installed Capacities (2018-2030) by Subsidiary in Metric Tons

GLOBAL MARKET OVERVIEW

- Chart 32: Global Carbon Fibers Market Analysis (2021-2030)- Volume in Metric Tons and Value in US$ Million

- Chart 33: Global Carbon Fibers Production Capacity and Consumption Analysis (2021-2030) - Volume in Metric Tons

- Chart 34: Global Carbon Fibers Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in Metric Tons

- Chart 35: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

- Chart 36: Global Carbon Fibers Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in US$ Million

- Chart 37: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

- Chart 38: Global Carbon Fibers Market Analysis (2021-2030) in Aerospace & Defense by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 39: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Aerospace & Defense by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 40: Global Carbon Fibers Market Analysis (2021-2030) in Aerospace & Defense by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 41: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Aerospace & Defense by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 42: Global Carbon Fibers Market Analysis (2021-2030) in Sports & Leisure by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 43: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Sports & Leisure by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 44: Global Carbon Fibers Market Analysis (2021-2030) in Sports & Leisure by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 45: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Sports & Leisure by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 46: Global Carbon Fibers Market Analysis (2021-2030) in Wind Energy by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 47: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Wind Energy by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 48: Global Carbon Fibers Market Analysis (2021-2030) in Wind Energy by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 49: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Wind Energy by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 50: Global Carbon Fibers Market Analysis (2021-2030) in Automotive & Transportation by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 51: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Automotive & Transportation by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 52: Global Carbon Fibers Market Analysis (2021-2030) in Automotive & Transportation by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 53: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Automotive & Transportation by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 54: Global Carbon Fibers Market Analysis (2021-2030) in Pressure Vessels by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 55: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Pressure Vessels by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 56: Global Carbon Fibers Market Analysis (2021-2030) in Pressure Vessels by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 57: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Pressure Vessels by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 58: Global Carbon Fibers Market Analysis (2021-2030) in Construction/Infrastructure by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 59: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Construction/Infrastructure by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 60: Global Carbon Fibers Market Analysis (2021-2030) in Construction/Infrastructure by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 61: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Construction/Infrastructure by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 62: Global Carbon Fibers Market Analysis (2021-2030) in Molding Compounds by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 63: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Molding Compounds by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 64: Global Carbon Fibers Market Analysis (2021-2030) in Molding Compounds by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 65: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Molding Compounds by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 66: Global Carbon Fibers Market Analysis (2021-2030) in Oil & Gas by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 67: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Oil & Gas by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 68: Global Carbon Fibers Market Analysis (2021-2030) in Oil & Gas by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 69: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Oil & Gas by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 70: Global Carbon Fibers Market Analysis (2021-2030) in Other Industrial Applications by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 71: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Other Industrial Applications by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 72: Global Carbon Fibers Market Analysis (2021-2030) in Other Industrial Applications by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 73: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) in Other Industrial Applications by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 74: Global Carbon Fibers Market Analysis (2021-2030) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus in Metric Tons

- Chart 75: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus

- Chart 76: Global Carbon Fibers Market Analysis (2021-2030) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus in US$ Million

- Chart 77: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus

- Chart 78: Global Standard Modulus Large-tow Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 79: Glance at 2021, 2024 and 2030 Global Standard Modulus Large-tow Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 80: Global Standard Modulus Large-tow Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 81: Glance at 2021, 2024 and 2030 Global Standard Modulus Large-tow Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 82: Global Standard Modulus Regular-tow Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 83: Glance at 2021, 2024 and 2030 Global Standard Modulus Regular-tow Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 84: Global Standard Modulus Regular-tow Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 85: Glance at 2021, 2024 and 2030 Global Standard Modulus Regular-tow Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 86: Global Intermediate Modulus Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 87: Glance at 2021, 2024 and 2030 Global Intermediate Modulus Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 88: Global Intermediate Modulus Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 89: Glance at 2021, 2024 and 2030 Global Intermediate Modulus Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 90: Global High Modulus Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 91: Glance at 2021, 2024 and 2030 Global High Modulus Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 92: Global High Modulus Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 93: Glance at 2021, 2024 and 2030 Global High Modulus Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 94: Global Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) - Volume in Metric Tonsand Value in US$ Million

- Chart 95: Global Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by Manufacturing Process - Prepreg-layup, Pultrusion & Winding, Molding & Compounding, Resin Transfer Molding (RTM), Preform, Vacuum Infusion and Other in Metric Tons

- Chart 96: Glance at 2021, 2024 and 2030 Global Carbon Fiber Reinforced Plastics (CFRP) Market Share (%) by Manufacturing Process - Prepreg-layup, Pultrusion & Winding, Molding & Compounding, Resin Transfer Molding (RTM), Preform, Vacuum Infusion and Other

- Chart 97: Global Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in Metric Tons

- Chart 98: Glance at 2021, 2024 and 2030 Global Carbon Fiber Reinforced Plastics (CFRP) Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

- Chart 99: Global Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in US$ Million

- Chart 100: Glance at 2021, 2024 and 2030 Global Carbon Fiber Reinforced Plastics (CFRP) Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

PART B: REGIONAL MARKET PERSPECTIVE

- Chart 101: Global Carbon Fibers Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 102: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 103: Global Carbon Fibers Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 104: Glance at 2021, 2024 and 2030 Global Carbon Fibers Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 105: Global Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in Metric Tons

- Chart 106: Glance at 2021, 2024 and 2030 Global Carbon Fiber Reinforced Plastics (CFRP) Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 107: Global Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 108: Glance at 2021, 2024 and 2030 Global Carbon Fiber Reinforced Plastics (CFRP) Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

REGIONAL MARKET OVERVIEW

NORTH AMERICA

- Chart 109: North American Carbon Fibers Market Analysis (2021-2030) - Volume in Metric Tons and Value in US$ Million

- Chart 110: North American Carbon Fibers Production Capacity and Demand Analysis (2021-2030) - Volume in Metric Tons

- Chart 111: North American Carbon Fibers Market Analysis (2021-2030) by Geographic Region - United States and Canada in Metric Tons

- Chart 112: Glance at 2021, 2024 and 2030 North American Carbon Fibers Market Share (%) by Geographic Region - United States and Canada

- Chart 113: North American Carbon Fibers Market Analysis (2021-2030) by Geographic Region - United States and Canada in US$ Million

- Chart 114: Glance at 2021, 2024 and 2030 North American Carbon Fibers Market Share (%) by Geographic Region - United States and Canada

- Chart 115: North American Carbon Fibers Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in Metric Tons

- Chart 116: Glance at 2021, 2024 and 2030 North American Carbon Fibers Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

- Chart 117: North American Carbon Fibers Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in US$ Million

- Chart 118: Glance at 2021, 2024 and 2030 North American Carbon Fibers Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

- Chart 119: North American Carbon Fibers Market Analysis (2021-2030) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus in Metric Tons

- Chart 120: Glance at 2021, 2024 and 2030 North American Carbon Fibers Market Share (%) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus

- Chart 121: North American Carbon Fibers Market Analysis (2021-2030) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus in US$ Million

- Chart 122: Glance at 2021, 2024 and 2030 North American Carbon Fibers Market Share (%) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus

- Chart 123: North American Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) - Volume in Metric Tons and Value in US$ Million

- Chart 124: North American Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by Geographic Region - United States and Canada in Metric Tons

- Chart 125: Glance at 2021, 2024 and 2030 North American Carbon Fiber Reinforced Plastics (CFRP) Market Share (%) by Geographic Region - United States and Canada

- Chart 126: North American Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by Geographic Region - United States and Canada in US$ Million

- Chart 127: Glance at 2021, 2024 and 2030 North American Carbon Fiber Reinforced Plastics (CFRP) Market Share (%) by Geographic Region - United States and Canada

- Chart 128: North American Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in Metric Tons

- Chart 129: Glance at 2021, 2024 and 2030 North American Carbon Fiber Reinforced Plastics (CFRP) Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

- Chart 130: North American Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in US$ Million

- Chart 131: Glance at 2021, 2024 and 2030 North American Carbon Fiber Reinforced Plastics (CFRP) Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

THE UNITED STATES

- Chart 132: United States Carbon Fibers Market Analysis (2021-2030) - Volume in Metric Tons and Value in US$ Million

- Chart 133: United States Carbon Fibers Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in Metric Tons

- Chart 134: Glance at 2021, 2024 and 2030 United States Carbon Fibers Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

- Chart 135: United States Carbon Fibers Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in US$ Million

- Chart 136: Glance at 2021, 2024 and 2030 United States Carbon Fibers Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

- Chart 137: United States Carbon Fibers Market Analysis (2021-2030) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus in Metric Tons

- Chart 138: Glance at 2021, 2024 and 2030 United States Carbon Fibers Market Share (%) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus

- Chart 139: United States Carbon Fibers Market Analysis (2021-2030) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus in US$ Million

- Chart 140: Glance at 2021, 2024 and 2030 United States Carbon Fibers Market Share (%) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus

- Chart 141: United States Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) - Volume in Metric Tons and Value in US$ Million

- Chart 142: United States Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in Metric Tons

- Chart 143: Glance at 2021, 2024 and 2030 United States Carbon Fiber Reinforced Plastics (CFRP) Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

- Chart 144: United States Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in US$ Million

- Chart 145: Glance at 2021, 2024 and 2030 United States Carbon Fiber Reinforced Plastics (CFRP) Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

CANADA

- Chart 146: Canadian Carbon Fibers Market Analysis (2021-2030) - Volume in Metric Tons and Value in US$ Million

- Chart 147: Canadian Carbon Fibers Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in Metric Tons

- Chart 148: Glance at 2021, 2024 and 2030 Canadian Carbon Fibers Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

- Chart 149: Canadian Carbon Fibers Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in US$ Million

- Chart 150: Glance at 2021, 2024 and 2030 Canadian Carbon Fibers Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

- Chart 151: Canadian Carbon Fibers Market Analysis (2021-2030) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus in Metric Tons

- Chart 152: Glance at 2021, 2024 and 2030 Canadian Carbon Fibers Market Share (%) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus

- Chart 153: Canadian Carbon Fibers Market Analysis (2021-2030) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus in US$ Million

- Chart 154: Glance at 2021, 2024 and 2030 Canadian Carbon Fibers Market Share (%) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus

- Chart 155: Canadian Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) - Volume in Metric Tons and Value in US$ Million

- Chart 156: Canadian Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in Metric Tons

- Chart 157: Glance at 2021, 2024 and 2030 Canadian Carbon Fiber Reinforced Plastics (CFRP) Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

- Chart 158: Canadian Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in US$ Million

- Chart 159: Glance at 2021, 2024 and 2030 Canadian Carbon Fiber Reinforced Plastics (CFRP) Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

EUROPE

- Chart 160: European Carbon Fibers Market Analysis (2021-2030) - Volume in Metric Tons and Value in US$ Million

- Chart 161: European Carbon Fibers Production Capacity and Demand Analysis (2021-2030) - Volume in Metric Tons

- Chart 162: European Carbon Fibers Market Analysis (2021-2030) by Geographic Region - France, Germany, Italy, Denmark, Spain, United Kingdom and Rest of Europe in Metric Tons

- Chart 163: Glance at 2021, 2024 and 2030 European Carbon Fibers Market Share (%) by Geographic Region - France, Germany, Italy, Denmark, Spain, United Kingdom and Rest of Europe

- Chart 164: European Carbon Fibers Market Analysis (2021-2030) by Geographic Region - France, Germany, Italy, Denmark, Spain, United Kingdom and Rest of Europe in US$ Million

- Chart 165: Glance at 2021, 2024 and 2030 European Carbon Fibers Market Share (%) by Geographic Region - France, Germany, Italy, Denmark, Spain, United Kingdom and Rest of Europe

- Chart 166: European Carbon Fibers Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in Metric Tons

- Chart 167: Glance at 2021, 2024 and 2030 European Carbon Fibers Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

- Chart 168: European Carbon Fibers Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in US$ Million

- Chart 169: Glance at 2021, 2024 and 2030 European Carbon Fibers Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

- Chart 170: European Carbon Fibers Market Analysis (2021-2030) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus in Metric Tons

- Chart 171: Glance at 2021, 2024 and 2030 European Carbon Fibers Market Share (%) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus

- Chart 172: European Carbon Fibers Market Analysis (2021-2030) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus in US$ Million

- Chart 173: Glance at 2021, 2024 and 2030 European Carbon Fibers Market Share (%) by Product Type - Standard Modulus (Large-tow), Standard Modulus (Regular-tow), Intermediate Modulus and High Modulus

- Chart 174: European Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) - Volume in Metric Tons and Value in US$ Million

- Chart 175: European Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by Geographic Region - France, Germany, Italy, Denmark, Spain, United Kingdom and Rest of Europe in Metric Tons

- Chart 176: Glance at 2021, 2024 and 2030 European Carbon Fiber Reinforced Plastics (CFRP) Market Share (%) by Geographic Region - France, Germany, Italy, Denmark, Spain, United Kingdom and Rest of Europe

- Chart 177: European Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by Geographic Region - France, Germany, Italy, Denmark, Spain, United Kingdom and Rest of Europe in US$ Million

- Chart 178: Glance at 2021, 2024 and 2030 European Carbon Fiber Reinforced Plastics (CFRP) Market Share (%) by Geographic Region - France, Germany, Italy, Denmark, Spain, United Kingdom and Rest of Europe

- Chart 179: European Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in Metric Tons

- Chart 180: Glance at 2021, 2024 and 2030 European Carbon Fiber Reinforced Plastics (CFRP) Market Share (%) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial

- Chart 181: European Carbon Fiber Reinforced Plastics (CFRP) Market Analysis (2021-2030) by End-use Application - Aerospace & Defense, Sports & Leisure, Wind Energy, Automotive & Transportation, Pressure Vessels, Construction/Infrastructure, Molding Compounds, Oil & Gas and Other Industrial in US$ Million