PUBLISHER: MIC - Market Intelligence & Consulting Institute | PRODUCT CODE: 1522834

PUBLISHER: MIC - Market Intelligence & Consulting Institute | PRODUCT CODE: 1522834

Global Five-Year Market Forecast 2024-2028: PCs, Servers, Motherboards, Wi-Fi Connected Devices, and Smartphones

Market Intelligence & Consulting Institute (MIC) has recently released our latest five-year forecast value pack, which delivers MIC's comprehensive research findings for the global notebook PC, desktop PC, server, motherboard, Wi-Fi connected device, and smartphone industries for the period 2024-2028.

Notebook PCs

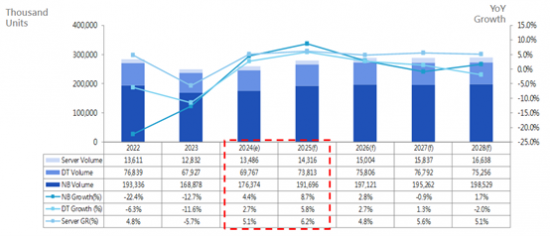

Global PC shipments are expected to reach 246.1 million units in 2024 and 265.5 million units in 2025, up 8.3% year-on-year. The compound annual growth rate (CAGR) is estimated at 2.7% for the period 2024-2028. This research focuses on traditional PCs, comprising notebook PCs and desktop PCs but not tablets; notebook PCs surveyed include those with screen sizes of 7 inches and larger.

Note 1: GR = Year-on-Year Growth Rate

Note 2: DT product values include the number of AIO PCs

Source: MIC, August 2024

Companies surveyed include Taiwanese notebook PC makers operating ODM, OEM, EMS, CEM, OBM, and private label businesses; production sites and shipment destinations include Taiwan, China, Japan, South Korea, Southeast Asia, North America, Latin America, Western Europe and other European countries, and other regions.

Facing the ongoing global economic downturn, the global notebook PC market witnessed another subdued year in 2023. Nevertheless, following two consecutive years of declining demand, manufacturers in the notebook PC supply chain are optimistic about a rebound in 2024.

Desktop PC

The global desktop PC industry witnessed a significant downturn in 2023, with shipments totaling 67.927 million units, marking an 11.6% decrease from 2022. Despite resolving excess inventory in the desktop PC supply chain and achieving healthier inventory levels, the market remained impacted by sluggish global economic conditions and high inflation rates, leading to sustained weak consumer demand for PC products.

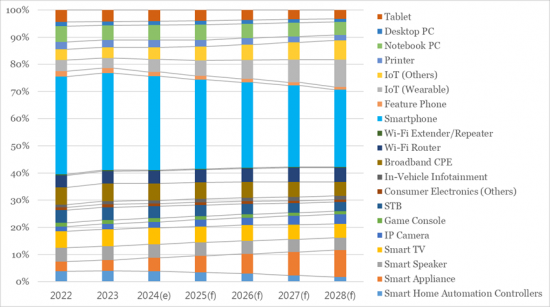

Wi-Fi Connected Device

The research focuses on a wide range of Wi-Fi connected devices, which are categorized into three application areas: information devices, mobile devices, and smart connected home devices. Devices included in this research are smartphones, feature phones, IoT (Wearable), IoT (Others), printers, notebook PCs, desktop PCs, tablets, broadband CPE, Wi-Fi routers, Wi-Fi extenders/repeaters, smart home automation controllers, smart appliances, smart speakers, smart TVs, IP cameras, game consoles, STBs, consumer electronics (Others), and in-vehicle infotainment (IVI). Among them, consumer electronics (Others) includes portable media players (PMPs), e-readers, digital cameras, digital photo frames, smart remote controls, etc. IoT (Wearable) includes smartwatches, fitness bands, XR devices, etc., and IoT (Others) includes robots, smart home peripherals, etc.

The overall market size is projected to continue increasing, with the global Wi-Fi connected device market estimated to exceed 4.4 billion units by 2028, representing a compound annual growth rate (CAGR) of 5.1% from 2023 to 2028, according to the Market Intelligence & Consulting Institute (MIC).

The shipment volume of global Wi-Fi connected devices in 2023 decreased to 3.22 billion units, down 3.1% year-on-year. As inventory clearance nears completion and the market generally holds a positive outlook for economic recovery, MIC estimates that Wi-Fi connected device shipments will rebound from their lows to reach 3.43 billion units in 2024, up 6.5% year-on-year.

Based on MIC's findings, the shipment shares of the top five Wi-Fi connected products in 2023, in descending order, were smartphones (35.7%), broadband CPE (6.5%), smart TVs (6.3%), notebook PCs (5.3%), and smart speakers (5.1%), totaling 58.9% of the market share.

Source: MIC, June 2024

Server Systems

The global server market is anticipated to undergo a revival in 2024, driven by the emergence of generative AI and the optimization of large language models (LLMs) for enterprise applications. This resurgence is primarily attributed to the increasing demand for AI servers, expected to propel the recovery of the global server market. This research focuses on server systems classified by three CPU architectures: x86, RISC (Reduced Instruction Set Computing), and others. Servers in this study are further segmented into tower, blade, and rack-mounted form factors, as well as by assembly level, including full system and barebones levels.

Motherboard

Due to several detrimental factors, the global motherboard market in 2023 was approximately 75.4 million units, with a year-on-year decline of 10.7%. Shipments are expected to grow by 3.9% year-on-year in 2024, reaching 78.4 million units. This growth is attributed to the increase in commercial and consumer spending, albeit modest, as inflationary pressures have improved compared to 2022 and 2023.

This research focuses on motherboards, divided by CPU connector type, including LGA1150, LGA1151, Socket AM3+, Socket AM4, and Socket TR4. The shipment types surveyed encompass barebones systems, complete systems, and standalone motherboards. For definitions of the aforementioned product classifications, please refer to the following sections.

Companies surveyed are major global motherboard manufacturers whose business models include OBM (Original Brand Manufacturer), ODM (Original Design Manufacturer), OEM (Original Equipment Manufacturer), EMS (Electronics Manufacturing Services), CEM (Contract Electronics Manufacturer), and Private Label. The production sites and shipment regions include Taiwan, China, Japan, South Korea, other Asian countries, North America, Latin America, Western Europe, other European countries, and other regions (rest of the world, RoW). Definitions of the aforementioned geographic coverage are provided in the following sections.

Smartphone

In 2023, smartphones—remaining the largest segment of Wi-Fi application categories—continued the sluggish market trend from 2022. The purchasing power for mid-to-high-end models was weaker than in previous years. Despite this, MIC estimates that global smartphone shipments will total around 1.319 billion units by 2028, with a compound annual growth rate (CAGR) of 2.26% from 2024 to 2028. Aside from major items like smartphones and notebook PCs, smart home appliances such as smart TVs and smart speakers are likely to experience growth reversals.

The research focuses on mobile phones and does not include low-frequency phones such as cordless phones and PHS (Personal Handy System) phones. Mobile phones can be divided by mobile communications standard and operating system into GSM, GPRS, EDGE, WCDMA, TD-SCDMA, cdmaOne, CDMA2000 1X, CDMA2000 1x EV-DO, and iDEN.

Table of Contents

- Desktop PC

- Worldwide PC (exclude Tablet) Shipment Volume, 2020 - 2028

- Worldwide Desktop PC Shipment Volume, 2020 - 2028

- Worldwide Desktop PC Shipment Volume, 1Q 2021 - 4Q 2023

- Worldwide Motherboard / Worldwide Desktop PC Shipment Volume Ratio, 2020 - 2028

- Worldwide Desktop PC Shipment Volume by Region, 2020 - 2024

- Worldwide Desktop PC Shipment Share by Region, 2020 - 2024

- Worldwide Desktop PC Shipment by Customer Type, 2020 - 2024

- Worldwide Desktop PC Shipment Share by Customer Type, 2020 - 2024

- Worldwide Desktop PC Shipment by CPU Connector Type, 1Q 2022 - 2Q 2024

- Worldwide Desktop PC Shipment Share by CPU Connector Type, 1Q 2022 - 2Q 2024

- Intelligence Insight

- Research Scope & Definitions

- Notebook PC

- Worldwide PC (exclude Tablet) Shipment Volume, 2020 - 2028

- Worldwide Notebook PC Shipment Volume, 2020 - 2028

- Worldwide Notebook PC Shipment Volume, 1Q 2022 - 4Q 2024

- Worldwide Notebook PC Shipment Volume by Region, 2020 - 2024

- Worldwide Notebook PC Shipment Share by Region, 2020 - 2024

- Worldwide Notebook PC Shipment Volume by by Panel Size, 1Q 2022 - 2Q 2024

- Worldwide Notebook PC Shipment Share by by Panel Size, 1Q 2022 - 2Q 2024

- Worldwide Notebook PC Shipment Volume by Computing Platform, 1Q 2022 - 2Q 2024

- Worldwide Notebook PC Shipment Share by Computing Platform, 1Q 2022 - 2Q 2024

- Intelligence Insight

- Research Scope & Definitions

- Server

- Worldwide Server Shipment Volume, 2020 - 2028

- Worldwide Server Shipment Volume, 1Q22 - 4Q24

- Worldwide Server Shipment Volume by Region, 2020 - 2024

- Worldwide Server Shipment Share by Region, 2020 - 2024

- Worldwide Server Shipment Volume by CPU Architecture, 2020 - 2024

- Worldwide Server Shipment Share by CPU Architecture, 2020 - 2024

- Intelligence Insight

- Research Scope & Definitions

- Motherboard

- Worldwide Motherboard Shipment Volume, 2020 - 2028

- Worldwide Motherboard Shipment Volume, 1Q22 - 4Q24

- Worldwide Motherboard / Worldwide Desktop PC Shipment Volume Ratio, 2020 - 2028

- Worldwide Motherboard Shipment Volume by Region, 2020 - 2024

- Worldwide Motherboard Shipment Share by Region, 2020 - 2024

- Intelligence Insight

- Research Scope & Definitions

- Smartphone

- Worldwide Mobile Phone Market by Device Type, 2022 - 2028

- Worldwide Mobile Phone Market Share by Device Type, 2022 - 2028

- Worldwide Smartphone Market by Region, 2022 - 2028

- Worldwide Smartphone Market Share by Region, 2022 - 2028

- Worldwide Smartphone Market by Price Point, 2022 - 2028

- Worldwide Smartphone Market Share by Price Point, 2022 - 2028

- Worldwide Smartphone Market by Operating System, 2022 - 2028

- Worldwide Smartphone Market Share by Operating System, 2022 - 2028

- Intelligence Insight

- Research Scope & Definitions

- Wi-Fi Connected Devices

- 1. Development of Worldwide Wi-Fi Devices

- 2. Analaysis of Wi-Fi Connected Devices

- 2.1 Shipment Volume Analysis

- 2.2 Shipment Share Analysis

- 2.3 Shipment Volume Forecast

- 2.3.1 Information Devices

- 2.3.2 Mobile Devices

- 2.3.4 Networking Devices

- 2.3.4 Smart Connected Home Devices

- 2.4 Shipment Share Forecast

- 2.4.1 Information Devices

- 2.4.2 Mobile Devices

- 2.4.3 Networking Devices

- 2.4.4 Smart Connected Home Devices

- 3. Changes in Wi-Fi Standard Adoption

- 4. MIC Perspective