PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708244

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708244

Automotive Premium Tires Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

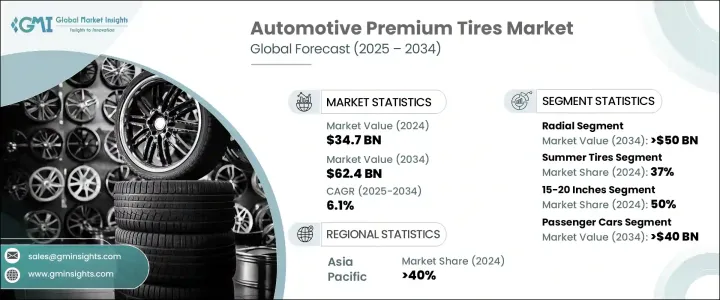

The Global Automotive Premium Tires Market was valued at USD 34.7 billion in 2024 and is projected to grow at a CAGR of 6.1% between 2025 and 2034. This growth is largely driven by the increasing demand for luxury vehicles and high-performance cars, with automakers prioritizing superior tire quality to enhance vehicle performance, comfort, and safety. As consumer preferences shift toward vehicles offering advanced driving dynamics, premium tire manufacturers continue to innovate with enhanced tread compounds, advanced rubber formulations, and improved sidewall structures. The rising adoption of electric vehicles (EVs) also contributes to market expansion, as premium tires designed for EVs offer low rolling resistance, improved efficiency, and noise reduction.

The emphasis on sustainable mobility has led to an increase in research and development activities in the premium tires sector. Tire manufacturers are incorporating environmentally friendly raw materials, innovative tread designs, and cutting-edge technology to create products that offer superior grip, extended lifespan, and fuel efficiency. The growing consumer awareness of the benefits of high-performance tires, including improved braking capabilities, lower noise levels, and better road grip, further accelerates market growth. Additionally, regulatory bodies are enforcing stricter safety and fuel efficiency norms, compelling automakers to equip vehicles with high-quality tires that meet stringent standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $34.7 Billion |

| Forecast Value | $62.4 Billion |

| CAGR | 6.1% |

The market is segmented based on tire construction into radial and bias designs. In 2024, radial tires accounted for 80% of the market share and are expected to generate USD 50 billion by 2034. Radial tires are preferred in the premium tire market due to their enhanced flexibility, superior traction, and extended tread life. The steel-belted construction minimizes heat buildup, improving fuel efficiency and prolonging tire lifespan. As the demand for performance vehicles increases, radial tires remain the preferred choice for their high-speed stability and ability to maintain shape under challenging driving conditions, further fueling market expansion.

The market is also categorized by tire types, including summer tires, winter tires, all-season tires, all-terrain tires, and others. In 2024, summer tires held a 37% market share, driven by their ability to provide exceptional traction and braking performance in warm conditions. With specialized tread compounds and designs that minimize rolling resistance, summer tires enhance fuel economy and improve vehicle handling. Luxury sedans and high-performance cars frequently utilize summer tires to achieve superior cornering capabilities and high-speed stability. The increasing sales of luxury vehicles, particularly in regions with warmer climates, continue to boost demand for high-performance summer tires.

Asia Pacific accounted for 40% of the global automotive premium tires market share in 2024. The region's rising disposable income, rapid urbanization, and growing demand for high-end sedans, SUVs, and sports models are major contributors to market growth. As a result, the need for durable, high-performance tires has surged, prompting manufacturers to expand their premium tire portfolios. Leading tire companies are investing in production facilities and distribution networks across Asia Pacific to cater to the increasing consumer demand for superior tire quality, enhanced safety, and advanced driving dynamics.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Manufacturers

- 3.2.3 Technology providers

- 3.2.4 Service providers

- 3.2.5 Distributors

- 3.2.6 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price trends

- 3.9 Cost breakdown analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing demand for luxury and high-performance vehicles

- 3.10.1.2 Increasing adoption of electric vehicles

- 3.10.1.3 Rising consumer preference for advanced safety features and durable high-performance tires

- 3.10.1.4 Expansion of online retail and exclusive brand dealerships

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial cost of premium tires

- 3.10.2.2 Fluctuations in raw material prices

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Tire, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Summer tires

- 5.3 Winter tires

- 5.4 All-season tires

- 5.5 All terrain tires

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Tire Construction, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Radial

- 6.3 Bias

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Run-flat technology

- 7.3 Self-sealing tires

- 7.4 Eco-friendly tires

- 7.5 Noise reduction technology

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Rim Size, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Below 15 inches

- 8.3 15-20 inches

- 8.4 Above 20 inches

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Passenger cars

- 9.2.1 SUV

- 9.2.2 Sedan

- 9.2.3 Hatchback

- 9.3 Commercial vehicles

- 9.3.1 Light Commercial Vehicles (LCV)

- 9.3.2 Medium Commercial Vehicles (MCV)

- 9.3.3 Heavy Commercial Vehicles (HCV)

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Apollo Tyres

- 12.2 Bridgestone

- 12.3 CEAT

- 12.4 Continental

- 12.5 Cooper Tire & Rubber

- 12.6 Dunlop Tires

- 12.7 Falken Tire

- 12.8 Goodyear Tire & Rubber

- 12.9 Hankook

- 12.10 Kumho Tire

- 12.11 Maxxis Tires

- 12.12 Michelin

- 12.13 MRF

- 12.14 Nitto Tire

- 12.15 Nokian

- 12.16 Pirelli

- 12.17 Sumitomo Rubber Industries

- 12.18 Toyo Tire

- 12.19 Vredestein Bande

- 12.20 Yokohama Rubber