PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708240

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708240

Oral Antidiabetic Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

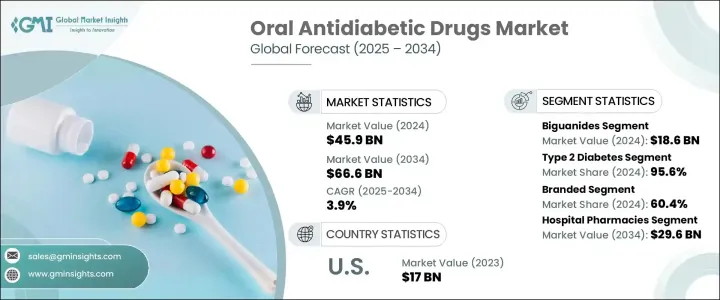

The Global Oral Antidiabetic Drugs Market generated USD 45.9 billion in 2024 and is projected to expand at a CAGR of 3.9% from 2025 to 2034. The growth of this market is largely driven by the rising global prevalence of diabetes, particularly Type 2 diabetes (T2DM). The increasing number of people diagnosed with T2DM, especially in developing nations, can be traced back to the widespread adoption of sedentary lifestyles and poor dietary habits. Obesity, a major contributor to insulin resistance, has further intensified the demand for oral medications designed to regulate blood sugar levels. Medications such as sodium-glucose transport protein-2 (SGLT-2) inhibitors and dipeptidyl peptidase-4 (DPP-4) inhibitors are becoming more popular. These drugs offer the added benefit of weight management in addition to effectively controlling blood glucose levels, giving patients a comprehensive solution to their condition.

This market is segmented by drug class into biguanides, SGLT-2 inhibitors, DPP-4 inhibitors, sulfonylureas, thiazolidinediones, meglitinides, alpha-glucosidase inhibitors, and other categories. In 2024, the biguanides segment generated USD 18.6 billion, with Metformin, the most widely prescribed biguanide, maintaining its dominance as the first-line treatment for T2DM. Its ability to reduce blood glucose levels by lowering hepatic glucose production and increasing insulin sensitivity has solidified its position in the market. Furthermore, biguanides continue to be a primary choice for healthcare providers, contributing significantly to market stability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $45.9 Billion |

| Forecast Value | $66.6 Billion |

| CAGR | 3.9% |

When considering disease type, the Type 2 diabetes segment accounted for a dominant 95.6% share in 2024. This is directly linked to the increasing prevalence of T2DM worldwide. Urbanization, unhealthy eating habits, and a lack of physical activity are key contributors to the early onset of T2DM, particularly in large-population countries. Consequently, there is a rising demand for convenient, long-term oral treatment options, reinforcing the growing role of oral antidiabetic drugs in managing diabetes.

In North America, the oral antidiabetic drugs market held a 41.1% share in 2024. The region's high prevalence of diabetes, combined with ongoing advancements in drug formulations and increased patient awareness, is expected to continue driving market growth. Factors such as aging populations, sedentary lifestyles, and poor dietary habits are contributing to the rising incidence of diabetes in the region. Additionally, innovations in healthcare, such as telemedicine and digital health tools, have made it easier for patients to manage their condition, further boosting the adoption of oral antidiabetic drugs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of type 2 diabetes

- 3.2.1.2 Increased preference for oral medications

- 3.2.1.3 Expansion of online pharmacies and e-commerce

- 3.2.1.4 Growing trend for combination therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of newer drug classes

- 3.2.2.2 Side effects and safety concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Diabetes landscape

- 3.6.1 Number of diabetics worldwide, by region, 2024

- 3.6.2 Countries with the highest number of diabetics, 2024

- 3.6.3 Number of diabetes deaths worldwide, by region, 2024

- 3.6.4 Countries with the highest projected number of diabetics worldwide in 2045

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Biguanides

- 5.3 Dipeptidyl peptidase - 4 (DPP-4) inhibitors

- 5.3.1 Sitagliptin

- 5.3.2 Linagliptin

- 5.3.3 Vildagliptin

- 5.3.4 Saxagliptin

- 5.3.5 Alogliptin

- 5.3.6 Other DPP-4 inhibitors

- 5.4 Sodium-glucose transport protein-2 (SGLT-2) inhibitors

- 5.4.1 Dapagliflozin

- 5.4.2 Empagliflozin

- 5.4.3 Canagliflozin

- 5.5 Sulfonylureas

- 5.5.1 Glimepiride

- 5.5.2 Glipizide

- 5.5.3 Glyburide

- 5.6 Thiazolidinediones

- 5.7 Meglitinides

- 5.7.1 Repaglinide

- 5.7.2 Nateglinide

- 5.8 Alpha-glucosidase inhibitors

- 5.9 Other drug classes

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 2 diabetes

- 6.3 Type 1 diabetes

Chapter 7 Market Estimates and Forecast, By Medication Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Branded

- 7.3 Generic

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Astellas Pharma

- 10.2 AstraZeneca

- 10.3 Bayer

- 10.4 Boehringer Ingelheim

- 10.5 Bristol Myers Squibb

- 10.6 Eli Lilly and Company

- 10.7 Glenmark Pharmaceuticals

- 10.8 Johnson & Johnson (Janssen Pharmaceuticals)

- 10.9 Merck

- 10.10 Novartis

- 10.11 Novo Nordisk

- 10.12 Pfizer

- 10.13 Sanofi

- 10.14 Takeda Pharmaceuticals