PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708226

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708226

Residential Energy Efficient Windows Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

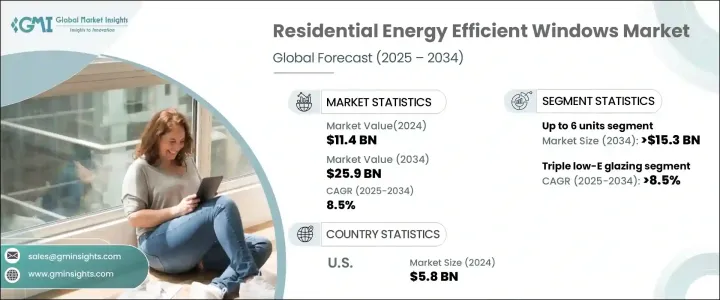

The Global Residential Energy Efficient Windows Market was valued at USD 11.4 billion in 2024 and is expected to grow at a CAGR of 8.5% from 2025 to 2034. Increasing concerns about heating and cooling efficiency in homes are driving demand for energy-efficient windows, which help reduce energy consumption and minimize carbon footprints. Homeowners are becoming more conscious of adopting energy-efficient technologies, supported by government incentives such as tax credits, rebates, and low-interest loans that encourage sustainable investments. Green financing options are also gaining traction, enabling homeowners to enhance property value while contributing to global environmental goals. Moreover, growing awareness about environmental protection, climate change, and the reduction of greenhouse gas emissions is prompting homeowners to invest in advanced window technologies, fostering industry growth.

Homeowners are shifting towards energy-efficient products that offer enhanced comfort by maintaining consistent indoor temperatures, minimizing drafts, reducing condensation, and eliminating cold spots near windows, particularly during extreme weather conditions. These benefits not only create a more comfortable living environment but also increase the home's resale value, making energy-efficient windows an attractive feature for potential buyers. As energy costs continue to rise, homeowners are prioritizing solutions that promise long-term savings, sustainability, and improved comfort, thereby accelerating the adoption of these products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.4 Billion |

| Forecast Value | $25.9 Billion |

| CAGR | 8.5% |

The industry is categorized based on the number of windows installed, including up to 6 units, more than 6 to 10 units, and above 10 units. The up to 6 units segment is projected to surpass USD 15.3 billion by 2034, driven by rising heating and cooling costs and growing environmental concerns. Smaller households that invest in well-insulated windows experience improved temperature regulation, reducing the dependence on HVAC systems and cutting down carbon emissions. This trend is expected to continue as more homeowners seek to reduce their energy consumption while maintaining a comfortable indoor environment.

In terms of glazing types, the market is segmented into double glazing and triple low-E glazing, with the latter poised to grow at a CAGR of over 8.5% by 2034 due to its superior thermal insulation properties. Triple low-E glazing helps maintain consistent indoor temperatures year-round, making it particularly beneficial for regions experiencing extreme temperature variations. Additionally, the rising demand for sound insulation in urban environments, where noise pollution is a concern, is further driving the adoption of triple low-E glazing. Homeowners are increasingly looking for durable, high-performance window solutions that provide long-term cost savings and offer lifespans of 20 to 30 years, depending on the frame material and maintenance.

North America accounted for over 63.1% of the global market share in 2024, a figure that is expected to rise by 2034. The U.S. market alone was valued at USD 4.9 billion in 2022, USD 5.3 billion in 2023, and USD 5.8 billion in 2024, highlighting the region's growing commitment to energy-efficient solutions. Increasing investment by industry players in developing advanced window technologies, including low-E coatings and dynamic windows that adjust based on external temperatures, will further fuel market growth. Rising home renovation projects aimed at improving energy efficiency in older homes and growing consumer awareness of the long-term benefits of energy-efficient solutions are expected to sustain the industry's positive trajectory.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research Design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Glazing Type, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Double glazing

- 5.3 Triple low-E glazing

Chapter 6 Market Size and Forecast, By Adoption, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Replacement

- 6.3 Insulation

Chapter 7 Market Size and Forecast, By Number of Windows, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Up to 6 units

- 7.3 >6 to 10 units

- 7.4 >10 units

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 Australia

- 8.5 Rest of World

Chapter 9 Company Profiles

- 9.1 AeroShield

- 9.2 Atrium Corporation

- 9.3 Andersen Corporation

- 9.4 Builders First Choice

- 9.5 Champion Window

- 9.6 Fenesta

- 9.7 French Steel Company

- 9.8 Jeld-Wen

- 9.9 Milgard Manufacturing

- 9.10 Marvin Windows & Doors

- 9.11 Nordik Windows

- 9.12 Pella Corporation

- 9.13 Soft-Lite Windows

- 9.14 YKK AP