PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708222

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708222

High Barrier Packaging Films Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

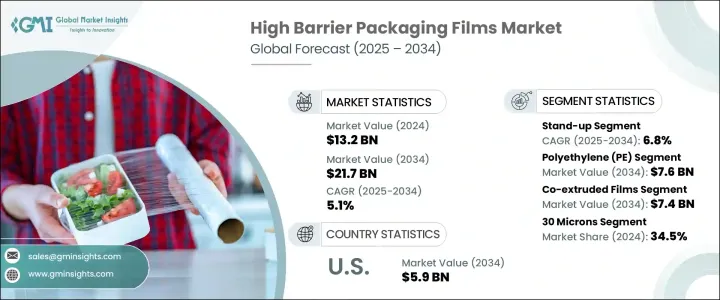

The Global High Barrier Packaging Films Market generated USD 13.2 billion in 2024 and is expected to grow at a CAGR of 5.1% from 2025 to 2034, driven by the rapid growth of the pharmaceutical sector, the expansion of e-commerce, and the increasing popularity of online food delivery services. As pharmaceutical companies continue to innovate and expand, the need for advanced packaging solutions that protect sensitive products becomes more critical. High barrier packaging films ensure optimal protection against moisture, oxygen, and other contaminants while extending the shelf life of pharmaceuticals. Moreover, the booming e-commerce industry and the surge in online food delivery services have further fueled the demand for high-performance packaging that maintains product integrity during shipping and storage. Rising consumer expectations for secure, hygienic, and sustainable packaging have also contributed to market growth. Additionally, increasing environmental awareness is driving manufacturers to invest in recyclable, biodegradable, and high-barrier materials to align with circular economy goals.

The market encompasses a variety of packaging formats, including stand-up pouches, flat pouches, bags and sacks, blisters and clamshells, wraps and lidding films, and sachets and stick packs. Among these, stand-up pouches are projected to experience the highest growth, with a CAGR of 6.8% through 2034. This growth is largely attributed to the rising consumer preference for lightweight, high-barrier flexible packaging, particularly for snacks and ready-to-eat meals. Manufacturers are increasingly adopting high-quality recyclable materials and integrating advanced resealable features to meet consumer demands for convenience and sustainability. As environmental concerns about plastic waste intensify, industry players are developing packaging solutions that reduce environmental impact while maintaining product safety and freshness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.2 Billion |

| Forecast Value | $21.7 Billion |

| CAGR | 5.1% |

In terms of material type, the high barrier packaging films market is segmented into polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyvinylidene chloride (PVDC), ethylene vinyl alcohol (EVOH), polyamide (nylon), and others. Polyethylene (PE) is expected to dominate the segment, reaching USD 7.6 billion by 2034. A notable shift is underway towards recyclable and bio-based PE materials as companies emphasize sustainable practices to meet regulatory requirements and customer expectations. Manufacturers are developing innovative mono-material PE films that offer superior oxygen and moisture barriers, ensuring product protection while promoting sustainability. These advancements in PE materials are driving the growth of this segment and catering to the rising demand for environmentally responsible packaging.

North America High Barrier Packaging Films Market held a 38.4% share in 2024, propelled by increasing demand for convenience foods and ready-to-eat meals. As consumer preferences shift towards packaged foods that provide extended shelf life and freshness, the demand for high-barrier packaging solutions continues to grow. The region is witnessing a notable rise in the consumption of prepackaged frozen meals, snacks, and food trays, which further boosts the adoption of high barrier packaging films. Additionally, the region's strong emphasis on innovation, combined with the growing need for sustainable and eco-friendly packaging solutions, is expected to maintain North America's dominant position in the market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth in e-commerce and online food delivery

- 3.2.1.2 Expansion of pharmaceutical industry

- 3.2.1.3 Rising demand for vacuum and modified atmosphere packaging (MAP)

- 3.2.1.4 Expansion of the dairy and meat packaging industry

- 3.2.1.5 Rapid urbanization and changing lifestyles driving packaged goods

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs of advanced barrier films

- 3.2.2.2 Volatility in petrochemical prices affecting raw material supply

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Material Type, 2021 - 2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Polyethylene (PE)

- 5.3 Polypropylene (PP)

- 5.4 Polyethylene Terephthalate (PET)

- 5.5 Polyvinylidene Chloride (PVDC)

- 5.6 Ethylene Vinyl Alcohol (EVOH)

- 5.7 Polyamide (Nylon)

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Packaging Format, 2021 - 2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Stand-up pouches

- 6.3 Flat pouches

- 6.4 Bags & sacks

- 6.5 Blisters & clamshells

- 6.6 Wraps & lidding films

- 6.7 Sachets & stick packs

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Co-extruded films

- 7.3 Metallized films

- 7.4 Sputtered films

- 7.5 Atomic Layer Deposition (ALD) Films

- 7.6 Laminated films

Chapter 8 Market Estimates & Forecast, By Film Thickness, 2021 - 2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Up to 30 microns

- 8.3 30-50 microns

- 8.4 50-70 microns

- 8.5 Above 70 microns

Chapter 9 Market Estimates & Forecast, By Application Type, 2021 - 2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 Fresh food packaging

- 9.3 Processed food packaging

- 9.4 Beverage packaging

- 9.5 Healthcare products

- 9.6 Personal care & cosmetics

- 9.7 Industrial components

- 9.8 Agricultural products

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Billion & Kilo Tons)

- 10.1 Key trends

- 10.2 Food & beverages

- 10.3 Pharmaceuticals & medical

- 10.4 Electronics & semiconductor

- 10.5 Industrial

- 10.6 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion & Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 3M

- 12.2 ACG

- 12.3 Amcor

- 12.4 Bemis Manufacturing

- 12.5 Berry Global

- 12.6 Celplast Metallized Products

- 12.7 Cosmo Films

- 12.8 Innovia Films

- 12.9 Jindal Poly Films

- 12.10 Klockner Pentaplast

- 12.11 Mitsubishi Chemical Advanced Materials

- 12.12 Mondi

- 12.13 Oike

- 12.14 Perlen Packaging

- 12.15 Sealed Air

- 12.16 Sigma Plastics Group

- 12.17 Sonoco Products

- 12.18 Toppan

- 12.19 Toray Plastics

- 12.20 Uflex

- 12.21 Winpak