PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708212

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708212

Unit Dose Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

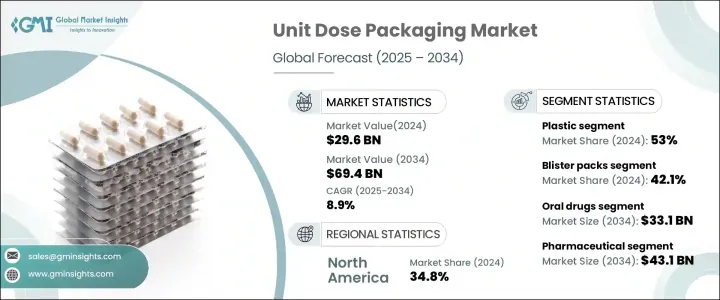

The Global Unit Dose Packaging Market was valued at USD 29.6 billion in 2024 and is projected to grow at a CAGR of 8.9% between 2025 and 2034. This robust growth is fueled by the rising demand for precise and convenient dosing solutions across industries, particularly pharmaceuticals, nutraceuticals, and dietary supplements. Unit dose packaging has gained traction due to its ability to enhance patient compliance, reduce medication errors, and improve safety. As healthcare systems worldwide emphasize the importance of accurate dosing, pharmaceutical companies are increasingly adopting unit dose formats such as blister packs, pre-filled syringes, ampoules, and vials to ensure safe and effective medication delivery. Furthermore, the growing popularity of personalized nutrition and preventive healthcare has expanded the use of unit dose packaging in functional foods and probiotic supplements, creating new growth opportunities in the market.

The market's growth trajectory is also influenced by regulatory policies that promote the use of safer and tamper-evident packaging, particularly in the pharmaceutical sector. With an increasing focus on minimizing medication errors and enhancing patient safety, unit dose packaging formats are becoming a preferred choice. Additionally, the surge in demand for convenience-driven packaging solutions, especially in the post-COVID-19 era, has further propelled the market. Consumers now seek single-use, hygienic, and portable packaging formats that align with their on-the-go lifestyles. The trend has also extended to the food and beverage industry, where single-dose sachets and pouches are gaining momentum due to their ease of use and precise portion control. As a result, manufacturers are investing heavily in advanced packaging technologies and sustainable materials to cater to evolving consumer preferences while complying with stringent regulatory requirements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.6 Billion |

| Forecast Value | $69.4 Billion |

| CAGR | 8.9% |

The market is segmented by material type, with plastic, aluminum, paper & paperboard, and glass being the primary categories. In 2024, the plastic segment accounted for 53% of the market share, driven by its strength, versatility, and ability to provide effective barrier protection. Plastic packaging extends product shelf life while ensuring safety, making it a preferred choice in pharmaceuticals and food packaging. However, the increasing emphasis on environmental sustainability has prompted manufacturers to develop eco-friendly alternatives, such as recyclable and biodegradable plastics. These innovations provide environmentally conscious solutions without compromising packaging functionality, positioning the plastic segment for continued dominance in the market.

In terms of packaging types, the market is divided into blister packs, sachets & pouches, ampoules & vials, pre-filled syringes, and others. Blister packs held a 42.1% share in 2024, reflecting their widespread use in pharmaceutical and nutraceutical applications. Manufacturers are enhancing blister packs with peelable lids, easy-open designs, and improved barrier properties to ensure product safety while delivering a user-friendly experience. These innovations align with the growing demand for packaging solutions that balance functionality and sustainability, driving the popularity of blister packs in the market.

North America unit dose packaging market accounted for 34.8% of the global share in 2024, propelled by a high demand for advanced packaging solutions. The region's focus on improving patient safety and medication adherence has led to a surge in the adoption of unit dose formats such as pre-filled syringes, single-dose vials, and stick packs. The increasing prevalence of chronic conditions, including diabetes, cardiovascular diseases, and respiratory issues, has further driven pharmaceutical companies to invest in packaging technologies that minimize medication errors and improve treatment outcomes. As a result, North America remains a critical market for unit dose packaging innovations, with continued investments in research and development expected to shape the future of the industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for precision dosing solutions

- 3.2.1.2 Growth in the pharmaceutical industry

- 3.2.1.3 Growth in over-the-counter (OTC) medicines

- 3.2.1.4 Increasing use of unit dose packaging in nutraceuticals and supplements

- 3.2.1.5 Expansion of point-of-care testing and diagnostic kits

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment in advanced packaging machinery

- 3.2.2.2 Environmental concerns regarding single-use plastic waste

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Plastic

- 5.3 Aluminum

- 5.4 Paper & paperboard

- 5.5 Glass

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Blister packs

- 6.3 Sachets & pouches

- 6.4 Ampoules & vials

- 6.5 Pre-filled syringes

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Oral drugs

- 7.3 Injectables

- 7.4 Topical & transdermal

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Pharmaceutical

- 8.3 Cosmetics & personal care

- 8.4 Nutraceuticals

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Adelphi Healthcare Packaging

- 10.2 Amcor

- 10.3 AptarGroup

- 10.4 Berry Global

- 10.5 Borosil

- 10.6 Catalent

- 10.7 Constantia Flexibles

- 10.8 Corning

- 10.9 DWK Life Sciences

- 10.10 Gerresheimer

- 10.11 Glenroy

- 10.12 Lameplast

- 10.13 Nipro

- 10.14 Schott

- 10.15 SGD Pharma

- 10.16 Shiotani Glass

- 10.17 Stevanato Group

- 10.18 Unit Pack Company

- 10.19 Valmatic

- 10.20 West Pharmaceutical Services