PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708210

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708210

Single-Serve Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

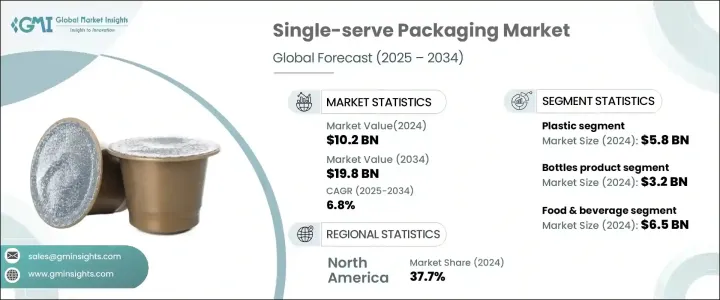

The Global Single-Serve Packaging Market was valued at USD 10.2 billion in 2024 and is projected to grow at a CAGR of 6.8% during 2025-2034. This impressive growth is primarily fueled by rising consumer preferences for portion-controlled, health-conscious consumption and the proliferation of convenient food and beverage options. As individuals become more focused on managing their health, portion control has gained prominence, driving demand for single-serve packaging that offers convenience and reduced food wastage. Busy urban lifestyles, longer working hours, and time constraints have intensified the need for easy-to-carry and ready-to-eat (RTE) or ready-to-drink (RTD) products. Single-serve packaging formats have gained traction as they provide convenience, portability, and efficient portion management.

The market is also benefiting from technological advancements in packaging solutions that improve product safety, extend shelf life, and enhance aesthetic appeal. Additionally, increased environmental consciousness has prompted the development of eco-friendly and sustainable packaging materials, boosting market growth. As e-commerce platforms continue to thrive, the demand for lightweight and durable packaging solutions that ensure product freshness during transportation is steadily rising. Single-serve packaging formats have proven to be effective in catering to the evolving preferences of consumers who seek both convenience and sustainability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.2 Billion |

| Forecast Value | $19.8 Billion |

| CAGR | 6.8% |

The market is segmented by material type, with plastic, paper, metal, and glass being the primary categories. Plastic emerged as the dominant segment, valued at USD 5.8 billion in 2024, due to its lightweight, durable, and flexible characteristics that facilitate easy transportation and secure storage. Plastic packaging effectively shields products from external elements such as moisture, air, and light, thereby extending shelf life. Moreover, the growing emphasis on sustainability and the increasing preference for environmentally friendly solutions have compelled manufacturers to introduce recyclable and bio-based plastic alternatives that align with regulatory standards and environmental expectations. These innovations not only cater to consumer preferences but also address the rising concerns surrounding plastic waste and its impact on the environment.

Single-serve packaging is extensively utilized across multiple applications, including food and beverage, pharmaceuticals, and personal care. The food and beverage segment, generating USD 6.5 billion in 2024, witnessed substantial growth driven by the popularity of RTE and RTD products. Consumers' preference for snack packs, functional beverages, and meal kits has fueled demand for portion-controlled and easily portable packaging solutions. The surge in online grocery shopping and food delivery services further reinforces the need for lightweight, durable, and secure packaging that maintains product freshness during transit. Manufacturers are increasingly focusing on packaging innovations that enhance product safety while aligning with changing consumer preferences and sustainability goals.

North America single-serve packaging market accounted for 37.7% of the global share in 2024. The region's growing inclination toward health-conscious and portion-controlled consumption, along with the adoption of on-the-go lifestyles, has driven demand for innovative packaging solutions. Additionally, regulatory support for eco-friendly packaging and the push for sustainable alternatives have encouraged the adoption of recyclable and innovative single-serve packaging formats. As sustainability takes center stage, the integration of bio-based and biodegradable packaging solutions is expected to further accelerate the market's growth trajectory.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand in the travel, tourism, and hospitality sectors

- 3.2.1.2 Rising demand for portion control and health-conscious consumption

- 3.2.1.3 Evolving consumer lifestyles and urbanization

- 3.2.1.4 Expansion of the ready-to-eat (RTE) and ready-to-drink (RTD) segments

- 3.2.1.5 Growth of e-commerce and direct-to-consumer channels

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fluctuation in raw materials price

- 3.2.2.2 Supply chain disruption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Plastic

- 5.3 Paper

- 5.4 Metal

- 5.5 Glass

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Pouches & sachets

- 6.3 Cups & tubs

- 6.4 Bottles

- 6.5 Blister packs

- 6.6 Trays

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals

- 7.4 Personal care & cosmetics

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor plc

- 9.2 Amber Packaging

- 9.3 American FlexPack

- 9.4 CarePac

- 9.5 Constantia Flexibles

- 9.6 CP Italy S.r.l.

- 9.7 Duropack Limited

- 9.8 Glenroy, Inc.

- 9.9 Huhtamaki

- 9.10 IMA Group

- 9.11 Mondi

- 9.12 Polysack Flexible Packaging Ltd.

- 9.13 ProAmpac

- 9.14 Rain Nutrience

- 9.15 RATTPACK

- 9.16 RCP Ranstadt GmbH

- 9.17 TIPA LTD

- 9.18 Transcontinental Inc.

- 9.19 Winpak LTD.