PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708203

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708203

Biomarkers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

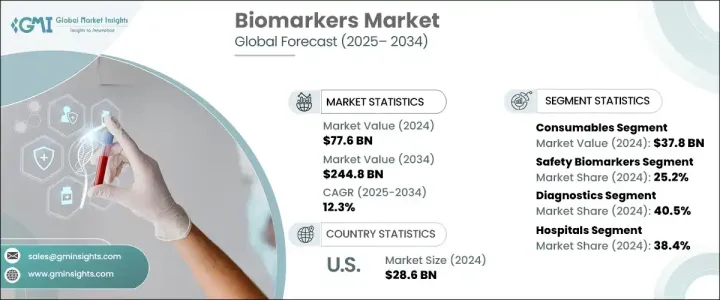

The Global Biomarkers Market was valued at USD 77.6 billion in 2024 and is projected to grow from USD 85.9 billion in 2025 to USD 244.8 billion by 2034 at a CAGR of 12.3%. Biomarkers, which include proteins, genes, and other molecules found in blood, tissues, and body fluids, play a crucial role in identifying biological processes and disease conditions. Their use in early disease detection, monitoring treatment response, and developing personalized therapies continues to drive market growth. Advances in personalized medicine are transforming biomarker detection and treatment approaches, with innovations such as liquid biopsies enabling non-invasive identification and real-time monitoring of treatment responses. These advancements have expanded the clinical applications of biomarkers, making them indispensable tools in improving patient outcomes and accelerating drug discovery.

The consumables segment, which includes reagents, assay kits, and microplates, generated USD 37.8 billion in 2024 and is projected to grow at a CAGR of 12.1% during the forecast period. Consumables manufactured under stringent quality control standards ensure consistent and reproducible results across biomarker studies, particularly in clinical diagnostics and drug discovery. Their compatibility with advanced platforms such as mass spectrometry, next-generation sequencing (NGS), and liquid chromatography enhances the accuracy and efficiency of biomarker discovery and analysis, driving demand in this segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $77.6 Billion |

| Forecast Value | $244.8 Billion |

| CAGR | 12.3% |

The safety biomarkers segment captured a 25.2% market share in 2024 and is expected to reach USD 63.2 billion by 2034. Safety biomarkers play a critical role in detecting potential adverse effects of drugs or treatments at an early stage, preventing severe complications, and minimizing costs associated with late-stage clinical trial failures. These biomarkers facilitate the identification of toxicity across multiple organ systems, allowing continuous monitoring of organ function and improving overall safety in drug development.

The diagnostics segment held a 40.5% market share in 2024, driven by the ability of biomarkers to identify diseases at an early stage and improve prognosis through timely intervention. Non-invasive and minimally invasive biomarker detection methods, including blood, urine, and saliva tests, enhance patient compliance while reducing discomfort associated with traditional diagnostic methods. Innovations in diagnostic technologies, such as NGS and mass spectrometry, further improve the sensitivity and accuracy of biomarker detection, expanding their clinical utility and boosting market growth.

The cancer segment, with a 38.5% market share in 2024, remains a dominant application of biomarkers. Biomarkers enable the early detection of various cancers, improving the likelihood of successful treatment and distinguishing between benign and malignant tumors. They also facilitate post-treatment surveillance to identify potential cancer recurrence, ensuring timely intervention and contributing to better patient outcomes.

Hospitals, which accounted for a 38.4% market share in 2024, continue to lead the biomarkers market due to their ability to manage a large volume of chronic disease patients and provide highly skilled personnel for advanced diagnostic procedures. The growing demand for non-invasive biomarker tests, such as liquid biopsy and companion diagnostics, has further strengthened the role of hospitals in the biomarker landscape.

North America generated USD 31.4 billion in 2024 and is expected to reach USD 97.5 billion by 2034, with the U.S. dominating the region at USD 28.6 billion in 2024. The rising prevalence of chronic diseases, including cardiovascular diseases, neurological disorders, and cancer, drives market growth in the U.S. The increasing burden of these diseases has prompted pharmaceutical companies, hospitals, and research institutions to invest in the development of advanced diagnostic solutions and innovative therapies, ensuring the continued expansion of the biomarkers market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 Advancements in genomic and proteomic technologies

- 3.2.1.3 Rising demand for personalized medicine

- 3.2.1.4 Increasing research and development activities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of biomarker development and testing

- 3.2.2.2 Lack of standardization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product and Services, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By Biomarker Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Safety biomarkers

- 6.3 Efficacy biomarkers

- 6.4 Predictive biomarkers

- 6.5 Surrogate biomarkers

- 6.6 Pharmacodynamic biomarkers

- 6.7 Prognostics biomarkers

- 6.8 Validation biomarkers

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Diagnostics

- 7.3 Drug discovery and development

- 7.4 Personalized medicine

- 7.5 Disease risk assessment

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By Disease Type, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cancer

- 8.3 Cardiovascular diseases

- 8.4 Neurological diseases

- 8.5 Immunological diseases

- 8.6 Other diseases types

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic laboratories

- 9.4 Academic and research institutions

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott Laboratories

- 11.2 Agilent Technologies

- 11.3 Bio-Rad Laboratories

- 11.4 Becton, Dickinson and Company

- 11.5 Eurofins Scientific

- 11.6 Epigenomics

- 11.7 F. Hoffmann-La Roche

- 11.8 GE Healthcare

- 11.9 Illumina

- 11.10 Johnson & Johnson

- 11.11 Merck KGaA

- 11.12 PerkinElmer

- 11.13 QIAGEN

- 11.14 Siemens Healthineers

- 11.15 Thermo Fisher Scientific