PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708188

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708188

Smart Orthopedic Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

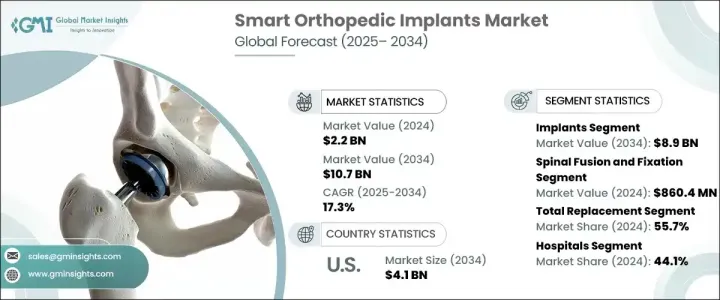

The Global Smart Orthopedic Implants Market was valued at USD 2.2 billion in 2024 and is expected to grow at a CAGR of 17.3% from 2025 to 2034. Smart orthopedic implants are innovative medical devices equipped with sensors and connectivity features that monitor, diagnose, and enhance treatment outcomes for musculoskeletal conditions. These implants offer real-time data on metrics such as load, alignment, and healing progress, enabling personalized patient care and improving treatment efficiency. Increasing demand for personalized healthcare, coupled with advancements in technology, is driving the adoption of these implants, contributing to significant market growth. Rising cases of musculoskeletal disorders and a growing geriatric population further fuel the demand. Conditions such as osteoarthritis, osteoporosis, and fractures are becoming increasingly common due to aging, sedentary lifestyles, and obesity, boosting the need for effective treatment solutions.

The market is segmented based on components, with implants and electronic components as the primary categories. Implants accounted for 83.4% of the market revenue in 2024 and are projected to reach USD 8.9 billion by 2034. These implants, particularly for knee and hip replacements, are widely used to treat degenerative bone conditions, which drives their market dominance. The integration of advanced technologies like sensors and artificial intelligence (AI) enhances implant performance, leading to better patient outcomes and greater adoption rates.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 17.3% |

By application, the smart orthopedic implants market includes spinal fusion and fixation, VCF treatment, motion preservation/non-fusion, and spinal decompression. Spinal fusion and fixation dominated the market with a value of USD 860.4 million in 2024. These procedures are commonly used to treat herniated discs, scoliosis, and spinal stenosis, particularly among the aging population. The integration of sensors for real-time monitoring and improved fixation techniques enhances the effectiveness of these procedures, ensuring their continued market leadership.

When segmented by procedure type, the market includes total replacement, partial replacement, and other procedures. Total replacement emerged as the dominant segment, accounting for 55.7% of the revenue share in 2024, and is estimated to reach USD 5.9 billion by 2034. The rising incidence of degenerative joint diseases and an aging population drive the demand for total replacement procedures, particularly for knee joints. These procedures provide comprehensive solutions for severe joint conditions, offering better functionality and long-term relief, which reinforces their market dominance.

Based on end use, the market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and other facilities. Hospitals held the largest revenue share of 44.1% in 2024 due to their capability to manage complex surgeries and provide comprehensive post-operative care. Their advanced surgical capabilities, specialized equipment, and multidisciplinary care make them the preferred choice for orthopedic procedures involving smart implants.

In the United States, the smart orthopedic implants market accounted for USD 748.5 million in 2023 and is expected to grow significantly, reaching USD 4.1 billion by 2034. The country's emphasis on healthcare innovation, robust infrastructure, widespread insurance coverage, and increasing awareness of cutting-edge orthopedic solutions drive the adoption of smart orthopedic implants across diverse patient demographics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of musculoskeletal disorders

- 3.2.1.2 Rising geriatric population in developed as well as developing economies

- 3.2.1.3 Shift towards personalized medicine

- 3.2.1.4 Technological advancements in the field of smart implants

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory framework

- 3.2.2.2 High cost of implants

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Gap analysis

- 3.7 Technological landscape

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Implants

- 5.2.1 Knee arthroplasty

- 5.2.2 Hip arthroplasty

- 5.2.3 Spine fusion

- 5.2.4 Fracture fixation

- 5.2.5 Other implants

- 5.3 Electronic components

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Spinal fusion and fixation

- 6.3 VCF treatment

- 6.4 Motion preservation/ non - fusion

- 6.5 Spinal decompression

Chapter 7 Market Estimates and Forecast, By Procedure Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Total replacement

- 7.3 Partial replacement

- 7.4 Other procedure types

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Specialty clinics

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Canary Medical

- 10.2 Exactech

- 10.3 Medtronic

- 10.4 SpineGuard

- 10.5 Stryker

- 10.6 Zimmer Biomet