PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708187

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708187

Cloud Storage Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

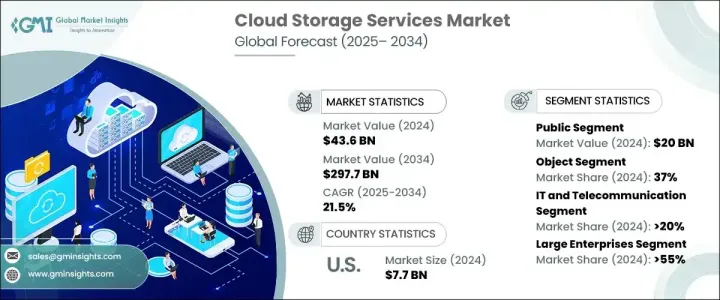

The Global Cloud Storage Services Market was valued at USD 43.6 billion in 2024 and is projected to grow at a CAGR of 21.5% between 2025 and 2034. The rise of remote work has fueled the demand for cloud storage and file-sharing solutions, enabling teams to store and access files without being physically present. Service providers allow seamless file sharing, secure backups, and easy collaboration on documents, ensuring real-time access to files from any location. The growing adoption of cloud storage services is also driven by the increasing volume of data generated by social media, digital content, and IoT devices. Massive real-time data is collected by IoT devices, such as smart home systems, which require scalable storage solutions. Businesses use cloud storage to securely store and analyze this data for actionable insights.

Reduced maintenance costs are another factor driving cloud storage adoption. Maintaining an on-premise data storage infrastructure involves significant expenses, including hardware maintenance, technical support, and IT personnel. Cloud service providers handle maintenance, including security patches, software updates, and hardware repairs, eliminating the need for specialized personnel. Cloud storage systems also incorporate data recovery and redundancy to protect against hardware failures or data loss. Cloud providers replicate data across different regions or data centers, ensuring a seamless disaster recovery process.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $43.6 Billion |

| Forecast Value | $297.7 Billion |

| CAGR | 21.5% |

Public cloud services enable remote access and collaboration for global workforces while investing heavily in security features such as multi-factor authentication (MFA), data encryption, and access control. Compliance with industry standards and regulations like GDPR, HIPAA, and ISO 27001 ensures data security and privacy. Public cloud storage allows organizations to store data in the provider's data centers, eliminating the need for hardware maintenance or software updates. Hybrid cloud models, which combine public and private cloud environments, allow organizations to move workloads between the two as needed, ensuring operational flexibility.

Object storage systems are designed to handle vast amounts of unstructured data, such as media files, backups, and log files. Their architecture allows businesses to scale storage capacity seamlessly without complex configurations. Unlike traditional systems that require physical hardware scaling, object storage automates the process. File cloud storage is expected to maintain a significant share of the market due to its remote accessibility and enhanced security. Users can access files from multiple devices through an internet connection, and providers offer encryption and MFA for added protection.

Block storage caters to data-intensive applications in industries like finance, healthcare, and gaming that require high-speed storage with low latency. As these industries generate increasing amounts of data, the demand for high-performance block storage solutions continues to rise. Cold cloud storage, which is more cost-effective for infrequently accessed data, is anticipated to hold a significant market share due to its durability and availability across multiple regions.

The cloud storage services market is segmented by industry verticals, including BFSI, healthcare, IT and telecommunication, retail and consumer goods, media and entertainment, manufacturing, and others. The IT and telecommunication segment accounted for over 20% of the market share in 2024, utilizing cloud storage for customer records, network data, and service logs. Media and entertainment companies also rely heavily on cloud storage to manage large files, including high-resolution video content and audio files. By end-use, large enterprises held a market share of over 55% in 2024, leveraging cloud services for computing power, storage, networking, security, analytics, and disaster recovery. Infrastructure-as-a-Service (IaaS) and Software-as-a-Service (SaaS) solutions provide businesses with virtualized computing resources and complete managed applications through the cloud.

Europe holds approximately 25% of the global cloud storage services market, with Germany being a major contributor due to its strict data privacy regulations. GDPR compliance mandates that cloud providers offer features such as data encryption, access controls, and audit trails to ensure data security and regulatory adherence. European organizations increasingly adopt multi-cloud and hybrid cloud strategies to balance cost and performance while addressing stringent data security requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Cloud storage service providers

- 3.2.2 Cloud storage infrastructure providers

- 3.2.3 Cloud management and security service providers

- 3.2.4 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Use cases

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Emergence of remote work location

- 3.9.1.2 Rising demand for data security and back up

- 3.9.1.3 Less maintenance cost

- 3.9.1.4 Ease in data recovery

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Surge in Metadata

- 3.9.2.2 Threats of ransomware

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Public

- 5.3 Private

- 5.4 Hybrid

Chapter 6 Market Estimates & Forecast, By Storage, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Object

- 6.3 File

- 6.4 Block

- 6.5 Cold

Chapter 7 Market Estimates & Forecast, By Industry Vertical, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 BFSI

- 7.3 Healthcare

- 7.4 IT and telecommunication

- 7.5 Retail and consumer goods

- 7.6 Media and entertainment

- 7.7 Manufacturing

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large enterprises

- 8.4 Individual

Chapter 9 Market Estimates & Forecast, By Pricing Model, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Pay-as-you-go

- 9.3 Subscription-based

- 9.4 Freemium

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Adobe

- 11.2 Alibaba

- 11.3 Amazon

- 11.4 Apple

- 11.5 Backblaze

- 11.6 Box

- 11.7 Dell

- 11.8 DigitalOcean

- 11.9 Dropbox

- 11.10 Google

- 11.11 HPE

- 11.12 IBM

- 11.13 Microsoft

- 11.14 Oracle

- 11.15 OVHcloud

- 11.16 pCloud

- 11.17 RackSpace

- 11.18 Tencent

- 11.19 VMware

- 11.20 Wasabi Technologies