PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708186

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708186

Metalized Barrier Film Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

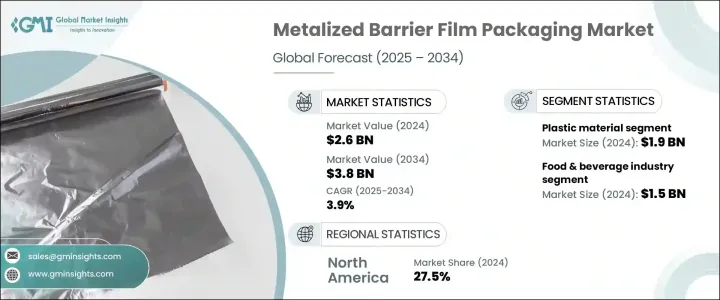

The Global Metalized Barrier Film Packaging Market, valued at USD 2.6 billion in 2024, is expected to grow at a CAGR of 3.9% from 2025 to 2034. This growth is primarily driven by rising demand from the pharmaceutical industry and the increasing need for extended shelf life across various sectors. Metalized barrier films provide high protection against environmental factors, preserving the freshness, flavor, and nutritional quality of packaged goods. As globalization and consumer preferences for packaged and processed foods increase, manufacturers are turning to these films to ensure product integrity during extended transit times. The pharmaceutical sector, in particular, benefits from these films in blister packs and medical pouches, ensuring the protection of sensitive drugs. Manufacturers focusing on high-barrier solutions and adherence to regulatory standards will see increased adoption in this sector.

The need for longer shelf life is another significant factor fueling market expansion. These films effectively safeguard packaged foods, pharmaceuticals, and cosmetics, preventing spoilage and maintaining quality over time. As consumer lifestyles become more fast-paced, there is a greater inclination toward ready-to-eat and processed food products, driving demand for advanced packaging solutions. In addition, the rise in e-commerce and global trade has heightened the need for robust barrier films to protect products during transportation and storage.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 3.9% |

The market is segmented by material, with plastic dominating this space, accounting for USD 1.9 billion in 2024. Plastic-based metalized films are preferred due to their lightweight nature, cost-efficiency, and flexibility. As consumers increasingly opt for portable and convenient packaging, flexible plastic films gain traction. Their ability to reduce the need for preservatives while maintaining product freshness makes them ideal for high-volume applications. This trend is further supported by the growing popularity of ready-to-eat foods and beverages, which require superior packaging to retain their quality.

By end-use industry, the food and beverage segment is the largest contributor, with a valuation of USD 1.5 billion in 2024. The segment's growth is attributed to rapid urbanization and changing consumer habits, which favor packaged and ready-to-eat products. Metalized barrier films are widely used in snacks, coffee, dairy, and other packaged foods, preserving freshness and preventing spoilage without relying on chemical preservatives. Increasing regulatory emphasis on sustainable packaging and consumer demand for eco-friendly solutions further boost adoption in this segment.

North America held 27.5% of the global market share in 2024, driven by the rising need for high-barrier packaging and the rapid growth of the e-commerce sector. Government support for adopting sustainable packaging materials, combined with changing consumer preferences, is promoting the adoption of metalized barrier film packaging. The United States led the regional market, accounting for USD 523.9 million in 2024, fueled by the growing demand for packaged foods that require high-performance packaging to maintain product integrity during transportation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for extended shelf life

- 3.2.1.2 Advancements in sustainable barrier coatings

- 3.2.1.3 Booming e-commerce & food delivery services

- 3.2.1.4 Rapid urbanization and busy lifestyles

- 3.2.1.5 Growing demand in pharmaceutical packaging

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited recycling & sustainability issues

- 3.2.2.2 Competition from biodegradable alternatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Plastics

- 5.2.1 Polypropylene (PP)

- 5.2.2 Polyethylene Terephthalate (PET)

- 5.2.3 Polyamide (PA)

- 5.2.4 Polyethylene (PE)

- 5.2.5 Nylon

- 5.2.6 Others

- 5.3 Metals

Chapter 6 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverage

- 6.3 Pharmaceuticals

- 6.4 Electronics

- 6.5 Personal care and cosmetics

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Aerolam Group

- 8.2 Amcor

- 8.3 Cosmo Films

- 8.4 Dunmore

- 8.5 Ester Industries

- 8.6 Finfoil

- 8.7 Flex Films

- 8.8 Jindal Films

- 8.9 Kolon Industries

- 8.10 Nahar PolyFilms

- 8.11 PC Laminations

- 8.12 SRF

- 8.13 Sumilon Group

- 8.14 Taghleef Industries

- 8.15 Toray

- 8.16 Zhejiang Changyu New Materials