PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708171

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708171

AI in Endoscopy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

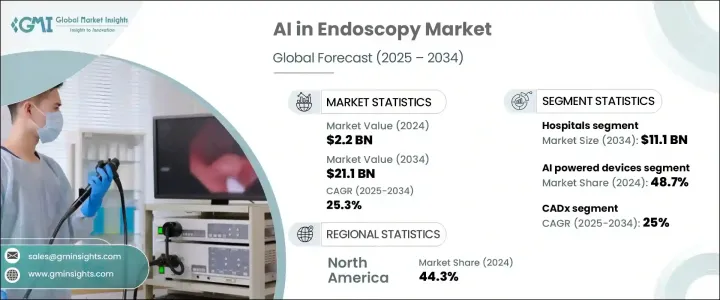

The Global AI in Endoscopy Market was valued at USD 2.2 billion in 2024 and is projected to expand at a robust CAGR of 25.3% from 2025 to 2034. The rapid growth of this market reflects the increasing demand for advanced diagnostic tools driven by a surge in gastrointestinal and related disorders worldwide. As gastrointestinal diseases, including colorectal cancer, inflammatory bowel disease, and peptic ulcers, continue to rise, healthcare systems are urgently seeking solutions that offer more accurate, faster, and reliable diagnoses. AI-powered endoscopy is emerging as a transformative tool that is reshaping how clinicians detect and treat abnormalities in real time. Artificial intelligence is now playing a pivotal role in enhancing diagnostic accuracy, streamlining clinical workflows, and delivering predictive insights, all contributing to better patient outcomes.

The integration of AI in endoscopy procedures allows physicians to identify lesions, tumors, and polyps with higher precision, significantly reducing human error and improving early diagnosis rates. With healthcare providers worldwide focusing on minimally invasive procedures, AI technologies are becoming essential in providing enhanced visualization, real-time analysis, and automated detection, ultimately improving clinical decision-making processes. The continuous evolution of AI algorithms, coupled with the integration of high-definition imaging and robotic-assisted platforms, is further driving the demand for AI-based endoscopy solutions, making this market a critical focus for medical device manufacturers and healthcare institutions alike.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $21.1 Billion |

| CAGR | 25.3% |

The AI in endoscopy market is segmented based on procedure types, including gastrointestinal, urological, respiratory, colonoscopy, and others. Among these, the gastrointestinal endoscopy segment dominated the market and generated USD 631.2 million in 2023, largely propelled by the rising prevalence of gastrointestinal conditions. AI-driven solutions such as computer-aided detection (CADe) systems are transforming gastrointestinal endoscopy by enabling precise identification of abnormalities like polyps and tumors. Tools featuring AI-powered real-time video analysis and image enhancement technologies are improving diagnostic speeds and accuracy, facilitating quicker clinical interventions. These advancements are encouraging hospitals and clinics to adopt AI-based endoscopy tools as part of their standard diagnostic protocols.

From a component perspective, the market is divided into AI-powered devices, software, and services. The AI-powered devices segment accounted for a 48.7% share in 2024, underpinned by the growing preference for advanced diagnostic and visualization technologies. These devices are enabling healthcare providers to perform more targeted and efficient endoscopic procedures, supporting faster diagnosis and treatment. The shift toward minimally invasive interventions, coupled with real-time AI capabilities, is driving significant innovations in the development of compact, high-performance endoscopic tools that integrate seamlessly with AI software for optimized outcomes.

Regionally, North America led the AI in endoscopy market with a 44.3% share in 2024, spearheaded by the U.S. due to its strong healthcare infrastructure and early adoption of AI technologies. Ongoing collaborations between technology providers and healthcare institutions are fostering innovative product development and accelerating market penetration. The region's proactive investment in R&D and focus on integrating AI to improve procedural efficiency and patient care continue to strengthen its position in the global market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of gastrointestinal and respiratory diseases

- 3.2.1.2 Rising adoption of minimally invasive surgeries

- 3.2.1.3 Advancements in AI algorithms for real-time imaging and diagnostics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation and equipment costs

- 3.2.2.2 Regulatory and ethical challenges in AI deployment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type of Endoscopy, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Gastrointestinal endoscopy

- 5.3 Urological endoscopy

- 5.4 Respiratory endoscopy

- 5.5 Colonoscopy

- 5.6 Other types

Chapter 6 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 AI powered devices

- 6.3 Software

- 6.4 Services

Chapter 7 Market Estimates and Forecast, By Type of CAD, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 CADx

- 7.3 CADe

Chapter 8 Market Estimates and Forecast, End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Specialty clinics

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ambu

- 10.2 Fujifilm

- 10.3 Hoya

- 10.4 Intuitive Surgical

- 10.5 Iterative Scopes

- 10.6 Magentiq Eye

- 10.7 Medtronic

- 10.8 NEC Corporation

- 10.9 Odin Vision

- 10.10 Olympus

- 10.11 PENTAX Medical

- 10.12 Wision Al

- 10.13 Wuhan EndoAngel Medical Technology