PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708167

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708167

Data Center Fire Detection and Suppression Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

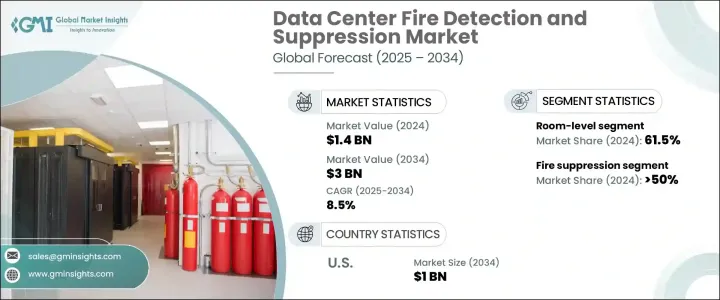

The Global Data Center Fire Detection and Suppression Market reached USD 1.4 billion in 2024 and is expected to witness a robust CAGR of 8.5% from 2025 to 2034. The rising demand for advanced fire safety solutions is largely fueled by the exponential growth of data centers worldwide, driven by the increasing adoption of cloud computing, edge computing, AI-powered technologies, and high-performance computing (HPC). As companies continue to scale up their data infrastructure to support massive data flows and low-latency services, ensuring comprehensive fire safety has become a top priority.

Modern data centers, especially hyperscale and colocation facilities, house mission-critical IT assets worth millions of dollars, making them vulnerable to fire hazards caused by electrical faults, overheating, or equipment failures. With downtime costs running into hundreds of thousands of dollars per minute, the need for reliable and intelligent fire detection and suppression systems has never been greater. Additionally, stringent fire safety regulations and rising awareness about safeguarding sensitive data and equipment are pushing operators to integrate AI-based and IoT-enabled fire protection solutions, which offer real-time monitoring and faster response times. Increasing emphasis on business continuity, operational resilience, and protection against growing cyber-physical risks is further propelling the market forward.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $3 Billion |

| CAGR | 8.5% |

The market is categorized into fire detection and fire suppression systems, where in 2024, the fire suppression segment captured a 50% market share, highlighting its critical role in safeguarding high-value assets from fire-related damages. Fire detection systems are indispensable for early-stage fire risk identification and efficient incident response. These systems comprise AI-powered smoke detectors, multi-sensor detection units, and aspirating smoke detection (ASD) systems, all designed to offer faster and more accurate detection capabilities. Cutting-edge technologies like ASD+ leverage dual-wavelength signal processing, enhancing their ability to differentiate between smoke and dust, thereby reducing false alarms and ensuring timely alerts for genuine threats.

Based on deployment, the market is split between room-level and building-level solutions, with room-level systems commanding a 61.5% share in 2024. Data center operators increasingly prefer room-level fire protection because it provides localized and targeted suppression, protecting individual data halls, server rooms, and high-density rack spaces without compromising entire facilities. This approach involves the use of pre-action sprinklers, advanced gas-based suppression systems, and AI-integrated detection devices designed to respond swiftly within confined zones. Given the rapid rise of hyperscale, colocation, and enterprise data centers, room-level fire protection is seen as essential to prevent widespread outages and equipment loss in the event of a fire.

North America Data Center Fire Detection and Suppression Market is projected to generate USD 1 billion by 2034, retaining its dominant position globally. The region's market strength stems from the expanding footprint of complex data center infrastructure and a growing emphasis on implementing state-of-the-art fire safety technologies. In the U.S., continuous growth in cloud services, AI workloads, and data traffic is escalating the demand for next-gen fire detection and suppression systems that offer unmatched reliability and compliance with stringent safety standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Manufacturers

- 3.1.3 System integrators

- 3.1.4 Installation and maintenance providers

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Case studies

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising data center expansion

- 3.9.1.2 Increasing stringency of fire safety regulations

- 3.9.1.3 Growing adoption of AI & smart detection

- 3.9.1.4 Increasing shift to sustainable fire suppression

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High implementation cost

- 3.9.2.2 Integration with existing infrastructure

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By System, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Fire detection

- 5.2.1 Smoke

- 5.2.2 Heat

- 5.2.3 Flame

- 5.2.4 Gas

- 5.3 Fire suppression

- 5.3.1 Clean agent

- 5.3.2 Water-based

- 5.3.3 Gas- based

- 5.3.4 Foam- based

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Room level

- 6.3 Building level

Chapter 7 Market Estimates & Forecast, By Data Center, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Hyperscale

- 7.3 Colocation

- 7.4 Enterprise

- 7.5 Edge

- 7.6 Government & military

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 3S

- 9.2 Ambetronics Engineers

- 9.3 Cannon Fire Protection

- 9.4 Chemours

- 9.5 Control Fire Systems

- 9.6 Eaton

- 9.7 Fike

- 9.8 FireFlex Systems

- 9.9 Hiller Companies

- 9.10 Honeywell

- 9.11 Impact Fire Services

- 9.12 Johnson Controls

- 9.13 Minimax

- 9.14 ORR Protection

- 9.15 Robert Bosch

- 9.16 SEM-SAFE

- 9.17 SEVO Systems

- 9.18 Siemens

- 9.19 Victaulic

- 9.20 WAGNER Group