PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913315

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913315

Passenger Vehicle ADAS Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

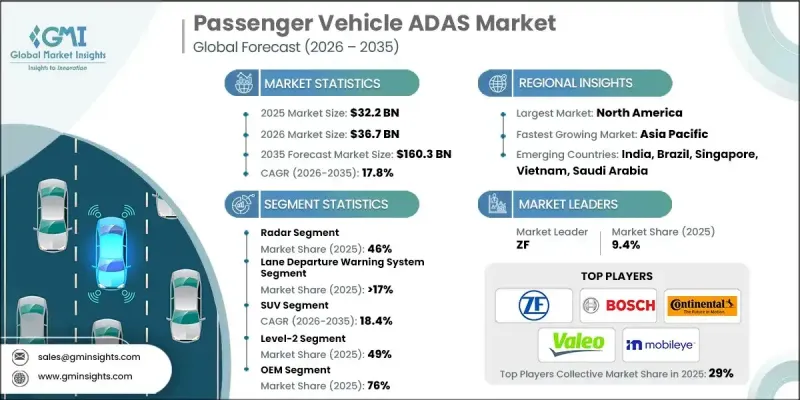

The Global Passenger Vehicle ADAS Market was valued at USD 32.2 billion in 2025 and is estimated to grow at a CAGR of 17.8% to reach USD 160.3 billion by 2035.

Growth is attributed to stricter government safety policies and evolving vehicle assessment standards that encourage automakers to integrate advanced driver assistance capabilities to meet compliance targets and enhance competitiveness. Buyers are increasingly prioritizing protection, driving ease, and reduced fatigue, which is supporting higher adoption of intelligent assistance technologies across passenger vehicles. Improvements in chip manufacturing efficiency, large-scale production, and intensified supplier competition have lowered system costs, allowing ADAS penetration to expand beyond premium models without significantly impacting vehicle pricing. Manufacturers are actively leveraging ADAS feature sets as a strategic tool to strengthen brand perception, support pricing strategies, and build long-term customer loyalty. Increased consumer familiarity with driver assistance technologies continues to reinforce demand, positioning ADAS as a core component of modern passenger vehicle design.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $32.2 Billion |

| Forecast Value | $160.3 Billion |

| CAGR | 17.8% |

The radar segment held 46% share in 2025. Radar systems are positioned as a foundational sensing technology within ADAS architectures due to their consistent performance and reliability. At the same time, image sensors are recognized for delivering detailed visual inputs that support accurate system interpretation. Advancements in sensor resolution and processing capability have improved overall system accuracy and robustness, reinforcing the role of multi-sensor integration in next-generation ADAS deployments.

The lane departure warning system segment held 17% share in 2025, with a valuation of approximately USD 5.5 billion. This segment benefits from the growing demand for driving assistance solutions that help reduce driver workload and improve comfort during extended vehicle operation. The system's ability to support stable vehicle positioning contributes to higher user confidence and sustained attention, factors that are driving its increasing acceptance among passenger vehicle owners.

U.S. Passenger Vehicle ADAS Market was valued at USD 10.7 billion in 2025. Adoption is supported by rising interest in advanced assistance capabilities, manufacturer-led feature differentiation, and broader availability of intelligent driving functions. Software-centric vehicle platforms and remote update capabilities are accelerating feature enhancements and enabling new revenue models across vehicle categories. Regulatory developments are also gradually supporting more advanced automation levels under controlled conditions through structured deployment frameworks.

Key companies active in the Global Passenger Vehicle ADAS Market include Bosch, Mobileye, Continental, Valeo, Aptiv, ZF, Magna International, Denso, Autoliv, Harman, Siemens, and Clarion. Companies operating in the Global Passenger Vehicle ADAS Market are reinforcing their market position through continuous innovation, strategic partnerships, and scalable product development. Leading players are investing heavily in sensor fusion, software intelligence, and system integration to deliver reliable and cost-effective solutions. Collaboration with automakers is helping suppliers align technologies with evolving vehicle platforms and regulatory expectations. Firms are also focusing on modular architectures that allow flexible deployment across different vehicle segments. Expansion of global production capacity and long-term supply agreements are being used to improve cost efficiency and market reach.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 System

- 2.2.3 Sensor

- 2.2.4 Vehicle

- 2.2.5 Level

- 2.2.6 Propulsion

- 2.2.7 Distribution Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook & strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Regulatory safety mandates

- 3.2.1.3 Consumer preference for safer vehicles

- 3.2.1.4 Technology cost reduction

- 3.2.1.5 OEM differentiation strategies

- 3.2.1.6 Growth of electric vehicles

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system integration complexity

- 3.2.2.2 Regulatory uncertainty for higher automation

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of Level 2+ and Level 3 systems

- 3.2.3.2 Advancement in sensor fusion and AI

- 3.2.3.3 Aftermarket and retrofit potential

- 3.2.3.4 Data monetization and software services

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. - Federal Motor Vehicle Safety Standards (FMVSS)

- 3.4.1.2 Canada - Motor Vehicle Safety Regulations

- 3.4.2 Europe

- 3.4.2.1 UK - Road Vehicles (Construction and Use) Regulations

- 3.4.2.2 Germany - Autonomous Driving Act

- 3.4.2.3 France - Mobility Orientation Law (LOM)

- 3.4.2.4 Italy - Highway Code (Codice della Strada)

- 3.4.2.5 Spain - General Traffic Regulation

- 3.4.3 Asia Pacific

- 3.4.3.1 China - Intelligent Connected Vehicle Regulations

- 3.4.3.2 Japan - Road Transport Vehicle Act

- 3.4.3.3 India - Central Motor Vehicle Rules

- 3.4.4 Latin America

- 3.4.4.1 Brazil - National Traffic Code

- 3.4.4.2 Mexico - Official Mexican Vehicle Safety Standards (NOM)

- 3.4.4.3 Argentina - National Traffic Law

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE - Federal Traffic Law

- 3.4.5.2 South Africa - National Road Traffic Act

- 3.4.5.3 Saudi Arabia - Traffic Law

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Production statistics

- 3.8.1 Production hubs

- 3.8.2 Consumption hubs

- 3.8.3 Export and import

- 3.9 Cost breakdown analysis

- 3.9.1 Development cost structure

- 3.9.2 R&D cost analysis

- 3.9.3 Marketing & sales costs

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 ADAS standards, validation & safety ratings impact

- 3.12.1 Euro NCAP, Global NCAP & IIHS rating impact on ADAS adoption

- 3.12.2 UNECE regulations (R79, R152, R157) and OEM compliance pathways

- 3.12.3 Homologation, validation & testing requirements by automation level

- 3.12.4 Impact of safety ratings on OEM feature packaging & pricing

- 3.13 ADAS software & compute architecture landscape

- 3.13.1 Centralized vs domain vs zonal ADAS architectures

- 3.13.2 SoC and ECU evolution (ADAS ECUs → centralized compute)

- 3.13.3 Middleware, operating systems & real-time constraints

- 3.13.4 OTA update readiness & software lifecycle implications

- 3.14 ADAS Cost vs Willingness-to-Pay

- 3.15 ADAS Data, Cybersecurity & Functional Safety (ISO 26262 / SOTIF)

- 3.16 OEM ADAS Roadmap & Feature Migration Analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By System, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Adaptive cruise control

- 5.3 Blind spot detection

- 5.4 Lane departure warning system

- 5.5 Automatic emergency braking (AEB)

- 5.6 Forward collision warning

- 5.7 Night vision system

- 5.8 Driver monitoring

- 5.9 Tire pressure monitoring system

- 5.10 Head-up display

- 5.11 Park assist system

- 5.12 Others

Chapter 6 Market Estimates & Forecast, By Sensor, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Radar

- 6.3 Lidar

- 6.4 Ultrasonic

- 6.5 Camera

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Sedan

- 7.3 SUV

- 7.4 Hatchback

Chapter 8 Market Estimates & Forecast, By Level, 2022-2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Level-1

- 8.3 Level-2

- 8.4 Level-3

- 8.5 Level-4

- 8.6 Level-5

Chapter 9 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 ICE

- 9.3 EV

- 9.3.1 BEV

- 9.3.2 HCEV

- 9.3.3 FCEV

- 9.4 Hybrid

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Portugal

- 11.3.9 Croatia

- 11.3.10 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Singapore

- 11.4.7 Thailand

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

- 11.6.4 Turkey

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Aisin

- 12.1.2 Aptiv

- 12.1.3 Autoliv

- 12.1.4 Bosch

- 12.1.5 Continental

- 12.1.6 Denso

- 12.1.7 Harman

- 12.1.8 Hella Forvia

- 12.1.9 Magna International

- 12.1.10 Mobileye

- 12.1.11 Renesas Electronics

- 12.1.12 Texas Instruments

- 12.1.13 Valeo

- 12.1.14 ZF Friedrichshafen

- 12.2 Regional Players

- 12.2.1 Ambarella

- 12.2.2 Clarion

- 12.2.3 Ficosa

- 12.2.4 Gentex

- 12.2.5 Siemens

- 12.3 Emerging / Disruptor Players

- 12.3.1 Black Sesame Technologies

- 12.3.2 Horizon Robotics

- 12.3.3 Innoviz Technologies

- 12.3.4 Luminar Technologies

- 12.3.5 Mobileye Vision Technologies (China)

- 12.3.6 Spark Minda

- 12.3.7 Uhnder