PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708144

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708144

Automotive Touch Screen Control System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

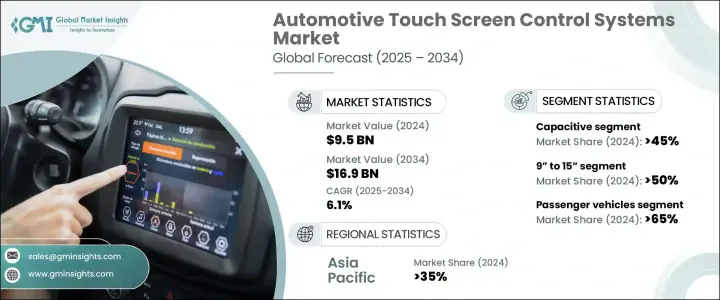

The Global Automotive Touch Screen Control Systems Market was valued at USD 9.5 billion in 2024 and is projected to grow at a CAGR of 6.1% between 2025 and 2034. The market expansion is driven by the increasing demand for advanced touch interfaces in modern vehicles, particularly with the rapid adoption of electric vehicles (EVs) and connected car technologies. Automakers are prioritizing user-friendly, high-performance touchscreen systems to enhance the driving experience and streamline vehicle functionalities.

As the automotive industry undergoes a digital transformation, touchscreen control systems have become a central component of next-generation vehicles. The rise of EVs has significantly influenced the development of specialized touch interfaces that facilitate battery monitoring, regenerative braking, and energy-efficient climate settings. Automakers are also integrating artificial intelligence (AI) and cloud-based technologies to enhance touchscreen capabilities, allowing for seamless connectivity, personalized settings, and predictive controls. The shift towards digital cockpits is further fueling market growth, with manufacturers focusing on delivering sophisticated infotainment systems, interactive vehicle controls, and enhanced safety features through high-resolution touchscreens. Increasing consumer preference for intuitive, multi-functional interfaces has led to a surge in demand for capacitive touch panels, which offer superior responsiveness, multi-touch capabilities, and crystal-clear display quality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.5 Billion |

| Forecast Value | $16.9 Billion |

| CAGR | 6.1% |

The automotive touch screen market is segmented based on touch panel technology, with capacitive touch panels holding a dominant 45% market share in 2024. Unlike resistive touch panels, which require physical pressure to register inputs, capacitive touch screens provide a smooth and seamless interaction, making them the preferred choice for infotainment systems, navigation controls, and climate settings. These advanced touchscreens not only improve user convenience but also enhance vehicle aesthetics by enabling sleek, button-free dashboards.

Screen size is another key market segmentation, with the 9" to 15" category accounting for a 50% market share in 2024. This size range has become the standard for modern vehicles, offering the perfect balance between usability and visibility. Mid-sized touchscreens are widely used for in-car navigation, media control, and system settings, providing an immersive yet non-intrusive interface. Automakers are leveraging AI-driven features, customizable displays, and voice-assisted controls to enhance touchscreen functionality, ensuring a highly interactive and personalized user experience.

Asia Pacific accounted for a significant 35% share of the Automotive Touch Screen Control Systems Market in 2024, with China emerging as a major growth driver. The country is expected to generate USD 3 billion by 2034, fueled by its booming electric vehicle sector and increasing investment in smart vehicle technologies. The push for AI-powered, large-format touchscreens is accelerating adoption rates as automakers integrate advanced digital interfaces into EVs and connected vehicles. As competition intensifies, market players are focusing on innovation, incorporating cutting-edge features such as gesture recognition, haptic feedback, and augmented reality (AR) displays to stay ahead in the evolving automotive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Suppliers

- 3.1.2 Manufacturers

- 3.1.3 System Integrators

- 3.1.4 Technology Providers

- 3.1.5 End Use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Cost analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing demand for in-vehicle infotainment

- 3.9.1.2 Rising adoption of electric and connected vehicles

- 3.9.1.3 Increasing advancements in touchscreen technology

- 3.9.1.4 Rising adoption of intuitive touch controls and voice-assisted interfaces

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Durability and reliability concerns

- 3.9.2.2 High cost of advanced touchscreen systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Touch Panel, 2021 – 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Resistive

- 5.3 Infrared

- 5.4 Capacitive

- 5.5 Optical imaging

Chapter 6 Market Estimates & Forecast, By Screen Size, 2021 – 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Below 9”

- 6.3 9” to 15”

- 6.4 Above 15”

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Application, 2021 – 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Infotainment systems

- 8.3 Navigation systems

- 8.4 Climate control

- 8.5 Driver assistance features

- 8.6 Vehicle diagnostics

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Analog

- 10.2 AU Optronics

- 10.3 Bosch

- 10.4 Continental

- 10.5 Denso

- 10.6 Dingtouch

- 10.7 Eaton

- 10.8 Harman

- 10.9 Infineon

- 10.10 Kyocera

- 10.11 LG Display

- 10.12 Magneti Marelli

- 10.13 Microchip

- 10.14 Nippon Seiki

- 10.15 Pioneer

- 10.16 Sharp

- 10.17 Synaptics

- 10.18 TPK Holding

- 10.19 Valeo

- 10.20 Visteon