PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708141

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708141

U.S. Pickup Trucks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

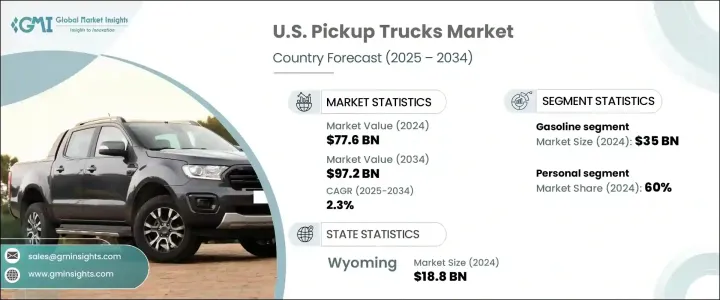

U.S. pickup trucks market reached USD 77.6 billion in 2024 and is projected to expand at a CAGR of 2.3% between 2025 and 2034. The growing consumer preference for versatile, high-performance vehicles has been a key factor fueling demand across the country. As the U.S. economy remains robust, increased disposable income has further driven the adoption of pickup trucks, making them a staple choice among both personal and commercial users. With technological advancements improving fuel efficiency and safety features, pickup trucks continue to attract a broad customer base, from adventure enthusiasts to business owners who rely on them for daily operations.

A rising trend toward outdoor recreational activities such as hiking, fishing, and camping has significantly boosted pickup truck sales. Consumers value these vehicles for their ability to transport various types of recreational equipment, offering both practicality and rugged appeal. More Americans are engaging in off-road adventures and outdoor pursuits, making pickups an essential vehicle for hauling gear like bicycles, camping equipment, and boats. Their durability and spacious design make them a preferred choice for drivers who need a reliable vehicle that balances utility with comfort.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $77.6 Billion |

| Forecast Value | $97.2 Billion |

| CAGR | 2.3% |

Gasoline-powered pickup trucks dominate the market, primarily due to their affordability, lower maintenance costs, and the convenience of a well-established refueling infrastructure across the U.S. The accessibility of gasoline ensures that owners can travel long distances without concerns about refueling availability. While electric and hybrid options are gradually entering the market, gasoline trucks remain the top choice due to their proven reliability and cost-effectiveness, making them a practical investment for both personal and commercial use.

Market segmentation by vehicle size indicates that full-sized trucks held the largest share in 2024. These trucks are favored for their ability to handle heavy-duty tasks such as towing large loads, transporting construction materials, and carrying oversized recreational equipment. Both individual owners and businesses rely on full-sized pickups for their exceptional towing capacity and spacious interiors. Families also appreciate these trucks for their ability to accommodate passengers while providing ample cargo space, making them a preferred option for long road trips and outdoor excursions.

Four-wheel-drive (4WD) trucks led the market in 2024, capturing significant attention from adventure seekers and off-road enthusiasts. The superior control and stability offered by 4WD systems make these vehicles ideal for navigating rough terrains, whether in snow, mud, or rocky landscapes. Drivers looking for all-weather capabilities and enhanced traction continue to choose 4WD pickups for their versatility and reliability. Their ability to tackle diverse driving conditions makes them an essential choice for consumers who demand power, performance, and adaptability in their vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component suppliers

- 3.2.3 Manufacturers

- 3.2.4 Distributors

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Cost breakdown analysis

- 3.8 Regulatory landscape

- 3.9 Price trend

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing popularity of off-roading and outdoor activities

- 3.10.1.2 Consumer demand for versatility and utility

- 3.10.1.3 Advancements in pickup truck technology

- 3.10.1.4 Electrification and sustainability trends

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High purchase price and affordability

- 3.10.2.2 Consumer preferences shifting toward SUVs and crossovers

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Size, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Compact

- 5.3 Mid-size

- 5.4 Full-size

Chapter 6 Market Estimates & Forecast, By Powertrain, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

- 6.5 Hybrid

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Personal

- 7.3 Commercial

- 7.3.1 Construction and heavy equipment

- 7.3.2 Agriculture and farming

- 7.3.3 Landscaping and outdoor services

- 7.3.4 Utility and municipal use

Chapter 8 Market Estimates & Forecast, By Drive, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Rear-wheel drive

- 8.3 All wheel drive

- 8.4 Four-wheel drive

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Alabama

- 9.3 Alaska

- 9.4 Arizona

- 9.5 Arkansas

- 9.6 California

- 9.7 Colorado

- 9.8 Florida

- 9.9 Georgia

- 9.10 Idaho

- 9.11 Illinois

- 9.12 Indiana

- 9.13 Iowa

- 9.14 Kansas

- 9.15 Kentucky

- 9.16 Louisiana

- 9.17 Maine

- 9.18 Michigan

- 9.19 Minnesota

- 9.20 Mississippi

- 9.21 Missouri

- 9.22 Montana

- 9.23 Nebraska

- 9.24 Nevada

- 9.25 New Mexico

- 9.26 North Carolina

- 9.27 North Dakota

- 9.28 Ohio

- 9.29 Oklahoma

- 9.30 Oregon

- 9.31 Pennsylvania

- 9.32 South Carolina

- 9.33 South Dakota

- 9.34 Tennessee

- 9.35 Texas

- 9.36 Utah

- 9.37 Virginia

- 9.38 Washington

- 9.39 West Virginia

- 9.40 Wisconsin

- 9.41 Wyoming

- 9.42 Rest of U.S.

Chapter 10 Company Profiles

- 10.1 Alpha Motor

- 10.2 Bollinger Motors

- 10.3 Canoo

- 10.4 Chevrolet

- 10.5 EdisonFuture

- 10.6 Fisker

- 10.7 Ford

- 10.8 GMC

- 10.9 Honda

- 10.10 Hyundai

- 10.11 Jeep

- 10.12 Nissan

- 10.13 Nu Ride

- 10.14 RAM Trucks

- 10.15 Rivian

- 10.16 Telo Truck

- 10.17 Tesla

- 10.18 Toyota

- 10.19 Workhorse Group