PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708140

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708140

Remanufactured Automotive Parts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

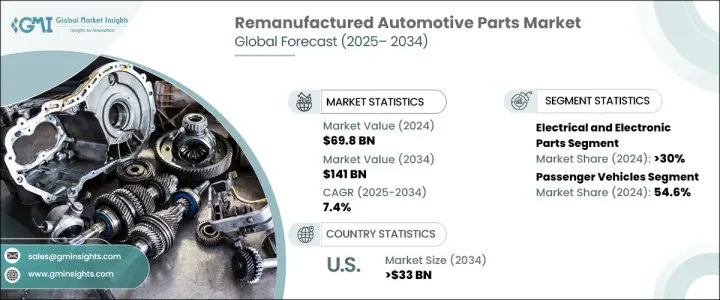

The Global Remanufactured Automotive Parts Market reached USD 69.8 billion in 2024 and is projected to grow at a CAGR of 7.4% between 2025 and 2034. The demand for remanufactured automotive parts is surging due to a combination of technological advancements, environmental benefits, and cost-efficiency. As sustainability concerns and circular economy principles gain momentum, remanufactured components are emerging as a preferred alternative to new parts. These components undergo rigorous refurbishment processes, ensuring they meet or exceed original equipment manufacturer (OEM) standards while reducing material waste and energy consumption. As a result, automakers and consumers alike are recognizing the advantages of remanufactured automotive parts, driving substantial market expansion.

The rapid integration of automation, digitalization, and material science innovations has revolutionized the remanufacturing process, enhancing product quality and reliability. With modern technology, remanufacturers can efficiently restore used parts to near-new condition, ensuring optimal performance and longevity. This trend is further bolstered by the rising adoption of electric vehicles (EVs) and hybrid models, which rely on a greater number of sophisticated components. Additionally, stringent government regulations on emissions and sustainability initiatives are pushing automakers to invest in remanufacturing solutions, reinforcing market growth. The increasing availability of high-quality remanufactured parts at competitive prices is influencing consumer purchasing decisions as more vehicle owners seek cost-effective and environmentally friendly alternatives to new components.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $69.8 Billion |

| Forecast Value | $141 Billion |

| CAGR | 7.4% |

The remanufactured automotive parts market is segmented into key component categories, including electrical and electronic parts, engines, transmissions, wheels, and brakes. In 2024, the electrical and electronic parts segment held the largest market share, accounting for 30%. The growing reliance on advanced vehicle technologies, such as sensors, electric drivetrains, and infotainment systems, has amplified the demand for remanufactured electrical and electronic components. These components offer a sustainable way to extend the lifespan of vehicle systems while lowering repair and replacement costs. The integration of remanufactured electronics not only enhances vehicle efficiency but also significantly reduces electronic waste, further driving the market forward.

By vehicle type, the remanufactured automotive parts market includes passenger and commercial vehicles. The passenger vehicle segment dominated the market in 2024, securing a 54.6% share. This growth is largely driven by efforts to extend the longevity of automotive components and reduce the carbon footprint of vehicle production. The increasing adoption of remanufactured starters, alternators, and high-voltage batteries aligns with the industry's transition toward a circular economy, where reusing and refurbishing parts minimizes environmental impact and conserves valuable resources. With automakers prioritizing sustainable production and repair solutions, the demand for remanufactured parts in the passenger vehicle sector is expected to accelerate.

North America held a significant 35% share of the remanufactured automotive parts market in 2024, with the U.S. emerging as the dominant contributor. Projections indicate that the U.S. market will reach USD 33 billion by 2034, fueled by an increasing focus on sustainability, cost-effectiveness, and OEM-backed remanufacturing programs. Major automotive manufacturers are expanding their remanufacturing initiatives, offering a diverse range of remanufactured components to cater to rising demand. With stringent environmental policies, a strong aftermarket industry, and growing consumer awareness, North America remains a key region driving the global expansion of the remanufactured automotive parts market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Automakers

- 3.1.2 Third-party remanufacturers

- 3.1.3 Reverse logistics providers

- 3.1.4 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Cost breakdown

- 3.8 Price trend

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Improving remanufacturing processes

- 3.10.1.2 Stricter environmental policies

- 3.10.1.3 Growing emphasis on reducing waste

- 3.10.1.4 Increasing cost savings by using remanufactured parts

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Negative consumer perception

- 3.10.2.2 Supply chain complexity

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 – 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Electrical and electronic parts

- 5.3 Engine

- 5.4 Transmission

- 5.5 Wheels and brakes

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Supply, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Andre Niermann

- 9.2 BBB Industries

- 9.3 BorgWarner

- 9.4 Bosch

- 9.5 Cardone

- 9.6 Carwood

- 9.7 Caterpillar

- 9.8 Denso

- 9.9 Detroit Diesel

- 9.10 Eaton

- 9.11 Jasper Engines & Transmissions

- 9.12 Lucas Electrical

- 9.13 Marelli

- 9.14 Maval

- 9.15 Motorcar Parts of America

- 9.16 NAPA

- 9.17 Stellantis

- 9.18 Teamec

- 9.19 Valeo

- 9.20 ZF