PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708132

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708132

Insurtech Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

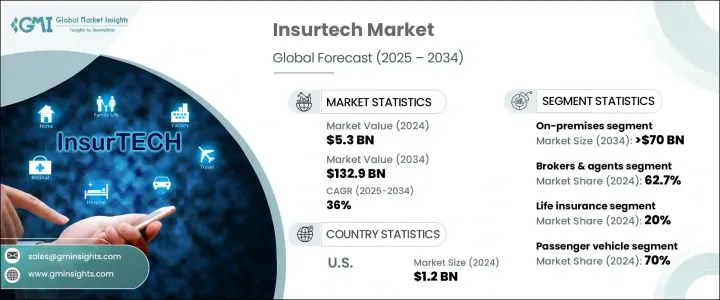

The Global Insurtech Market was valued at USD 5.3 billion in 2024 and is projected to grow at a CAGR of 36% between 2025 and 2034. This impressive expansion is fueled by the rapid adoption of cutting-edge technologies like artificial intelligence (AI) and machine learning (ML), which are redefining the insurance landscape. As digital transformation accelerates, Insurtech firms are leveraging AI-driven automation to enhance efficiency, streamline claim processing, and improve customer interactions. These advancements significantly reduce operational costs and improve fraud detection, making insurance services faster, more secure, and more customer-centric. The growing penetration of mobile applications, chatbots, and advanced analytics platforms further contributes to the sector's development, offering policyholders seamless digital experiences.

Regulatory support and evolving consumer preferences also shape the Insurtech market's trajectory. Governments and financial regulators worldwide endorse digital insurance solutions, easing compliance requirements, and encouraging competition among traditional insurers and startups. Consumers are increasingly drawn to tech-driven insurance models that provide real-time claim tracking, personalized policy recommendations, and swift dispute resolutions. The demand for usage-based insurance (UBI), parametric insurance, and embedded insurance solutions is surging, driving innovation in the sector. Additionally, partnerships between Insurtech firms and established insurance providers are fostering the development of hybrid solutions, ensuring a balance between digital convenience and traditional risk assessment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $132.9 Billion |

| CAGR | 36% |

The market is categorized based on deployment models, with on-premises and cloud-based solutions leading the segment. The on-premises segment held a 60% market share and is forecasted to generate USD 70 billion by 2034. This dominance is largely due to the enhanced security offered by on-premises infrastructure, which remains critical for industries handling sensitive customer and business data. Financial institutions, healthcare providers, and insurance companies prioritize on-premises solutions to ensure compliance with regulatory frameworks like GDPR, HIPAA, and PCI-DSS. These regulations necessitate stringent data protection measures, making on-premises deployment an attractive choice for enterprises prioritizing data control and cybersecurity.

The Insurtech market is also segmented by distribution channels, which include brokers & agents, Direct-to-Consumer (D2C), and other methods. The brokers & agents segment held a 62.7% market share in 2024, underscoring the continued relevance of human expertise in insurance transactions. Brokers and agents play a vital role in assisting clients with complex policy structures, providing tailored advice, and helping customers navigate risk assessments. Their ability to negotiate customized coverage solutions offers a competitive edge over digital-only models, particularly in high-value insurance categories. Despite the rise of automated insurance platforms, many consumers still prefer personalized consultation to ensure comprehensive coverage and financial security.

North America Insurtech market generated USD 1.2 billion in 2024, with the United States emerging as a dominant force in the sector. The country's well-established insurance industry, coupled with its advanced technological infrastructure, positions it at the forefront of global Insurtech innovation. The U.S. regulatory environment fosters a competitive ecosystem that encourages digital insurance adoption and incentivizes startups to develop innovative solutions. With a strong emphasis on AI-driven underwriting, blockchain-based smart contracts, and IoT-powered risk assessments, the U.S. continues to shape the future of Insurtech. These factors, combined with increasing investments from venture capitalists and financial institutions, solidify North America's leadership in the digital insurance revolution.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Technology providers

- 3.1.1.2 Insurance providers

- 3.1.1.3 Distributors

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Use cases

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Digital transformation using AI, blockchain, IoT, and cloud computing

- 3.6.1.2 Growing demand for personalized and flexible insurance solutions

- 3.6.1.3 Increased investments and partnerships fuelling innovation

- 3.6.1.4 Regulatory initiatives supporting digital innovation

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Data security and privacy concerns

- 3.6.2.2 Integration with legacy systems and navigating complex regulatory requirements

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Health insurance

- 5.3 Life insurance

- 5.4 Property & casualty (P&C) insurance

- 5.5 Auto insurance

- 5.6 Specialty insurance

- 5.7 Reinsurance

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Artificial intelligence (AI) & machine learning (ML)

- 6.3 Big data & analytics

- 6.4 Blockchain

- 6.5 Internet of things (IoT)

- 6.6 Telematics

- 6.7 Cloud computing

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 On-Premises

- 7.3 Cloud-Based

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Direct-to-Consumer (D2C)

- 8.3 Brokers & agents

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Alan

- 10.2 BIMA

- 10.3 Bolttech

- 10.4 Bright Health Group

- 10.5 Clover Health

- 10.6 Coalition

- 10.7 Cover Genius

- 10.8 Duck Creek Technologies

- 10.9 GoHealth

- 10.10 Hippo Insurance

- 10.11 Lemonade

- 10.12 Metromile

- 10.13 Next Insurance

- 10.14 Oscar Health

- 10.15 PolicyBazaar

- 10.16 Root Insurance

- 10.17 Shift Technology

- 10.18 Trov

- 10.19 Wefox

- 10.20 ZhongAn Insurance