PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708126

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708126

Flexible Intermediate Bulk Container (FIBC) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

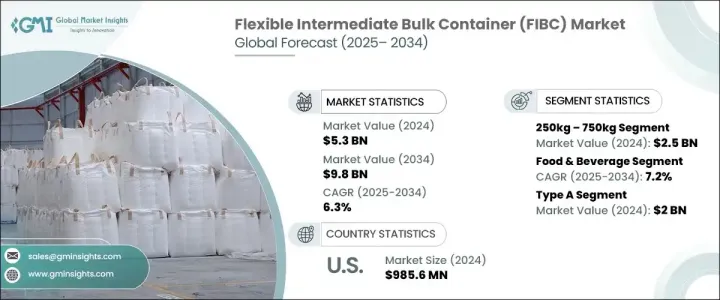

The Global Flexible Intermediate Bulk Container Market was valued at USD 5.3 billion in 2024 and is projected to grow at a CAGR of 6.3% between 2025 and 2034. The increasing demand from industries such as pharmaceuticals, food and beverage, chemicals, agriculture, and construction is fueling this expansion. These containers offer cost-effective, durable, and lightweight solutions for bulk material handling, making them a preferred choice across multiple sectors. Additionally, the surge in global trade, rising industrialization, and stringent packaging regulations have significantly contributed to the market's growth.

As businesses worldwide continue to emphasize efficiency and sustainability, FIBCs are gaining traction due to their eco-friendly properties, reusability, and compliance with international packaging standards. The growing preference for sustainable bulk packaging, particularly in developed regions, is further supporting market expansion. The rise of e-commerce has also played a pivotal role as online retailers and logistics companies increasingly adopt FIBCs for cost-effective and secure bulk transportation. In sectors such as pharmaceuticals and food processing, these containers ensure contamination-free storage and transit, adhering to strict hygiene and safety regulations. Moreover, continuous innovations in FIBC technology, including moisture-resistant, UV-protected, and anti-static bags, are making them more adaptable to diverse industrial needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 6.3% |

The 250kg-750kg segment generated USD 2.5 billion in 2024, primarily catering to medium-sized industries such as agriculture, food processing, and construction. These containers provide a cost-efficient solution for handling large volumes of goods while reducing labor costs and improving operational efficiency. The demand for hygienic and contamination-free packaging is growing across various industries, particularly in food, chemicals, and pharmaceuticals, where safety and regulatory compliance are paramount. The increasing adoption of advanced bulk packaging solutions in these sectors is expected to sustain the segment's upward trajectory over the coming decade.

Among the key application areas, the food and beverage industry stands out as the fastest-growing segment, anticipated to expand at a CAGR of 7.2% from 2025 to 2034. Stricter government regulations regarding hygienic food packaging, coupled with the rising global trade of grains, pulses, and other food commodities, are driving this growth. The need for reliable and large-capacity bulk packaging solutions has led to an increased demand for FIBCs in the food sector. Furthermore, advancements in FIBC materials and designs, including tamper-proof, moisture-resistant, and UV-shielded options, are enhancing their appeal, ensuring product integrity during long-distance transportation.

The United States Flexible Intermediate Bulk Container (FIBC) Market generated USD 985.6 million in 2024, driven by robust demand from the pharmaceutical, food, and chemical industries. Stricter sustainability regulations, coupled with an increasing shift toward cost-effective and environmentally friendly packaging solutions, are propelling market growth. Businesses across the U.S. are prioritizing efficient material handling, with FIBCs emerging as a preferred choice for reducing operational costs and improving productivity. The heightened focus on sustainable and hygienic packaging in industries such as food processing, pharmaceuticals, and chemicals has further strengthened the demand for these bulk containers, positioning the market for steady expansion in the years ahead.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of international trade

- 3.2.1.2 Sustainable and eco-friendly packaging

- 3.2.1.3 Booming e-commerce industry

- 3.2.1.4 Cost effectiveness and operational efficiency

- 3.2.1.5 Growth in food and pharmaceutical industries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain disruption

- 3.2.2.2 Fluctuating price of raw materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Type A (Non-conductive, Non-static)

- 5.3 Type B (Non-conductive, Limited-static)

- 5.4 Type C (Conductive FIBCs, Grounded)

- 5.5 Type D (Static dissipative, No Grounding)

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 Upto 250 kg

- 6.3 250kg – 750 kg

- 6.4 Above 750 kg

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Chemicals

- 7.4 Pharmaceuticals

- 7.5 Mining

- 7.6 Construction

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion & Units)

- 9.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Bag Corp

- 9.2 Berry Global Group, Inc.

- 9.3 Bulk Container Europe BV

- 9.4 Bulk Lift International

- 9.5 C.L. Smith

- 9.6 FlexiblePackagingSolutions.com

- 9.7 Global-Pak

- 9.8 Halsted

- 9.9 Intertape Polymer Group

- 9.10 Isbir Sentetik

- 9.11 Jumbo Bag Limited

- 9.12 Langston Companies Inc.

- 9.13 LC Packaging International BV

- 9.14 Masterpack Group

- 9.15 Palmetto Industries International Inc.

- 9.16 Rishi FIBC Solutions

- 9.17 Taihua Group